Tax Forms Documents

Tax Forms

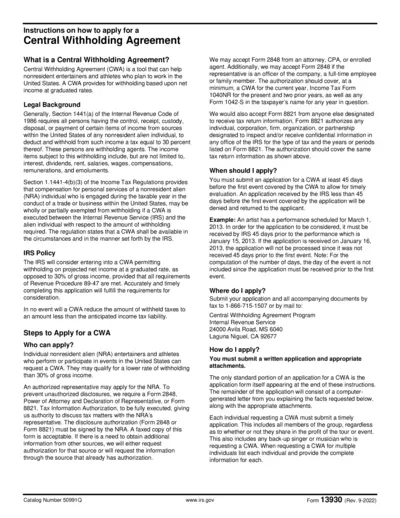

Central Withholding Agreement Application Instructions

This file provides step-by-step instructions on applying for a Central Withholding Agreement. It outlines eligibility requirements, submission guidelines, and necessary documentation. Ideal for nonresident entertainers and athletes planning to work in the U.S.

Tax Forms

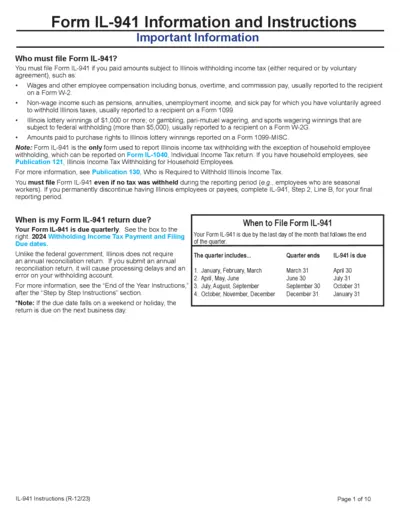

Form IL-941 Information and Instructions

Form IL-941 provides essential information regarding Illinois income tax withholding requirements for employers. It outlines who needs to file, how to file, and when to file, ensuring compliance with Illinois tax laws. This form is crucial for reporting wages, pensions, lottery winnings, and other income subject to Illinois withholding tax.

Tax Forms

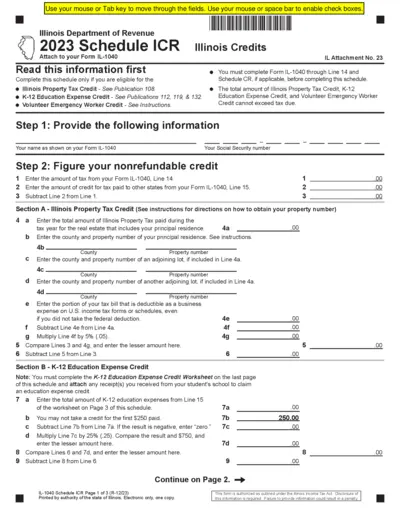

Illinois 2023 Schedule ICR for Tax Credits

This file provides the necessary schedule for claiming Illinois tax credits. It includes details about property tax credits, education expense credits, and volunteer emergency worker credits. Complete this form accurately to ensure compliance with Illinois tax regulations.

Tax Forms

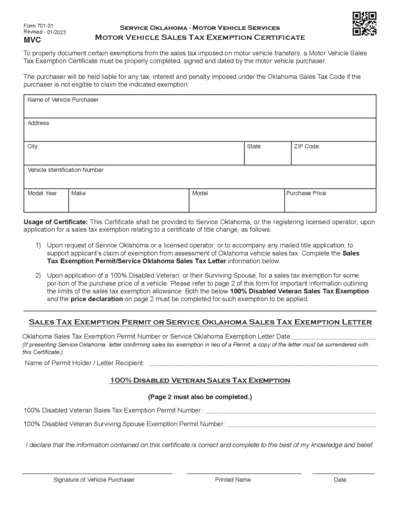

Motor Vehicle Sales Tax Exemption Certificate

The Motor Vehicle Sales Tax Exemption Certificate is essential for documenting exemptions from sales tax on vehicle transfers. This form must be completed, signed, and presented by eligible purchasers, such as disabled veterans. Ensure to understand the specific requirements to benefit from available exemptions.

Tax Forms

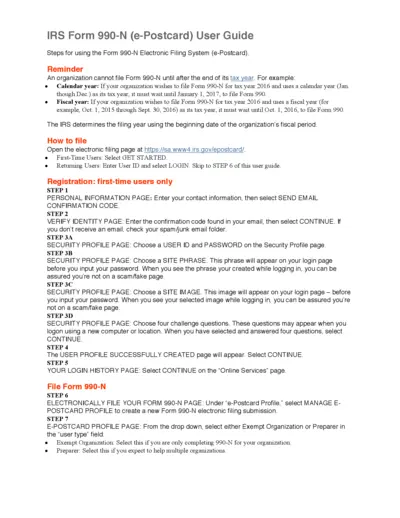

IRS Form 990-N e-Postcard User Guide

This comprehensive guide provides detailed instructions for organizations filing IRS Form 990-N electronically. It covers registration, filing steps, and important tips for successful submission. Ideal for first-time users and returning organizations alike.

Tax Forms

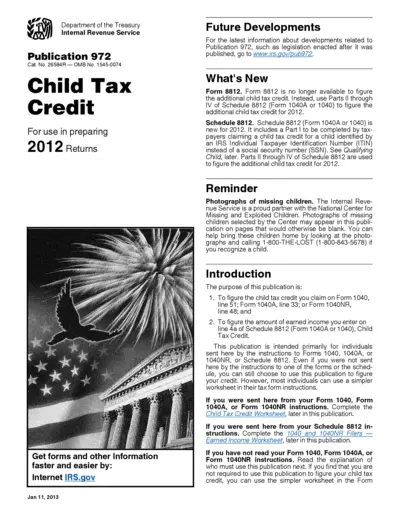

Child Tax Credit Publication 972 - IRS 2012

This publication provides detailed instructions for calculating the Child Tax Credit for 2012. It includes eligibility criteria and necessary forms for submitting your claim. Use this guide to ensure you accurately receive your available credits for dependents.

Tax Forms

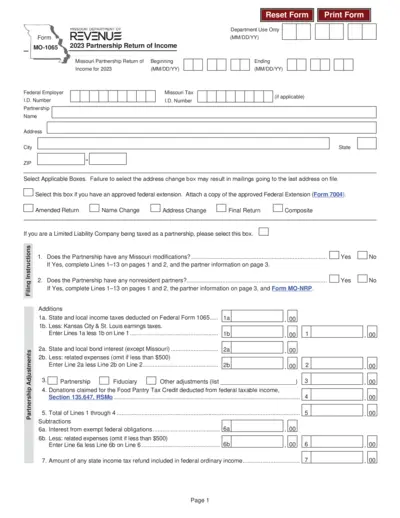

Missouri 2023 Partnership Return of Income Form MO-1065

The Missouri Partnership Return of Income Form MO-1065 is used to report the income, deductions, and credits for partnerships in Missouri. This form is essential for partnerships to correctly file their taxes and ensure compliance with state regulations. It includes detailed instructions and a breakdown of necessary information for accurate completion.

Tax Forms

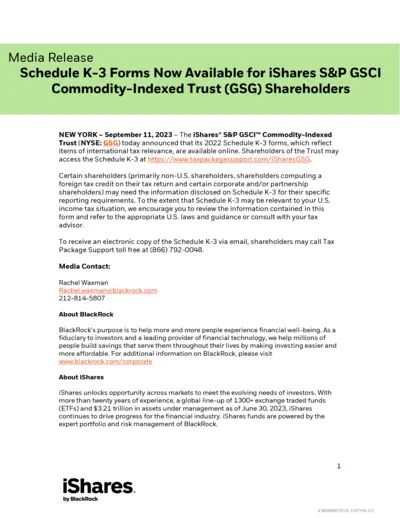

Schedule K-3 Forms Now Available for iShares GSG

The iShares S&P GSCI Commodity-Indexed Trust has made its 2022 Schedule K-3 forms available online. Shareholders, particularly non-U.S. investors, may find essential international tax information in these forms. We encourage review to ensure compliance with U.S. tax laws.

Tax Forms

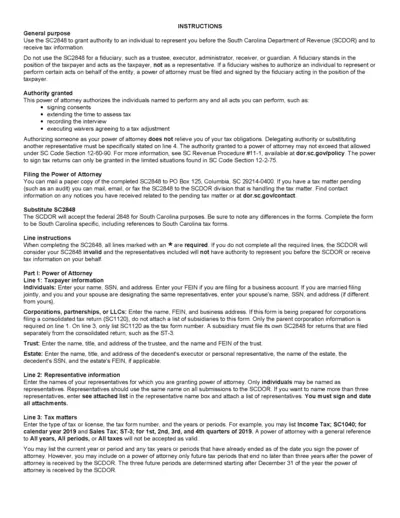

South Carolina SC2848 Power of Attorney Instructions

The SC2848 form authorizes an individual to represent you before the South Carolina Department of Revenue. It is essential for taxpayers needing assistance in handling their tax matters. Ensure all required sections are completed to avoid invalidation of the form.

Tax Forms

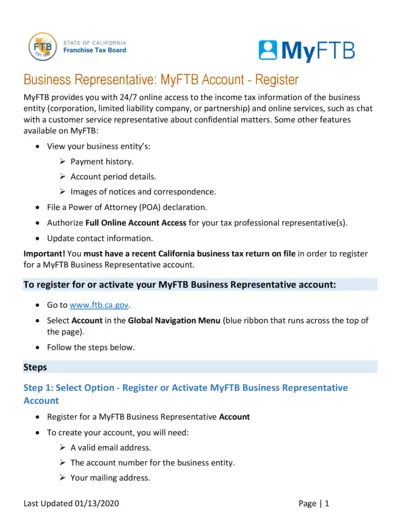

MyFTB Business Representative Account Instructions

This document provides detailed instructions on how to register and use the MyFTB Business Representative account. It includes steps for account creation, activation, and important features available to users. Ideal for business entities needing access to their tax information online.

Tax Forms

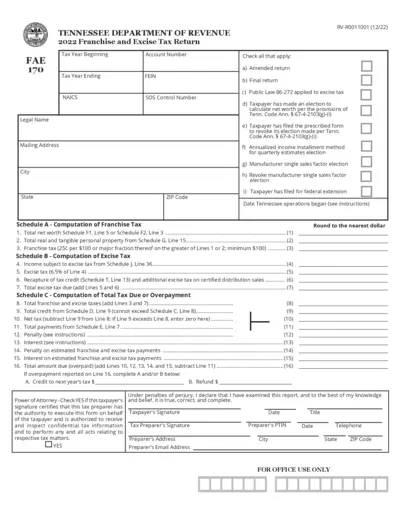

Tennessee Franchise and Excise Tax Return 2022

This document is the 2022 Franchise and Excise Tax Return for the state of Tennessee. It details instructions and computations for taxpayers. The form includes various schedules necessary for filing taxes accurately.

Tax Forms

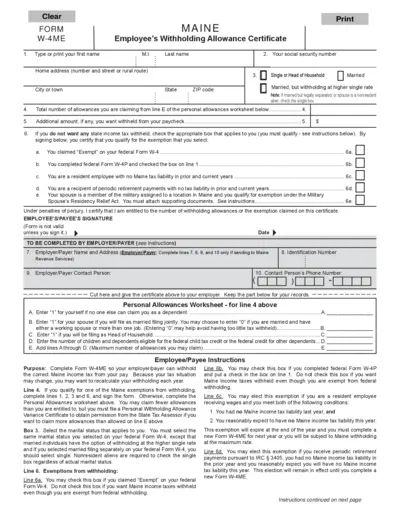

Maine Employee Withholding Allowance Certificate W-4ME

The Maine Employee's Withholding Allowance Certificate (Form W-4ME) is essential for employees to declare their withholding preferences. Properly filling out this form ensures accurate state income tax withholding. This guide offers step-by-step instructions to help you complete the W-4ME correctly.