Tax Forms Documents

Tax Forms

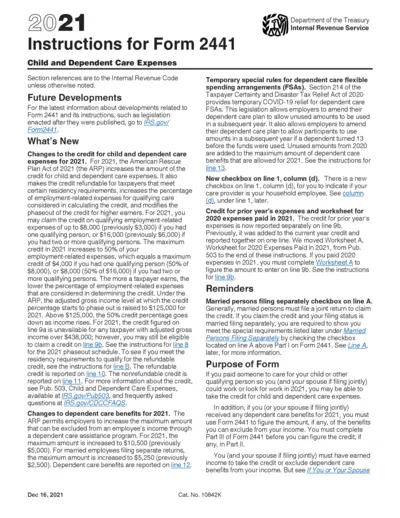

Instructions for Form 2441 Child Dependent Care Expenses

This document provides instructions for completing Form 2441, which is used for Child and Dependent Care Expenses. It includes important updates and clarifications for 2021. Understanding these instructions is essential for taxpayers seeking to maximize their credits for child and dependent care.

Tax Forms

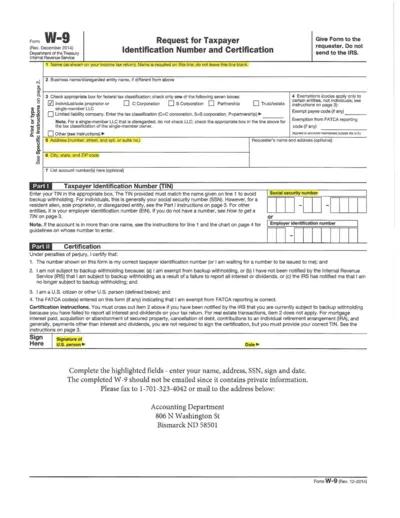

W-9 Request for Taxpayer Identification Number

The W-9 form is used to provide taxpayer identification information to businesses for tax reporting purposes. It ensures accurate reporting of income and helps avoid penalties. Complete this form accurately to comply with IRS regulations.

Tax Forms

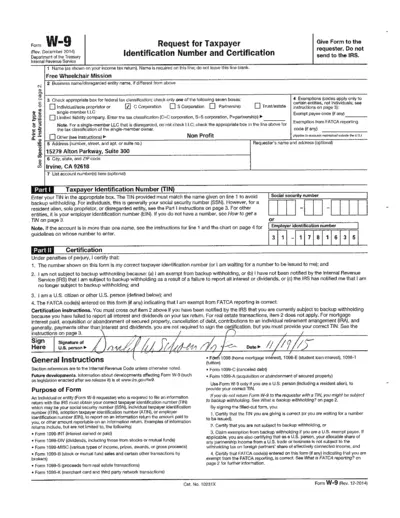

W-9 Tax Form Guidance and Instructions

The W-9 form is essential for U.S. taxpayers to provide their Taxpayer Identification Number (TIN). This document offers clear instructions for filling out the W-9 form, ensuring compliance with IRS requirements. Whether you're an individual or a business, understanding this form is crucial for accurate tax reporting.

Tax Forms

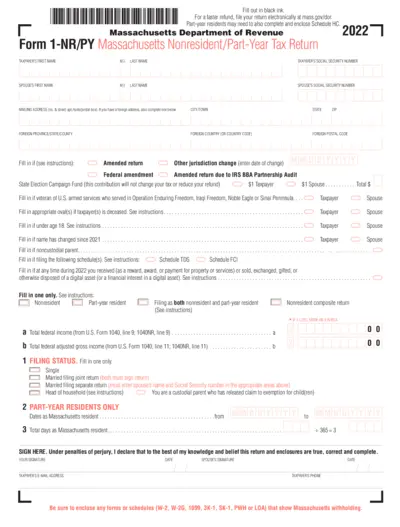

2022 Massachusetts Nonresident Part-Year Tax Return

This file is for nonresidents and part-year residents to file their tax returns in Massachusetts. It includes essential fields to report income, exemptions, and deductions. Completing this form ensures compliance with state tax laws and accurate tax refund processing.

Tax Forms

Instructions for Form 843 Claim for Refund Abatement

This file contains the official instructions for Form 843, used to claim a refund for overpaid taxes and request tax abatement. It outlines the necessary steps for filing claims related to specific taxes, penalties, and interest. Essential for individuals and businesses needing guidance on tax refund processes.

Tax Forms

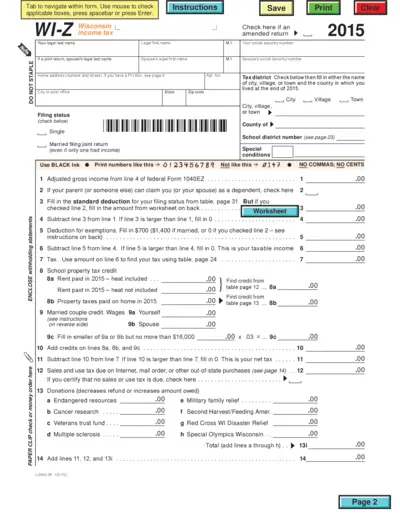

Wisconsin Income Tax Form WI-Z Instructions

Form WI-Z is a streamlined Wisconsin income tax filing form. It is designed for individuals with simple tax situations. Follow the instructions to complete your filing accurately and on time.

Tax Forms

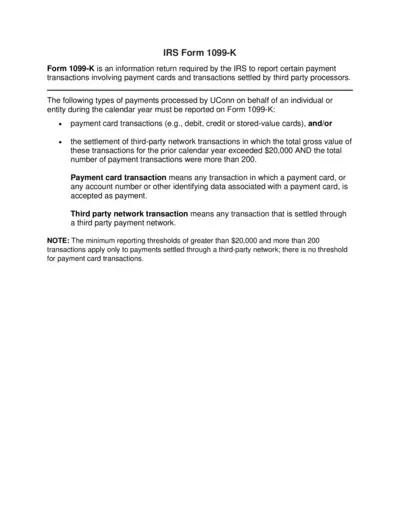

IRS Form 1099-K Reporting Instructions for 2024

This document provides essential information on IRS Form 1099-K, required for reporting certain payment transactions. It outlines the types of transactions that must be reported and how to fill out the form. Ensure compliance by understanding the guidelines and requirements detailed within.

Tax Forms

Instructions for Form 5695 Residential Energy Credits

This file contains the detailed instructions for Form 5695, which is used to claim residential energy credits. It includes eligibility requirements, types of credits available, and guidance on how to fill out the form. Designed for taxpayers who made energy-saving improvements to their homes in 2021, this document helps ensure correct submission.

Tax Forms

W-9 Taxpayer Identification Number Request

Form W-9 is essential for providing your taxpayer identification number to the requester. It is used by individuals and entities to confirm tax status. Complete the form to avoid backup withholding and ensure compliance.

Tax Forms

Free File Fillable Forms User's Guide

This file provides comprehensive instructions for using the Free File Fillable Forms offered by the IRS. It guides users through account creation, form selection, and entry of information. Essential for anyone filing taxes using these fillable forms.

Tax Forms

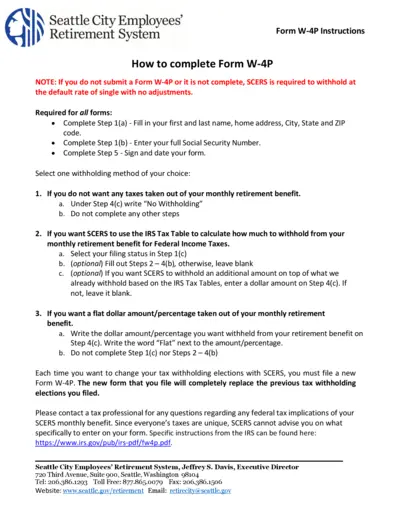

Form W-4P Instructions for Retirement Tax Withholding

This document provides essential instructions for filling out Form W-4P, which is necessary for tax withholding from periodic pension or annuity payments. It guides users on the steps required to properly complete the form and outlines important contact information for assistance. Ensure compliance with federal tax laws by accurately submitting this form.

Tax Forms

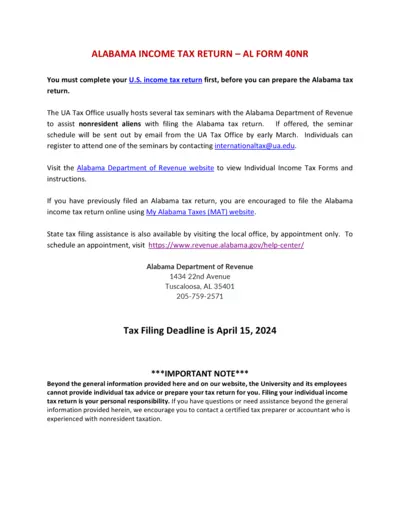

Alabama Income Tax Return Form 40NR Instructions

This file provides essential information and instructions for nonresident aliens filing the Alabama income tax return. It includes details about seminars, online filing options, and state assistance. Essential for ensuring compliance with Alabama tax regulations.