Property Taxes Documents

Property Taxes

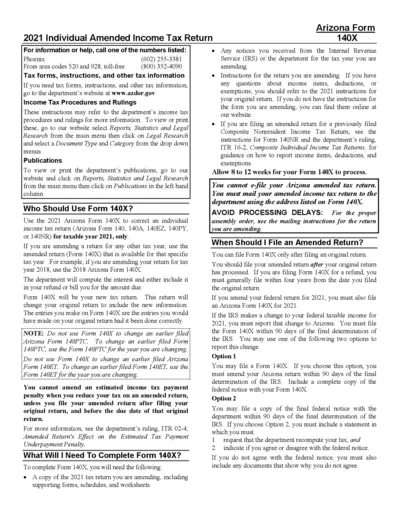

Arizona Form 140X 2021 Individual Amended Income Tax Return

The Arizona Form 140X is used for amending individual income tax returns filed in 2021. It is essential for taxpayers who need to correct previously submitted tax information. This form allows for adjustments to ensure accurate tax reporting and compliance.

Property Taxes

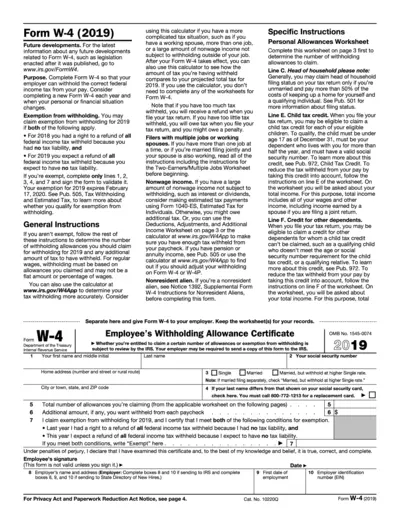

Form W-4 2019 Federal Tax Withholding Certificate

Form W-4 allows employees to specify their federal income tax withholding. It can be updated annually or when personal circumstances change. Proper completion ensures accurate tax withholdings throughout the year.

Property Taxes

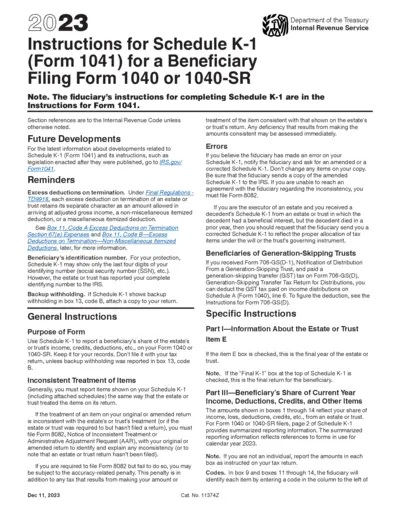

Schedule K-1 Form 1041 Instructions for Beneficiaries

This file contains essential instructions for completing Schedule K-1 related to Form 1041. Beneficiaries will find detailed information on how to report their share of income, deductions, and credits. It is a crucial document for tax reporting purposes for estates and trusts.

Property Taxes

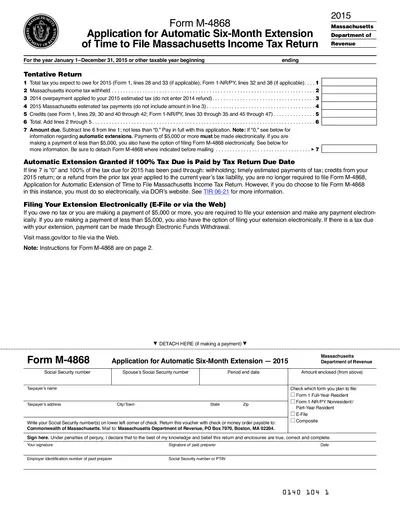

Massachusetts Form M-4868 Automatic Extension 2015

Form M-4868 allows individuals to apply for an automatic six-month extension to file their Massachusetts income tax return. It is essential for taxpayers who need more time to prepare their returns. Ensure timely filing and any necessary payments to avoid penalties.

Property Taxes

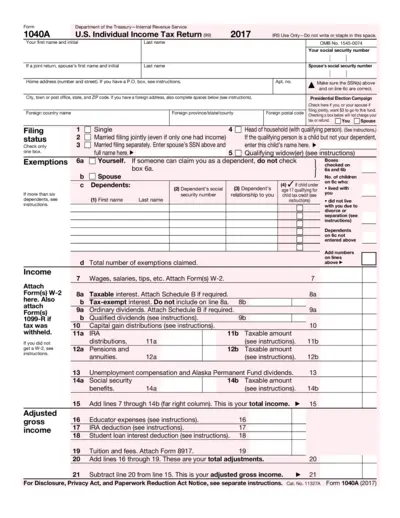

U.S. Individual Income Tax Return Form 1040A 2017

Form 1040A is for U.S. taxpayers to file their individual income tax return for the year 2017. This form is simpler than other tax forms, allowing for streamlined reporting of income and deductions. It is designed for taxpayers who meet specific income and filing requirements.

Property Taxes

Instructions for Schedule K Form 1118 Tax Year 2018

This document provides detailed instructions for filling out Schedule K (Form 1118) for tax years involving foreign tax carryover. Essential for corporations handling foreign taxes, it outlines the necessary forms and steps to complete the process accurately. It is crucial for compliance with IRS regulations regarding tax credits.

Property Taxes

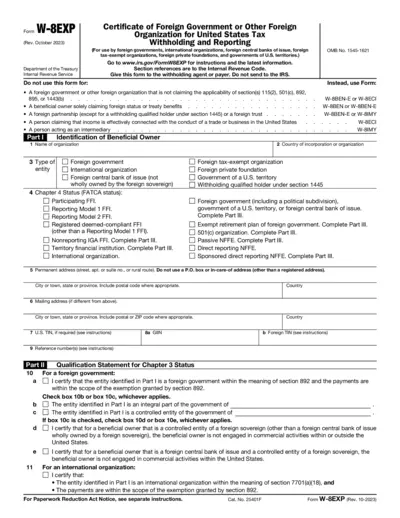

W-8EXP Foreign Government Tax Form Instructions

The W-8EXP form is a certificate for foreign government entities for tax purposes. It is used to claim exemption from U.S. tax withholding. This form must be provided to the withholding agent or payer.

Property Taxes

Instructions for IRS Form 709 Gift Tax Return 2023

This file provides essential instructions for completing IRS Form 709, the United States Gift Tax Return. It outlines who must file, the filing process, and important updates for 2023, ensuring accurate reporting of gifts. Follow these guidelines to ensure compliance with tax regulations related to gift and generation-skipping transfer taxes.

Property Taxes

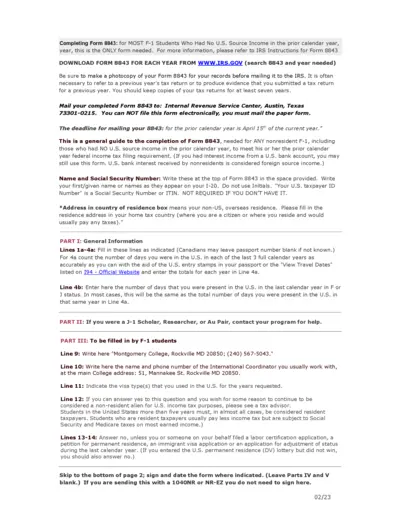

Completing Form 8843 for F-1 Students

This file provides comprehensive guidance on completing Form 8843 for F-1 students with no U.S. source income. It includes essential instructions and mailing details for submitting to the IRS. Ensure compliance with federal tax filing requirements by following the outlined steps.

Property Taxes

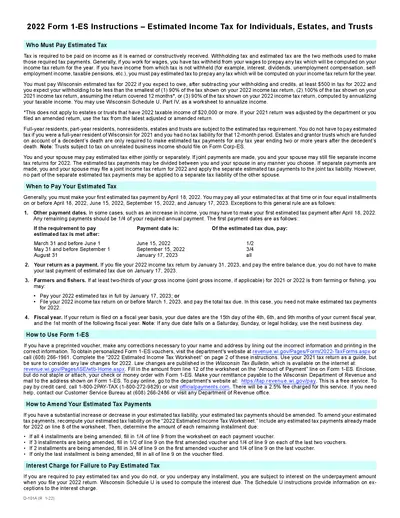

2022 Form 1-ES Instructions for Estimated Tax

This document provides critical instructions for individuals, estates, and trusts regarding the estimated income tax for 2022. It outlines who must pay estimated tax and the requirements for making payments. Understanding these guidelines is essential for compliance with Wisconsin tax regulations.

Property Taxes

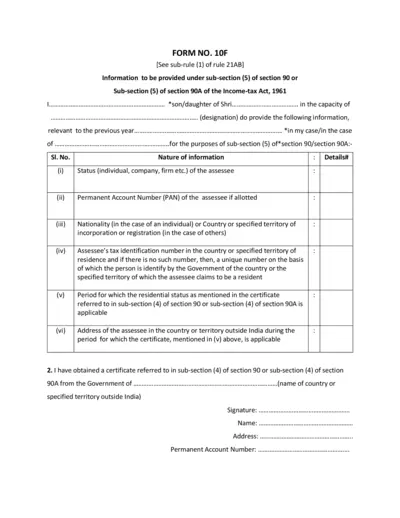

Form 10F Submission Guidelines and Information

This document provides essential information for filling out Form 10F under the Income-tax Act of India. It outlines the requirements for non-residents seeking tax benefits under applicable treaties. Follow the instructions carefully to ensure accurate submission.

Property Taxes

Instructions for Schedule B Form 941

This file provides instructions for completing Schedule B of Form 941. It outlines tax liability for semiweekly schedule depositors. Users will find essential guidance for filing their quarterly federal tax return.