Property Taxes Documents

Property Taxes

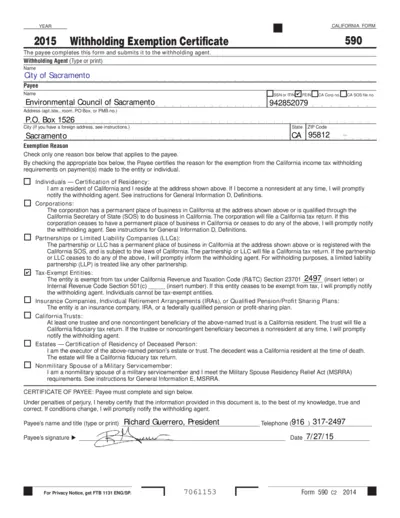

California Withholding Exemption Certificate 2015

This form is the California Withholding Exemption Certificate for the year 2015. It is completed by the payee to certify their exemption from income tax withholding. Proper deduction is essential for accurate taxation and compliance.

Property Taxes

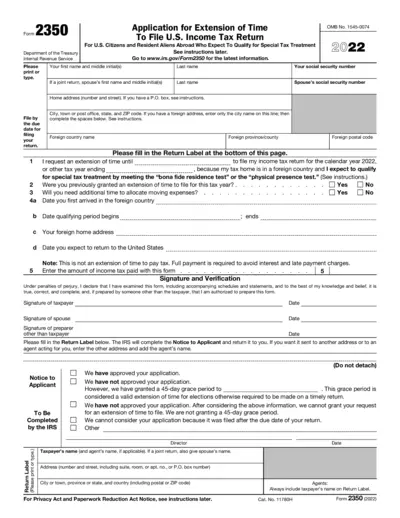

Form 2350 Application for Extension of Time to File Taxes

Form 2350 allows U.S. citizens and resident aliens abroad to request an extension for filing their income tax return. It is essential for those seeking special tax treatment under the foreign earned income exclusion. Properly completing and submitting this form helps avoid penalties and ensures compliance.

Property Taxes

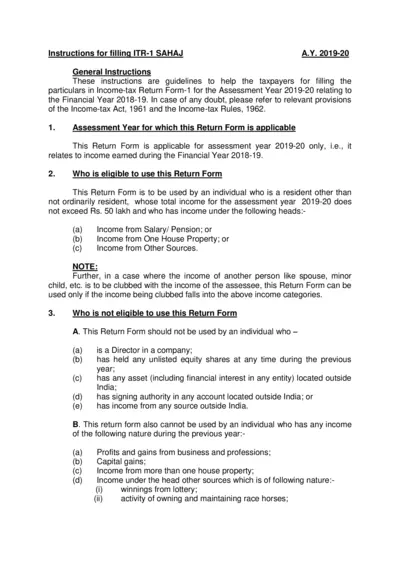

Filling Instructions for ITR-1 SAHAJ AY 2019-20

This document provides essential guidelines for filling out Income Tax Return Form ITR-1 SAHAJ for the Assessment Year 2019-20. It details the eligibility criteria, necessary steps, and common mistakes to avoid during the filing process. Whether you're a first-time filer or need a refresher, this guide is designed to assist taxpayers effectively.

Property Taxes

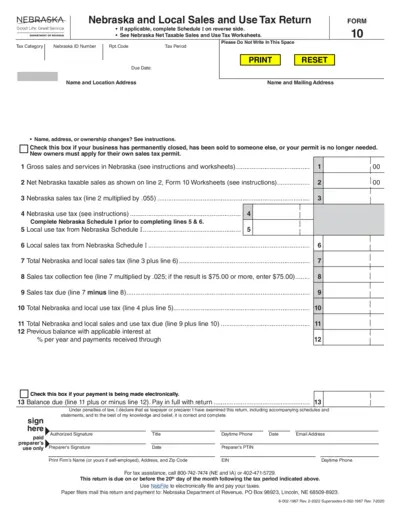

Nebraska Sales and Use Tax Return Instructions

This file provides comprehensive details on completing the Nebraska Sales and Use Tax Return. It includes instructions for filling out various sections, understanding tax obligations, and compliance requirements. Businesses must utilize this template to ensure accurate tax filing in Nebraska.

Property Taxes

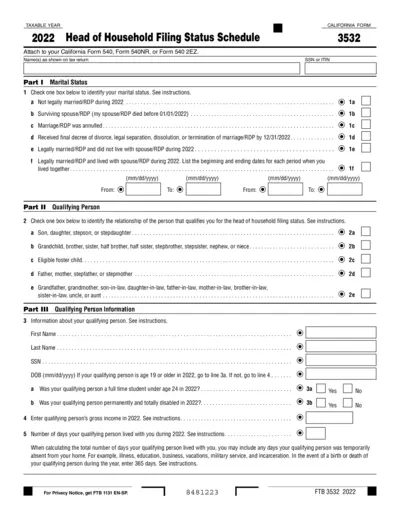

CALIFORNIA FORM 3532 2022 Head of Household Details

This file provides tax details for California's Head of Household tax filing status. It includes instructions for filing, eligibility criteria, and required information. Use this form to ensure accurate submission of your tax information for the year 2022.

Property Taxes

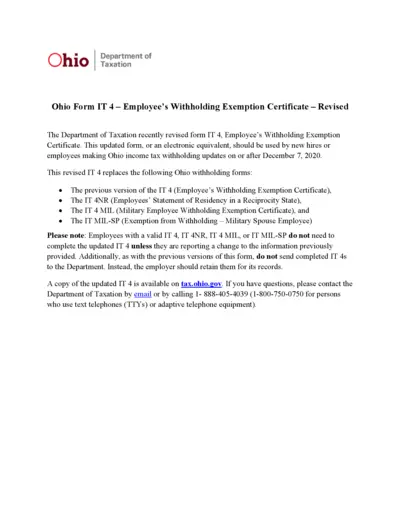

Ohio Form IT 4 Employee Withholding Exemption Certificate

Ohio Form IT 4 is used for employee's withholding exemption. It should be filled out by new hires or those updating their withholding. This updated form ensures compliance with Ohio tax regulations.

Property Taxes

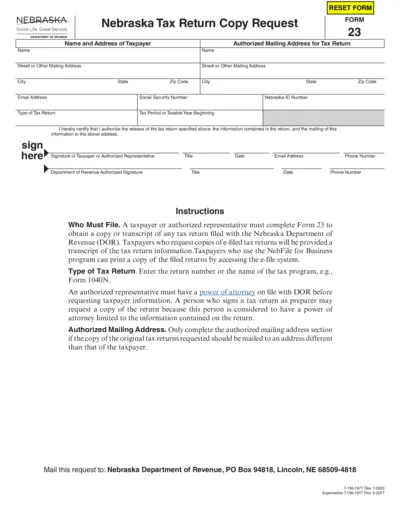

Nebraska Tax Return Copy Request Form

This form is used to request a copy of your Nebraska tax return from the Department of Revenue. It is essential for taxpayers needing duplicates for records or personal use. Ensure all fields are completed accurately to facilitate processing.

Property Taxes

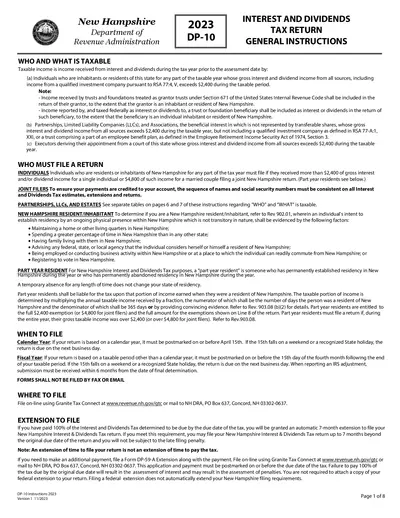

New Hampshire Interest and Dividends Tax Return Instructions

This document provides general instructions for filing the New Hampshire Interest and Dividends Tax Return. It outlines who must file and explains the taxable income criteria. It also details how to complete and submit the DP-10 form.

Property Taxes

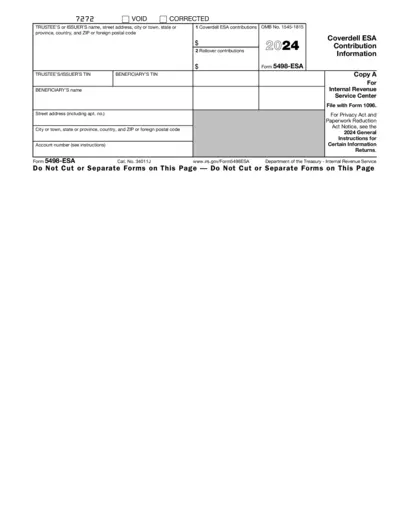

IRS Form 5498-ESA Instructions and Details

This document provides essential instructions and details regarding IRS Form 5498-ESA. It outlines contributions and rollovers for Coverdell Education Savings Accounts. Understanding this form is crucial for accurate tax reporting.

Property Taxes

Instructions for Form IT-2105 Estimated Tax Voucher

This document provides instructions for individuals to fill out Form IT-2105 for estimated tax payments in New York State. It includes essential guidelines, who needs to file, payment details, and important dates. Follow the steps outlined within to ensure accurate submission of your tax voucher.

Property Taxes

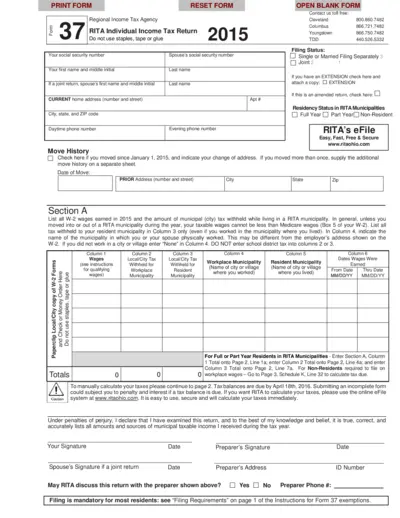

RITA Individual Income Tax Return Form 37 Instructions

The RITA Form 37 is essential for individuals filing their municipal income taxes in Ohio for the year 2015. This form collects income details, tax withheld, and residency status for accurate tax reporting. Use this form to ensure compliance with RITA requirements and avoid penalties.

Property Taxes

IRS Premium Tax Credit Form 8962 Instructions

Form 8962 is essential for claiming the Premium Tax Credit. It helps taxpayers reconcile advance payments of the premium tax credit with actual tax credit amounts. Complete this form when filing your federal income tax return to ensure correct tax credits.