Tax Forms Documents

Tax Forms

Instructions for Form 8829 Business Home Use Expenses

This document provides guidance on how to use Form 8829 for calculating deductible expenses related to the business use of your home. It includes step-by-step instructions, eligibility criteria, and essential information for proper completion. Ideal for self-employed individuals and home-based business owners.

Tax Forms

FreeTaxUSA Form 8814 Instructions for Tax Filing

Form 8814 allows parents to report their child's interest and dividends on their tax returns. This form is essential for families wanting to simplify tax reporting for minors. Ensure accurate completion of this form to maximize tax benefits.

Tax Forms

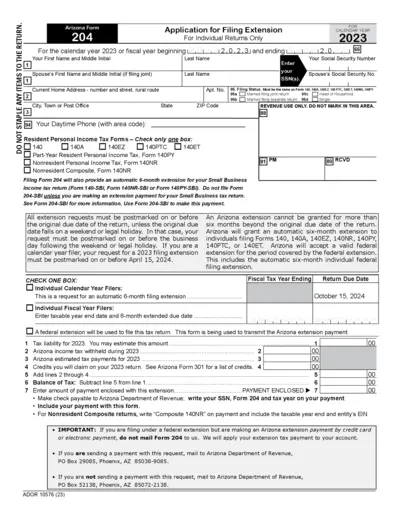

Arizona Form 204 Application for Filing Extension

Arizona Form 204 is used to request an extension for filing individual tax returns for the year 2023. It allows taxpayers to extend their filing deadline and provides essential information for accurate submission. Ensure to complete all required fields and follow the guidelines for a smooth process.

Tax Forms

Virginia Sales and Use Tax Exemption Certificate

The Form ST-13A is a Sales and Use Tax Certificate of Exemption for nonprofits in Virginia. This certificate allows churches exempt from taxation to purchase tangible personal property tax-free. Learn how to complete and utilize this form for your organization's tax-exempt purchases.

Tax Forms

Indiana Sales Tax Exemption Certificate ST-105

The Indiana Form ST-105 is a General Sales Tax Exemption Certificate utilized by state registered businesses. It enables exempt purchases to support legitimate commercial transactions in compliance with Indiana tax codes. Ensure all sections are completed to validate the exemption.

Tax Forms

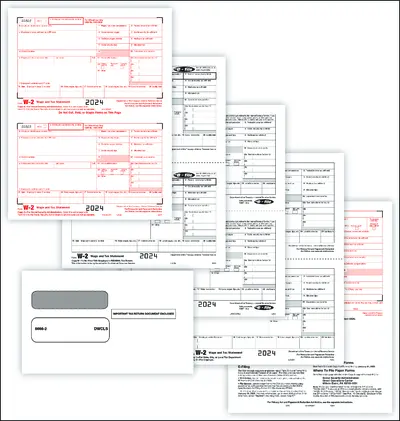

W-2 Wage and Tax Statement for 2024 Submission

The W-2 Wage and Tax Statement is a crucial document for reporting an employee's annual wages and the taxes withheld from their pay. This form is used by employers to provide essential tax information to both employees and the IRS. It ensures employees can accurately file their tax returns.

Tax Forms

Application Form for Income Tax Convention Relief

This form allows recipients of royalties to claim relief from Japanese Income Tax and Special Income Tax for Reconstruction based on treaties. It's essential for foreign entities receiving payments from Japanese sources. Ensure to follow the detailed instructions while filling out this form to benefit from tax exemptions.

Tax Forms

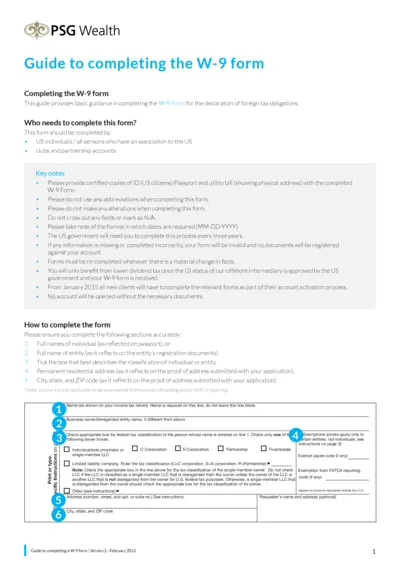

Complete Guide to the W-9 Form for Tax Identification

This comprehensive guide provides step-by-step instructions for completing the W-9 form. Users will find crucial information on requirements and common pitfalls. Ensure compliance with U.S. tax regulations by following the guidelines outlined in this document.

Tax Forms

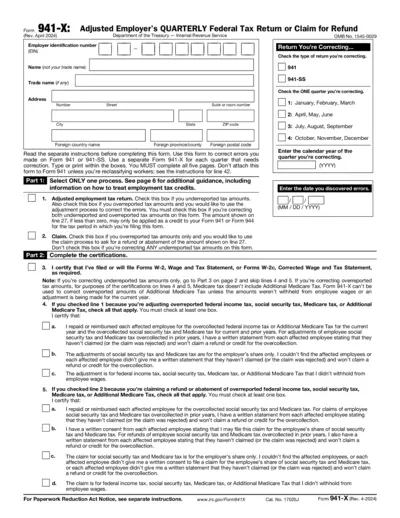

Form 941-X: Adjusted Employer's Quarterly Tax Return

Form 941-X is used to correct errors on your previously filed Form 941. Ensure you correctly report entries and adjustments for accurate tax reporting. Follow the instructions to avoid potential issues with your tax filings.

Tax Forms

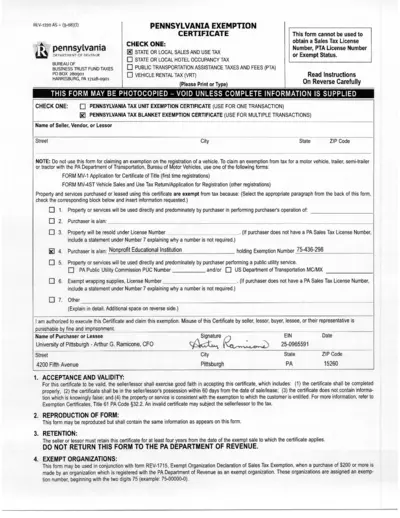

Pennsylvania Exemption Certificate Form REV-1220 AS

This Pennsylvania Exemption Certificate form is required for various tax exemption purposes. It enables purchasers to declare their exemptions for specific transactions. Ensure to follow the instructions carefully to avoid issues.

Tax Forms

Ohio IT-501 Employer's Payment of Withheld Tax

The Ohio IT-501 form is used by employers to report and pay withheld Ohio income taxes. Complete the form with accurate information to ensure compliance with Ohio tax regulations. It's essential for maintaining proper tax records for your business.

Tax Forms

2018 Form 1040 Social Security Benefits Worksheet

This file contains the instructions for filling out the 2018 Form 1040 regarding Social Security benefits. It details the process of determining the taxability of your benefits and provides guidelines for completing the relevant lines on the Form 1040. This worksheet simplifies the calculations needed for reporting your Social Security income.