Tax Forms Documents

Tax Forms

IRS W-9 Form Instructions and Certification Guide

This document contains the instructions and guidelines for filling out the IRS W-9 form. It is essential for individuals and entities to provide their taxpayer identification number. Ensure compliance with IRS regulations while using this form.

Tax Forms

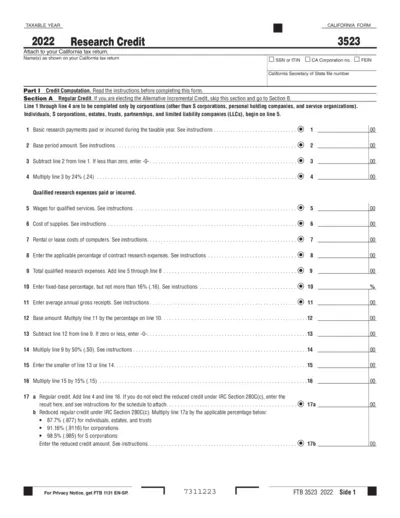

California Taxable Year 2022 Research Credit Form

This file contains the California Form 3523 for the Taxable Year 2022 regarding Research Credit. It includes detailed computation instructions for determining your eligible research credits. Suitable for individuals and corporations claiming research credits on their California tax returns.

Tax Forms

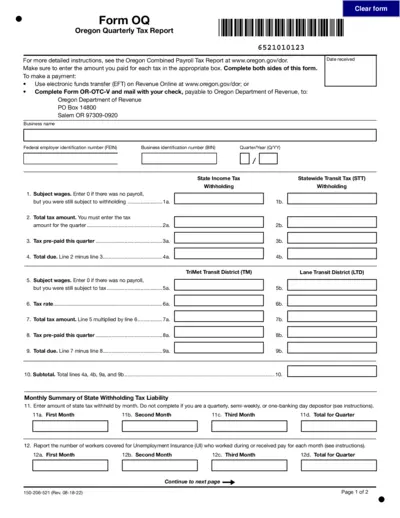

Oregon Quarterly Tax Report Form OQ Instructions

The Oregon Quarterly Tax Report Form OQ is essential for businesses to report and pay quarterly taxes. This form facilitates the correct calculation and remittance of state taxes, including income and employment taxes. Ensure compliance by accurately completing this form each quarter.

Tax Forms

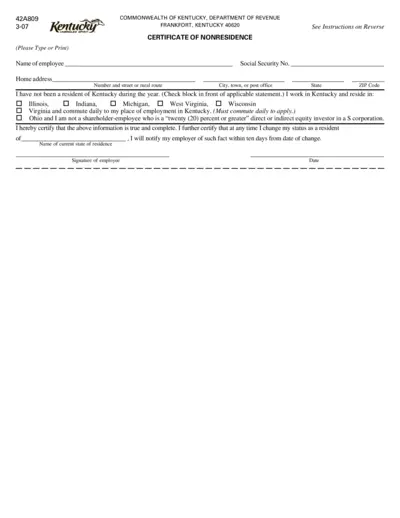

Kentucky Certificate of Nonresidence Form Instructions

This file contains the Certificate of Nonresidence for Kentucky. It provides essential instructions for employees who are not residents of Kentucky but work in the state. Use this document to ensure you are exempt from Kentucky income tax withholding.

Tax Forms

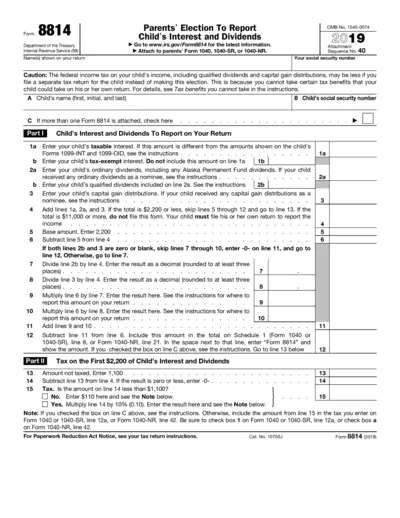

Form 8814 Instructions for Reporting Child's Income

Form 8814 is used by parents to report their child's income on their tax return. This form allows parents to report interest and dividends earned by their child without having the child file a separate tax return. For specific qualifications and reporting methods, refer to the instructions provided with the form.

Tax Forms

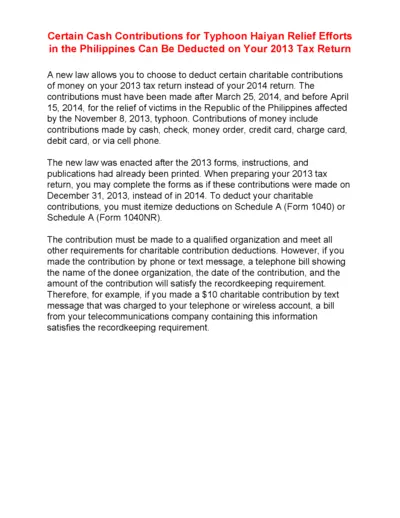

Typhoon Haiyan Relief Contributions Tax Deduction

This file provides information about deducting cash contributions made for Typhoon Haiyan relief efforts. It details the qualifications and time frames for these deductions. Essential for taxpayers looking to benefit from charitable contributions on their 2013 tax returns.

Tax Forms

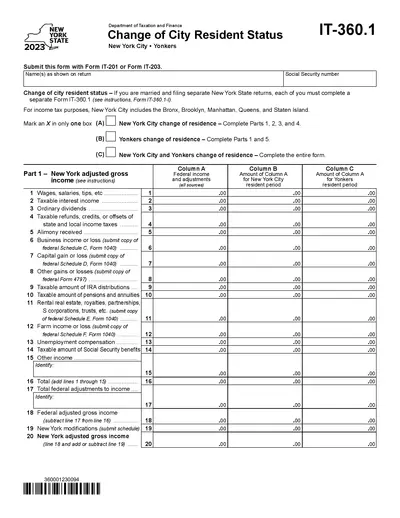

New York State Change of City Resident Status Form

This form is essential for New York residents changing their city residency status. It allows individuals to update their tax obligations in New York City or Yonkers. Use this form alongside IT-201 or IT-203 for accurate tax filing.

Tax Forms

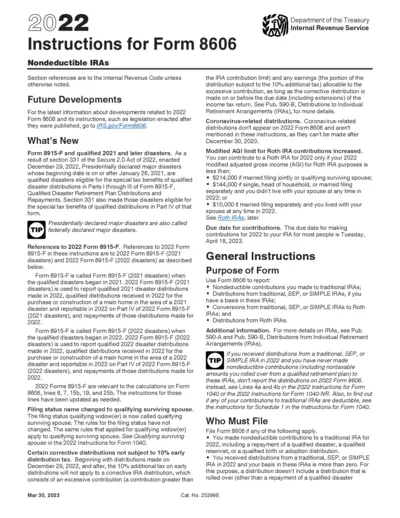

Instructions for Form 8606 Nondeductible IRAs

This document provides instructions for Form 8606 for reporting nondeductible IRAs. It includes essential updates and details on filling out the form. Business and individual tax filers can benefit from understanding these instructions.

Tax Forms

Form 1096 Annual Summary Transmittal Instructions

This document provides important instructions for completing Form 1096, a summary and transmittal of U.S. information returns. It guides users on necessary steps to ensure accurate filing with the IRS. Use this file to help you streamline your tax preparation process.

Tax Forms

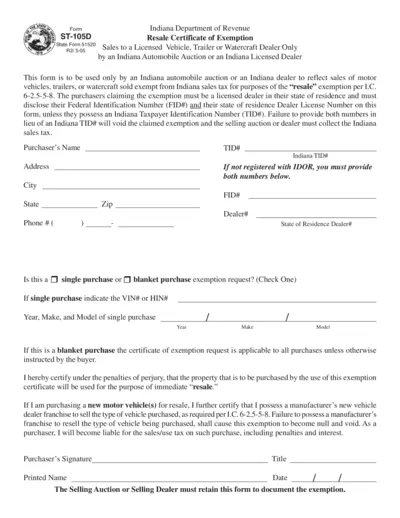

Indiana Resale Certificate Exemption Form ST-105D

The Indiana Resale Certificate of Exemption Form ST-105D is used by licensed dealers to exempt sales from Indiana sales tax. It serves as proof for automobile auctions and dealers making tax-exempt sales for resale purposes. Complete this form accurately to avoid taxes on eligible transactions.

Tax Forms

Form 8992 Instructions for U.S. Shareholder GILTI

Form 8992 provides instructions for U.S. shareholders regarding the calculation of Global Intangible Low-Taxed Income (GILTI). It is essential for compliance with tax laws set by the IRS. Understanding these instructions ensures accurate reporting and claims for deductions.

Tax Forms

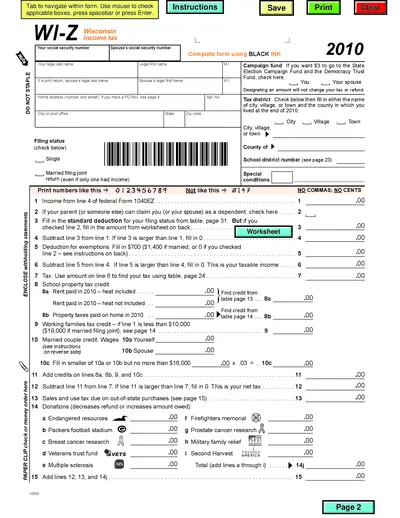

Wisconsin 2010 Income Tax Form Instructions

This file provides essential instructions for completing the Wisconsin income tax form WI-Z for 2010. It includes essential details for personal information, deductions, and credits. Follow the guidelines to ensure an accurate submission and possible refunds.