Tax Forms Documents

Tax Forms

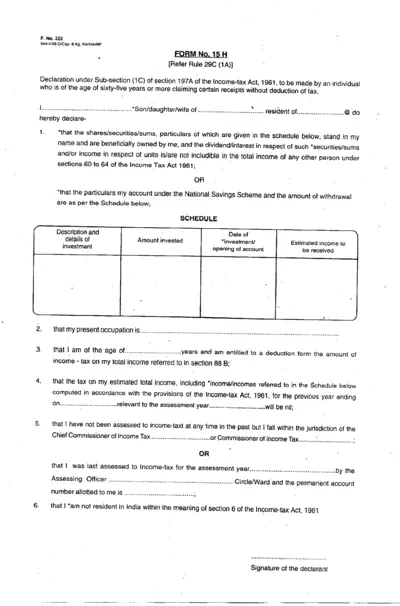

Income Tax Declaration Form No. 15H Instructions

This document is an Income Tax Declaration Form No. 15H for individuals aged 65 or older. It allows you to claim certain receipts without deduction of tax. Fill out the details accurately to ensure compliance with the Income Tax Act.

Tax Forms

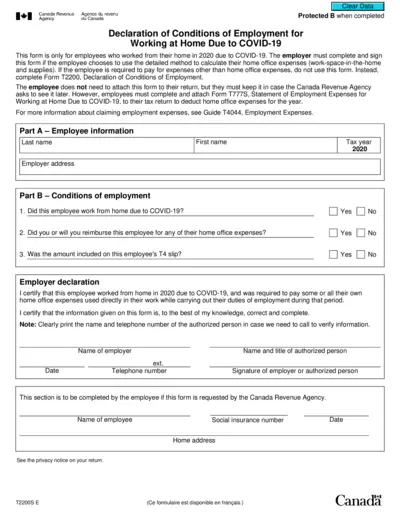

Declaration for Working at Home Due to COVID-19

This form is designed for employees who worked from home due to COVID-19 in 2020. It helps calculate home office expenses using the detailed method. Employers must complete this form as part of the employment expense claim process.

Tax Forms

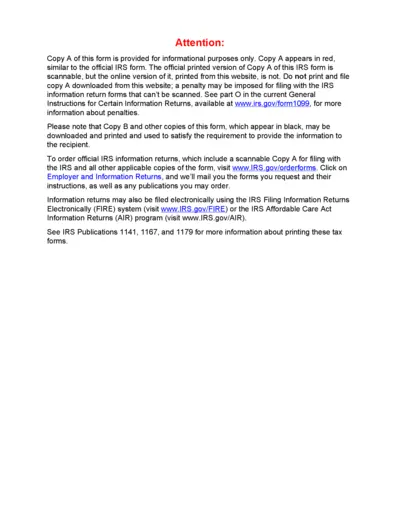

IRS Form 3921 Instructions and Information

This file contains essential instructions for filling out IRS Form 3921, which is used for reporting incentive stock options. It provides clarity on submission procedures and penalties. Users will find detailed steps for accurate completion and submission.

Tax Forms

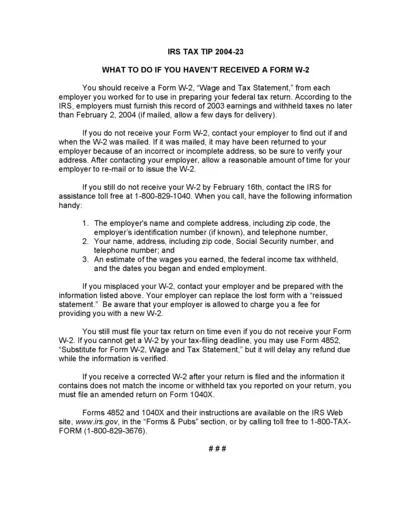

IRS Tax Tip 2004-23: Form W-2 Instructions

This document provides essential guidance for individuals who have not received their Form W-2. It outlines the steps to take in order to obtain this vital tax document. Understanding these instructions is crucial for timely and accurate tax filing.

Tax Forms

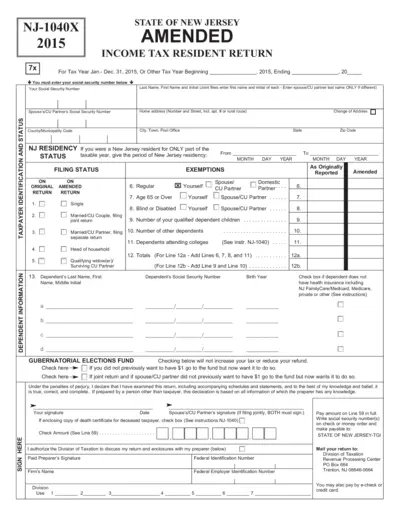

NJ 1040X Amended Income Tax Resident Return 2015

This file is the NJ-1040X form for the tax year 2015, allowing taxpayers to make amendments to their New Jersey income tax returns. It includes essential details for filing, exemptions, and credits. Perfect for residents needing corrections or updates to their previously filed returns.

Tax Forms

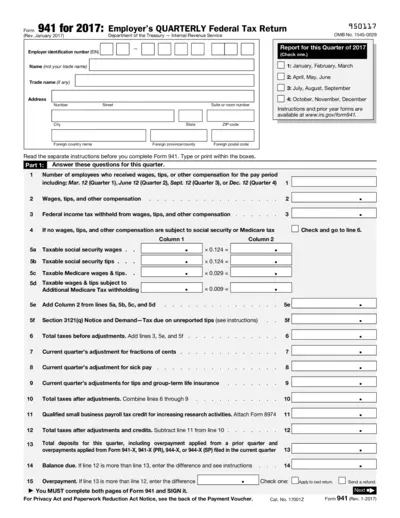

Employer's Quarterly Federal Tax Return 2017

Form 941 is used by employers to report taxes withheld from employees' paychecks. It provides essential details on wages, tips, and federal tax liabilities. This form is crucial for tax compliance in the business sector.

Tax Forms

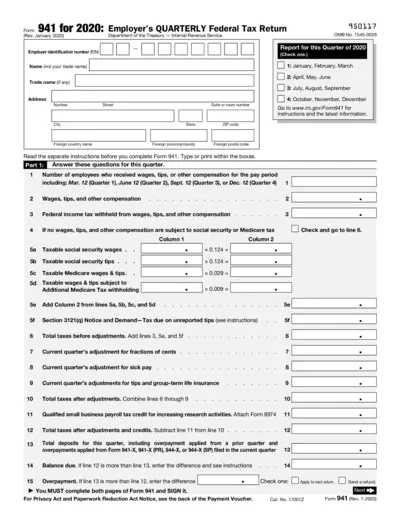

Employer's Quarterly Federal Tax Return Form 941

Form 941 is a quarterly tax return filed by employers to report wages and taxes withheld. It provides essential information for payroll tax calculations. Employers must accurately complete and submit this form to ensure compliance with IRS regulations.

Tax Forms

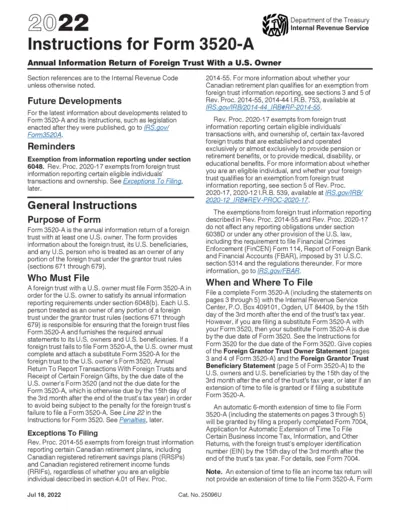

IRS Instructions for Form 3520-A Foreign Trust Filing

This document provides comprehensive instructions for completing Form 3520-A, essential for U.S. owners of foreign trusts. It outlines filing requirements, penalties, and important exemptions. Understanding these guidelines ensures proper compliance with IRS regulations.

Tax Forms

POPPY COMPANY Form 940 FUTA Tax Return Guidelines

This document provides detailed instructions for filling out Form 940 for the year 2013. It is essential for employers reporting their federal unemployment taxes. Utilize this resource for accurate tax submissions and compliance.

Tax Forms

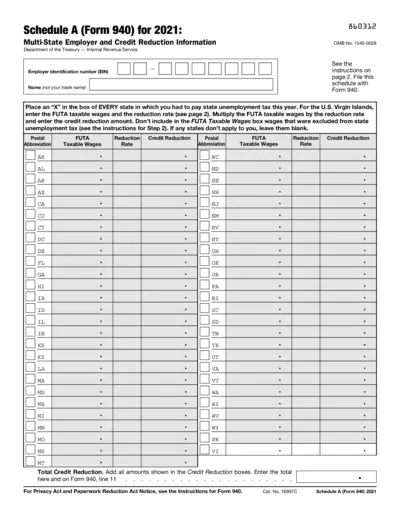

Schedule A Form 940 Multi-State Employer 2021

This file contains Schedule A (Form 940) information for employers who operate in multiple states. It provides detailed instructions for completing the form, including credit reduction guidelines. Essential for employers who must report state unemployment tax information.

Tax Forms

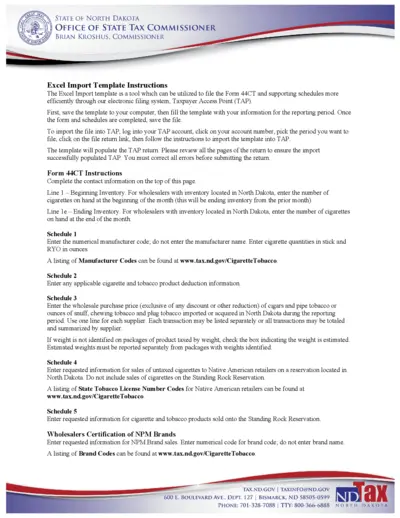

Excel Import Template Instructions for Form 44CT

The Excel Import Template helps streamline the filing of Form 44CT and supporting schedules electronically. Users can easily input their inventory and sales details, ensuring accurate and timely submissions. This file serves as a guide to assist taxpayers in utilizing the Taxpayer Access Point (TAP) efficiently.

Tax Forms

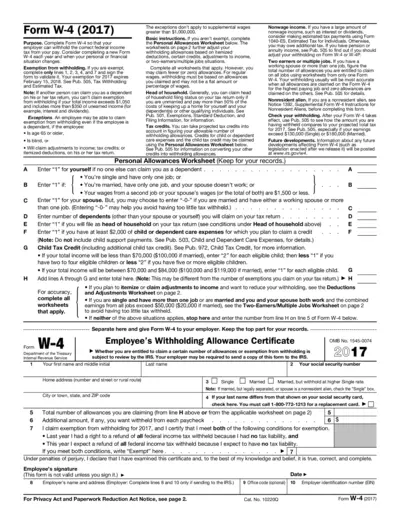

Form W-4 2017 Tax Withholding Certificate

Form W-4 is required for employees to indicate their tax withholding allowances. This form helps employers withhold the correct federal income tax from paychecks. Completing this form accurately can help avoid issues with your tax liabilities.