Tax Forms Documents

Tax Forms

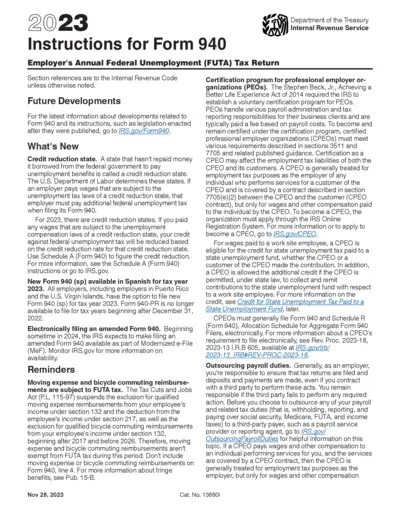

Instructions for Form 940 - Employer's Annual FUTA Tax Return

This file provides comprehensive instructions for the Form 940 filing process, ensuring employers understand their federal unemployment tax obligations. It includes guidance on who must file, key deadlines, and detailed descriptions of various sections of the form. Utilize this resource to ensure compliance with the Internal Revenue Service requirements.

Tax Forms

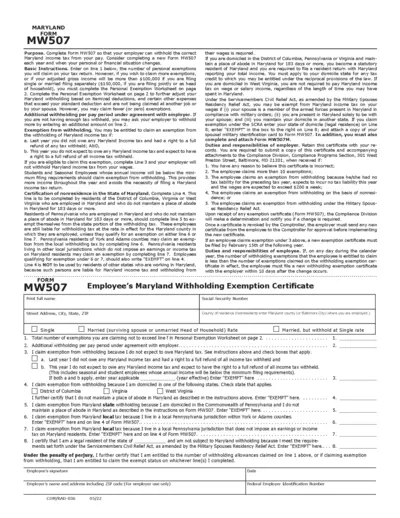

Maryland Form MW507 Instructions for Tax Withholding

Form MW507 is essential for Maryland residents to ensure accurate income tax withholding. This form allows employees to claim personal exemptions and additional withholding. Completing this form correctly helps in determining your Maryland state tax obligations.

Tax Forms

IRS Form 1099-R Distributions From Pensions and Annuities

The IRS Form 1099-R is necessary for reporting distributions from pensions, annuities, and retirement plans. This file provides essential information on how to fill out the form correctly. Ensure you understand the instructions to avoid penalties when submitting to the IRS.

Tax Forms

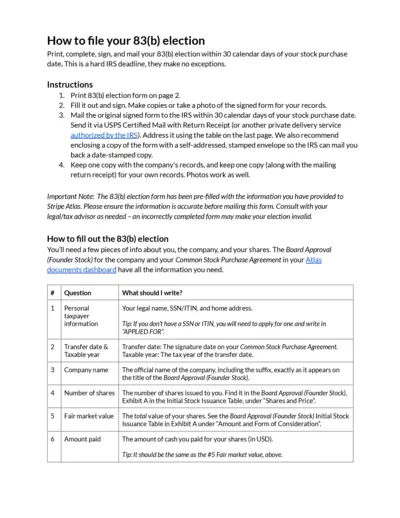

83(b) Election Filing Instructions and Details

This file provides detailed instructions for filing your 83(b) election. Follow the steps to ensure compliance with IRS regulations. Ensure your information is accurate to avoid an invalid election.

Tax Forms

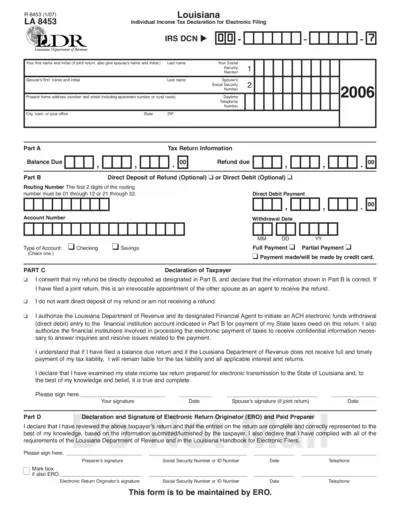

Louisiana Individual Income Tax Declaration for E-filing

The Louisiana Individual Income Tax Declaration for Electronic Filing is essential for taxpayers filing electronically. This form ensures that all necessary information is submitted correctly. Follow the instructions provided to complete your e-filing accurately.

Tax Forms

Instructions for Form 1099-CAP - IRS 2018

This file contains detailed instructions for completing Form 1099-CAP issued by the IRS. It provides information necessary for shareholders involved in changes of corporate control and capital structure. Users will find specific filing requirements, exemptions, and steps to follow for accurate submission.

Tax Forms

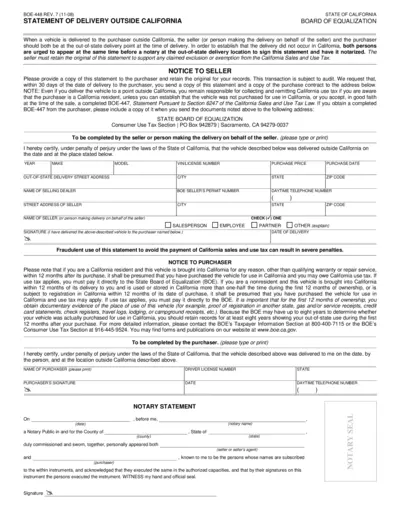

California Delivery Statement Form BOE-448

The BOE-448 form is used for documenting vehicle deliveries outside California. It provides essential guidance for sellers and purchasers regarding tax responsibilities. This form helps ensure compliance with California Sale and Use Tax laws.

Tax Forms

Health Care Information Schedule HC for 2023

The Schedule HC provides necessary health care information required for Massachusetts tax filings. It includes details about health insurance coverage and eligibility for tax penalties. Completing this schedule ensures compliance with Massachusetts health insurance mandates.

Tax Forms

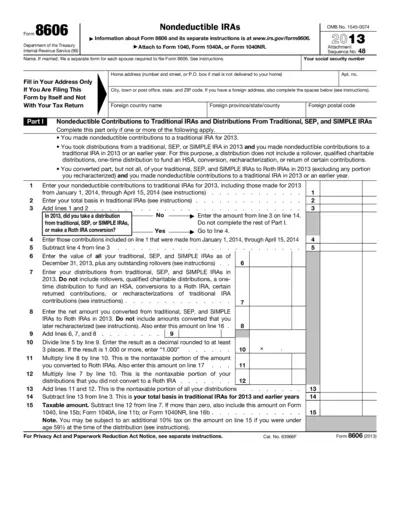

Form 8606 Nondeductible IRA Instructions and Details

Form 8606 pertains to nondeductible IRAs, providing essential instructions for accurate completion. This file serves taxpayers who need to report nondeductible contributions and distributions. Ensure compliance with IRS requirements by following the detailed guidelines within this document.

Tax Forms

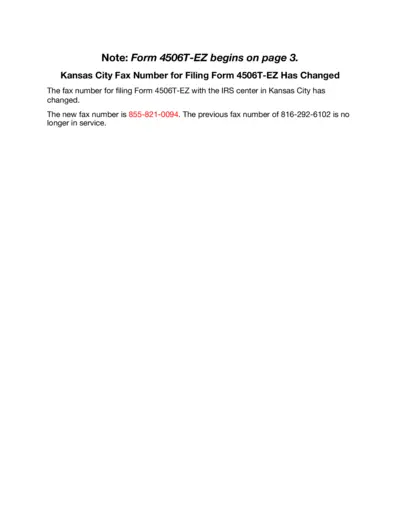

4506T-EZ Tax Return Transcript Request Form

Form 4506T-EZ allows individuals to quickly request their 1040 series tax return transcript. This form is essential for anyone needing tax documents for various purposes. Users benefit from a simplified process for obtaining important tax return information.

Tax Forms

Estimated Payment for Individual Income Tax 2014

This file contains essential details about the D-40ES form for estimated payments on individual income tax. Users will find instructions on how to complete the form accurately. It is a helpful resource for anyone required to file DC income tax returns.

Tax Forms

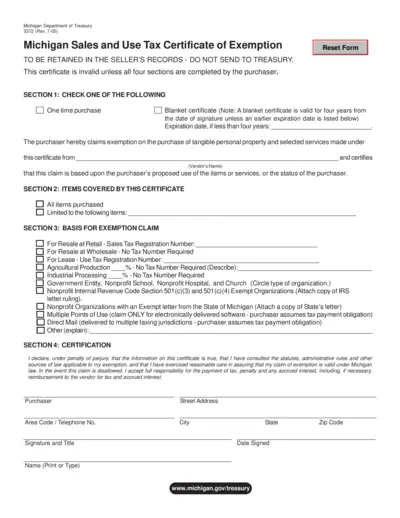

Michigan Sales and Use Tax Certificate of Exemption

This document serves as a Michigan Sales and Use Tax Certificate of Exemption. It allows purchasers to claim exemption on certain purchases. Ensure to complete all four sections for validity.