Tax Forms Documents

Tax Forms

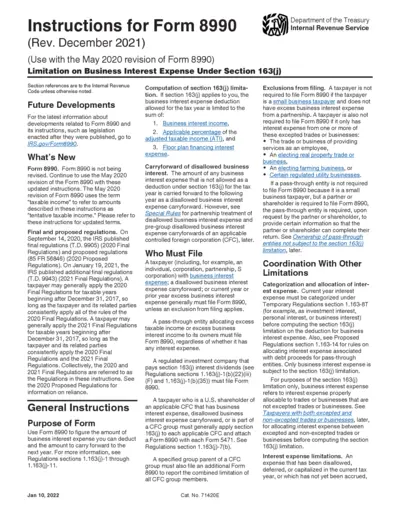

Instructions for Form 8990 Business Interest Expense

This file contains instructions for Form 8990 related to the limitation on business interest expenses under Section 163(j). It guides taxpayers on how to compute business interest expense deductions and outlines who must file the form. Essential for individuals and businesses navigating tax regulations.

Tax Forms

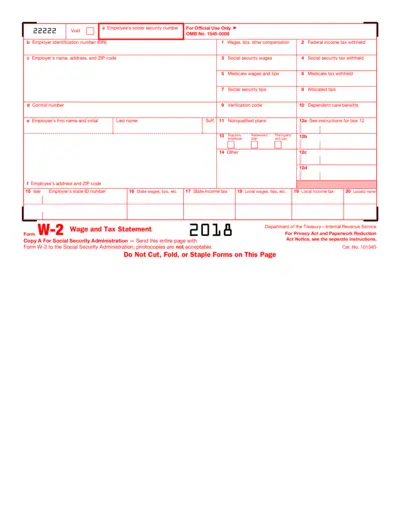

Employee Wage and Tax Statement Form W-2

The W-2 form provides important details about an employee's annual wages and tax withholding. It is essential for tax preparation and filing. Employers are required to provide this form to their employees each year.

Tax Forms

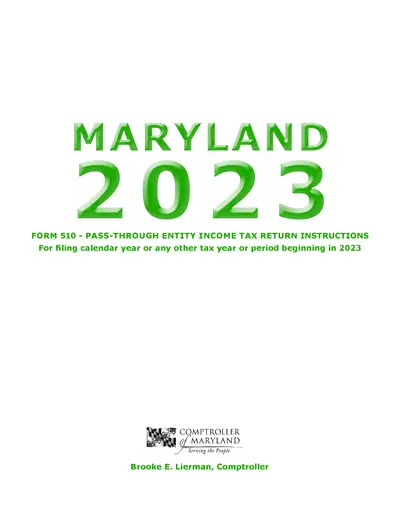

Maryland 2023 Form 510 Pass-Through Entity Tax Return

This file contains the 2023 instructions for the Maryland Pass-Through Entity Income Tax Return. It is essential for partnerships, S corporations, LLCs, and business trusts filing in Maryland. Follow the guidelines carefully to ensure accurate submissions and avoid delays.

Tax Forms

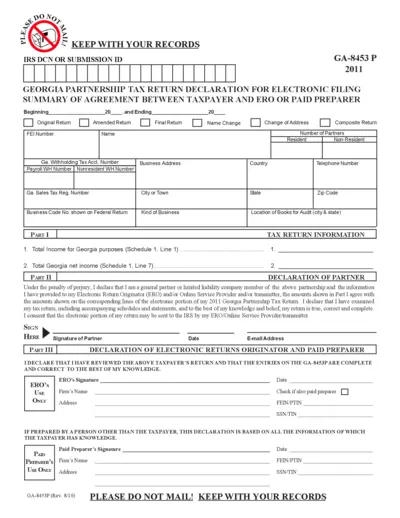

Georgia Partnership Tax Return Declaration Form

The GA-8453 P form is essential for Georgia partnerships to declare their tax electronically. It summarizes the agreement between the taxpayer and the ERO or paid preparer. This form should be retained for record-keeping purposes.

Tax Forms

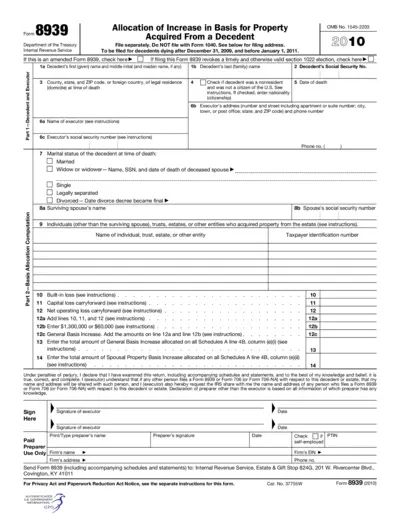

Form 8939 Allocation of Increase in Basis Property

This file contains the Form 8939 for allocating basis increases for property acquired from a decedent. It includes instructions for filing and requirements for executors. Use this form to report property basis for decedents dying between specified years.

Tax Forms

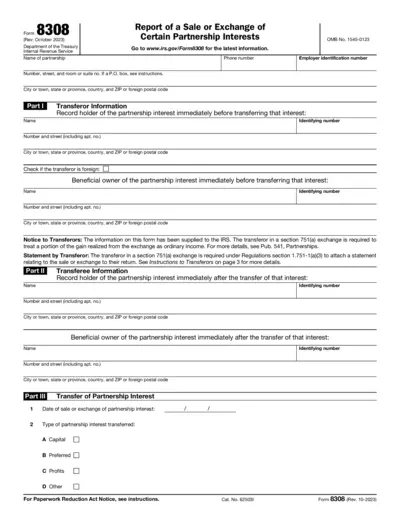

IRS Form 8308 Sale or Exchange of Partnership Interests

Form 8308 is used to report the sale or exchange of certain partnership interests. It helps partnerships fulfill their federal tax obligations. This form is essential for proper reporting of capital gains.

Tax Forms

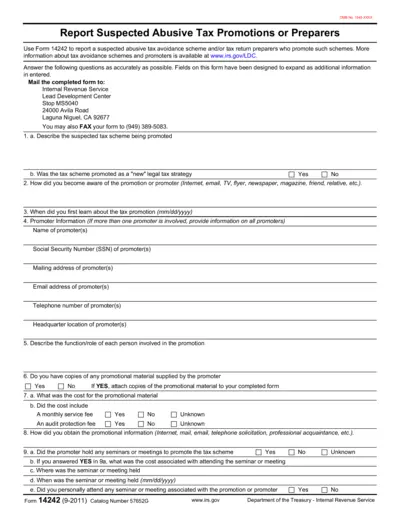

Report Suspected Abusive Tax Promotions Form 14242

Form 14242 allows individuals to report suspected abusive tax avoidance schemes. This form is crucial for those suspicious of tax promotions or preparers. Accurate reporting helps the IRS in enforcing tax laws.

Tax Forms

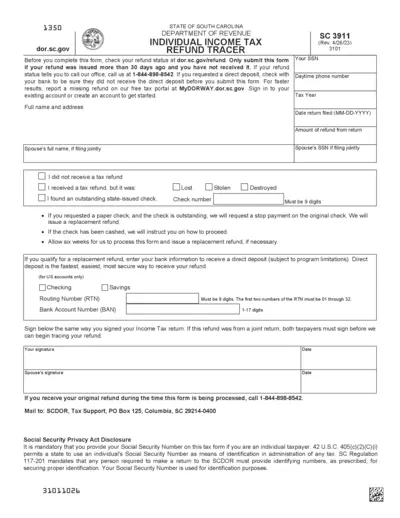

South Carolina Individual Income Tax Refund Tracer

This file helps individuals track missing tax refunds in South Carolina. It provides instructions on how to report a missing refund. Utilize this form if your refund status indicates you should contact the Department of Revenue.

Tax Forms

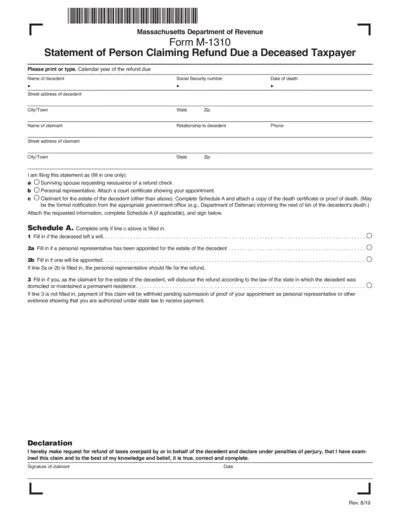

Massachusetts M-1310 Refund Claim for Deceased Taxpayer

The Massachusetts Department of Revenue Form M-1310 is used by survivors or personal representatives to claim refunds due to deceased taxpayers. This form requires details about the decedent and the claimant to ensure accurate processing of refunds. It is important to follow all instructions accurately to avoid delays.

Tax Forms

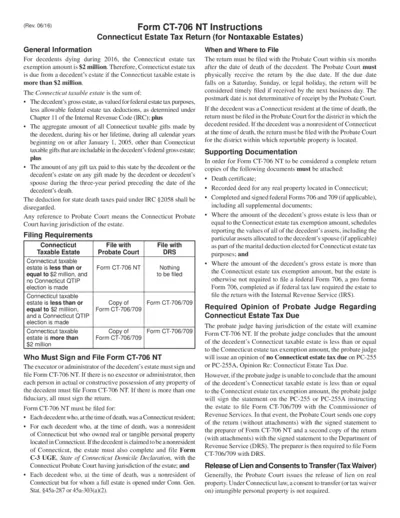

Connecticut Estate Tax Return Form CT-706 NT

This form provides comprehensive instructions for filing the Connecticut Estate Tax Return for nontaxable estates. It outlines requirements, filing processes, and documentation needed. Ideal for executors, administrators, and legal beneficiaries.

Tax Forms

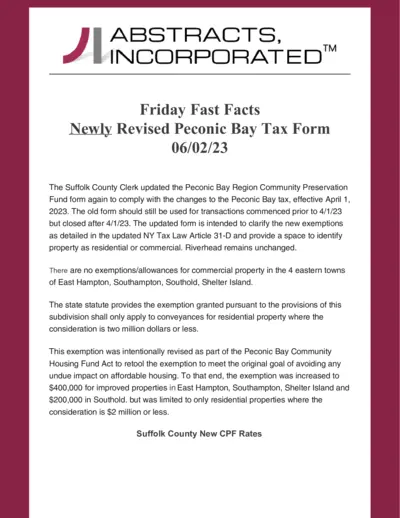

Updated Peconic Bay Tax Form Instructions

This document contains the updated Peconic Bay Tax Form and important instructions for its use. The form outlines new exemptions and considerations under the NY Tax Law Article 31-D. It is essential for property transactions in the Peconic Bay Region.

Tax Forms

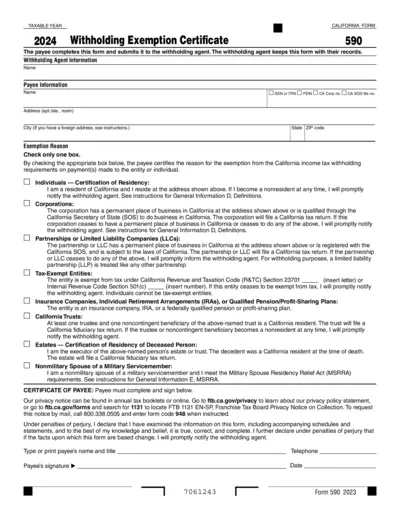

California Withholding Exemption Certificate Form 590

The California Withholding Exemption Certificate Form 590 is designed for individuals and entities to certify their exemption status from California income tax withholding. This form must be completed and submitted to the withholding agent to maintain compliance with state tax regulations. Understanding how to accurately fill out this form is crucial for residents and businesses operating in California.