Tax Forms Documents

Tax Forms

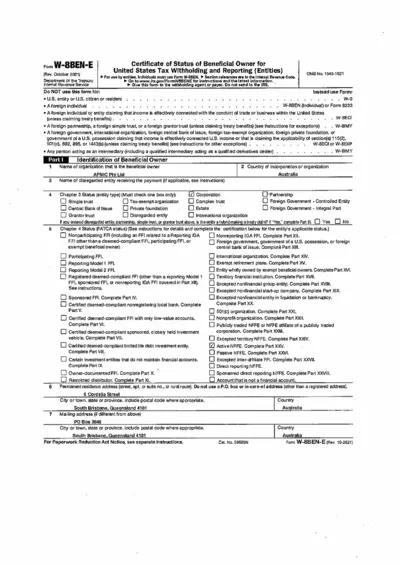

W-8BEN-E Tax Form for Foreign Entities Status

The W-8BEN-E form is an IRS document used by foreign entities to certify their status as beneficial owners for tax purposes. It helps such entities claim tax treaty benefits and exemptions from U.S. tax withholding. Proper completion is essential to ensure correct treatment by withholding agents.

Tax Forms

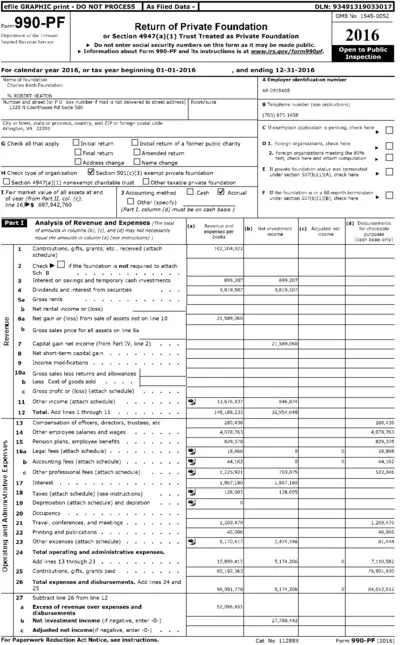

Form 990-PF - Return of Private Foundation 2016

This document is the Form 990-PF, which is used for filing the return of a private foundation or charitable trust. It includes financial information, assets, revenue, and expenses for the year 2016. Organizations need this form to comply with IRS regulations regarding charitable foundations.

Tax Forms

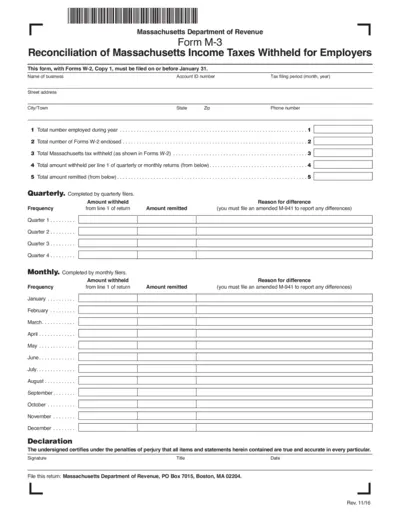

Reconciliation of Massachusetts Income Taxes Withheld

The Massachusetts Form M-3 allows employers to reconcile income taxes withheld from employee wages. This form must be filed with Forms W-2 by January 31st each year. Ensure that all required information is accurately reported to avoid penalties.

Tax Forms

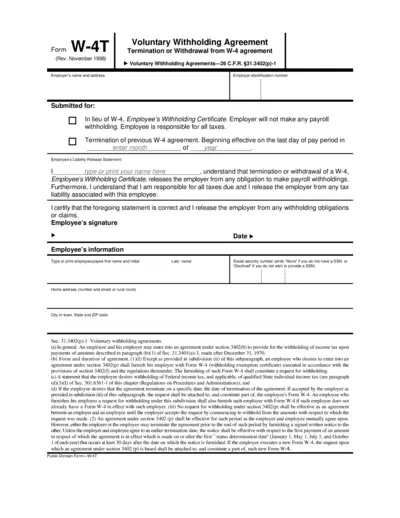

Form W-4T Voluntary Withholding Agreement

The Form W-4T is used by employees to request voluntary withholding of income taxes. It helps employers determine the correct amount to withhold from employees' payments. It's essential for managing tax obligations effectively.

Tax Forms

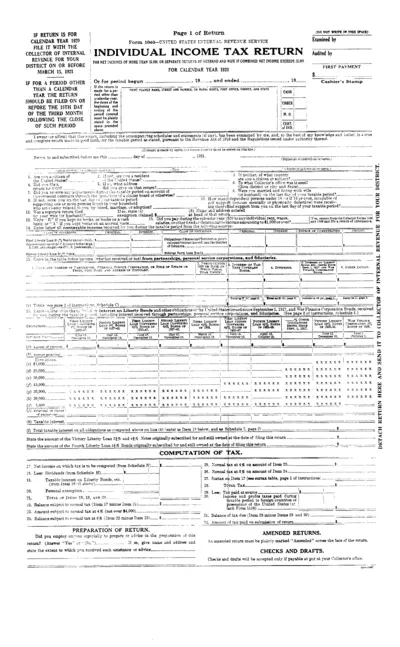

Form 1040 - Individual Income Tax Return

This file is the 1920 Individual Income Tax Return Form 1040. It provides essential guidance for filing personal tax returns. Complete it accurately to meet IRS requirements.

Tax Forms

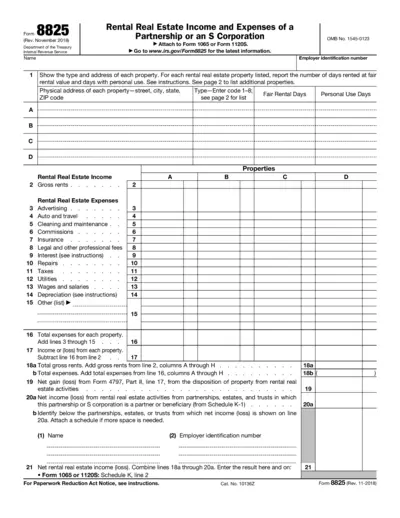

Form 8825 Rental Income and Expenses Worksheet

Form 8825 is used by partnerships and S corporations to report rental real estate income and expenses. It captures details about each property, including rental days and expenses to calculate net income or loss. This essential document is crucial for proper tax compliance in rental activities.

Tax Forms

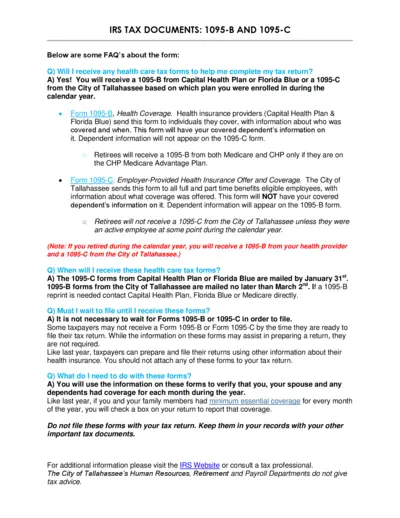

IRS Tax Documents: 1095-B and 1095-C FAQs

This document provides detailed FAQs about IRS tax forms 1095-B and 1095-C. It explains their purpose, who receives them, and how to fill them out. Essential information for taxpayers and health insurance beneficiaries.

Tax Forms

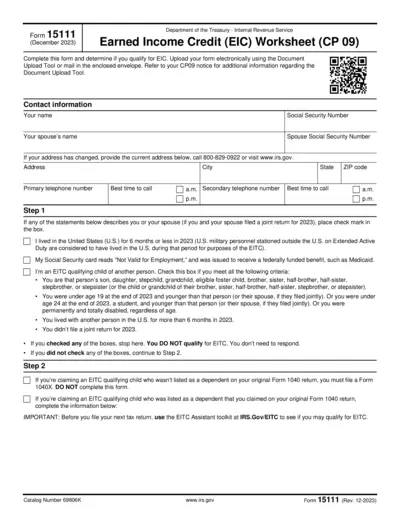

IRS Form 15111 Earned Income Credit (EIC) Worksheet

IRS Form 15111 helps individuals determine their eligibility for the Earned Income Credit (EIC). Complete this form to assess your qualification and submit it electronically or via mail. Be sure to refer to your CP09 notice for additional guidance on the EIC.

Tax Forms

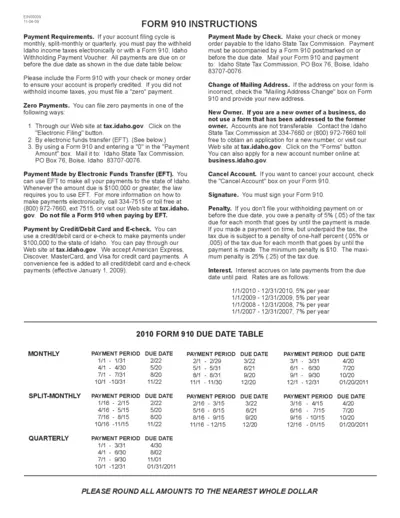

Idaho Form 910 Instructions for Withholding Payments

This document provides essential instructions for filing Idaho Form 910 for withholding payments. It covers payment requirements, filing schedules, and procedures for various types of filers. Ideal for business owners and payroll personnel managing Idaho income tax withholdings.

Tax Forms

W-9 Taxpayer Identification Number Submission Form

The W-9 form is used to provide your correct taxpayer identification number. It is essential for U.S. persons who are required to report income to the IRS. Use this form to avoid backup withholding and ensure accurate information is reported.

Tax Forms

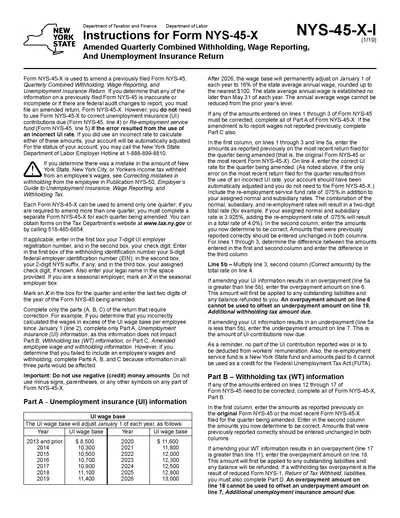

Instructions for Form NYS-45-X - Amended Return

Form NYS-45-X provides instructions for amending quarterly withholding tax and unemployment insurance returns in New York. This form is essential for employers who need to correct previously submitted information. Understanding how to properly fill out this form can help avoid errors and potential penalties.

Tax Forms

IRS Form 2290 Heavy Highway Vehicle Use Tax Return

IRS Form 2290 is used for reporting the heavy highway vehicle use tax. This form is essential for individuals and businesses operating heavy vehicles on public highways. Make sure to follow the instructions carefully to ensure accurate submission.