Property Taxes Documents

Property Taxes

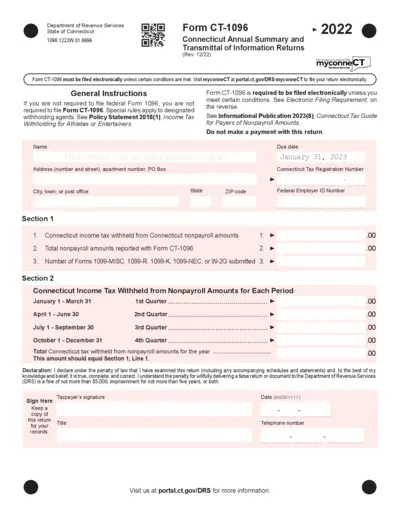

Connecticut Form CT-1096 Annual Summary Instructions

Form CT-1096 is essential for reporting nonpayroll amounts in Connecticut. It must be filed electronically via myconneCT. Ensure accurate filing to avoid penalties and ensure compliance.

Property Taxes

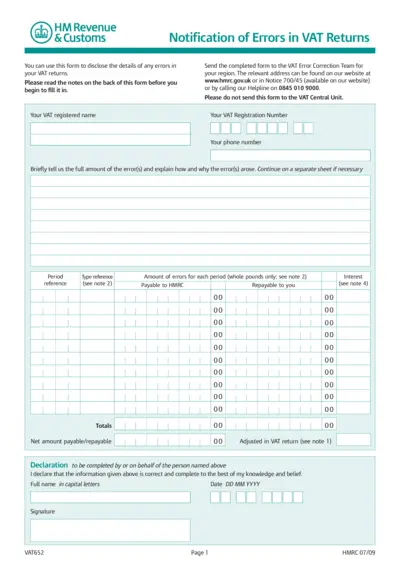

VAT Error Correction Notification Form for HMRC

This form is used to disclose errors in VAT returns. Completing this form ensures compliance with HMRC regulations. Always check the latest guidelines before submission.

Property Taxes

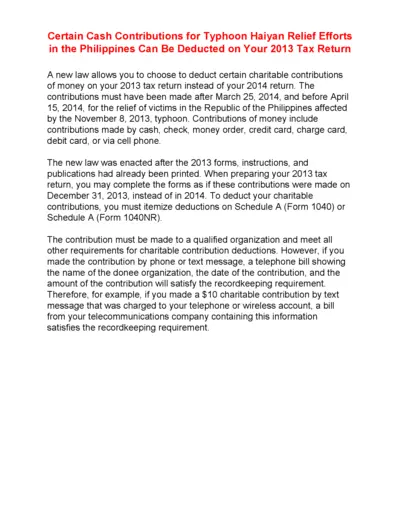

Tax Deductions for Typhoon Haiyan Contributions

This file provides instructions on deducting cash contributions made for the relief of Typhoon Haiyan victims in the Philippines for the 2013 tax return. It outlines requirements for eligibility, recordkeeping, and how to itemize deductions. Ensure to fulfill all guidelines to benefit from charitable contributions.

Property Taxes

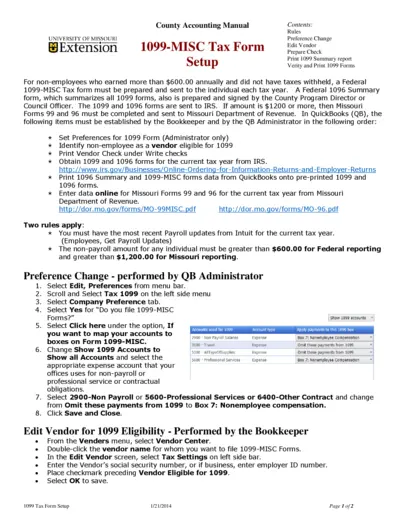

University of Missouri 1099-MISC Tax Form Instructions

This document provides comprehensive guidelines for preparing the 1099-MISC tax form for non-employees. It covers the necessary steps, requirements, and links to relevant forms needed for submission. Ensure compliance with both federal and Missouri state regulations for reporting miscellaneous income.

Property Taxes

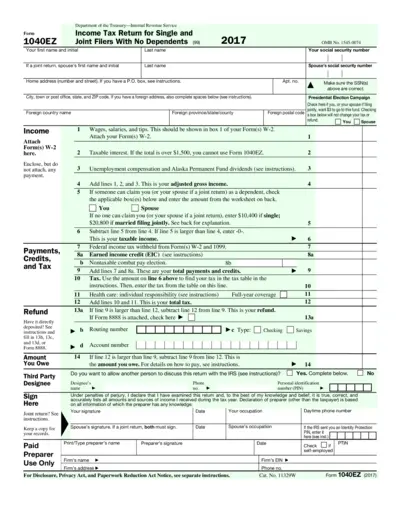

Form 1040EZ Income Tax Return for 2017

Form 1040EZ is the simplest income tax return to file for individuals and couples without dependents. It is designed for taxpayers with basic tax situations and allows for quick and easy filing. Use this form to report your income and calculate your federal tax obligation accurately.

Property Taxes

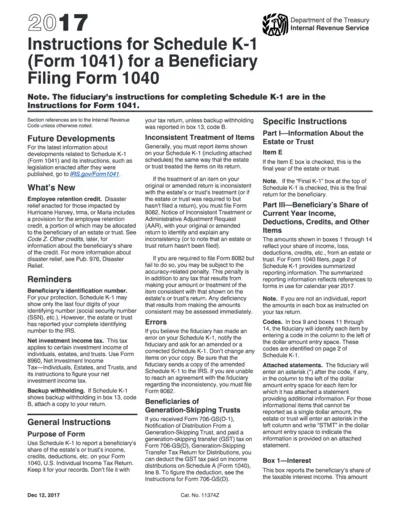

2017 Instructions for Schedule K-1 (Form 1041)

This document provides comprehensive instructions on how to fill out Schedule K-1 (Form 1041) for beneficiaries. It outlines important tax information and lists the necessary forms needed for proper filing. Ideal for estate or trust beneficiaries who need clarity on reporting income and deductions.

Property Taxes

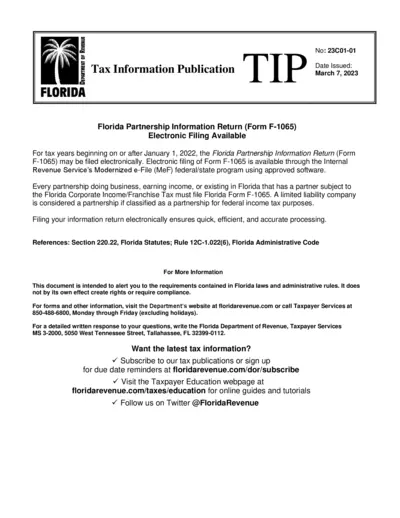

Florida Partnership Information Return Filing Guide

The Florida Partnership Information Return (Form F-1065) is essential for partnerships engaged in business or earning income in Florida. This document outlines eligibility, electronic filing options, and filing requirements to ensure compliance with Florida tax laws. Stay informed and file accurately by utilizing this guide as your key resource.

Property Taxes

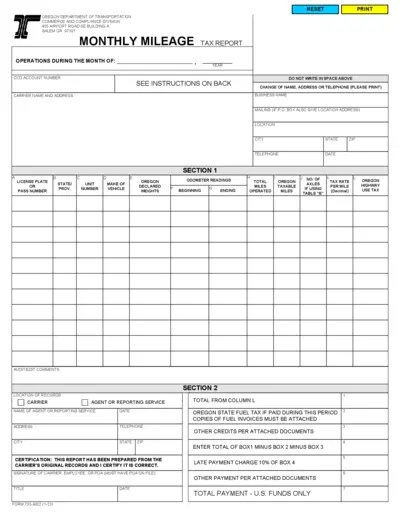

Oregon Monthly Mileage Tax Report Instructions

This file contains essential instructions for filing the Monthly Mileage Tax Report in Oregon. It details the required information, steps for completion, and payment guidelines. This resource is vital for individuals and businesses managing transportation operations in Oregon.

Property Taxes

IRS Form 1040: 1997 U.S. Individual Income Tax Return

This document is the IRS Form 1040 for the year 1997, designed for U.S. individual income tax returns. It provides detailed instructions and guidelines for taxpayers to accurately file their tax returns. Utilize this form to ensure compliance with IRS regulations and secure your tax refund efficiently.

Property Taxes

New York State IT-201-X Amended Tax Return Instructions

This file provides detailed instructions for filing Form IT-201-X, which is the amended resident income tax return for New York State. It includes important steps, requirements, and tips for successful submission. Understanding these guidelines ensures compliance and minimizes delays in processing your amended return.

Property Taxes

General Instructions for Information Returns

This document provides essential instructions for completing various IRS information returns including Forms 1097, 1098, 1099, 3921, 3922, 5498, and W-2G. It outlines who must file, how to file electronically or on paper, and the penalties for non-compliance. Detailed guidance is included to help both individuals and businesses accurately report necessary information.

Property Taxes

Illinois Department of Revenue ST-2 Instructions

The Illinois ST-2 form provides essential instructions for reporting sales and use taxes in Illinois. It details the requirements for remote retailers and multiple site sellers. This guide ensures compliance with state tax regulations for businesses operating in Illinois.