Tax Forms Documents

Tax Forms

IRS Form 1099-MISC Instructions and Details

This file contains vital information about IRS Form 1099-MISC, including how to fill it out and file it. It provides detailed instructions for both consumers and businesses who need to report miscellaneous income. Ensure compliance with IRS regulations by following the guidelines in this document.

Tax Forms

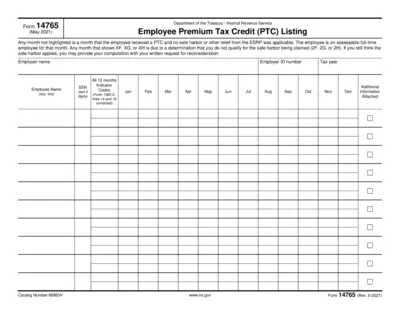

Employee Premium Tax Credit PTC Listing Instructions

Form 14765 provides necessary details regarding the Employee Premium Tax Credit (PTC). It outlines which months an employee received a PTC and highlights any notable gaps in eligibility. This document is essential for employers and assesses their compliance with the ESRP.

Tax Forms

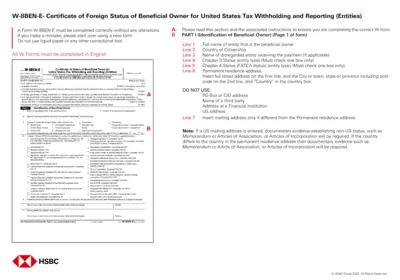

W-8BEN-E Form for U.S. Tax Withholding Compliance

The W-8BEN-E form certifies the foreign status of a beneficial owner for U.S. tax purposes. It is essential for entities and foreign organizations receiving income from U.S. sources. Proper completion of this form is critical for avoiding unnecessary tax withholding.

Tax Forms

IRS Form 940 Instructions for Employers

IRS Form 940 is the Employer's Annual Federal Unemployment Tax Return. This form is used by employers to report their Federal Unemployment Tax Act (FUTA) liabilities. Follow the provided instructions carefully to ensure accurate filing.

Tax Forms

2021 Form 1040-V Guide for IRS Tax Payments

Form 1040-V is a payment voucher for individuals submitting tax payments. It is required if you owe a balance on your tax return. This guide provides essential instructions for filling out and submitting Form 1040-V.

Tax Forms

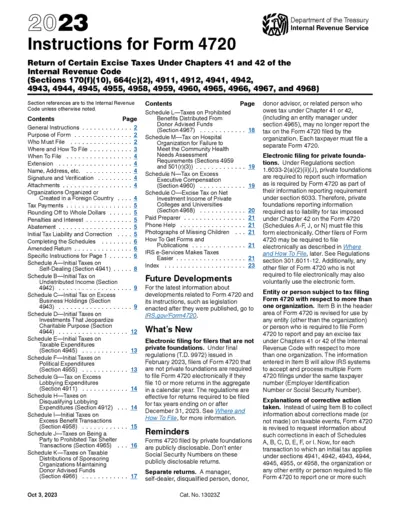

Instructions for Form 4720 - Excise Tax Reporting

This document provides essential instructions for filing Form 4720, which is used to report certain excise taxes under Chapters 41 and 42 of the Internal Revenue Code. Ideal for tax-exempt organizations and foundations, it outlines relevant sections and filing requirements. Stay compliant and avoid penalties with this detailed guidance.

Tax Forms

Instructions for Completing Form WH-4

This document contains detailed instructions for filling out Form WH-4, which is required for all Indiana employees. Learn how to correctly fill in your details to ensure proper tax withholding. Follow these guidelines to claim exemptions and ensure compliance with state tax regulations.

Tax Forms

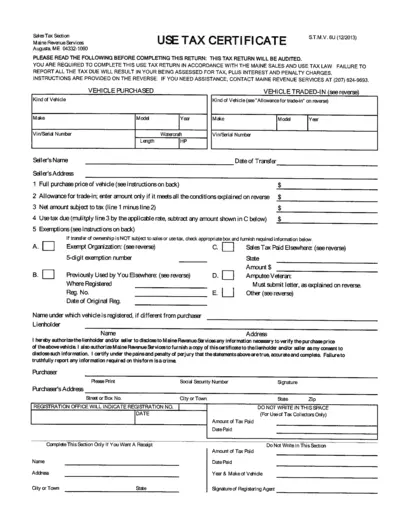

Maine Use Tax Certificate Instructions

This file contains detailed instructions for completing the Maine Use Tax Certificate. It helps individuals and organizations to understand the use tax obligations for vehicle purchases. Ensure compliance to avoid penalties by following the guidelines provided.

Tax Forms

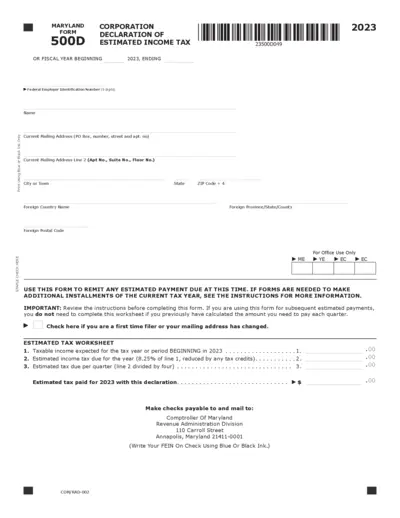

Maryland Form 500D Corporation Estimated Tax Declaration

Form 500D is essential for Maryland corporations to declare and remit their estimated income tax. This form ensures compliance with state tax laws, helping businesses avoid penalties. Properly filling out this form is crucial for effective financial planning.

Tax Forms

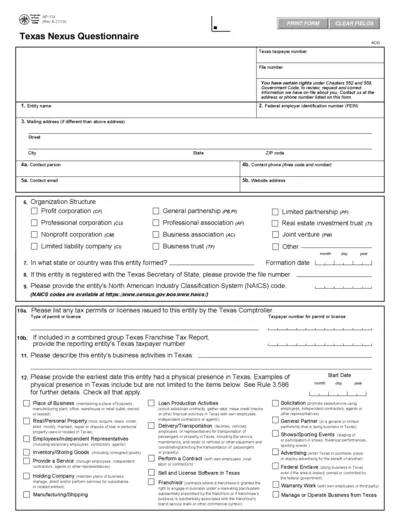

Texas Nexus Questionnaire AP-114 Submission Form

The Texas Nexus Questionnaire AP-114 is essential for entities doing business in Texas to determine franchise tax obligations. This form collects critical information regarding the entity's operations, presence, and relevant identifiers. Fill out this form to ensure compliance with Texas tax laws effectively.

Tax Forms

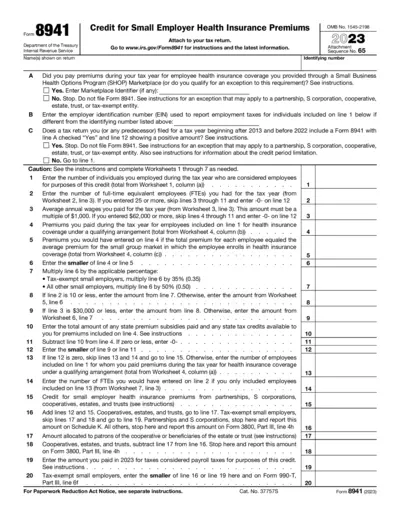

Form 8941 for Small Employer Health Insurance Premiums

Form 8941 allows small employers to claim a credit for health insurance premiums. This form is crucial for businesses using the SHOP Marketplace. Ensure accurate completion to qualify for the tax credit.

Tax Forms

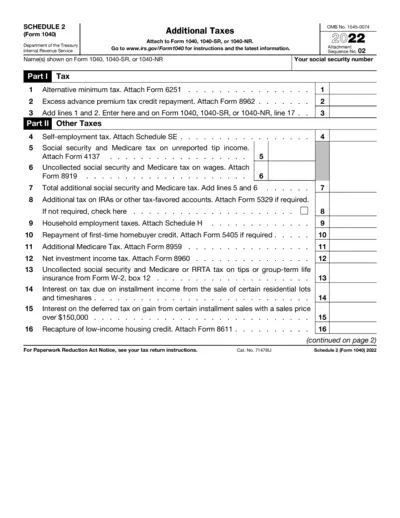

Schedule 2 Form 1040 Additional Taxes 2022

Schedule 2 of Form 1040 is used to report additional taxes owed by individuals. This includes taxes related to alternative minimum tax, self-employment tax, and more. It's essential for taxpayers to accurately complete this schedule to ensure compliance with tax regulations.