Tax Forms Documents

Tax Forms

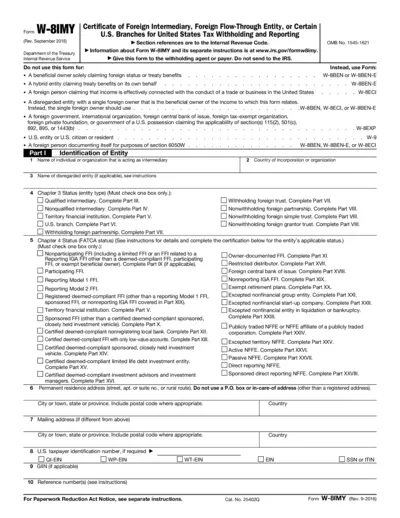

Certificate of Foreign Intermediary for Tax Reporting

The Certificate of Foreign Intermediary Form W-8IMY is essential for foreign entities claiming tax benefits. It helps determine the withholding tax rate for income received from U.S. sources. Follow the instructions carefully to ensure compliance with IRS regulations.

Tax Forms

2014 Employer's Annual Federal Tax Return Instructions

This document provides the necessary instructions for filing Form 944, including eligibility, required details, and filing process. It is essential for small employers whose annual tax liability is $1,000 or less. Follow these guidelines carefully to ensure compliance with IRS regulations.

Tax Forms

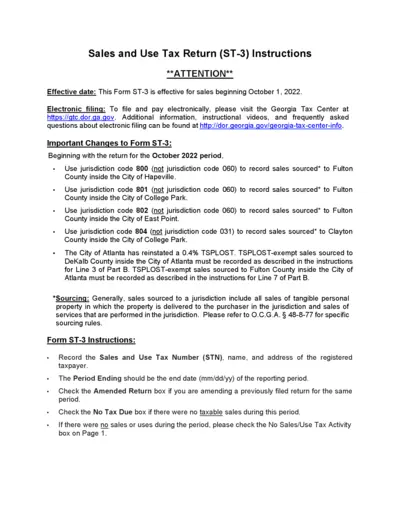

Sales and Use Tax Return ST-3 Instructions

Get detailed guidance on how to complete the Sales and Use Tax Return ST-3 form. This document provides essential instructions and jurisdiction codes necessary for accurate filing. Perfect for taxpayers in Georgia needing clarity on sales tax submissions.

Tax Forms

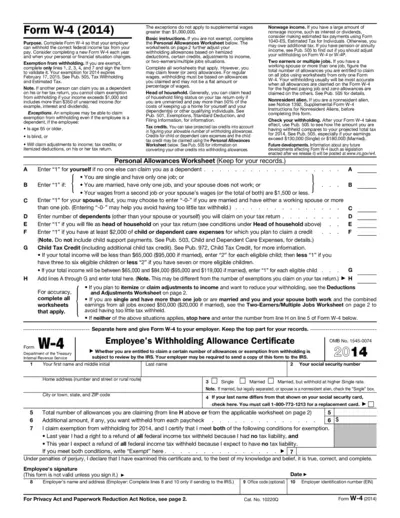

Guide to Form W-4 for Tax Withholding 2014

Form W-4 for 2014 provides details about federal tax withholding. It includes instructions on how to fill it out correctly and exemptions. Essential for employees to ensure correct tax withholding from their paychecks.

Tax Forms

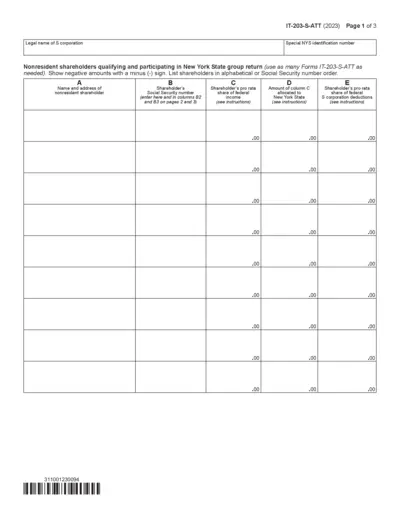

IT-203-S-ATT S Corporation Group Return Form

The IT-203-S-ATT form is used for S corporations with nonresident shareholders filing a group return in New York State. It helps in reporting shareholders' allocations of federal income, deductions, and New York tax liabilities. This form is essential for compliance with tax regulations and ensuring accurate reporting.

Tax Forms

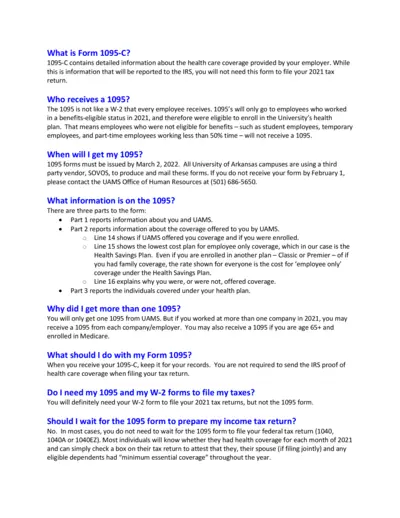

Understanding Form 1095-C: Health Coverage Details

Form 1095-C provides essential information regarding the health care coverage offered by your employer. This form is crucial for eligible employees who need to report their health coverage to the IRS. It outlines various details including coverage offered, enrolled status, and the lowest cost plan.

Tax Forms

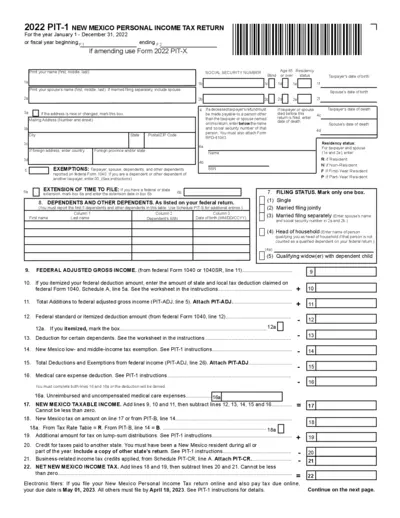

2022 New Mexico Personal Income Tax Return

This form is required for filing personal income tax in New Mexico for the year 2022. It captures essential taxpayer information and income details. Use this form to ensure compliance with New Mexico state tax regulations.

Tax Forms

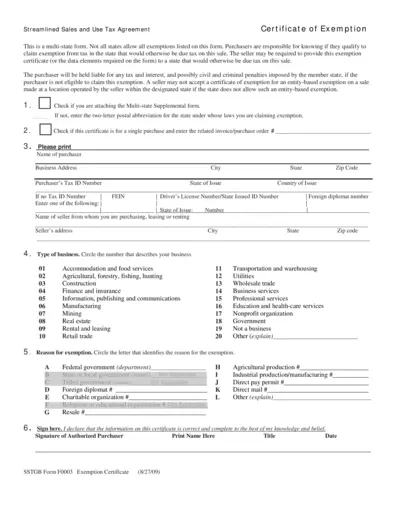

Streamlined Sales and Use Tax Agreement Exemption Certificate

The Streamlined Sales and Use Tax Agreement Exemption Certificate is a multi-state form used to claim tax exemptions. It is important for purchasers to understand their eligibility and the specific exemptions applicable in their state. Sellers may request this certificate to validate the exemption claim.

Tax Forms

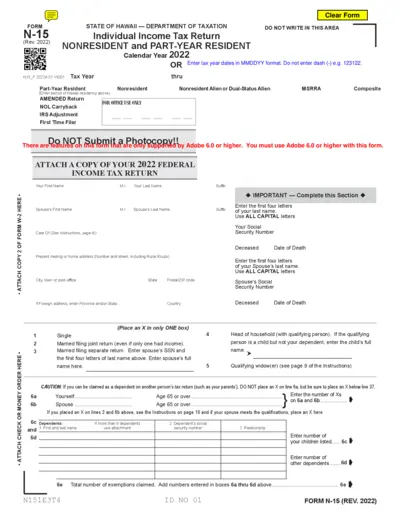

Hawaii Individual Income Tax Return Form N-15 2022

The Form N-15 is used by nonresidents and part-year residents in Hawaii to file their individual income tax returns. This form must be completed accurately to ensure compliance with state tax laws. Follow the provided instructions carefully to ensure smooth submission.

Tax Forms

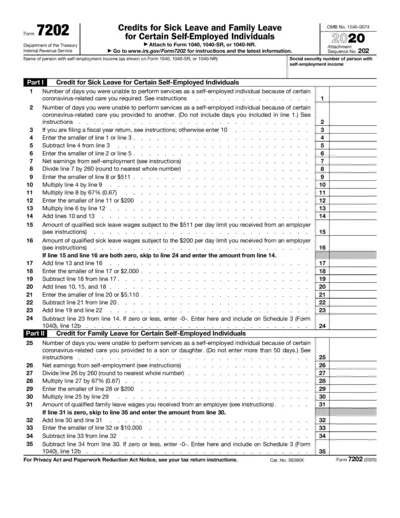

Form 7202 Credits for Sick Leave and Family Leave

Form 7202 is used by self-employed individuals to claim credits for sick and family leave due to coronavirus-related care. This form helps individuals calculate their eligible sick leave credits and family leave credits accurately. It is essential for ensuring you receive the correct financial support during this time.

Tax Forms

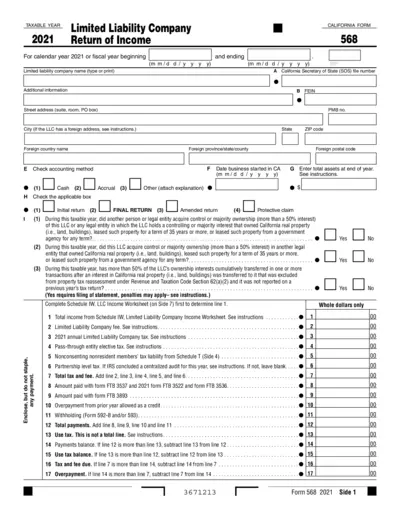

California Form 568 2021 Limited Liability Company Income

California Form 568 is a crucial document for Limited Liability Companies (LLCs) in the state for the tax year 2021. This return facilitates accurate income reporting and the payment of applicable fees. Ensure compliance with California tax regulations by completing this form correctly.

Tax Forms

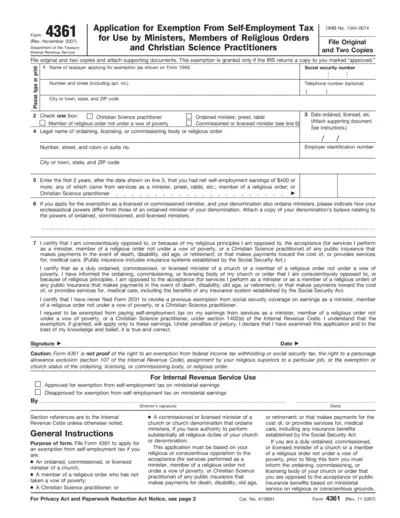

Application for Exemption from Self-Employment Tax

Form 4361 allows ministers, members of religious orders, and Christian Science practitioners to apply for an exemption from self-employment tax. It is crucial for those who qualify based on their religious beliefs and tax situations. Using this form can help save on taxes for eligible individuals.