Tax Forms Documents

Tax Forms

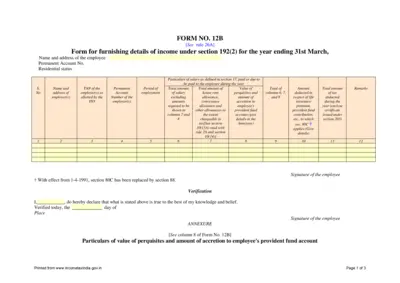

Form 12B: Income Details Submission

This file is a Form 12B for furnishing income details under section 192(2) for tax purposes. It is essential for employees to report their salary and perquisites accurately. Follow the instructions in this document to ensure proper submission.

Tax Forms

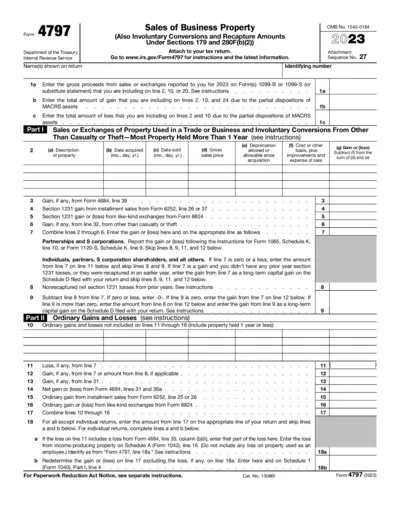

Form 4797: Sales of Business Property Instructions

Form 4797 provides guidelines for reporting sales of business property. This form is crucial for calculating gains and losses related to sales, exchanges, and involuntary conversions. Properly filling out this form ensures compliance with IRS regulations and accurate reporting on your tax return.

Tax Forms

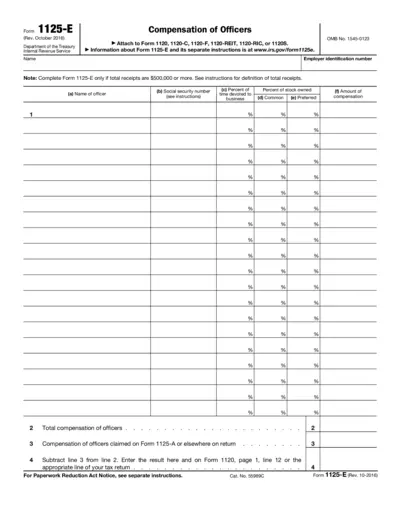

Form 1125-E Compensation of Officers Instructions

Form 1125-E is used for reporting officer compensation.

Tax Forms

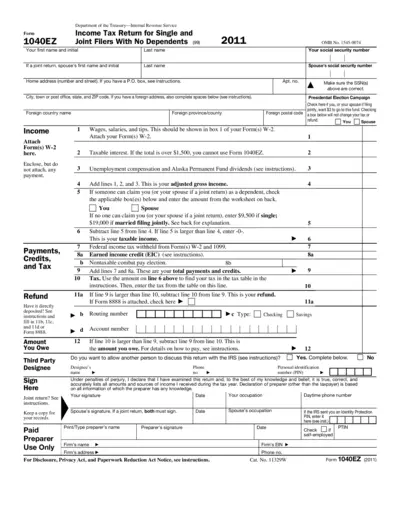

1040EZ Income Tax Return for 2011 Single/Joint Filers

The 1040EZ form is a simplified income tax return for individuals who are single or married filing jointly without dependents. This form is designed for those with straightforward tax situations, making it easier to complete your tax return. It helps ensure accurate reporting of income and taxes owed or refundable.

Tax Forms

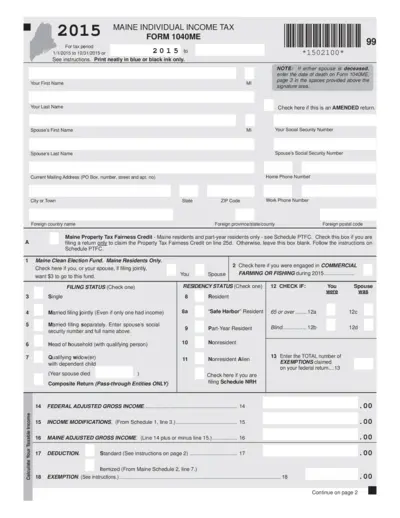

Maine Individual Income Tax Form 1040ME Instructions

This document provides a comprehensive guide for filling out the Maine Individual Income Tax Form 1040ME. It includes crucial deadlines, filing statuses, and step-by-step instructions. Use this form for your income tax filing needs in the state of Maine.

Tax Forms

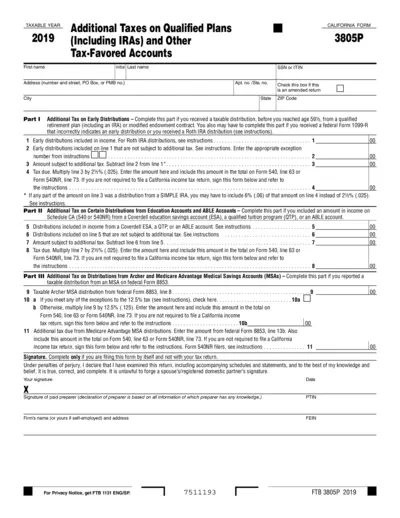

California 2019 Form 3805P: Additional Taxes Guide

This document provides details on California Form 3805P for the taxable year 2019. It outlines additional taxes on qualified plans including IRAs and other tax-favored accounts. Ensure compliance with state regulations by following the instructions provided.

Tax Forms

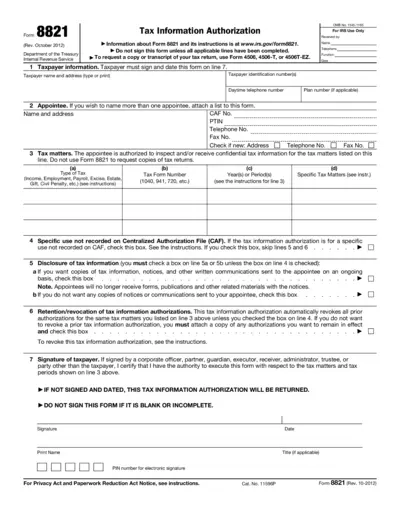

Form 8821 Tax Information Authorization

Form 8821 allows you to authorize an individual or entity to inspect and receive your confidential tax information. It is essential for managing your tax matters effectively. This form outlines the permissions granted and ensures proper handling of your tax data.

Tax Forms

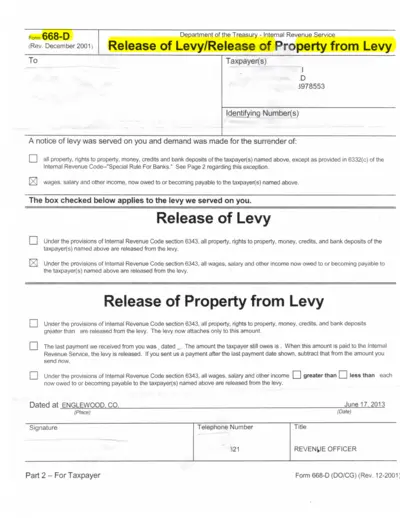

Release of Levy Property Form 668-D Instructions

Form 668-D is essential for taxpayers to release a levy on their property. This document outlines the necessary steps and requirements for submission. It serves to inform taxpayers of their rights and obligations under the Internal Revenue Code.

Tax Forms

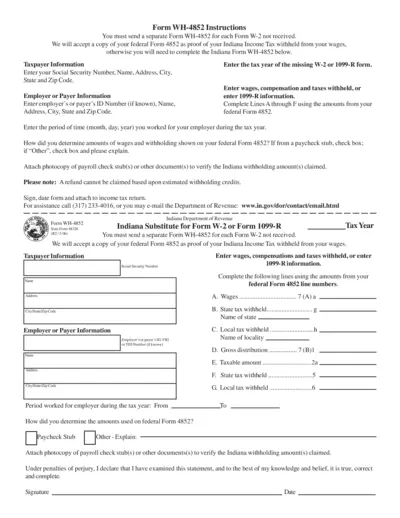

Indiana Form WH-4852 Instructions for Tax Year 2023

This file provides detailed instructions for completing Form WH-4852, which is necessary for individuals who have not received their W-2 forms. It outlines the required information needed for proper completion, as well as submission guidelines to ensure you receive the correct Indiana income tax credits. Follow the instructions carefully to avoid complications with your tax filing.

Tax Forms

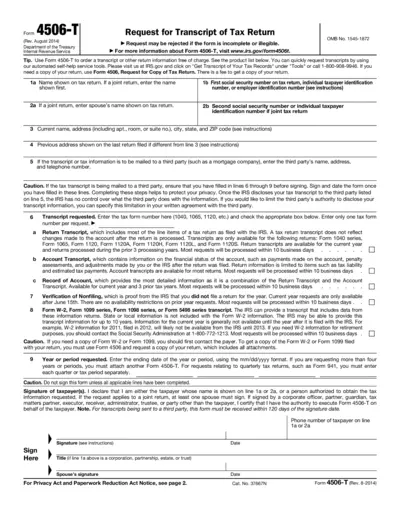

Form 4506-T Request for Transcript of Tax Return

Form 4506-T allows taxpayers to request transcripts of their tax returns. This form can be essential for verifying income information or for submitting a loan application. It is necessary to fill out all applicable fields to avoid rejection.

Tax Forms

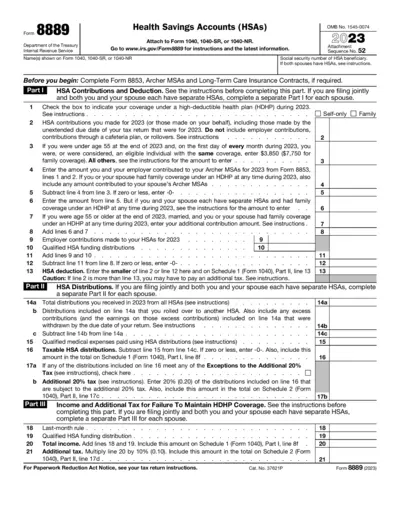

Form 8889 Health Savings Account IRS Instructions

Form 8889 is used to report Health Savings Account (HSA) contributions, deductions, and distributions. This form is crucial for individuals with HSAs to ensure compliance with IRS regulations. It provides necessary information for calculating tax benefits related to HSAs.

Tax Forms

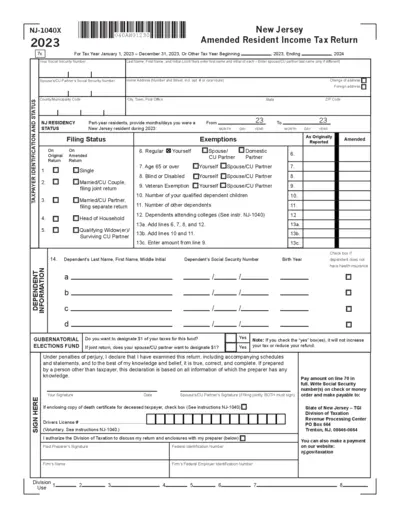

NJ 1040X Amended Resident Income Tax Return 2023

The NJ-1040X is used for filing an amended resident income tax return for New Jersey. This form is crucial for correcting any errors made on your original return and ensuring proper tax compliance. For tax year 2023, it is important to provide accurate information to avoid penalties and ensure timely processing.