Tax Forms Documents

Tax Forms

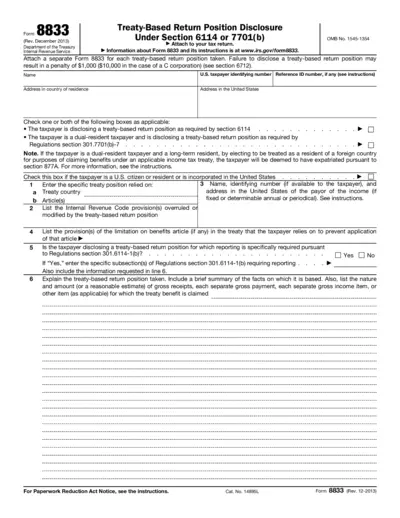

Treaty-Based Return Position Disclosure Instructions

This document provides detailed instructions for filing Form 8833, which is required for treaty-based tax return position disclosures. It is essential for both U.S. taxpayers and dual-resident taxpayers to avoid penalties and ensure compliance. Follow the guidelines to correctly fill out the form and understand your obligations.

Tax Forms

Form W-7A Instructions for Adoption Tax IDs

This file provides crucial instructions for Form W-7A, which is needed to apply for a Taxpayer Identification Number for pending U.S. adoptions. It includes guidelines on filling out the form, eligibility requirements, and essential documents to attach. Understanding this form is vital for families looking to adopt and navigate the tax implications.

Tax Forms

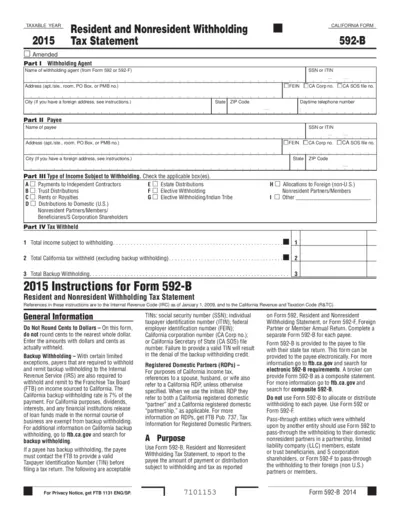

California 2015 Resident Nonresident Withholding Tax Form

This file contains essential information and instructions for completing California's Resident and Nonresident Withholding Tax Statement form for the year 2015. It includes guidelines on filling out the form, necessary information required, and details on who needs to submit it. Ideal for individuals and businesses handling income subject to withholding tax.

Tax Forms

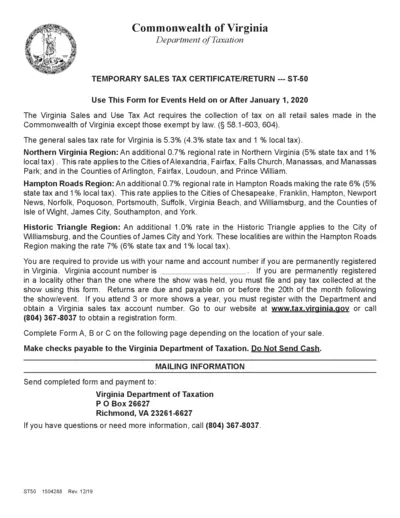

Virginia Temporary Sales Tax Certificate and Return

This file provides the necessary information and forms for the Virginia Temporary Sales Tax Certificate/Return. It is essential for vendors participating in sales events in Virginia. Ensure compliance with the Virginia Sales and Use Tax Act with this convenient guide.

Tax Forms

IRS W-2 and W-3 Filing Instructions and Information

This document provides essential information on how to file the IRS Forms W-2 and W-3. It includes instructions for employers to ensure compliance with tax laws. Users will find helpful resources and guidelines for electronic filing and physical submissions.

Tax Forms

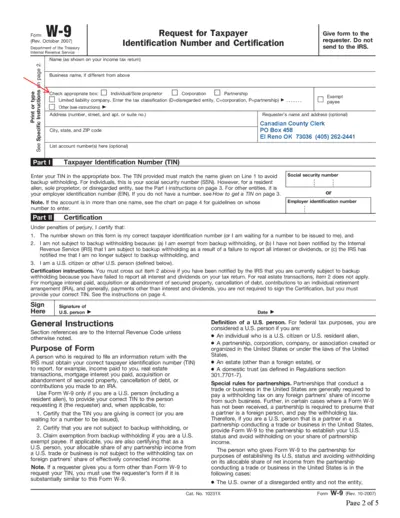

W-9 Form 2007 IRS Taxpayer Identification Certification

This file is the W-9 form for taxpayer identification. It is required for individuals and entities to provide their TIN to requesters. Use this form to certify your taxpayer identification number.

Tax Forms

Maryland 2022 State Local Tax Forms Instructions

This file contains the official Maryland state and local tax forms and instructions for filing personal income taxes. It is designed for both full and part-year residents. Understand the latest tax laws and filing requirements to ensure compliance and maximize your refund.

Tax Forms

Form 8960 Overview Net Investment Income Tax Guide

This file provides essential insights into Form 8960 related to the Net Investment Income Tax. It is a critical resource for estate planners and tax practitioners. The document outlines instructions and highlights for effectively filling out Form 8960.

Tax Forms

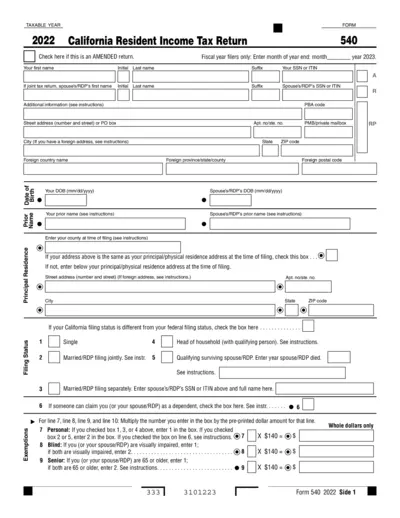

California Resident Income Tax Return 2022

This file contains the 2022 California Resident Income Tax Return for individuals. It provides detailed information on how to properly fill out your tax return. Ensure your compliance with state tax laws using this essential document.

Tax Forms

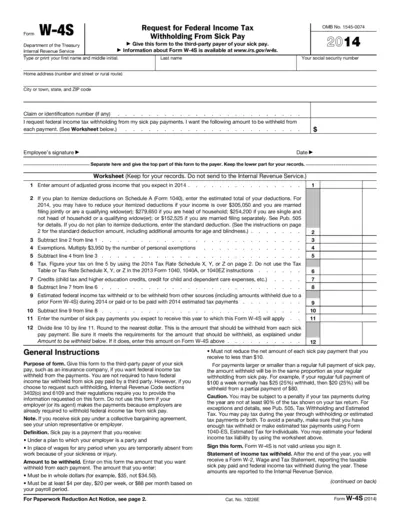

Form W-4S Request for Federal Income Tax Withholding

Form W-4S is used to request federal income tax withholding from sick pay payments. This IRS form is essential for individuals receiving sick pay and wanting to have tax withheld. Completing this form ensures proper tax deductions consistent with your financial situation.

Tax Forms

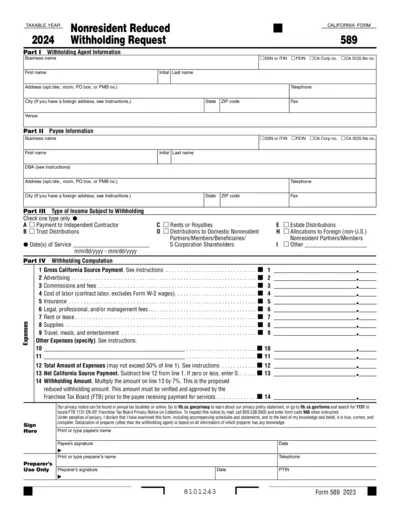

California Nonresident Reduced Withholding Request 589

The California Nonresident Reduced Withholding Request Form 589 is used to request reduced withholding on payments to nonresident individuals. This form is essential for independent contractors, trust beneficiaries, landlords, and others receiving qualifying payments. Proper completion ensures accurate withholding amounts as per California tax regulations.

Tax Forms

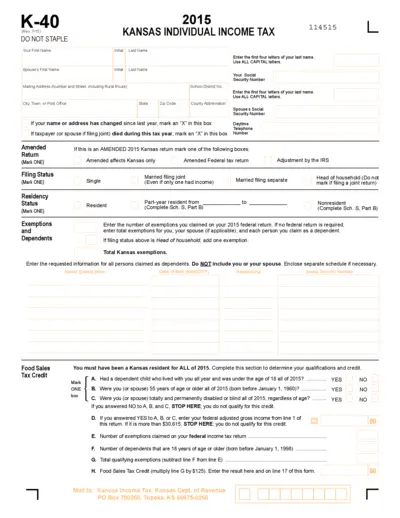

Kansas Individual Income Tax Form 2015 Instructions

This file provides comprehensive instructions for completing the Kansas Individual Income Tax form for 2015. It includes detailed guidelines on required information and submission procedures. Ideal for both individual taxpayers and tax professionals.