Tax Forms Documents

Tax Forms

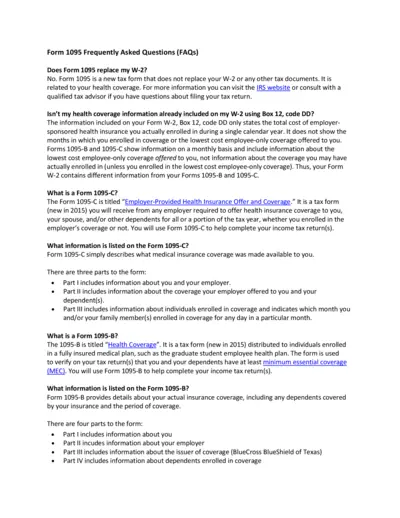

Form 1095 FAQs and Instructions for Tax Filing

This document addresses frequently asked questions about Form 1095, detailing its importance for tax returns. It includes information on different versions of the form and necessary actions for users. Essential for those needing to verify health coverage for compliance.

Tax Forms

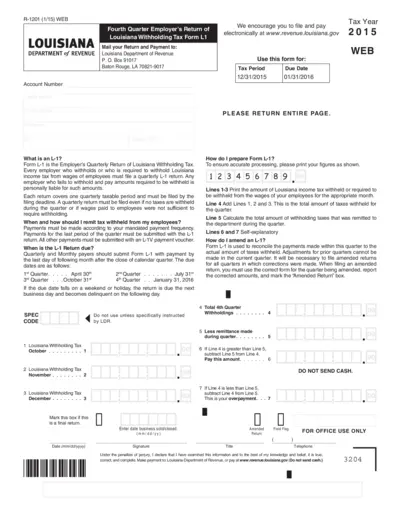

Louisiana Withholding Tax Form L1 Instructions

Form L-1 is the Employer's Quarterly Return for Louisiana Withholding Tax. Employers must file this return if withholding taxes are taken from employee wages. This document provides essential guidelines for accurate submission and payment.

Tax Forms

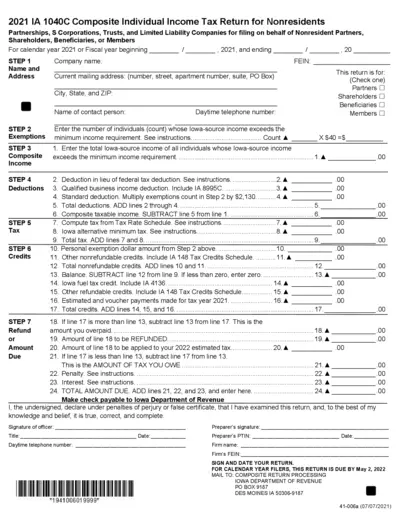

2021 IA 1040C Individual Income Tax Return

The 2021 IA 1040C form is essential for nonresidents, partnerships, and S corporations filing composite income tax returns in Iowa. It facilitates the inclusion of nonresident individuals, beneficiaries, and members in a single filing. This guide helps navigate the complexities of Iowa state tax regulations.

Tax Forms

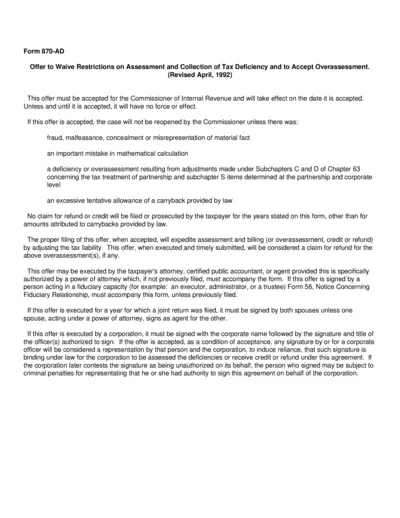

Form 870-AD Offer to Waive Tax Deficiency Restrictions

Form 870-AD is used to waive restrictions on the assessment and collection of tax deficiencies. This form must be accepted by the Commissioner of Internal Revenue to take effect. Proper submission expedites tax liability adjustment and claims for refunds.

Tax Forms

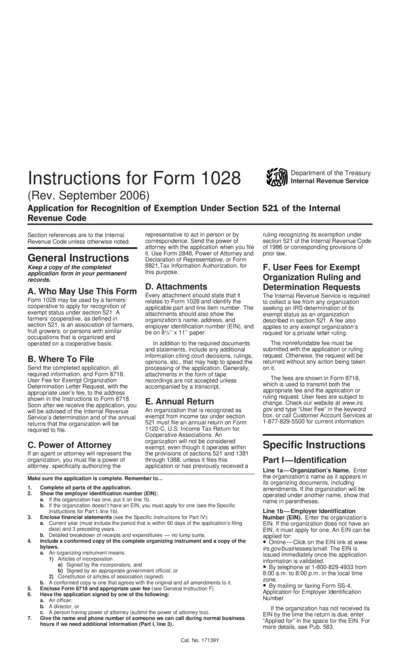

Application for Recognition of Exemption Form 1028

Form 1028 is used by farmers' cooperatives to apply for tax-exempt status under Section 521 of the Internal Revenue Code. It includes detailed instructions about necessary attachments and data requirements. Completing this form correctly is essential for obtaining the recognized exempt status from the IRS.

Tax Forms

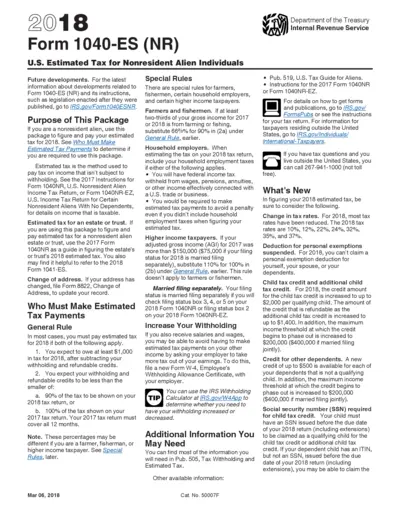

U.S. Estimated Tax for Nonresident Alien Individuals

This file contains essential guidelines for nonresident aliens to compute and pay their estimated tax for the year 2018. It addresses who must make payments and the methods available for calculating and submitting estimated tax amounts. Understanding these instructions ensures compliance with tax obligations.

Tax Forms

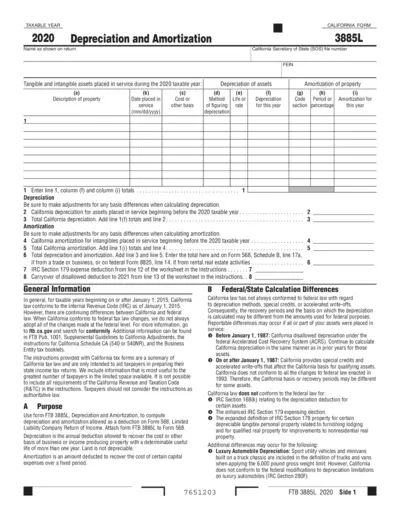

California Form 3885L Depreciation and Amortization

The California Form 3885L is used for reporting depreciation and amortization allowed as a deduction on Form 568 for the 2020 tax year. This form helps taxpayers accurately compute their depreciation for qualified property and ensure compliance with California tax laws. Utilize this guide to navigate the details of your assets and deductions effectively.

Tax Forms

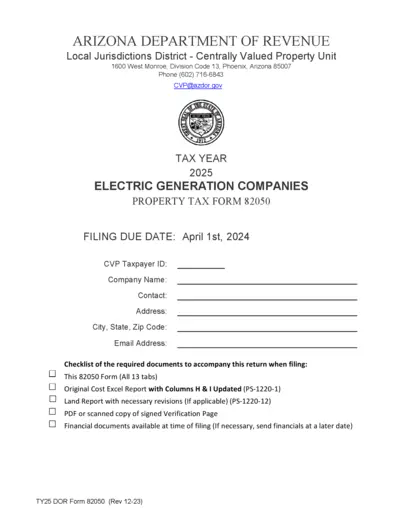

Arizona Department of Revenue Property Tax Form

This file contains the essential information and forms for Electric Generation Companies regarding property tax for the 2025 tax year. It provides instructions on completing and submitting the required forms. Relevant companies should utilize this form to ensure compliance with Arizona state tax regulations.

Tax Forms

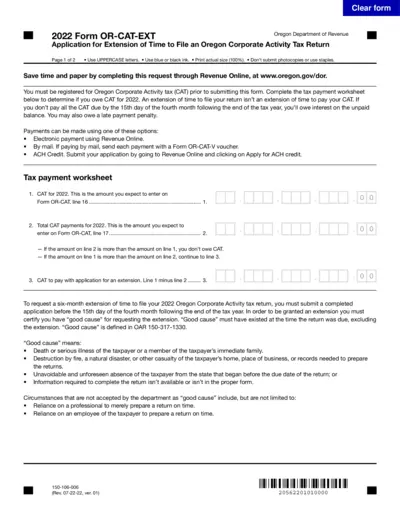

2022 Oregon Corporate Activity Tax Extension Form

This form is required for requesting an extension to file your Oregon Corporate Activity Tax Return. Ensure you complete it accurately to avoid penalties. It's essential for business owners needing to manage their tax deadlines effectively.

Tax Forms

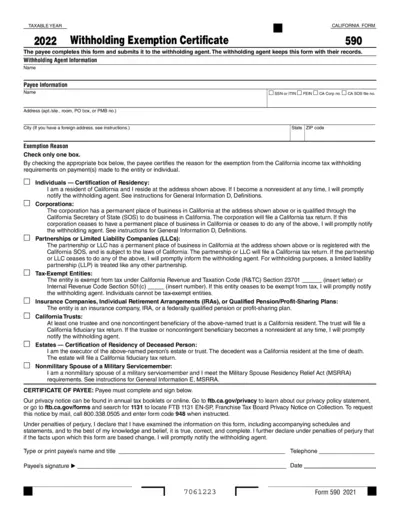

California Withholding Exemption Certificate 590

The California Form 590 is essential for individuals and businesses to claim withholding exemptions. This form helps ensure that the correct amount of tax is withheld by the withholding agent. It is critical for residency certifications and various tax-exempt statuses.

Tax Forms

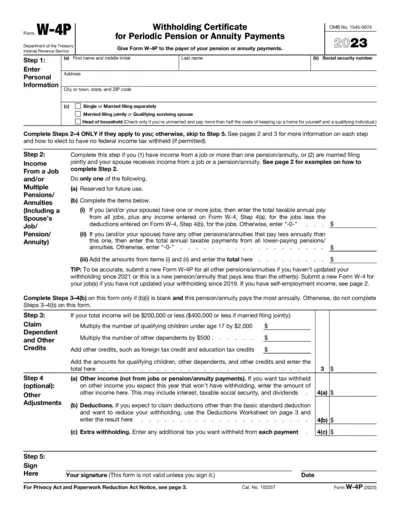

W-4P Withholding Certificate for Pension Payments

The W-4P form allows individuals to request federal income tax withholding from periodic pension or annuity payments. This form is essential for determining your tax withholding amount to avoid underpayment or overpayment. Ensure you complete the necessary sections accurately to reflect your tax situation.

Tax Forms

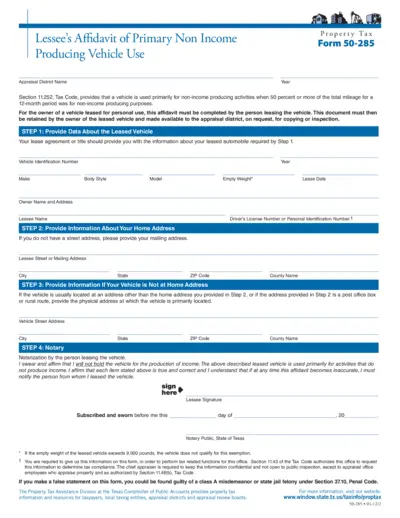

Lessee Affidavit for Non-Income Vehicle Use

This file provides the necessary affidavit form for lessees to declare that their vehicle is used primarily for non-income producing activities. The completed form must be submitted to the appraisal district for tax compliance. It is crucial for vehicle owners who lease their automobiles for personal use.