Tax Forms Documents

Tax Forms

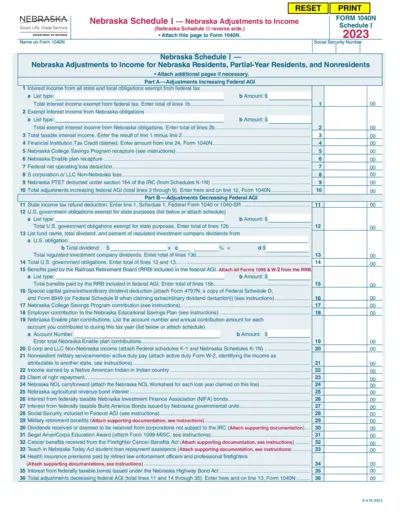

Nebraska Adjustments to Income Tax Form 1040N

This document provides the Nebraska Schedule I for adjustments to income for residents and nonresidents. It outlines how to calculate Nebraska adjustments effectively. Use this form to ensure accurate income reporting in compliance with Nebraska tax laws.

Tax Forms

Alabama Individual Income Tax Payment Voucher

This file contains the Alabama Individual Income Tax Payment Voucher. It provides essential information on how to submit your individual income tax payment. Use this voucher to ensure timely payment and avoid penalties.

Tax Forms

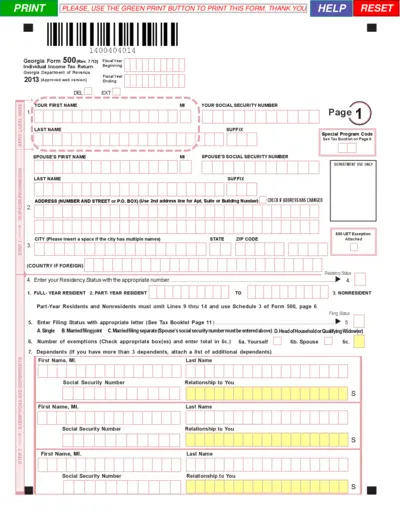

Georgia Individual Income Tax Return Form 500

The Georgia Form 500 is an Individual Income Tax Return form used by residents of Georgia to report their income and calculate taxes owed. This form must be completed annually and provides specific instructions for proper filing. Ensure you have all necessary information on hand before beginning to fill out this important tax document.

Tax Forms

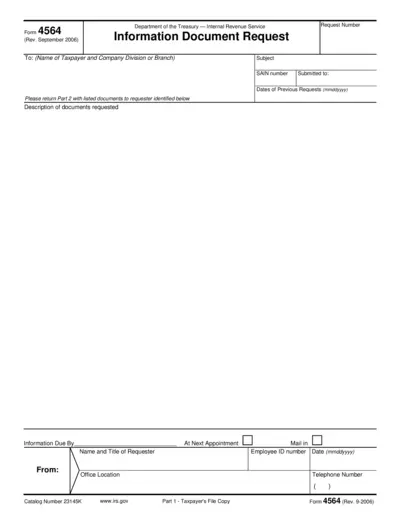

IRS Form 4564 Information Document Request

IRS Form 4564 is an Information Document Request form used by the IRS to gather documents from taxpayers. It solicits specific documentation necessary for tax compliance. This form facilitates communication between the IRS and taxpayers, ensuring all required information is collected efficiently.

Tax Forms

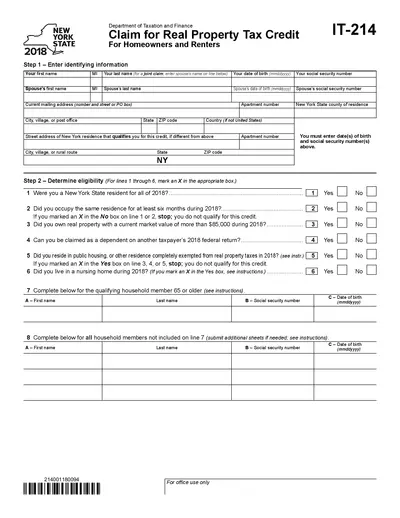

New York State IT-214 Real Property Tax Credit Form

The IT-214 form is used by homeowners and renters in New York State to claim a real property tax credit. This form helps determine eligibility based on residency and income. Ensure to provide accurate personal information and complete the income and tax sections.

Tax Forms

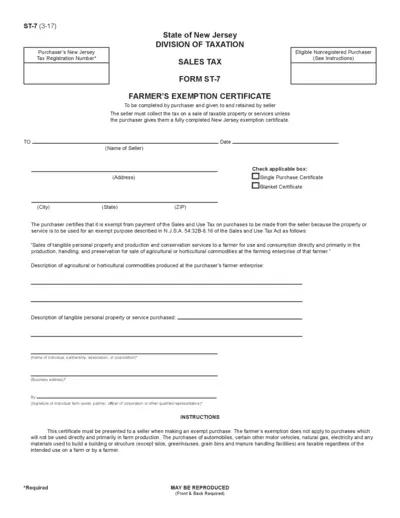

Farmers Exemption Certificate Form ST-7 Instructions

The Farmers Exemption Certificate Form ST-7 allows qualified purchasers in New Jersey to make tax-exempt purchases related to farming. This document must be presented to the seller to avoid sales tax on eligible items. It provides guidelines on filling out the form and the necessary exemptions applicable to farmers.

Tax Forms

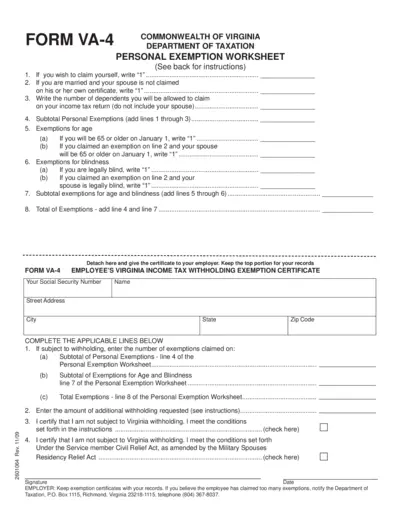

Virginia Tax Exemption Worksheet and Instructions

FORM VA-4 is a worksheet for Virginia residents to determine their personal tax exemptions. It includes detailed instructions for claiming yourself, your spouse, and dependents. Complete this form to notify your employer of your income tax withholding exemptions.

Tax Forms

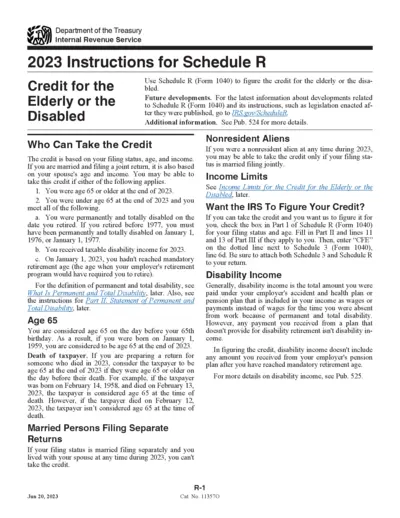

2023 Instructions for Schedule R Credit for Elderly or Disabled

This document provides instructions for Schedule R, which is used to claim the credit for the elderly or disabled. It includes eligibility criteria, income limits, and detailed filling procedures. Essential for taxpayers over 65 or permanently disabled to maximize tax benefits.

Tax Forms

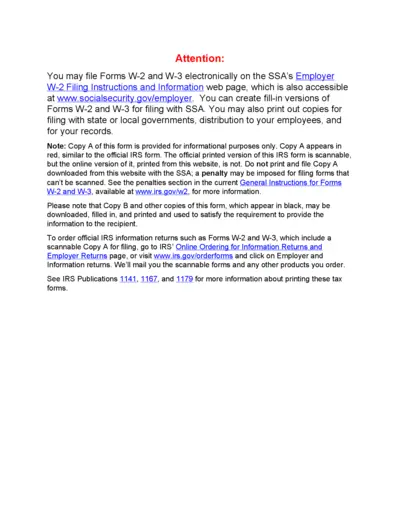

W-2 and W-3 Filing Instructions and Information

This document provides detailed filing instructions for Forms W-2 and W-3. It guides employers on how to electronically file and properly submit these forms. Additionally, it outlines key components of each form and important regulatory information.

Tax Forms

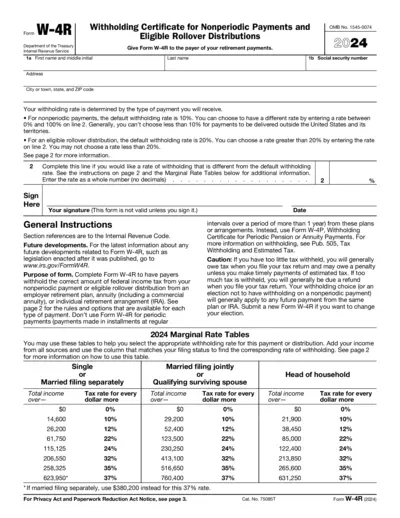

Withholding Certificate for Nonperiodic Payments

Form W-4R is used to request the correct amount of federal income tax withholding for nonperiodic payments and eligible rollover distributions. Completing this form ensures the right withholding rate is applied, avoiding future tax penalties. Access detailed instructions and information on withholding rates and eligibility.

Tax Forms

IRS Publication 907 Tax Highlights for Persons with Disabilities

IRS Publication 907 provides essential tax information for individuals with disabilities. It includes forms, filing instructions, and highlights on tax credits and benefits available. This publication is a valuable resource for anyone preparing their tax returns related to disability matters.

Tax Forms

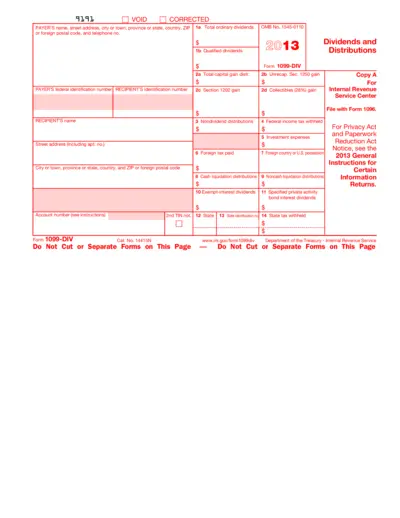

Form 1099-DIV Instructions and Key Information

Form 1099-DIV is essential for reporting dividends and distributions to the IRS. This file includes fields for payer and recipient details, as well as income types. Understanding its components is crucial for accurate tax reporting.