Tax Forms Documents

Tax Forms

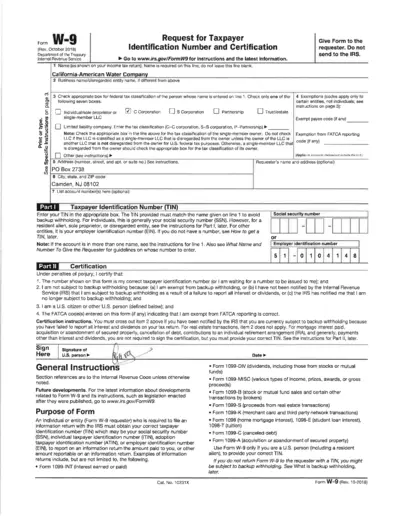

W-9 Form for Taxpayer Identification Certification

The W-9 form is essential for individuals and businesses needing to provide their taxpayer identification number. It is commonly used to report income paid to independent contractors. Completing this form accurately helps avoid backup withholding by the IRS.

Tax Forms

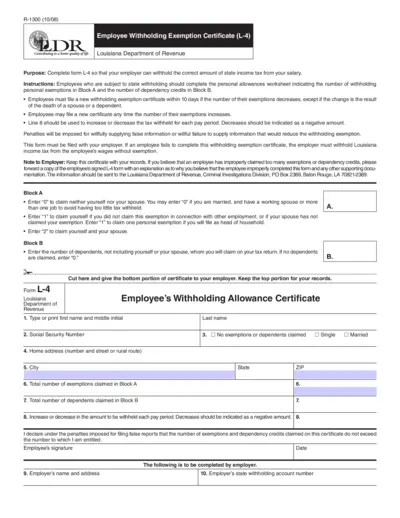

Employee Withholding Exemption Certificate L-4

The Employee Withholding Exemption Certificate (L-4) allows employees in Louisiana to declare the correct amount of state income tax withheld from their salaries. This form is essential for ensuring that employees do not overpay or underpay their taxes. It provides clear instructions for determining personal allowances and dependency credits.

Tax Forms

2017 Instructions for Schedule EO 568 Pass-Through Entities

This document provides essential instructions for filling out Schedule EO (568) concerning pass-through entity ownership. It outlines the requirements and instructions necessary for partnerships and limited liability companies in California. Users can refer to this guide for accurate tax reporting.

Tax Forms

Form N-11SF Instructions for Tax Filing 2023

The Form N-11SF is a vital document for Hawaii tax filing in 2023. It provides clear instructions and guidelines for taxpayers. This form is essential for residents, especially those seeking tax credits and accurate reporting.

Tax Forms

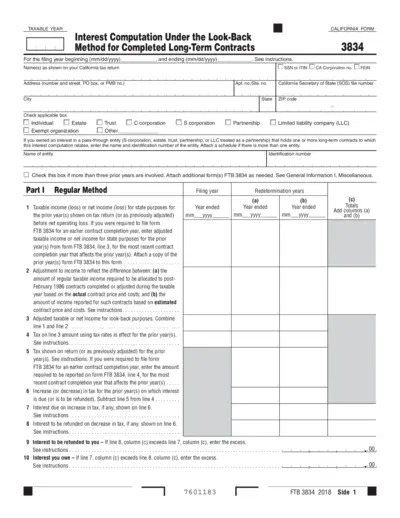

California Interest Computation for Long-Term Contracts

This form is used to calculate interest due or refundable under the look-back method for completed long-term contracts. It is essential for businesses and individuals involved in contractual agreements to ensure accurate tax filings. Follow the instructions carefully to complete the form properly.

Tax Forms

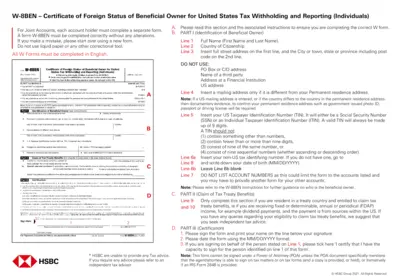

W-8BEN Form for Foreign Status Certification

The W-8BEN form allows foreign individuals to certify their foreign status for tax withholding purposes. It ensures proper income tax treaty benefits are applied. This form is essential for non-U.S. residents receiving income from U.S. sources.

Tax Forms

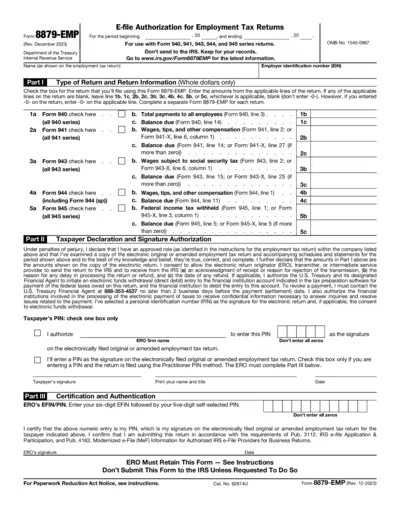

Form 8879-EMP E-file Authorization for Employment Tax Returns

Form 8879-EMP facilitates the e-filing of employment tax returns. It allows authorized users to electronically sign returns using a personal identification number (PIN). This form is essential for employers submitting Form 940, 941, 943, 944, and 945 series returns.

Tax Forms

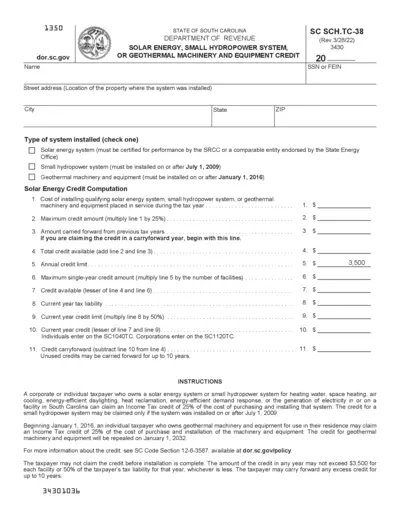

South Carolina Solar Energy Credit Application

This file contains the application form for claiming the solar energy or small hydropower system credit in South Carolina. It provides detailed instructions on the eligibility and computation of the credit. Taxpayers can use this form to claim a tax credit of 25% for qualifying energy systems.

Tax Forms

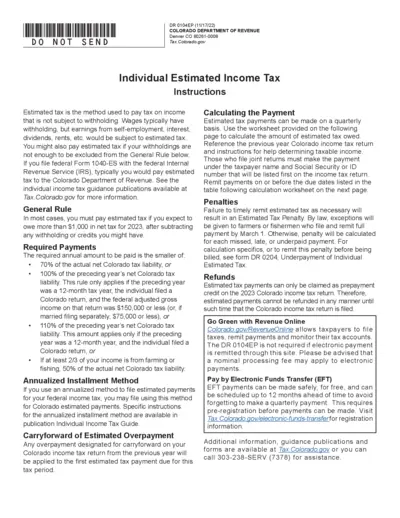

Colorado Estimated Income Tax Payment Instructions

This document provides detailed instructions for individuals on how to make estimated income tax payments in Colorado. It outlines the required forms, deadlines, and payment methods for taxpayers. Use this guide to ensure compliance with state tax regulations.

Tax Forms

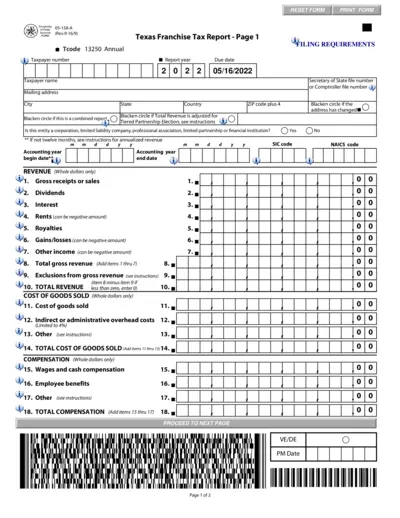

Texas Franchise Tax Report - Form 05-158

The Texas Franchise Tax Report Form 05-158 is essential for businesses to report their financial data to the Texas Comptroller. This document helps in calculating the franchise tax owed by the entity for the reported year. Accurate submission ensures compliance with state tax regulations.

Tax Forms

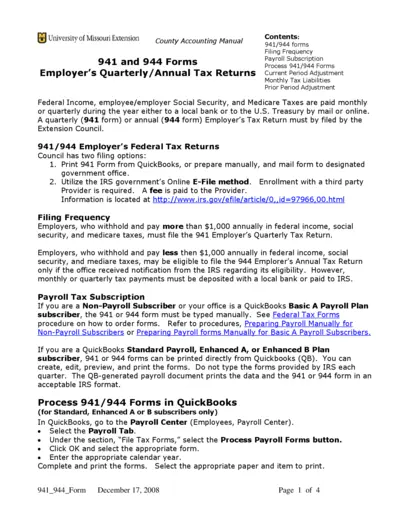

University of Missouri Extension County Accounting Manual

This manual provides detailed guidance for completing the 941 and 944 tax forms. It outlines the necessary steps and best practices for filing quarterly and annual tax returns. Ideal for extension councils and employers managing payroll taxes.

Tax Forms

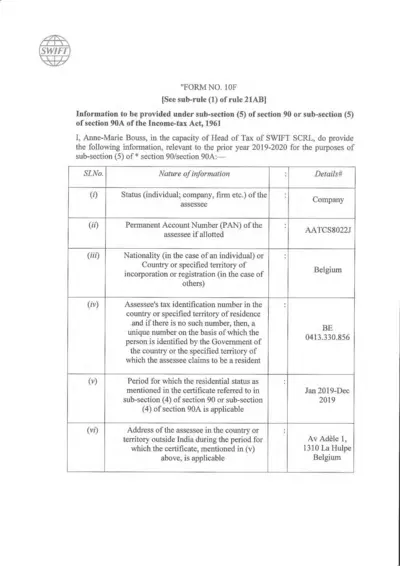

Form No. 10F Information Submission

This document provides essential information as required by the Income-tax Act, 1961. It is relevant for individuals and entities seeking tax residency status. Fill out this form accurately to ensure compliance with tax regulations.