Tax Forms Documents

Tax Forms

Colorado Form DR 8454 Income Tax Declaration

The Colorado Form DR 8454 is used for income tax declaration when electronically filing. It ensures that all necessary taxpayer information is accurately provided. This form must be signed and retained for four years.

Tax Forms

IRS Form 1041 Electronic Filing Instructions

This file provides essential information on electronically filing IRS Form 1041 for estates and trusts. It includes benefits, participation details, and filing instructions. Ideal for tax preparers and fiduciaries seeking efficient filing methods.

Tax Forms

Form 1310A Claiming Refund for Deceased Taxpayer

Form 1310A allows individuals to claim tax refunds on behalf of deceased taxpayers. This form is essential for surviving spouses or personal representatives seeking refunds. It provides the necessary framework for ensuring that any overpaid taxes are refunded correctly.

Tax Forms

Guide to 2023 1099-R Tax Reporting Statement

This file provides essential tax reporting information needed for preparing your 2023 federal tax return. It includes instructions for Form 1099-R, which reports retirement plan distributions. Use this guide to ensure accurate tax filing.

Tax Forms

W-9 Form Instructions for Taxpayer Identification 2018

The W-9 Form is essential for providing taxpayer identification information to the IRS. It allows individuals and entities to report the correct Taxpayer Identification Number (TIN). Proper completion ensures compliance and avoids backup withholding.

Tax Forms

Florida Substitute Form W-9 Taxpayer Details Guide

This guide provides essential information about the Florida Substitute Form W-9. Use it to understand completion requirements and updates. Ensure you have the correct Taxpayer Identification Number (TIN) and avoid backup withholding.

Tax Forms

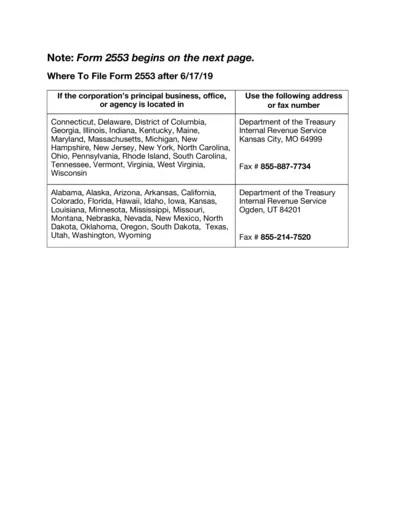

Form 2553 Instructions for S Corporation Election

Form 2553 is used by small business corporations to elect S corporation status. Proper completion and filing of this form is essential for tax purposes. This guide provides necessary instructions for using this form effectively.

Tax Forms

Instructions for Form 1065-X Amended Return

This file contains important instructions for Form 1065-X, an amended return or administrative adjustment request for partnerships. It includes what to attach, who must file, and defines key terms related to the form. Ensure compliance with filing requirements and understand recent changes.

Tax Forms

Deferral Application for Senior Citizens Disabilities

The Deferral Application for Senior Citizens and People with Disabilities allows eligible applicants to defer property taxes. This form must be completed and submitted to the county assessor's office with supporting documents. It provides vital information about property ownership and income eligibility.

Tax Forms

Instructions for Amended U.S. Individual Tax Return

This document provides detailed instructions on how to complete Form 1040-X for amending a U.S. Individual Income Tax Return. It includes information on filing deadlines, required information, and specific situations that might apply. Use this guide to ensure compliance with IRS regulations when filing your amended return.

Tax Forms

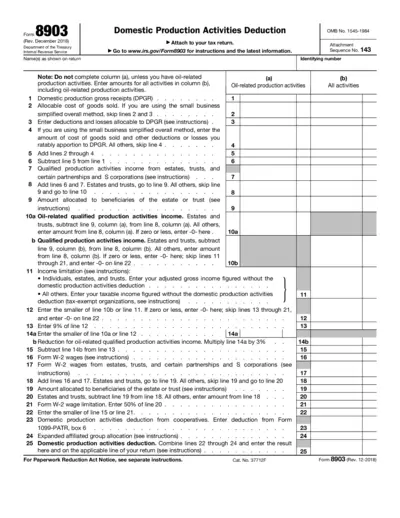

Domestic Production Activities Deduction Form 8903

The Domestic Production Activities Deduction Form 8903 is essential for reporting production-related income. This form helps in calculating deductions for qualified production activities. Utilize this form to maximize your tax benefits related to domestic production.

Tax Forms

Order Approval Form 10AC for Tax Exemptions

This file contains the Order for approval under Form No. 10AC, which is used for tax exemption applications. It outlines conditions, approval details, and compliance requirements for trusts and institutions. This document is crucial for organizations seeking tax benefits under section 80G of the Income Tax Act.