Tax Forms Documents

Tax Forms

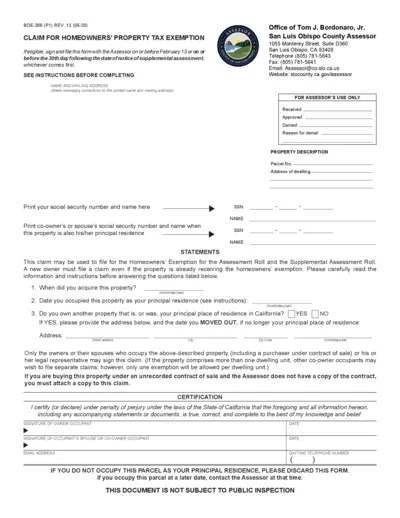

Claim for Homeowners' Property Tax Exemption

This form is essential for homeowners seeking a property tax exemption in California. It guides users through the eligibility criteria and filing process. Proper completion ensures the timely granting of the exemption.

Tax Forms

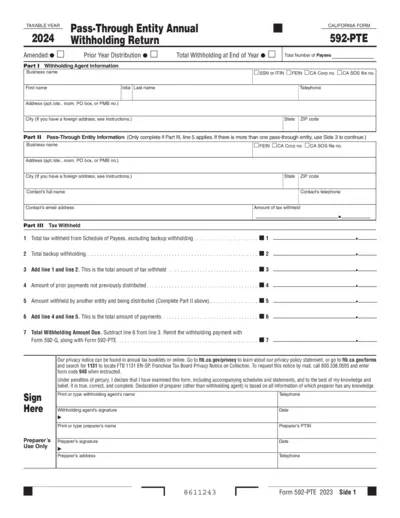

California Pass-Through Entity Tax Withholding Form

The California Pass-Through Entity Tax Withholding Form is essential for reporting tax withheld from pass-through entities for the tax year 2024. This form must be completed accurately to ensure compliance with California tax regulations. It includes detailed instructions for filling out each section.

Tax Forms

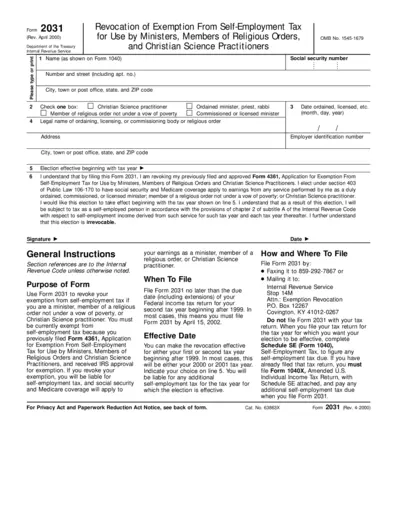

Revocation of Exemption From Self-Employment Tax

This file allows ministers, members of religious orders, and Christian Science practitioners to revoke their exemption from self-employment tax. It provides essential information regarding the revocation process and its implications. Users should carefully follow the instructions to ensure proper completion and submission of the form.

Tax Forms

IRS Reporting Agent Authorization Technical Guide

This publication provides essential instructions and specifications for the preparation and submission of Form 8655. It includes the necessary requirements for electronic filing and the Reporting Agent's List for clients/taxpayers. A must-have resource for professionals involved in tax submission and compliance.

Tax Forms

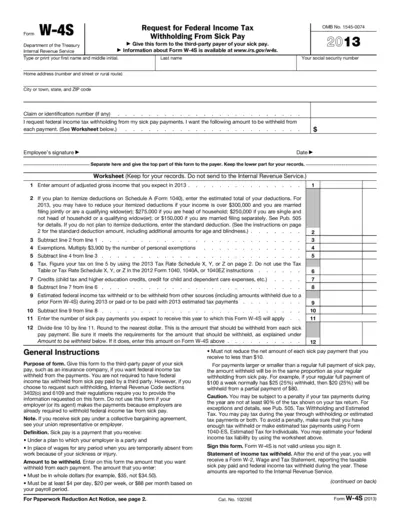

W-4S Form for Federal Income Tax Withholding

The W-4S form allows individuals to request federal income tax withholding from sick pay. It is important for those receiving sick pay from third-party payers. Understanding how to complete this form can help ensure accurate tax withholding.

Tax Forms

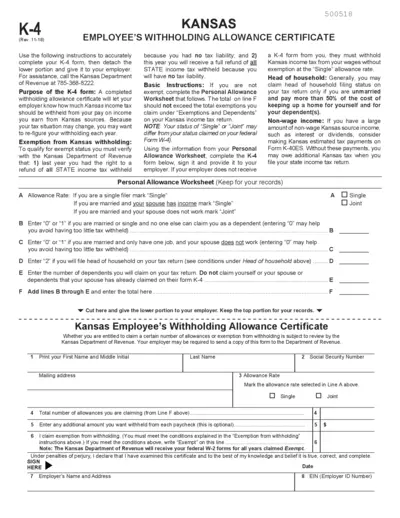

Kansas Employee Withholding Allowance Certificate

This form allows Kansas employees to claim withholding allowances. Use it to inform your employer how much tax to withhold from your paycheck. Follow instructions carefully to ensure accurate withholding.

Tax Forms

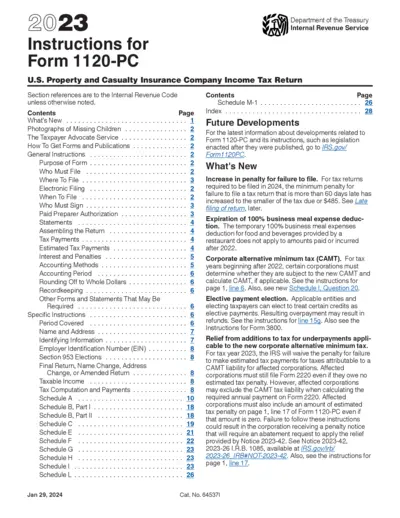

Form 1120-PC Instructions for 2023 Tax Year

This file contains detailed instructions for completing Form 1120-PC, the U.S. Property and Casualty Insurance Company Income Tax Return. It includes essential guidelines for tax year 2023, ensuring compliance with IRS regulations.

Tax Forms

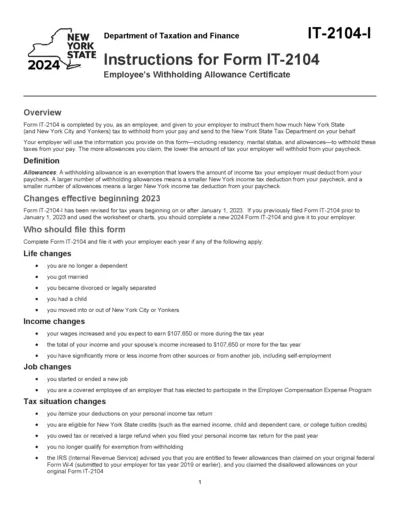

Instructions for Form IT-2104 Employee Withholding

This document provides comprehensive instructions on filling out Form IT-2104, the Employee's Withholding Allowance Certificate. It is essential for New York employees to determine the correct withholding for state taxes. Following these guidelines ensures compliance and minimizes tax liabilities.

Tax Forms

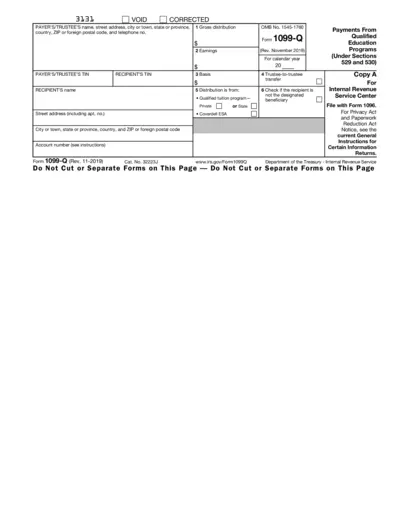

Form 1099-Q Instructions for Educational Distributions

This document provides essential instructions for completing IRS Form 1099-Q, detailing distributions from qualified education programs. It includes guidance on earnings and tax implications for Coverdell ESAs and QTPs. Use this file to ensure accurate reporting for education-related financial assistance.

Tax Forms

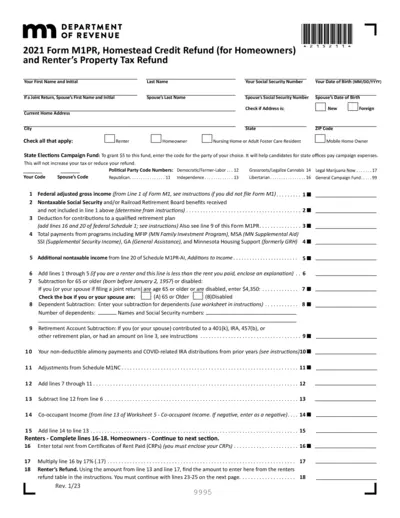

2021 Form M1PR Homestead Credit Refund Instructions

The 2021 Form M1PR provides homeowners and renters with instructions on how to file for homestead credit refunds. This essential guide breaks down the requirements and processes involved in claiming available refunds. Clear, concise, and easy to follow, it simplifies your tax refund journey.

Tax Forms

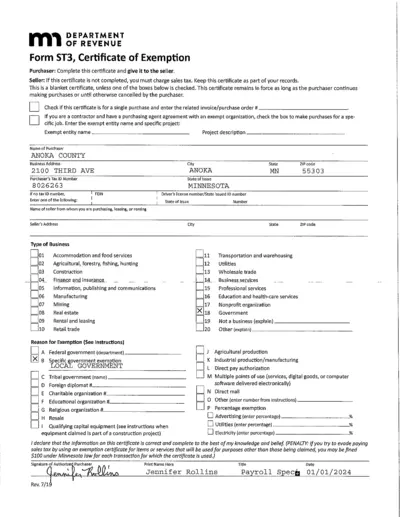

Form ST3 Certificate of Exemption Detailed Instructions

The Form ST3 Certificate of Exemption is essential for purchasers who are claiming exemption from sales tax. This certificate must be completed accurately to ensure compliance with Minnesota tax regulations. It serves as proof of the purchaser's exemption status during transactions.

Tax Forms

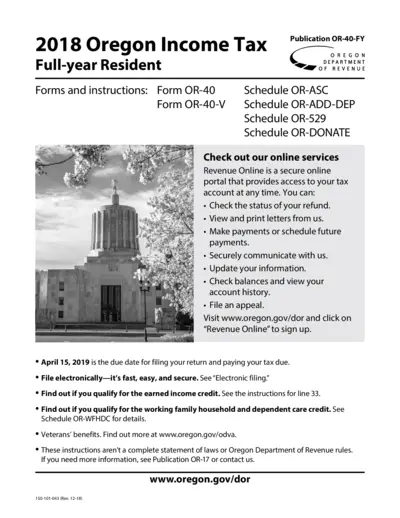

Oregon Income Tax Instructions and Forms 2018

This document provides essential forms and instructions for filing the 2018 Oregon income tax for full-year residents. It guides taxpayers on how to file their returns correctly and includes information about various credits and deductions. Use this resource to ensure compliance with Oregon tax laws and maximize your potential refund.