Tax Forms Documents

Tax Forms

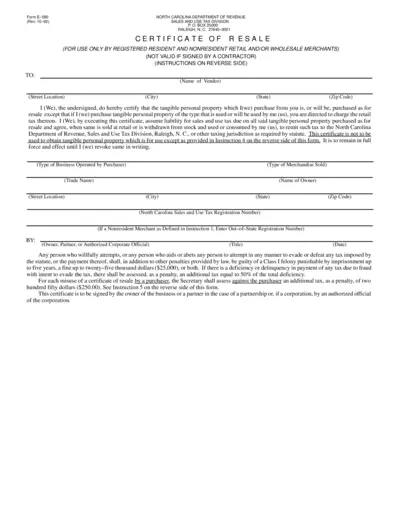

North Carolina Resale Certificate Form E-590 Instructions

This file contains the North Carolina Resale Certificate E-590, which is used by registered merchants for tax-exempt purchases. It outlines the necessary details and instructions for properly filling out the form. Ensure to adhere to the provided guidelines to avoid any penalties associated with misuse.

Tax Forms

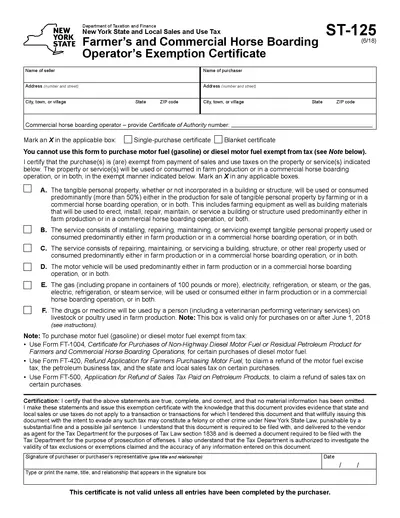

New York State Tax Exemption Certificate ST-125

The New York State ST-125 form is used to certify that a purchase is exempt from sales and use tax. This certificate applies to tangible personal property and specific services related to farm production and commercial horse boarding operations. It is essential for farmers and horse boarding operators to validate their tax-exempt purchases.

Tax Forms

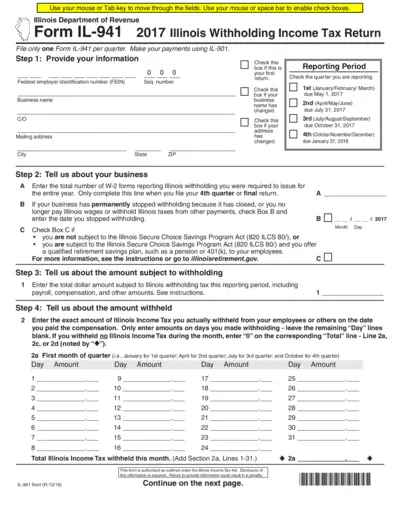

2017 Illinois Withholding Income Tax Return IL-941

The 2017 Illinois Withholding Income Tax Return (IL-941) is essential for businesses to report income tax withheld from employees. It guides employers in filing accurate tax returns quarterly. Complete the form to ensure compliance with Illinois tax regulations.

Tax Forms

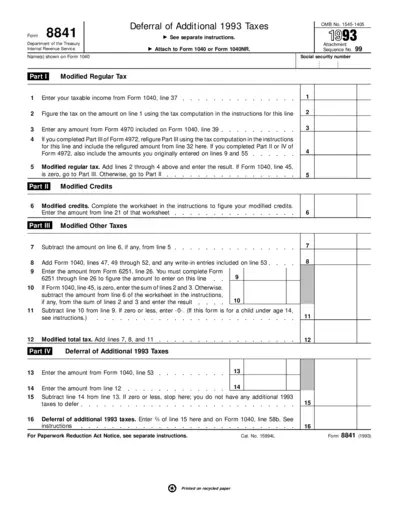

Form 8841 Instructions for Deferral of Taxes

Form 8841 is used by taxpayers to report certain deferrals of additional taxes for the tax year 1993. This form must be attached to Form 1040 or Form 1040NR. It includes detailed calculations related to modified regular tax and modified credits.

Tax Forms

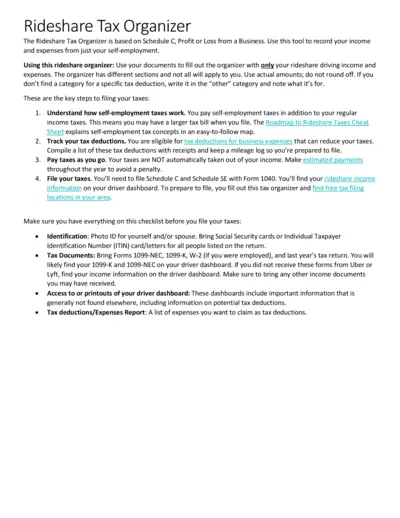

Rideshare Tax Organizer for Self-Employed Drivers

This Rideshare Tax Organizer helps self-employed drivers track their income and expenses effectively. It's an essential tool for ensuring accurate tax filings. Use it to prepare for your tax return and maximize deductions.

Tax Forms

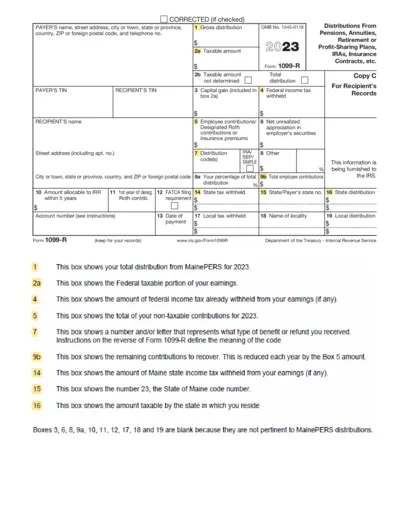

Form 1099-R Instructions for Filing 2023

This document provides essential information regarding the Form 1099-R. It outlines the details required for accurate filing, including distribution amounts. Users will find clear instructions on how to correctly fill out the form.

Tax Forms

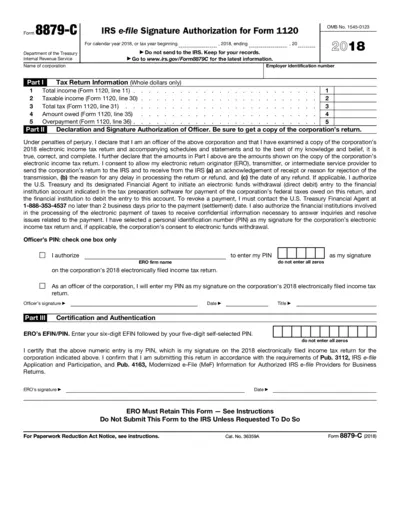

IRS Form 8879-C Signature Authorization for 2018

Form 8879-C is used for IRS e-filing of corporation tax returns. It enables a corporate officer to electronically sign the tax return using a PIN. This form must be completed and retained for records.

Tax Forms

Instructions for Form 1120-IC-DISC (2017)

Form 1120-IC-DISC is an essential document for interest charge domestic international sales corporations. It provides guidelines on filing requirements, penalties, and necessary documentation. Understanding and correctly completing this form is crucial for compliance with U.S. tax regulations.

Tax Forms

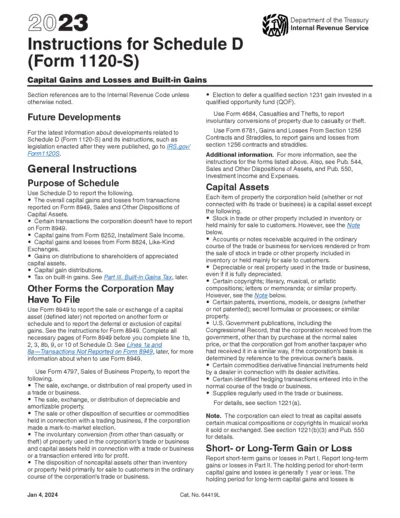

Instructions for Schedule D Form 1120-S Capital Gains

This file provides essential instructions for filing Schedule D of Form 1120-S, detailing capital gains and losses. It offers guidance on reporting transactions and understanding related tax implications. Corporations can benefit from following these instructions to comply with IRS requirements.

Tax Forms

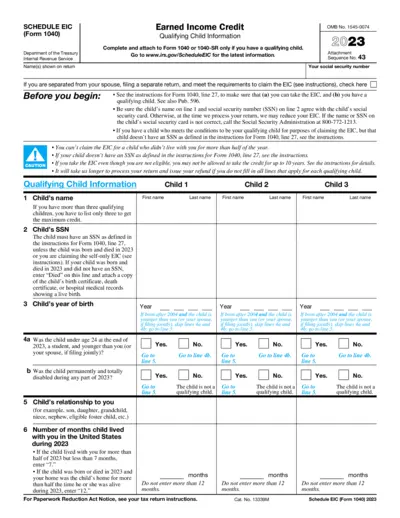

Schedule EIC Form 1040 Earned Income Credit 2023

This file contains the Earned Income Credit form and its detailed instructions. It helps claim the Earned Income Credit if you have a qualifying child. Utilize the information to ensure accurate completion for tax purposes.

Tax Forms

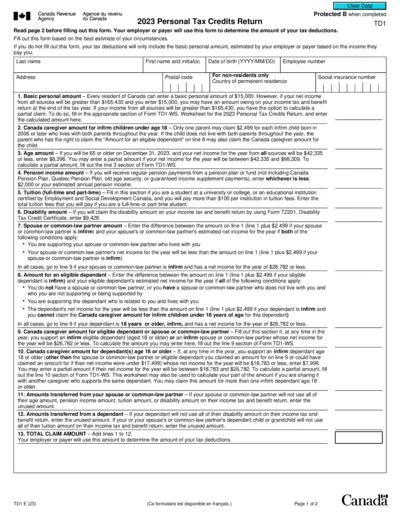

2023 Personal Tax Credits Return TD1 Guidance

The 2023 Personal Tax Credits Return (TD1) form is essential for Canadian residents to determine correct tax deductions. This form allows individuals to claim various personal tax credits based on their specific circumstances. Completing the TD1 accurately ensures proper deductions to avoid any year-end tax liabilities.

Tax Forms

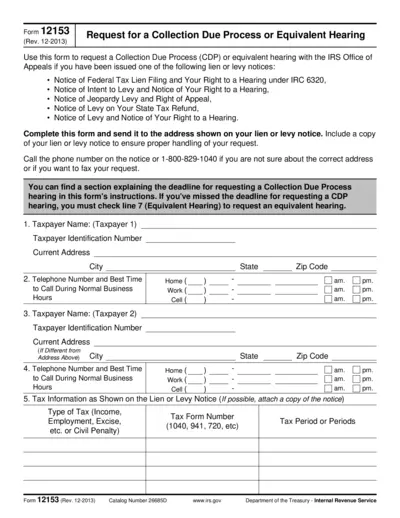

Form 12153 Request for Collection Due Process Hearing

Form 12153 allows taxpayers to request a Collection Due Process or equivalent hearing with the IRS regarding lien or levy notices. It is essential for ensuring taxpayer rights are upheld. Proper completion and submission of this form are necessary to initiate the hearing process.