Tax Forms Documents

Tax Forms

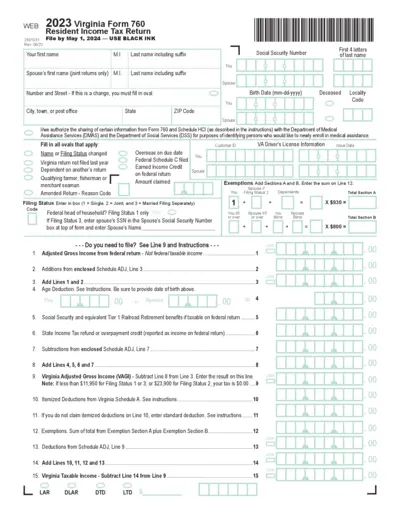

2023 Virginia Resident Income Tax Return Form

The 2023 Virginia Form 760 is the official Resident Income Tax Return required for residents in Virginia. This form must be filed by May 1, 2024, to ensure compliance and avoid penalties. It includes sections for personal information, income details, and tax calculations.

Tax Forms

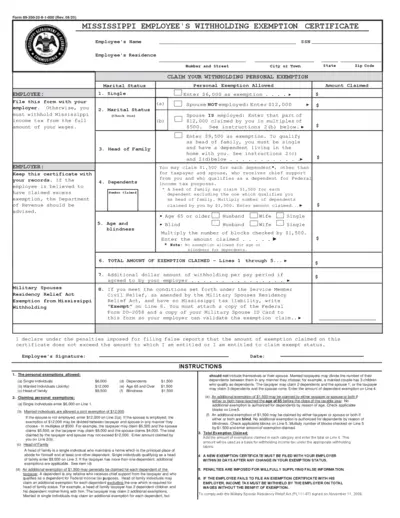

Mississippi Employee Withholding Exemption Certificate

The Mississippi Employee's Withholding Exemption Certificate is a crucial form for employees in Mississippi. It helps in determining personal exemptions for state income tax withholding. This certificate needs to be submitted to your employer to avoid unnecessary withholding.

Tax Forms

Form 8886-T Instructions for Tax-Exempt Entities

This file contains detailed instructions for tax-exempt entities regarding Form 8886-T. It outlines when and how to disclose prohibited tax shelter transactions. Essential for compliance with IRS regulations.

Tax Forms

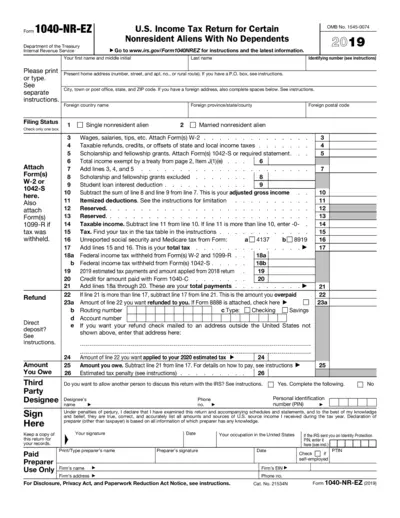

U.S. Income Tax Return for Nonresident Aliens

The Form 1040-NR-EZ is used by nonresident aliens who have no dependents to file their U.S. income tax return. This simplified form allows individuals to report their income and claim tax refunds. For detailed instructions and additional forms, visit the IRS website.

Tax Forms

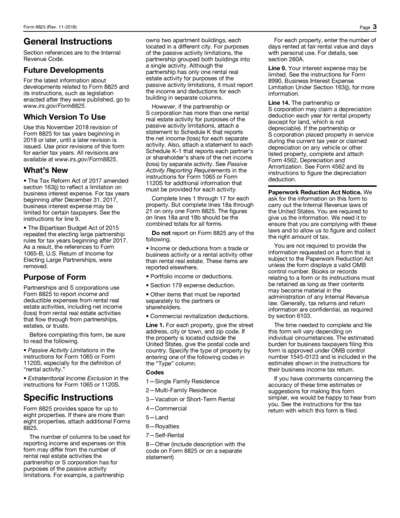

Form 8825 General Instructions for Tax Filing

Form 8825 is used by partnerships and S corporations to report income and deductible expenses from rental real estate activities. This guide provides detailed instructions to help you accurately fill out and file this essential tax form. Stay updated on the latest tax regulations and ensure compliance with your submissions.

Tax Forms

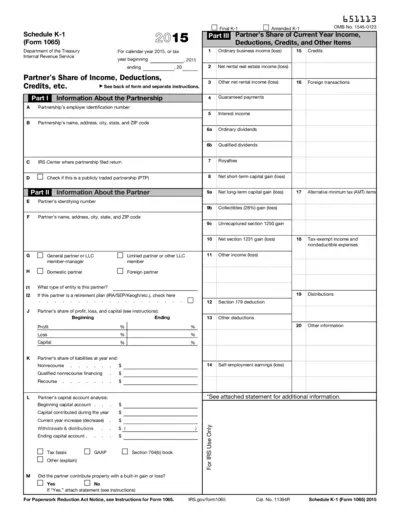

Schedule K-1 Form 1065 Tax Information 2015

The Schedule K-1 (Form 1065) provides essential tax information for partners in a partnership. It summarizes each partner's share of income, deductions, and credits for federal tax purposes. This important document is required for accurate tax reporting.

Tax Forms

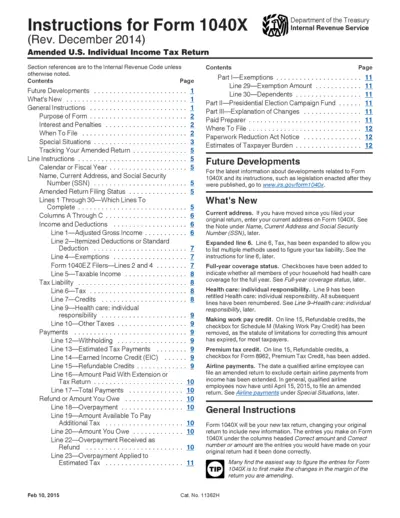

Instructions for Form 1040X Amended U.S. Income Tax

This document provides detailed instructions for filing Form 1040X, the Amended U.S. Individual Income Tax Return. It outlines eligibility requirements, necessary documentation, and key filing steps to ensure a smooth amendment process. Understanding these instructions helps taxpayers correct their tax returns effectively and avoid penalties.

Tax Forms

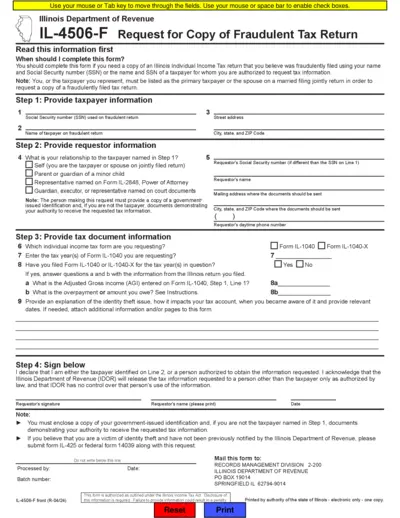

Illinois Department of Revenue IL-4506-F Tax Form

The IL-4506-F form is essential for individuals seeking a copy of a fraudulent tax return filed in their name. It provides clear instructions for filing and submitting the request. Ensure to include appropriate identification for faster processing.

Tax Forms

Form 2290 Heavy Highway Vehicle Use Tax Return

Form 2290 serves as the Heavy Highway Vehicle Use Tax Return for the tax period from July 1, 2017, to June 30, 2018. This form is essential for reporting heavy highway vehicle usage and calculating corresponding taxes. It is important for vehicle owners to file accurately and on time to avoid penalties.

Tax Forms

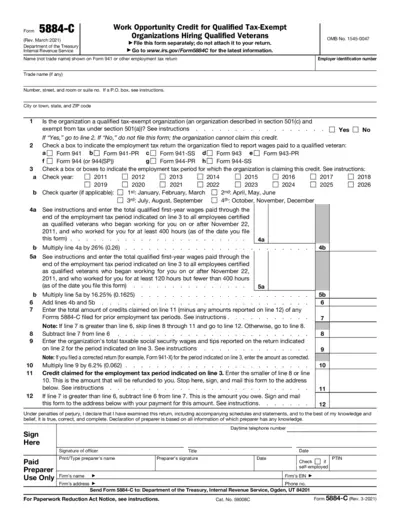

Form 5884-C Work Opportunity Credit for Veterans

Form 5884-C is used to claim the Work Opportunity Credit for qualified tax-exempt organizations that hire qualified veterans. This credit is available for wages paid to veterans during their first year of employment. It is essential for organizations looking to benefit from the incentives provided for hiring veterans.

Tax Forms

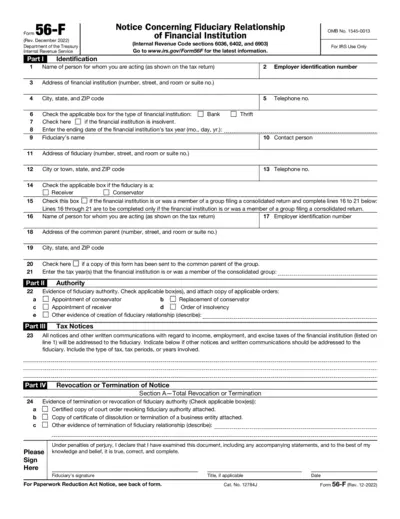

IRS Form 56-F Notify of Fiduciary Relationship

The IRS Form 56-F is used to notify the IRS of a fiduciary relationship with a financial institution. It is mandatory for fiduciaries to file this form within a specific time frame to ensure compliance with tax laws. This document includes detailed instructions for completing and submitting the form.

Tax Forms

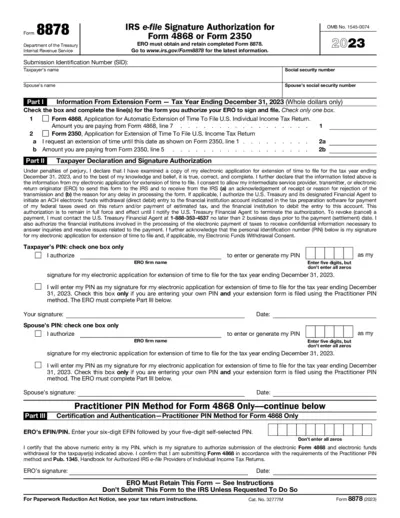

IRS Form 8878 e-file Signature Authorization

Form 8878 is an IRS e-file signature authorization used for tax extension applications. It allows taxpayers to authorize electronic return originators (EROs) to file Form 4868 or Form 2350 on their behalf. This form ensures that all information is accurate and that payments are processed properly.