Tax Forms Documents

Tax Forms

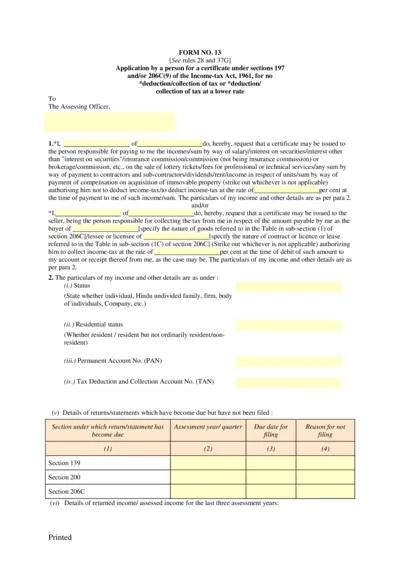

Application for Income-tax Certificate 197 206C

This file is an application form for a certificate under sections 197 and 206C(9) of the Income-tax Act, 1961. It helps individuals and entities to request no deduction of tax or a tax deduction at a lower rate. Users must fill out specific details about their income and tax status.

Tax Forms

Instructions for IRS Form 1040 for 2017 Tax Year

This file contains comprehensive instructions for filling out IRS Form 1040 for the 2017 tax year. It details filing requirements, tax changes, and guidance from the Taxpayer Advocate Service. Essential for taxpayers looking to understand their obligations and benefits when filing taxes.

Tax Forms

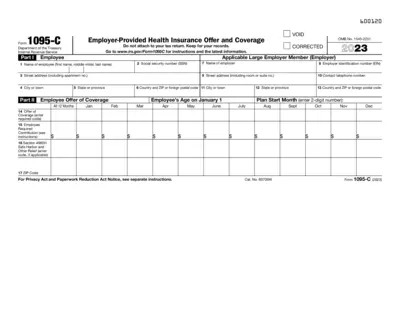

Form 1095-C Employee Health Insurance Coverage

Form 1095-C is an IRS document that provides information on the health insurance coverage offered to employees. It is essential for individuals who wish to claim the premium tax credit or verify health coverage for tax reporting. Employers must provide this form to eligible employees as part of the Affordable Care Act requirements.

Tax Forms

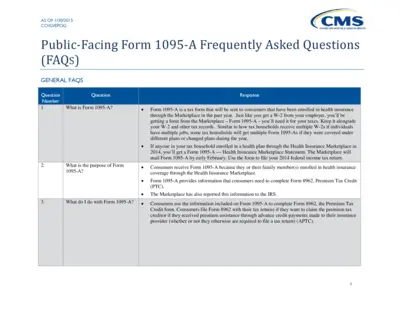

Public-Facing Form 1095-A FAQs and Instructions

This document contains frequently asked questions about Form 1095-A, which is essential for tax filings related to health insurance. It offers detailed guidance for consumers on how to utilize the form effectively. Users will find answers to common queries and instructions for completing the form.

Tax Forms

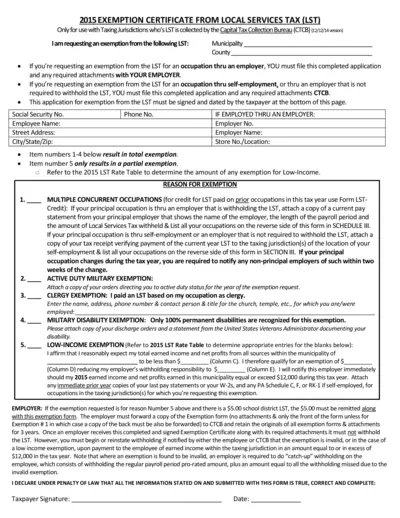

2015 Local Services Tax Exemption Certificate

This form is used to request an exemption from the Local Services Tax (LST) for eligible individuals.

Tax Forms

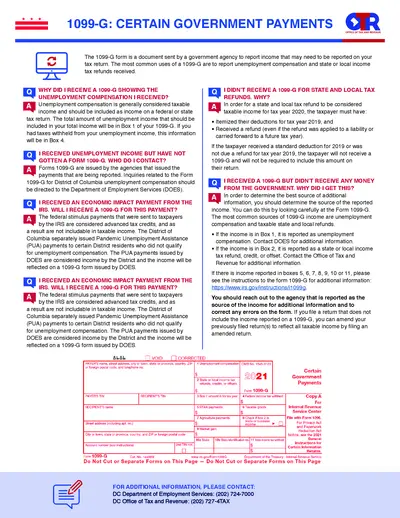

1099-G Certain Government Payments Form Instructions

This file contains essential information regarding the 1099-G form, detailing government payments and related tax obligations. Users will find guidance on how to fill out the form accurately. It includes FAQs, important dates, and submission instructions for effective compliance.

Tax Forms

IRS Schedule 8812 Child Tax Credit Form 2024

The IRS Schedule 8812 is used for claiming the Child Tax Credit and Credit for Other Dependents. It provides guidance on the credits available to qualifying families. Ensure you understand the eligibility criteria and instructions before filing.

Tax Forms

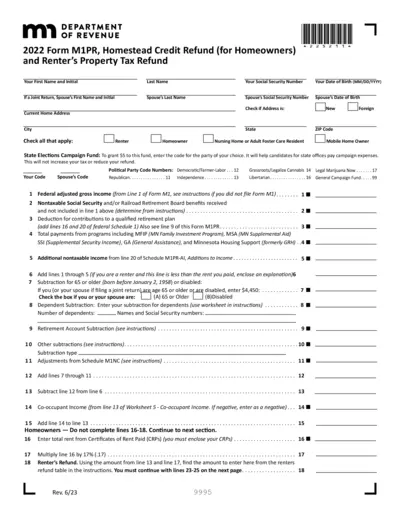

2022 Form M1PR Homestead Credit Refund Instructions

This file contains details and instructions for the 2022 Form M1PR, used for claiming the Homestead Credit Refund for homeowners and renters. The document guides users through filling out the necessary information for tax refunds. It includes sections for personal information, property details, and refund calculations.

Tax Forms

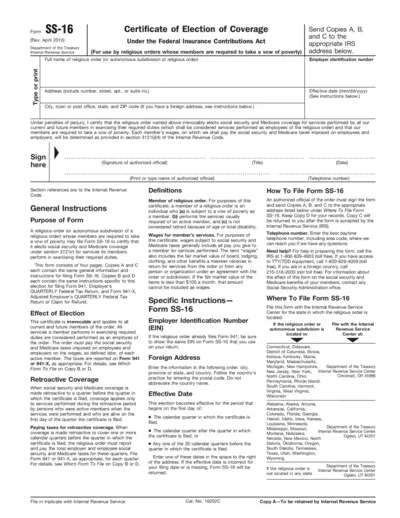

Form SS-16 Election of Coverage for Religious Orders

The Form SS-16 allows religious orders to certify their election for Social Security and Medicare coverage. This form is essential for members who have taken a vow of poverty. Utilize this document to ensure proper compliance with IRS requirements.

Tax Forms

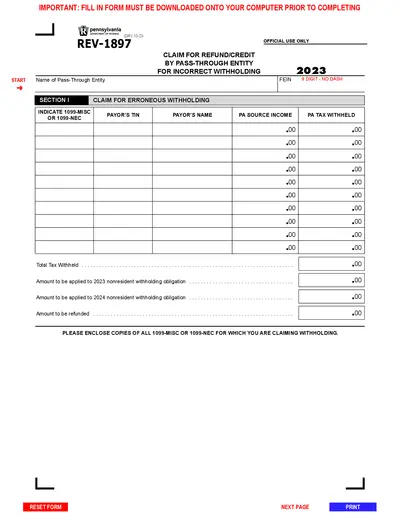

Pennsylvania Department of Revenue REV-1897 Tax Form

The REV-1897 form is essential for pass-through entities in Pennsylvania to claim a refund or credit for erroneous withholding. It is necessary for those who have had Pennsylvania tax withheld incorrectly on their behalf. Completing this form ensures proper processing of your tax obligations.

Tax Forms

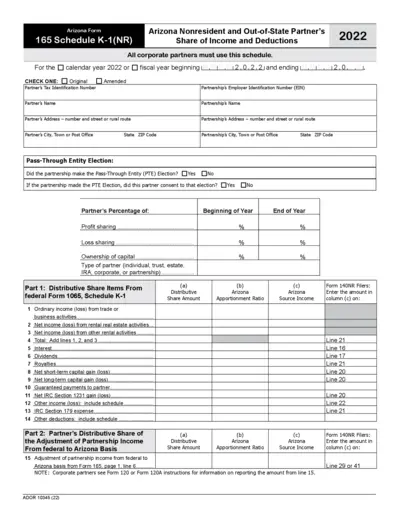

Arizona Form 165 Schedule K-1 (NR) Instructions

This document provides detailed instructions for completing the Arizona Form 165 Schedule K-1 for nonresident partners. It outlines all required fields and necessary information for accurate filing. Get guidance on how to report distributive shares and adjustments of partnership income.

Tax Forms

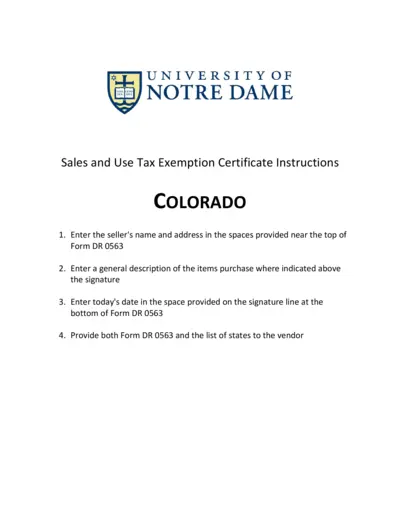

Sales and Use Tax Exemption Certificate Instructions

This file contains detailed instructions for filling out the Sales and Use Tax Exemption Certificate in Colorado. It outlines the necessary information required for exemption and specifies who qualifies for it. Users can refer to the guidelines to ensure proper completion of the form.