Tax Forms Documents

Tax Forms

Recovery Rebate Credit Instructions and Eligibility

This file provides essential information on the Recovery Rebate Credit. It covers eligibility criteria and how to apply for the credit. Detailed instructions and helpful online tools are included.

Tax Forms

Delaware Corporation Income Tax Return Form 1100

The Delaware Corporation Income Tax Return Form 1100 is essential for corporations operating in Delaware. This form needs to be filled out for accurate tax reporting. Ensure you adhere to the instructions for compliance and avoid penalties.

Tax Forms

Connecticut Annual Summary of Information Returns

This file provides comprehensive instructions for filers of the Connecticut CT-1096 form. It includes electronic filing requirements, line-by-line instructions, and deadlines. Useful for taxpayers needing to report nonpayroll amounts and withholdings.

Tax Forms

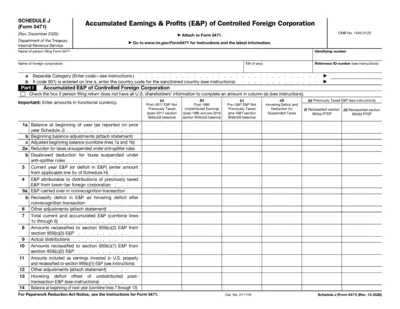

Form 5471 Schedule J Instructions and Details

This file provides the instructions for filling out Schedule J of Form 5471. It outlines the accumulated earnings and profits of controlled foreign corporations. Users must reference these instructions to ensure accurate reporting and compliance with tax regulations.

Tax Forms

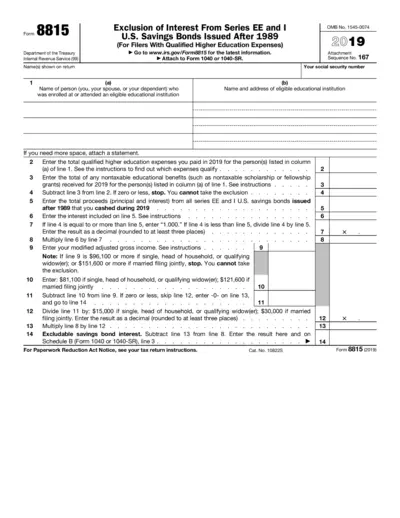

Form 8815: Exclusion of Interest From Savings Bonds

Form 8815 helps taxpayers exclude interest on U.S. savings bonds for qualified higher education expenses. It enables filers to appropriately manage their tax obligations. This form is essential for individuals who have education costs and have cashed in specific bonds.

Tax Forms

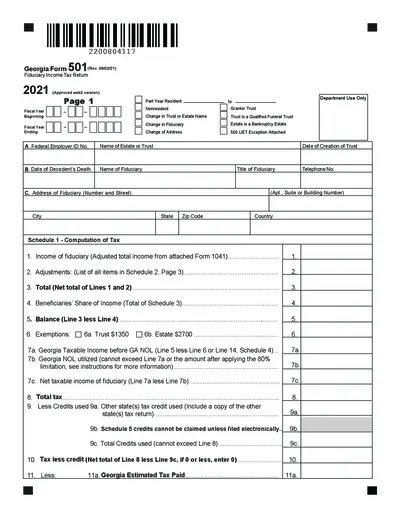

Georgia Fiduciary Income Tax Return Form 501

The Georgia Fiduciary Income Tax Return Form 501 is essential for fiduciaries of estates and trusts to report income. It provides a structured format for calculating taxable income and credits. Accurate completion is necessary to ensure compliance with state tax regulations.

Tax Forms

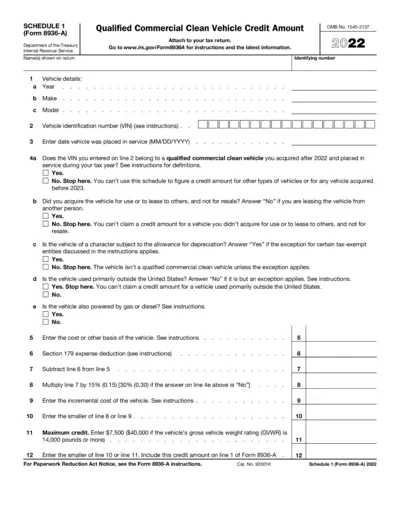

Qualified Commercial Clean Vehicle Credit Form 8936-A

Form 8936-A provides guidelines for claiming the Qualified Commercial Clean Vehicle Credit. It assists taxpayers in understanding eligibility and completing necessary fields for tax credit claims. Utilize this form to ensure compliance with IRS regulations regarding clean vehicle credits.

Tax Forms

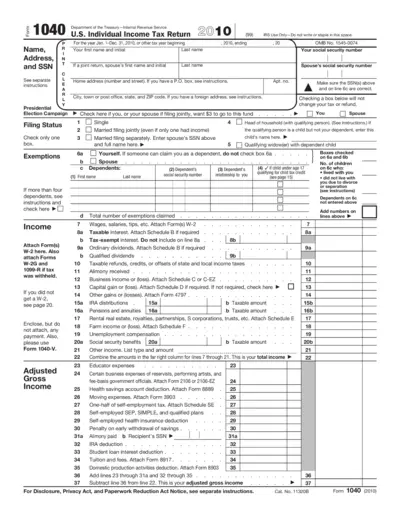

IRS Form 1040 Individual Income Tax Return 2010

The IRS Form 1040 is a vital document for filing U.S. individual income tax returns. This form is designed for taxpayers to report their income, deductions, and credits for the year 2010. It ensures compliance with federal tax regulations and determines the amount of tax owed or refund due.

Tax Forms

NJ GIT Tax Reconciliation Form for Employers

The NJ-W-3M form is essential for employers to reconcile tax withheld for Gross Income Tax in New Jersey. This document helps ensure compliance with state tax laws by accurately reporting withheld amounts. Complete and submit this form by the specified deadlines to avoid penalties.

Tax Forms

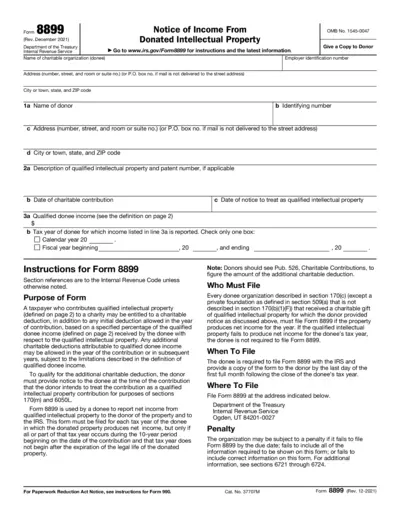

Form 8899 Notice of Income From Donated Intellectual Property

Form 8899 is a tax form used by organizations to report income from donated intellectual property. It enables donors to claim charitable deductions for their contributions. This essential document is required for tax compliance regarding intellectual property donations.

Tax Forms

W-2 Wage and Tax Statement Instructions

This file contains important information for employees regarding their wages, tax withholdings, and other compensations documented on Form W-2. It serves as an essential tool for tax reporting and reconciliation with the IRS. Completing this form accurately ensures compliance and avoids delays in tax processing.

Tax Forms

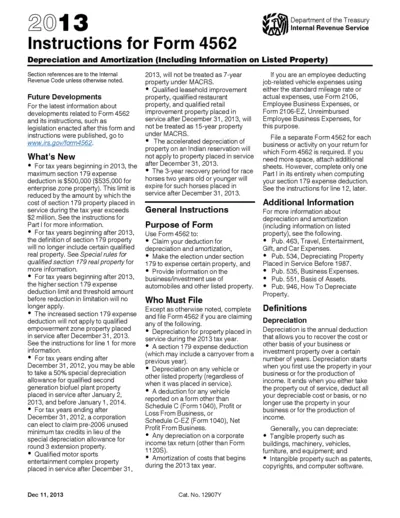

Instructions for Form 4562 Depreciation Amortization

This document provides essential instructions for filling out Form 4562 for depreciation and amortization. It outlines who needs to file, important updates, and key rules around Section 179 deductions. Users can leverage this guide to ensure compliance with IRS regulations regarding business property and amortization.