Tax Forms Documents

Tax Forms

Form FTB 3582 Instructions for Electronic Payments

This document provides essential instructions for completing Form FTB 3582, a payment voucher for individual e-filed returns. It outlines mandatory electronic payment requirements and the steps for submitting your voucher. Use this guide to ensure compliance and avoid penalties.

Tax Forms

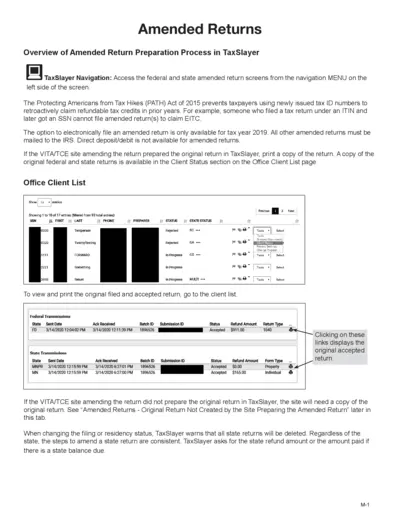

Amended Tax Return Filling Instructions with TaxSlayer

This document provides an overview of the amended return preparation process in TaxSlayer. Users will learn step-by-step instructions to properly fill out their amended returns. It is essential for those needing to make corrections to previously filed tax returns.

Tax Forms

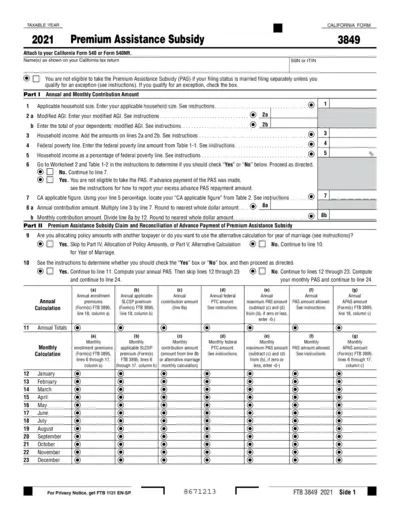

California Premium Assistance Subsidy Form 2021

This PDF form is for individuals applying for the Premium Assistance Subsidy in California for the year 2021. It includes detailed instructions and information necessary for filing your subsidy claim. Ensure your submission is accurate to receive the aid you qualify for.

Tax Forms

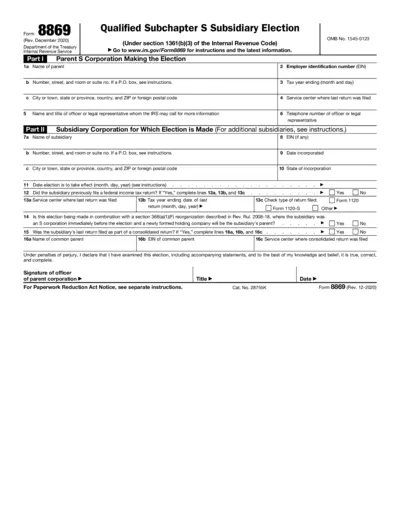

Form 8869 Qualified Subchapter S Subsidiary Election

Form 8869 is used by parent S corporations to elect to treat a qualified subchapter S subsidiary as a separate entity. This election allows the subsidiary to be included in the parent's tax return, simplifying the tax process. Users can access the form online and find detailed instructions for completion.

Tax Forms

Oregon Annual Withholding Tax Reconciliation Form OR-WR

Form OR-WR is a crucial tax reconciliation report for Oregon employers. It details the annual withholding tax obligations and filing requirements. Ensure compliance by following the provided instructions carefully.

Tax Forms

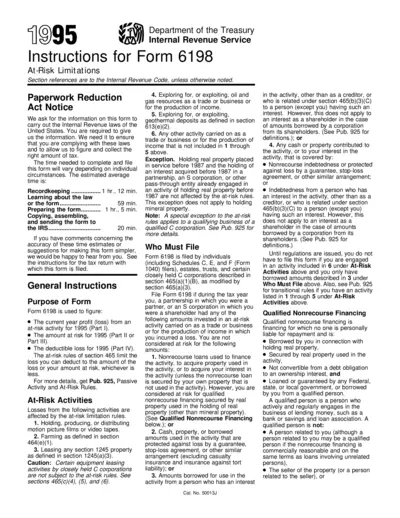

IRS Form 6198 Instructions for At-Risk Limitations

This document provides essential instructions for completing IRS Form 6198, which is used to calculate at-risk limitations. It details the time estimates, filing requirements, and specific instructions relevant to various taxpayers.

Tax Forms

New Jersey Sales and Use Tax Energy Return Instructions

This file contains filing instructions for the New Jersey Sales and Use Tax Energy Return. It provides detailed steps for businesses collecting sales tax on energy sales. Users will find guidance on completing the return accurately and maintaining required records.

Tax Forms

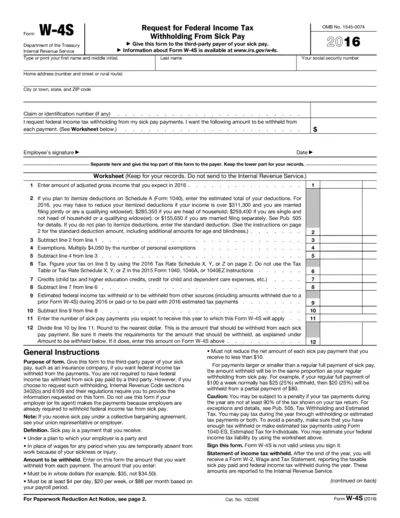

Form W-4S Request for Sick Pay Tax Withholding

Form W-4S is used to request Federal income tax withholding from sick pay payments. It's essential for employees who receive sick pay from a third party and want taxes withheld. This form requires personal information and withholding preferences to ensure accurate tax deductions.

Tax Forms

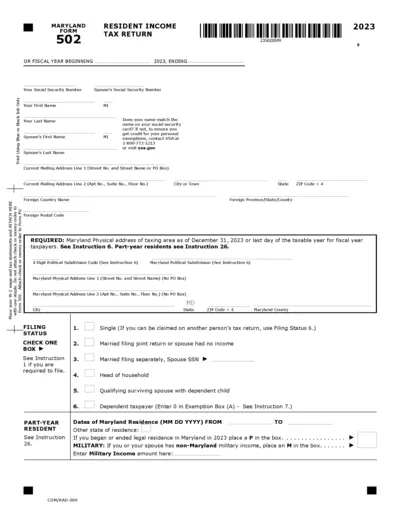

Maryland Form 502 Resident Income Tax Return 2023

The Maryland Form 502 is essential for residents filing their income taxes. This form helps determine your tax obligations for the fiscal year. Complete it accurately to ensure compliance and maximize your potential refund.

Tax Forms

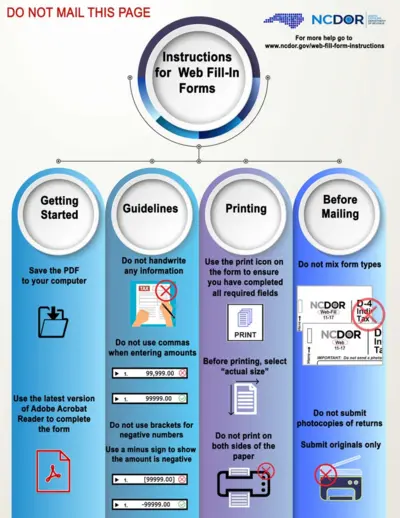

NCDOR Web Fill-In Form Instructions

This file provides essential instructions for filling out the NCDOR Web Fill-In forms. Users will find crucial guidelines for successful completion and submission. It also covers the necessary details for filing requests and objections.

Tax Forms

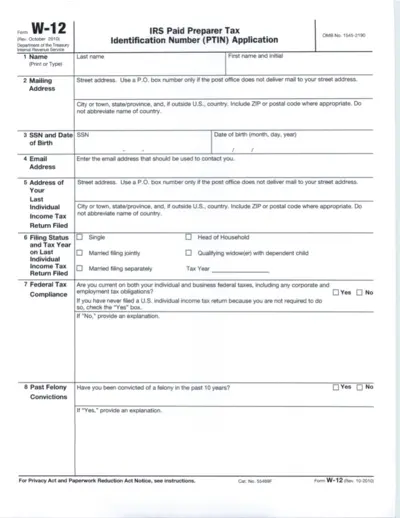

IRS Paid Preparer Tax Identification Number Application

The IRS W-12 form is used to apply for a Paid Preparer Tax Identification Number (PTIN). This form is essential for tax professionals who prepare tax returns for compensation. Ensure full compliance with tax laws while applying.

Tax Forms

Instructions for Form 8995-A Qualified Business Income

This file contains detailed instructions for filling out Form 8995-A, which is used to calculate the Qualified Business Income deduction. It provides guidance for individuals and eligible estates or trusts regarding their specific business income. Understanding this form is essential for accurate tax reporting and maximizing potential deductions.