Tax Forms Documents

Tax Forms

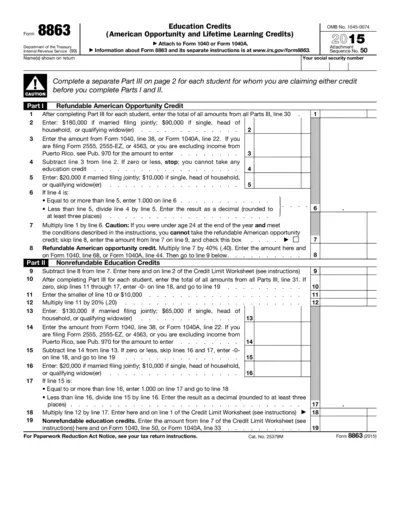

Form 8863: Education Credits for Tax Return

Form 8863 is used to claim education credits, such as the American Opportunity and Lifetime Learning Credits. This form needs to be attached to your Form 1040 or Form 1040A. Discover how to fill it out and maximize your tax credits.

Tax Forms

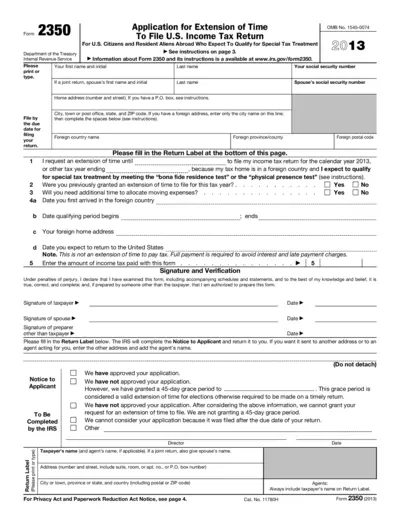

Application for Extension of Time to File U.S. Tax Return

Form 2350 is an application for U.S. citizens and resident aliens living abroad to request an extension to file their income tax return. This extension is especially for taxpayers who expect to qualify for specific tax treatments due to their foreign status. Complete and submit this form to ensure you meet tax requirements while overseas.

Tax Forms

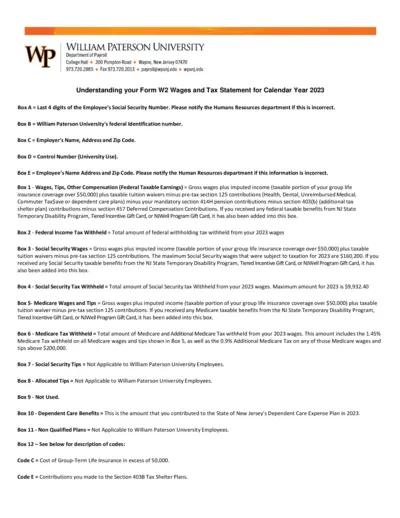

Understanding Your W2 Wage and Tax Statement 2023

This file provides detailed instructions related to your W2 Wage and Tax Statement for the calendar year 2023. It includes information on how to accurately interpret various boxes on the W2 form. This guide is essential for employees of William Paterson University to ensure correct tax reporting.

Tax Forms

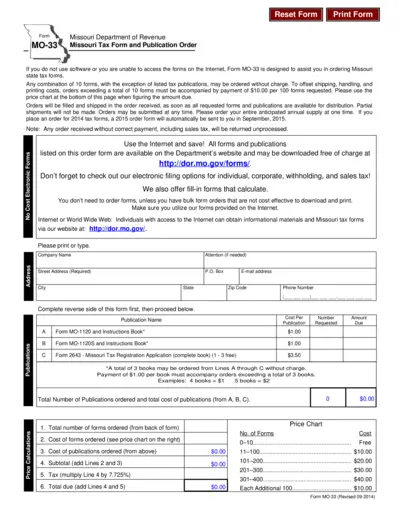

Missouri Department of Revenue Tax Form MO-33

The Missouri Tax Form MO-33 allows users to order state tax forms efficiently. It facilitates free orders of up to 10 forms while larger orders require fees. This form is essential for anyone needing physical copies of Missouri tax publications.

Tax Forms

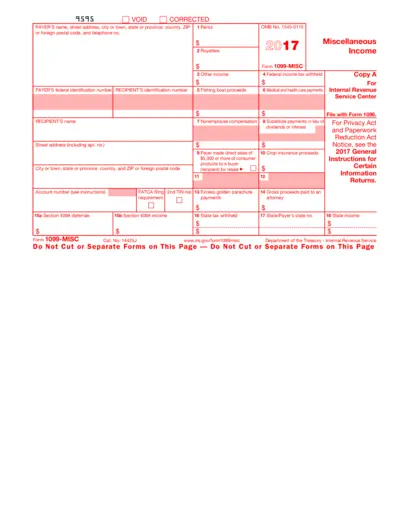

Form 1099-MISC Instructions and Details

This file contains essential information about Form 1099-MISC, including how to fill it out and who needs it. It's crucial for accurately reporting miscellaneous income. Get detailed instructions and examples for a smooth filing process.

Tax Forms

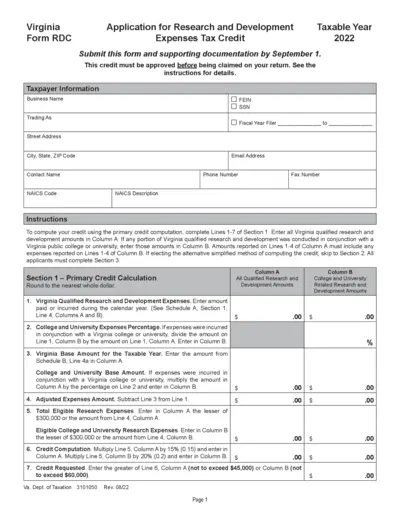

Virginia Research and Development Expenses Tax Credit

This form is for Virginia taxpayers applying for the Research and Development Expenses Tax Credit for the year 2022. It includes sections for qualifying expenses, instructions for filling, and submission guidelines. Eligible businesses must complete and submit this form along with supporting documentation.

Tax Forms

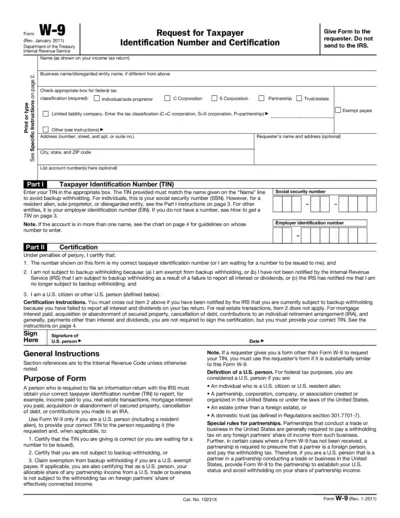

W-9 Form IRS Tax Identification and Certification

The W-9 form is used to request a taxpayer's identification number and certification. It is essential for various tax-related processes. Complete this form to ensure proper reporting and avoid backup withholding.

Tax Forms

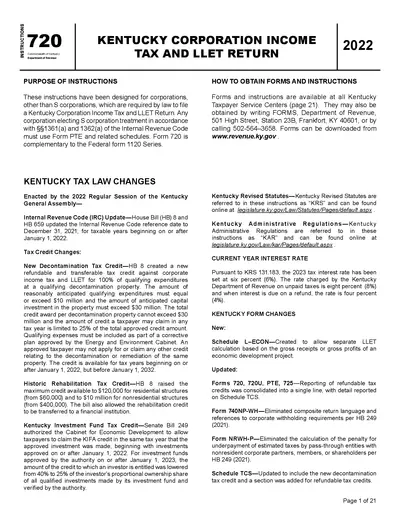

Kentucky Corporation Income Tax and LLET Return 2022

This document contains important instructions for corporations filing their Kentucky Corporation Income Tax and LLET Return for the year 2022. It includes updated tax laws and guidance on credits available. Corporations must follow these instructions to ensure compliance with state regulations.

Tax Forms

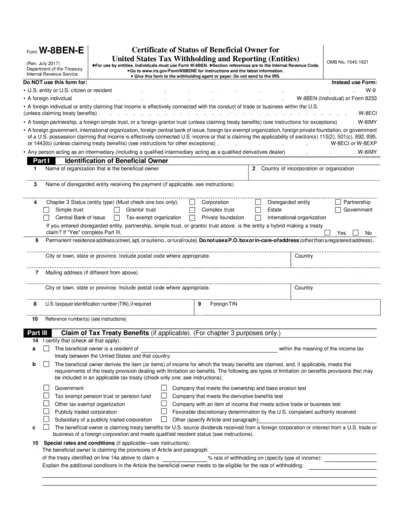

W-8BEN-E Form for U.S. Tax Withholding - Entities

The W-8BEN-E form certifies the status of a foreign entity for U.S. tax purposes. It is essential for entities receiving certain types of income from U.S. sources. Complete this form to claim a reduced rate of withholding tax under an applicable tax treaty.

Tax Forms

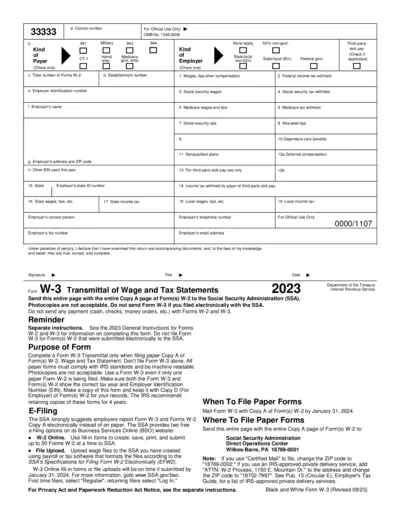

Form W-3 Transmittal of Wage and Tax Statements

Form W-3 is used to transmit copies of wage and tax statements (Form W-2) to the Social Security Administration. This form is crucial for employers reporting wages and taxes for their employees. Proper completion ensures compliance with IRS regulations.

Tax Forms

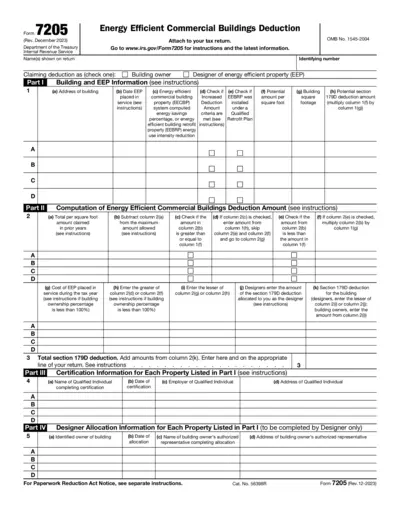

Form 7205 Energy Efficient Commercial Buildings Deduction

Form 7205 is used to claim the Energy Efficient Commercial Buildings Deduction. This IRS form requires specific information about energy-efficient property. Accurate completion can reduce your tax burden significantly.

Tax Forms

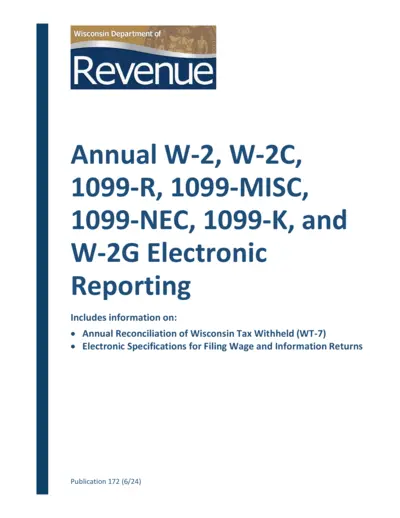

Wisconsin Electronic Reporting Guidelines 2024

This document provides detailed specifications and instructions for electronic filing of Wisconsin tax forms, including W-2 and 1099. It's essential for employers and payers in Wisconsin who need to report wages and information returns. Ensure compliance with state requirements to avoid penalties.