Tax Forms Documents

Tax Forms

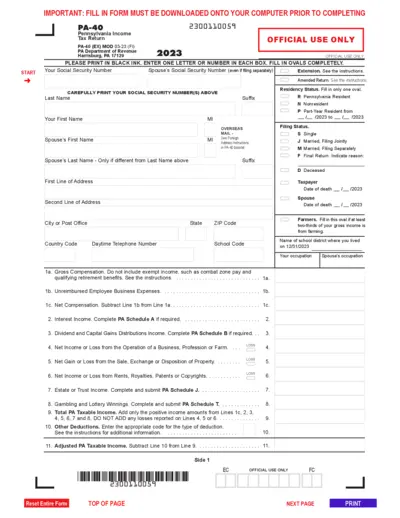

Pennsylvania PA-40 Tax Return Form 2023 Instructions

The PA-40 Tax Return is required for filing Pennsylvania state taxes. It details income, deductions, and credits for residents. Complete this official form accurately for your tax submissions.

Tax Forms

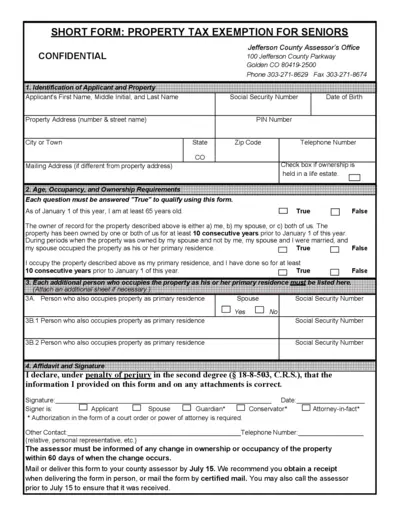

Property Tax Exemption for Seniors in Colorado

This form provides property tax exemptions for seniors 65 and older in Colorado. Applicants must meet specific age, ownership, and residency requirements. Follow the guidelines carefully to secure your exemption.

Tax Forms

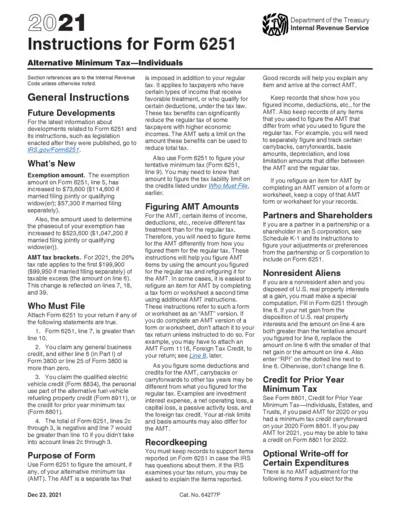

Instructions for Form 6251 - Alternative Minimum Tax

This file contains comprehensive instructions for Form 6251, which is used to calculate your Alternative Minimum Tax (AMT) obligations. It details exemptions, tax brackets, and required filings. This guide is essential for taxpayers subject to AMT regulations.

Tax Forms

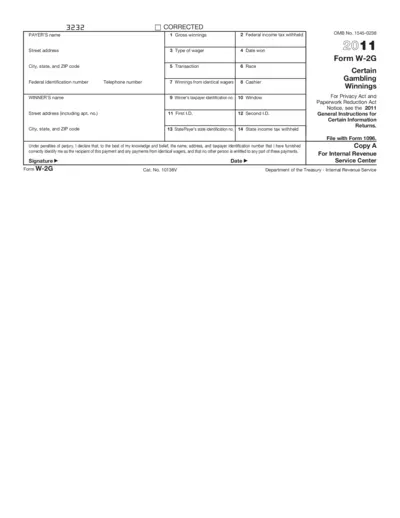

W-2G Gambling Winnings Reporting Form

The W-2G form is used to report certain gambling winnings. It is essential for winners to document their earnings for tax purposes. Complete the form accurately to ensure compliance with tax laws.

Tax Forms

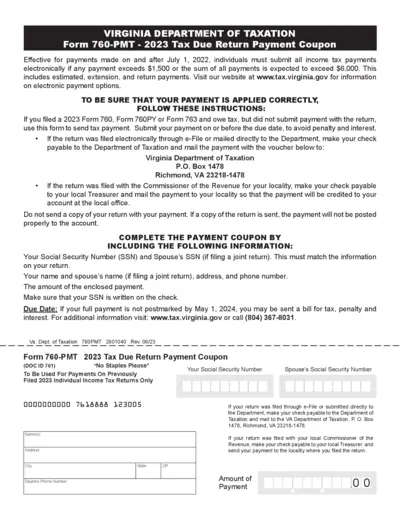

2023 Virginia Department of Taxation Payment Coupon

The Virginia Department of Taxation Form 760-PMT is designed for individuals who need to submit tax payments. This form should be used for payments due after filing individual income tax returns for the year 2023. Ensure to follow the instructions carefully to avoid penalties.

Tax Forms

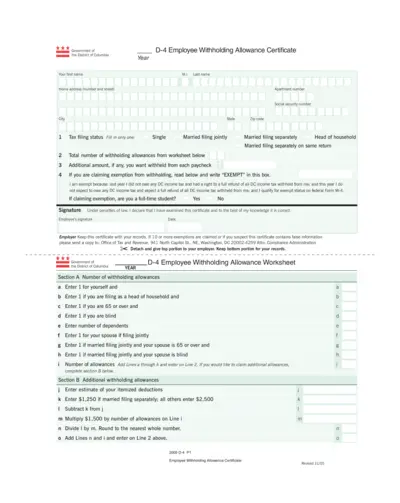

D-4 Employee Withholding Allowance Certificate Form

This form is essential for new employees in DC to establish their withholding allowances. Ensure accurate completion to avoid tax liabilities. Employers require this form to properly withhold DC income tax.

Tax Forms

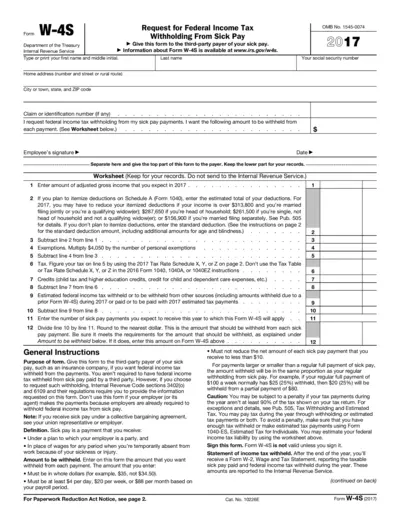

W-4S Form for Federal Income Tax Withholding

The W-4S form is used to request federal income tax withholding from sick pay payments. This form must be provided to the third-party payer of sick pay, such as an insurance company. It helps to manage tax payments effectively during periods of illness.

Tax Forms

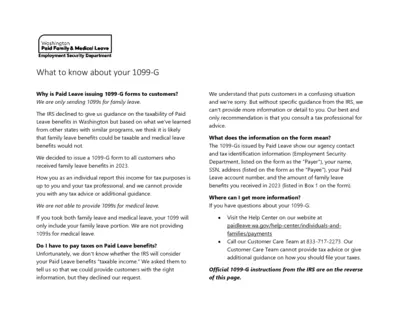

Paid Family Medical Leave 1099-G Instructions

This document provides essential information about the 1099-G form issued for Paid Family and Medical Leave benefits in Washington. It outlines tax implications and reporting requirements. Understanding this form is crucial for accurate tax filings.

Tax Forms

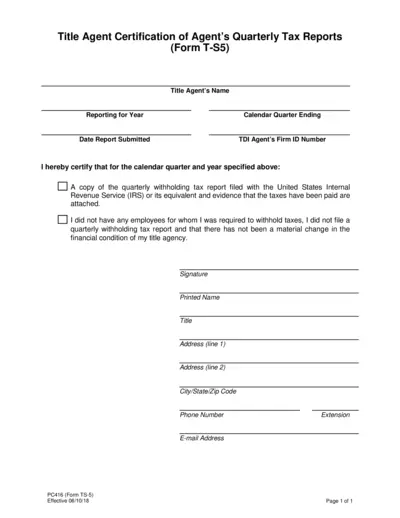

Agent Certification of Quarterly Tax Reports Form T-S5

This form is used by title agents to certify their quarterly tax filings. It includes necessary details about the tax reports and compliance. Ensure this form is filled out correctly to avoid any tax-related issues.

Tax Forms

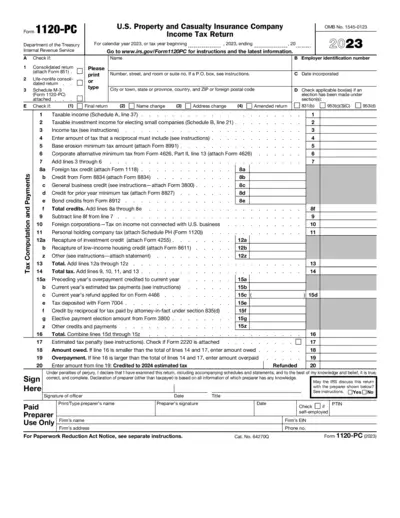

U.S. Property and Casualty Insurance Company Tax File

This file contains the Income Tax Return for property and casualty insurance companies, necessary for tax reporting. It offers detailed sections for inputting taxable income and investments. Essential for compliance with IRS requirements.

Tax Forms

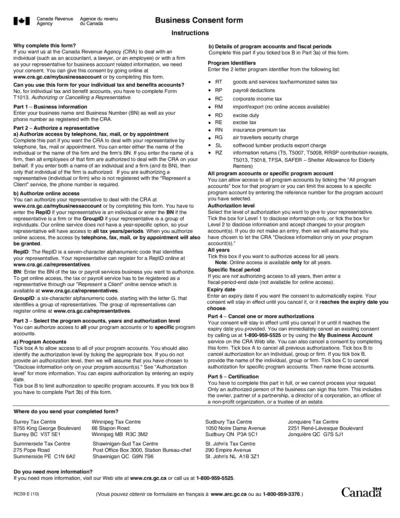

Canada Revenue Agency Business Consent Form Instructions

The Canada Revenue Agency Business Consent Form is essential for authorizing representatives to access your business account information. It allows individuals such as accountants or lawyers to manage your tax affairs on your behalf. Proper completion of this form ensures compliance and efficient handling of your business tax matters.

Tax Forms

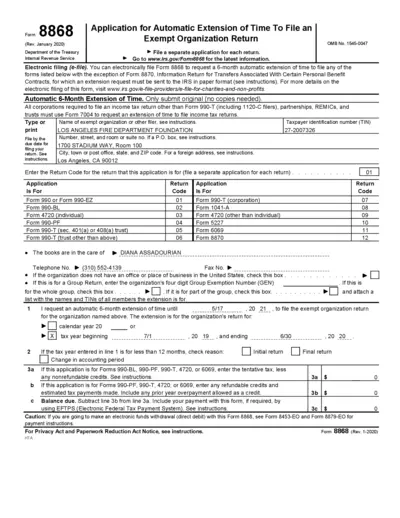

Automatic Extension to File Exempt Organization Returns

This form is used to request an automatic 6-month extension for filing exempt organization returns. Organizations can file this form electronically or via paper submission. Ensure filing aligns with IRS guidelines to avoid penalties.