Tax Forms Documents

Tax Forms

Free Tax USA Form 3800 General Business Credit

This file contains IRS Form 3800 for General Business Credit. It's essential for tax reporting and provides guidance for filling out the form. Users can e-file and print their federal tax return using FreeTaxUSA.

Tax Forms

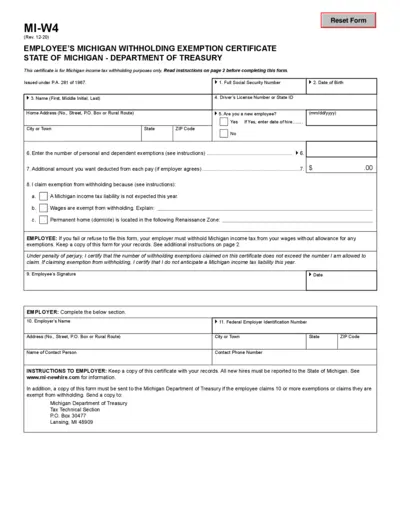

Michigan Withholding Exemption Certificate MI-W4 Form

The Michigan Withholding Exemption Certificate (Form MI-W4) is essential for employees to claim personal and dependent exemptions for state income tax withholding. It outlines the necessary details required for tax purposes and helps determine the correct withholding amount from wages. Understanding how to fill out this form correctly can save you money and ensure compliance with state tax regulations.

Tax Forms

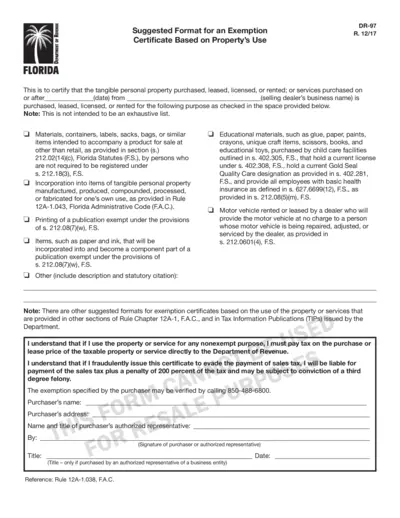

Exemption Certificate for Property Use Florida

The exemption certificate enables buyers to claim sales tax exemption for specific property uses in Florida. This document outlines the necessary criteria and provides instructions on completing the form. It is essential for businesses and individuals seeking to avoid unnecessary tax charges.

Tax Forms

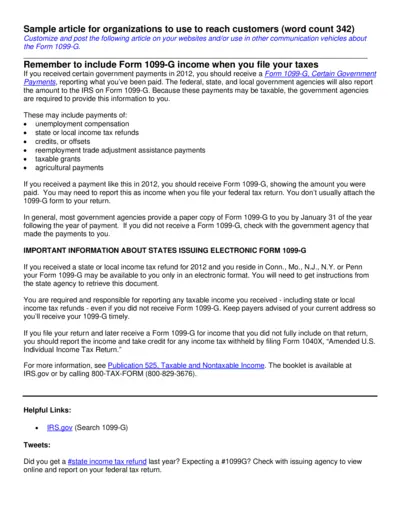

Understanding Form 1099-G for Tax Reporting

This document provides essential information regarding Form 1099-G, including instructions on when and how to report government payments for tax purposes. It's crucial for individuals who received government aid to ensure proper tax compliance. Utilize this guide to navigate the details of your 1099-G form effectively.

Tax Forms

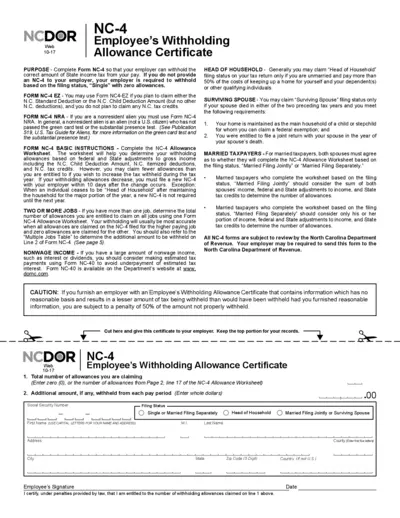

NC-4 Employee Withholding Allowance Certificate

The NC-4 form allows employees to determine the correct amount of State income tax withheld from their pay. Users can complete this form to make informed decisions regarding withholding allowances. It is essential for both individuals and employers to understand this form for accurate tax withholding.

Tax Forms

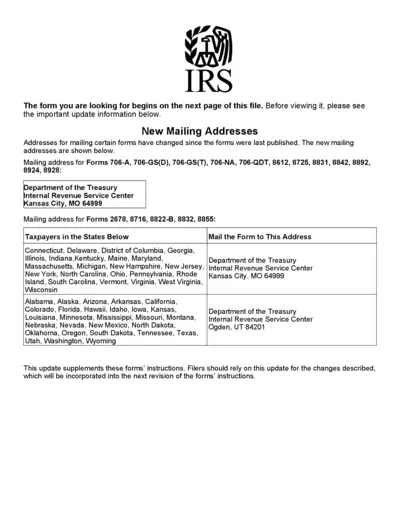

IRS Form 706-GS(T): Generation-Skipping Transfer Tax

Form 706-GS(T) is used for Generation-Skipping Transfer Tax returns. It is crucial for trust administrators handling terminations after December 31, 2012. Ensure to follow the specific guidelines for filling out the form accurately.

Tax Forms

Instructions for IRS Form W-7 Application ITIN

This document provides detailed instructions for completing the IRS Form W-7, which is necessary for applying for an Individual Taxpayer Identification Number (ITIN). It outlines eligibility, application procedures, and documentation requirements. Understanding these guidelines is crucial for individuals needing an ITIN for tax purposes.

Tax Forms

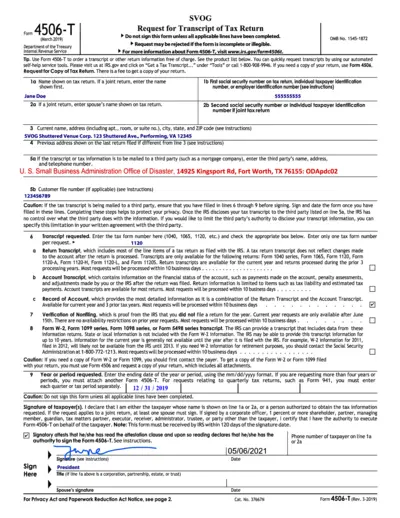

Request for Transcript of Tax Return Form 4506-T

This file is a request form for obtaining a transcript of your tax return. It includes essential instructions and guidelines on completing the form. Ideal for individuals needing tax information for various purposes.

Tax Forms

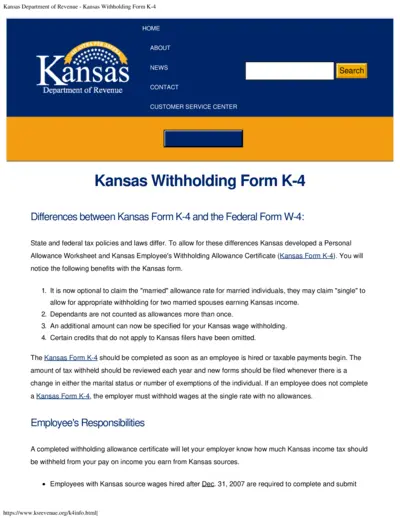

Kansas Withholding Form K-4 Instructions and Details

This document provides essential information about the Kansas Withholding Form K-4, including how to fill it out and who needs it. It's crucial for employees in Kansas to understand the differences between this state form and the federal Form W-4. Ensure you complete your K-4 accurately to maintain proper tax withholding.

Tax Forms

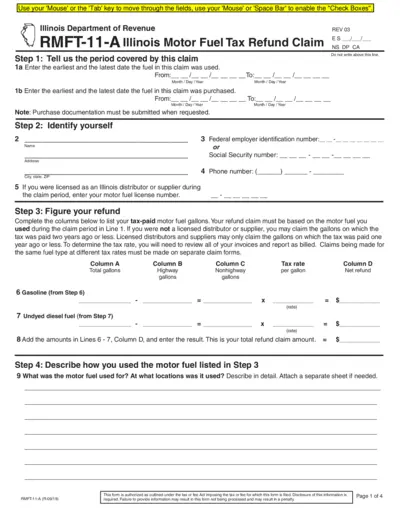

Illinois Motor Fuel Tax Refund Claim Form RMFT-11-A

This form is a claim for a refund of Illinois motor fuel tax. It allows individuals and businesses to submit claims for tax paid on motor fuel used for specific purposes. Proper completion ensures eligibility for a refund.

Tax Forms

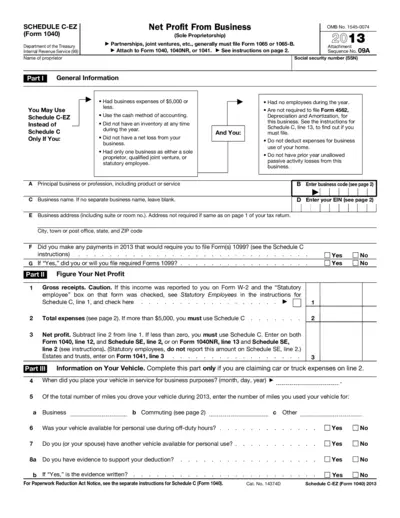

Schedule C-EZ Form 1040 for Simplified Tax Filing

Schedule C-EZ is designed for small businesses reporting under $5,000 in expenses. This form simplifies the process of reporting net profit from a sole proprietorship. Ideal for freelancers and self-employed individuals.

Tax Forms

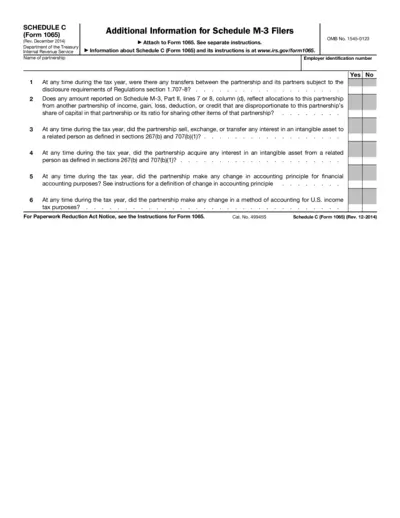

Schedule C Form 1065 Instructions and Details

Schedule C (Form 1065) provides essential information for partnerships to report financial activities. This form includes guidelines for reporting transfers and accounting changes. It is crucial for ensuring compliance with IRS regulations.