Tax Forms Documents

Tax Forms

Instructions for Form 8828 Recapture of Mortgage Subsidy

Form 8828 provides taxpayers with guidelines on how to calculate and report recapture taxes associated with federally subsidized mortgages. This form is crucial for individuals who have disposed of their federally subsidized homes and need to understand their tax obligations. Familiarizing yourself with this form ensures compliance with IRS requirements when selling your home.

Tax Forms

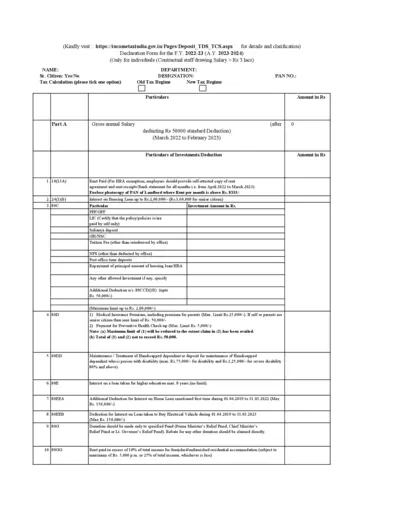

TDS TCS Declaration Form for Financial Year 2022-23

This form is a declaration for TDS and TCS for the financial year 2022-23. It is specifically designed for individuals earning above Rs. 3 lacs. Proper filling out will help in accurate tax deductions.

Tax Forms

Instructions for Form 8911 Alternative Fuel Credit

Form 8911 provides instructions for claiming the Alternative Fuel Vehicle Refueling Property Credit. This credit can help taxpayers reduce their tax liabilities related to alternative fuel refueling property. Ensure you're aware of eligibility for claiming this important credit.

Tax Forms

Guide to Original Issue Discount (OID) Instruments

This file provides essential information about Original Issue Discount (OID) instruments, including definitions and instructions for reporting. It assists brokers and owners in understanding their obligations regarding OID debt instruments for tax reporting purposes. The document includes a list of publicly offered OID debt instruments and guidelines for filling out related forms.

Tax Forms

Instructions for Form 2106 Employee Business Expenses

This document provides detailed instructions for Form 2106, used to report employee business expenses. Users will find information on mileage rates, depreciation limits, and the requirements for filing this form. Essential for employees seeking to reconcile business expenses and maximize deductions.

Tax Forms

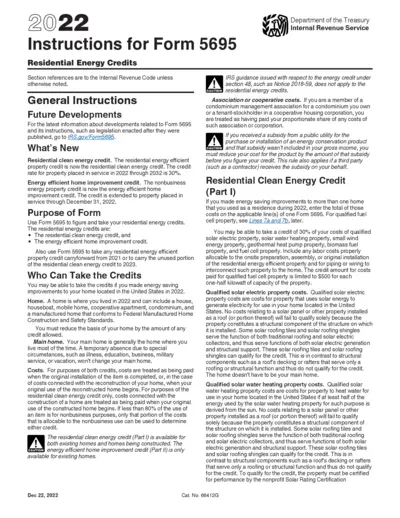

Form 5695 Instructions for Residential Energy Credits

This document provides detailed instructions on how to fill out Form 5695, which is used to calculate residential energy credits. It covers the eligibility requirements, available credits, and the necessary steps for homeowners. This guide is vital for anyone looking to claim tax credits for energy improvements made to their homes.

Tax Forms

Connecticut Real Estate Conveyance Tax Return Instructions

This document provides comprehensive instructions for filing the Connecticut Real Estate Conveyance Tax Return. It guides users through the necessary steps to complete and submit their forms accurately. Ensure compliance with state regulations by following these detailed guidelines.

Tax Forms

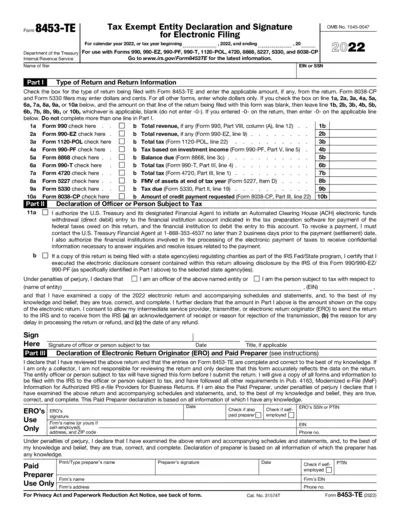

Form 8453-TE Tax Exempt Entity Declaration

Form 8453-TE is essential for tax-exempt entities to authorize the electronic filing of their returns. This form allows for signing, tax payments, and ensures compliance with IRS regulations. It serves multiple forms including 990, 990-EZ, and 8868 among others.

Tax Forms

IRS Draft Form 1099-NEC Instructions 2024

This file contains important information regarding the IRS Form 1099-NEC for the year 2024. It includes guidelines for completion and submission. Users should refer to the final version before filing.

Tax Forms

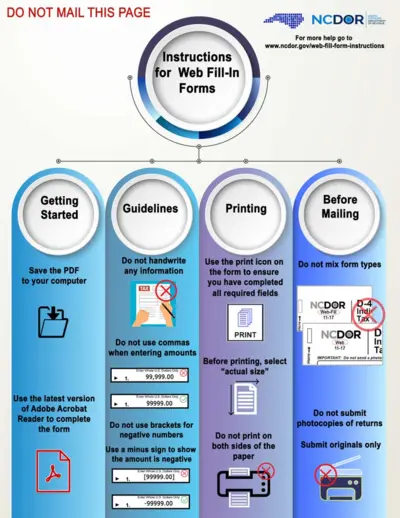

NCDOR Web Fill-In Instructions for Tax Forms

This document provides detailed instructions for completing the NCDOR web fill-in forms. It includes guidelines for taxes and necessary attachments. Users can refer to these instructions for a smooth filling process.

Tax Forms

Instructions for Schedule A Form 990 Public Charity

This document provides detailed guidance on completing Schedule A of Form 990 or 990-EZ for organizations seeking public charity status. It outlines who must file, how to complete the form accurately, and the requirements for maintaining public charity status. Ideal for accountants and nonprofit organizations.

Tax Forms

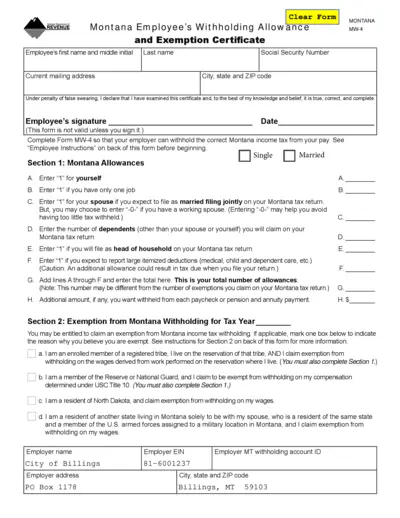

Montana Employee Withholding Allowance Exemption Certificate

This document is essential for Montana employees to correctly declare their withholding allowances and exemptions. It helps ensure the right amount of state income tax is withheld from their wages. Completing this form accurately can prevent surprises during tax filing.