Tax Forms Documents

Tax Forms

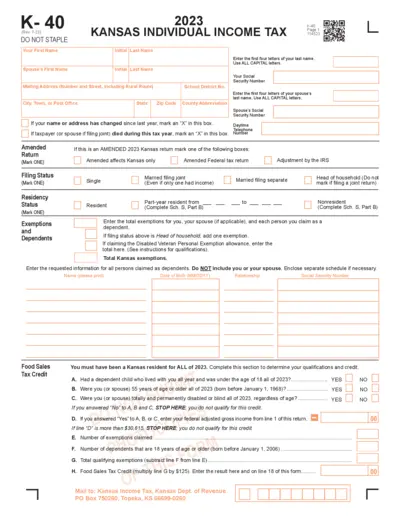

Kansas Individual Income Tax Form K-40 Instructions

The Kansas Individual Income Tax Form K-40 is essential for residents preparing their state tax returns. This form provides necessary fields for personal identification, income calculations, and deductions. Follow the guidelines to accurately complete and submit your tax return.

Tax Forms

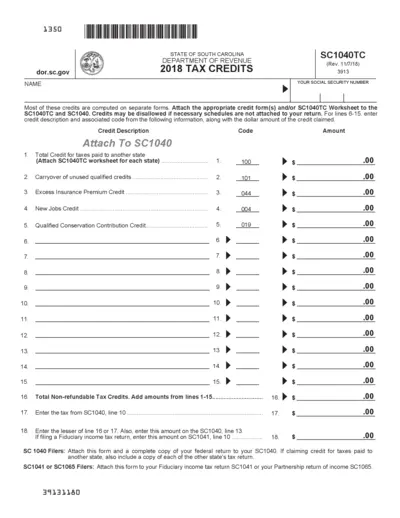

2018 South Carolina Tax Credits SC1040TC Form

The 2018 South Carolina Tax Credits SC1040TC form provides essential information on tax credits available to South Carolina taxpayers. This form is crucial for accurately claiming credits for taxes paid to other states and for ensuring the correct tax amount is reported. Complete this form to ensure compliance and maximize your tax benefits.

Tax Forms

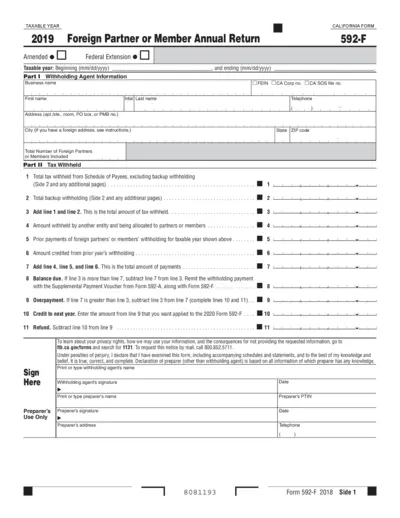

California Form 592-F Foreign Partner Return 2019

California Form 592-F is for reporting tax withheld on foreign partners or members. It details the total tax withheld and overpayments. Complete this form to ensure accurate reporting and compliance with California tax regulations.

Tax Forms

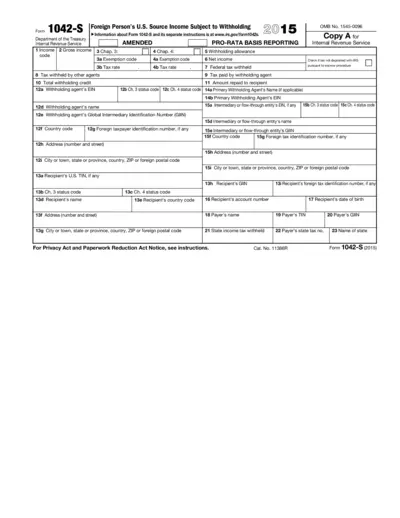

Form 1042-S Foreign Person Income Disclosure

Form 1042-S is designed for foreign persons receiving U.S. source income subject to withholding. This form is essential for accurately reporting income and withholding. Ensure proper completion to comply with IRS requirements.

Tax Forms

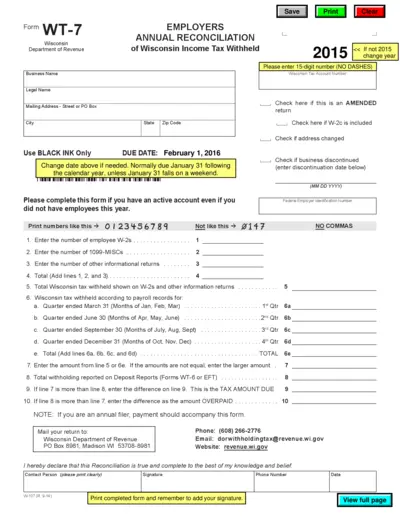

Wisconsin Employers Annual Reconciliation Form WT-7

The Wisconsin Employers Annual Reconciliation Form WT-7 is essential for businesses to report their state income tax withheld. This form must be filed even if there were no employees for the year. Ensure compliance by completing and submitting this form on time.

Tax Forms

Form 8945 PTIN Application for Conscientious Objection

The Form 8945 is for U.S. citizens with religious objections to obtaining a Social Security Number. This form is necessary to apply for a PTIN without an SSN. Follow the instructions closely to ensure compliance.

Tax Forms

California Real Estate Withholding Statement 2023

This form is used in California for the withholding of taxes on real estate transactions. It provides information necessary for remitters to comply with withholding requirements. Fill out the details accurately to ensure proper processing.

Tax Forms

IRS e-file Signature Authorization Form 8879-EO

This file contains the IRS e-file Signature Authorization for Exempt Organizations. It provides essential guidance and details for completing IRS Form 8879-EO. Important to retain for your records and not submit directly to the IRS.

Tax Forms

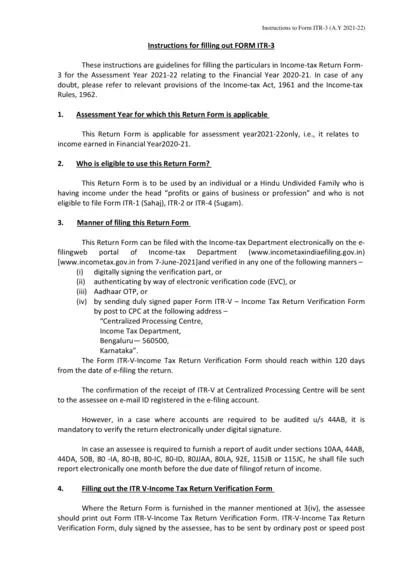

Instructions for Form ITR-3 A.Y 2021-22 Filling

This document provides comprehensive instructions for filling out Form ITR-3 for the Assessment Year 2021-22. It caters to individuals and Hindu Undivided Families with income under specific categories. Ensure to follow the guidelines to avoid any issues during tax filing.

Tax Forms

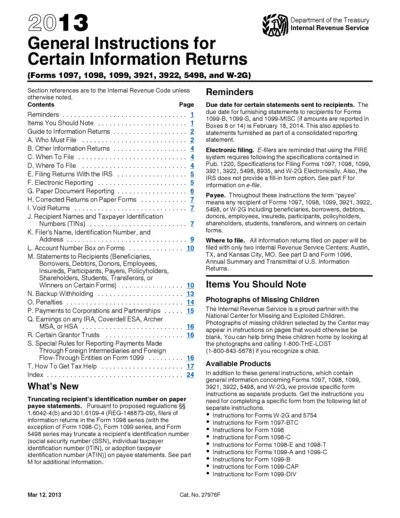

General Instructions for Certain Information Returns

This PDF provides comprehensive instructions for filing various information returns such as Forms 1097, 1098, 1099, and others. It outlines essential guidelines, deadlines, and filing requirements for individuals and businesses. Users can find specific instructions and details to ensure compliance with reporting regulations.

Tax Forms

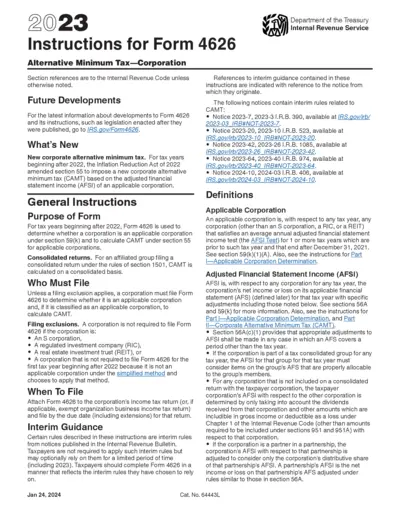

Form 4626 Alternative Minimum Tax Instructions

This document contains detailed instructions for completing Form 4626, which determines corporate alternative minimum tax. It outlines who must file this form and the necessary steps to ensure proper submission. Understanding these guidelines is essential for compliance with the tax regulations.

Tax Forms

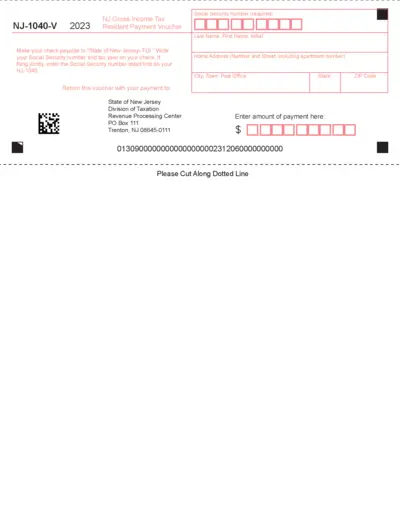

NJ Gross Income Tax Resident Payment Voucher

This is the NJ-1040-V form used for making resident payments for New Jersey Gross Income Tax. Ensure you fill it out accurately to avoid any issues with your tax payments. Follow the instructions provided to complete the form effectively.