Tax Forms Documents

Tax Forms

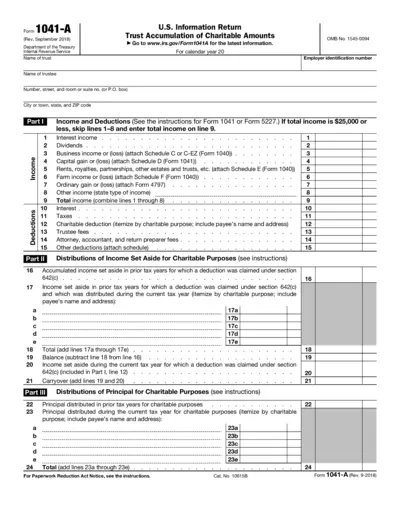

IRS Form 1041-A Information Return for Charitable Trusts

Form 1041-A is a vital document for charitable trusts in the United States. It is used to report income deductions relevant to charitable amounts. Ensure you provide accurate information to comply with IRS regulations.

Tax Forms

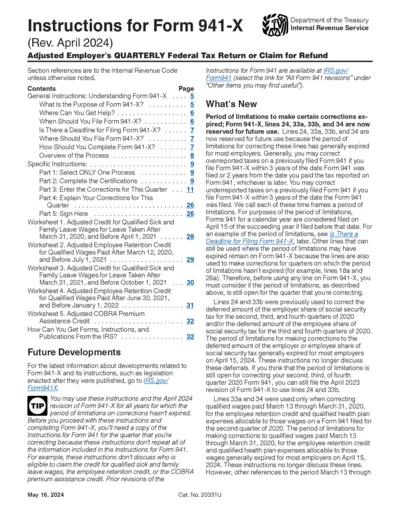

Instructions for Form 941-X Submission and Corrections

This document provides essential guidelines for completing Form 941-X. It covers filing instructions, deadlines, and necessary corrections. Perfect for employers needing to adjust their payroll tax filings.

Tax Forms

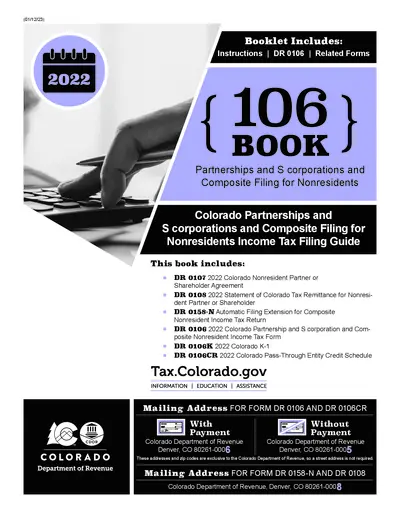

Colorado Nonresident Partner Tax Filing Guide

This guide provides essential instructions for filing the Colorado Nonresident Partner or Shareholder Agreement. It assists users in understanding the necessary requirements and forms needed for compliance. Use this resource to navigate nonresident income tax filing efficiently.

Tax Forms

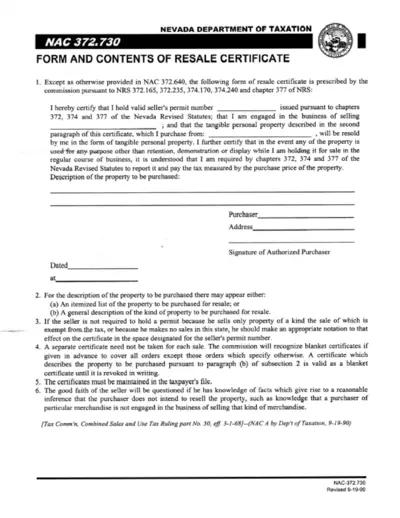

Nevada Resale Certificate Instructions and Details

This file provides guidelines on how to properly fill out the Nevada resale certificate. It ensures compliance with Nevada tax laws when purchasing goods for resale. Use this document to understand the forms and requirements needed for tax exemption.

Tax Forms

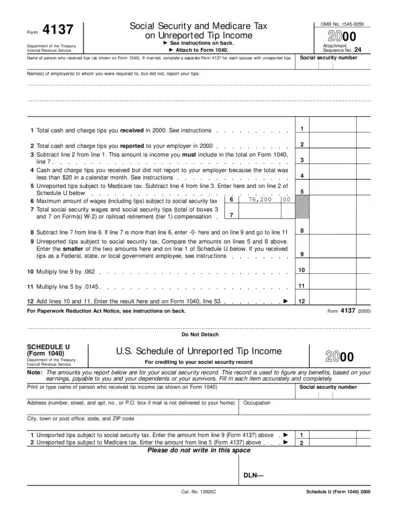

IRS Form 4137: Social Security and Medicare Tax on Tips

IRS Form 4137 is used to report unreported tip income for social security and Medicare tax purposes. This form is essential for individuals who received cash and charge tips but did not report all of them to their employer. Completing this form ensures compliance with tax regulations and protects your social security benefits.

Tax Forms

Developer Guide for Form 499R-2/W-2PR 2023

This guide provides essential instructions for electronic filing of Form 499R-2/W-2PR in Puerto Rico. It includes filing requirements, deadlines, and important information for employers. Users will find detailed steps for completing and submitting their tax forms electronically.

Tax Forms

IRS Form 8825: Rental Real Estate Income & Expenses

Form 8825 is utilized for reporting rental real estate income and expenses for partnerships or S corporations. It serves as an essential resource for accurate tax reporting. Ensure to follow the instructions carefully to avoid errors.

Tax Forms

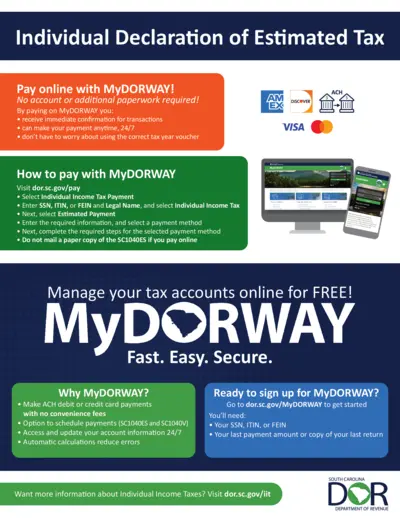

Individual Declaration of Estimated Tax Form SC1040ES

The Individual Declaration of Estimated Tax form is essential for individuals in South Carolina to report their estimated taxes. This form allows users to pay their taxes online easily. Completing this form accurately ensures compliance with tax regulations in South Carolina.

Tax Forms

Instructions for Form 8621 Passive Foreign Investment

This file provides comprehensive instructions for filling out Form 8621. It is designed for U.S. shareholders of Passive Foreign Investment Companies (PFICs). Ensure compliance with the latest tax regulations outlined herein.

Tax Forms

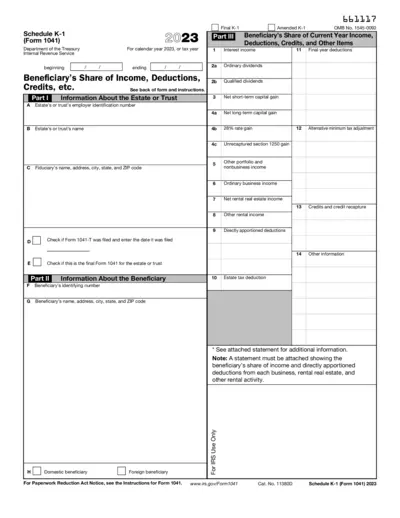

Schedule K-1 Form 1041 2023 Tax Return Instructions

This file provides essential details and instructions for beneficiaries of estates or trusts who receive Schedule K-1 (Form 1041). It outlines how to report income, deductions, and credits on tax returns. Users will find necessary information to accurately complete their tax forms.

Tax Forms

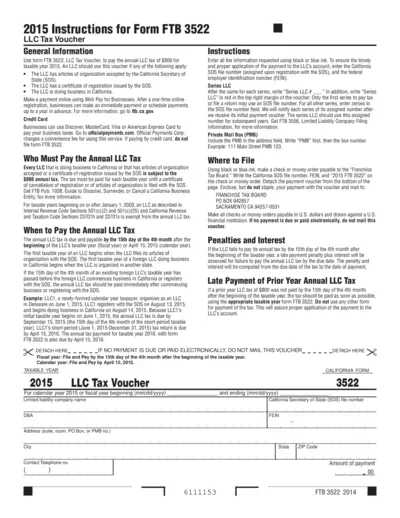

FTB 3522 LLC Tax Voucher Instructions for 2015

This file provides detailed instructions for completing the FTB 3522 LLC Tax Voucher for the year 2015. It outlines who must file, how to make payments, and associated penalties. Essential for any California LLC to ensure compliance with tax regulations.

Tax Forms

Kentucky Individual Income Tax Forms 2015

This document provides essential instructions for filing Kentucky Individual Income Tax for the year 2015. It includes details on credits, deductions, and filing options. Users can find necessary forms and guidelines to ensure accurate and timely submissions.