Tax Forms Documents

Tax Forms

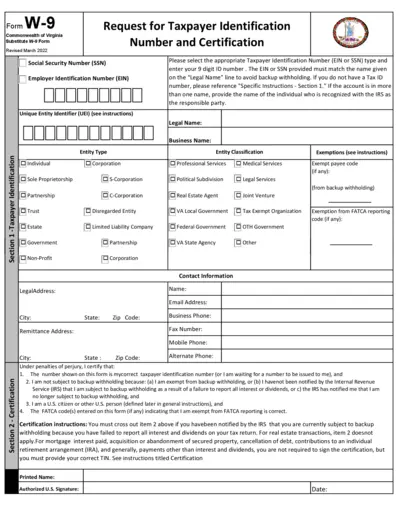

Virginia W-9 Taxpayer Identification Request Form

This form is a Request for Taxpayer Identification Number and Certification for individuals and entities in Virginia. It is essential for providing accurate taxpayer information to avoid backup withholding. Use this form to ensure compliance with IRS regulations.

Tax Forms

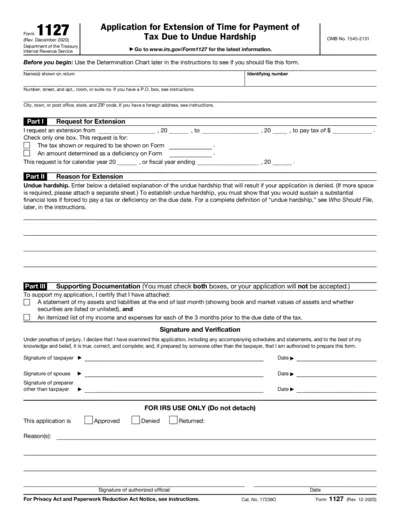

Request for IRS Extension of Time to Pay Taxes

Form 1127 allows taxpayers to request an extension for payment of taxes due to undue hardship. This form seeks to alleviate financial distress before tax payment deadlines. It ensures that individuals can manage tax liabilities more effectively.

Tax Forms

Employer's Quarterly Report Instructions Florida

This document provides detailed instructions for completing the Employer's Quarterly Report (RT-6) in Florida. It covers registration, filing procedures, due dates, and penalties for employers. This report is essential for compliance with Florida's reemployment tax requirements.

Tax Forms

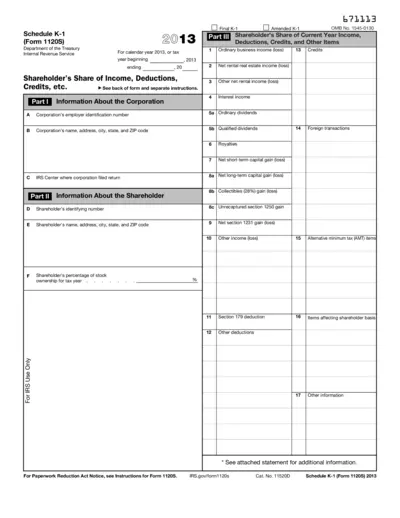

Schedule K-1 Form 1120S Instructions 2013

This file contains the Schedule K-1 (Form 1120S) for the year 2013 detailing shareholders' incomes, deductions, and credits. It provides essential information for tax reporting and filing for shareholders of S corporations. Users can refer to this document for guidance on filling out their tax returns accurately.

Tax Forms

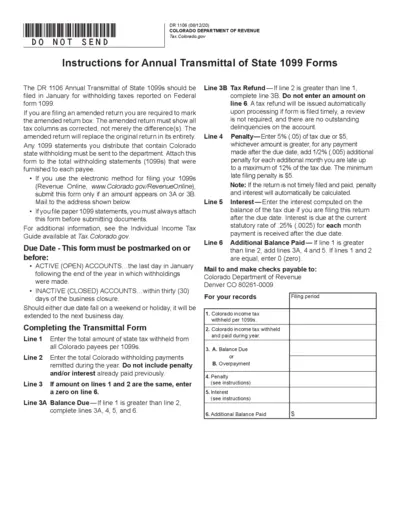

Annual Transmittal of State 1099 Forms Instructions

The DR 1106 form provides guidelines for submitting State 1099 forms in Colorado. This document is essential for businesses and individuals to report state tax withholding correctly. Users must adhere to submission timelines to avoid penalties.

Tax Forms

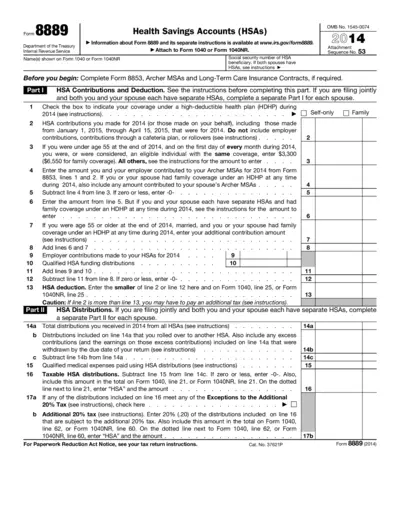

Form 8889 for Health Savings Accounts Instructions

Form 8889 provides information for Health Savings Accounts (HSAs). It includes guidelines for contributions and deductions related to HSAs. This form is essential for taxpayers utilizing HSAs to manage their health expenses.

Tax Forms

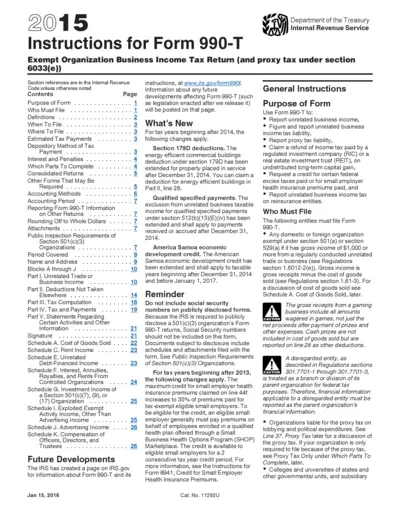

Instructions for Form 990-T Exempt Organizations

This file contains instructions for completing Form 990-T, an income tax return for exempt organizations. It provides guidelines for organizations to report unrelated business income. Users will find essential information regarding who must file, how to fill out the form, and important dates.

Tax Forms

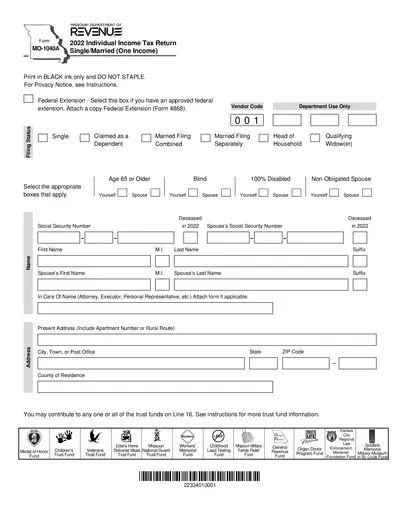

Missouri Department of Revenue 2022 Income Tax Return

This form is the 2022 Individual Income Tax Return for Missouri residents. It allows individuals to report their state income tax obligations. Completing this form is essential for ensuring compliance with Missouri tax laws.

Tax Forms

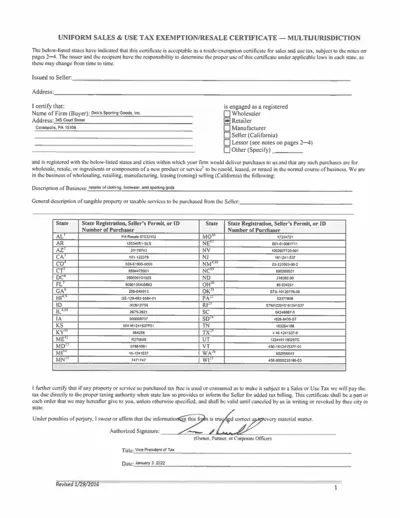

Uniform Sales & Use Tax Exemption Certificate

The Uniform Sales & Use Tax Exemption Certificate is a multi-jurisdictional form accepted by various states. This certificate allows buyers to claim tax exemption for eligible purchases. Ensure to provide accurate information and check state-specific guidelines.

Tax Forms

W-3 Transmittal of Wage and Tax Statements 2024

This file is the W-3 Transmittal of Wage and Tax Statements for 2024. It provides essential details for employers filing W-2 forms. Use this form to report wages and tax information to the SSA.

Tax Forms

Instructions for Form 8802 Application for Residency Certification

Form 8802 helps individuals request certification of U.S. residency for tax treaty benefits. This form is essential for verifying tax status to claim exemptions, especially from foreign taxes. It is applicable for the current and any prior calendar years.

Tax Forms

Form 8621 - Shareholder Information Return

This file is the IRS Form 8621, used by shareholders to report income from passive foreign investment companies. It is essential for tax compliance regarding foreign investments. Complete this form accurately to avoid penalties and ensure proper tax reporting.