Property Taxes Documents

Property Taxes

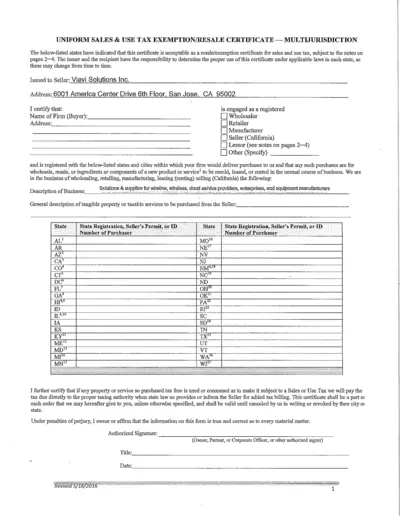

Sales and Use Tax Exemption Resale Certificate

This document serves as a sales and use tax exemption certificate accepted across multiple jurisdictions. It certifies that the purchaser is registered to buy goods for resale without paying sales tax. Essential for businesses engaged in wholesale, retail, and manufacturing.

Property Taxes

Missouri Employer Reporting of W-2s Instructions

This handbook provides detailed instructions for filing electronic W-2 forms with the Missouri Department of Revenue. It is essential for employers to understand the filing specifications and submission requirements. The guidelines ensure compliance with state regulations.

Property Taxes

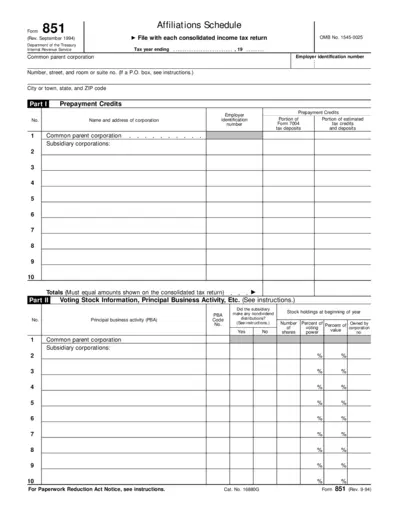

Form 851 Instructions for Affiliations Schedule

Form 851 is used by corporations to declare affiliations in consolidated income tax returns. It provides necessary details about the common parent corporation and subsidiary corporations. Properly completing this form is crucial for accurate tax reporting.

Property Taxes

IRS Form 8814 Instructions for Parents Filing

IRS Form 8814 allows parents to report their child's interest and dividends on their tax return. This form is essential for parents who want to utilize the tax benefits for income earned by their children. Be sure to follow the specific instructions for accurate filing.

Property Taxes

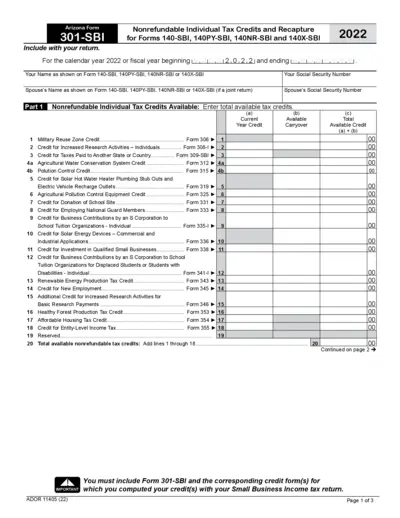

Arizona Form 301-SBI Nonrefundable Tax Credits 2022

The Arizona Form 301-SBI is used for reporting nonrefundable individual tax credits in Arizona for the year 2022. This form must be included with your tax return. Ensure all required information is filled accurately to avoid delays.

Property Taxes

IRS Instructions for Noncash Charitable Contributions

This file contains essential instructions for Form 8283 used when reporting noncash charitable contributions. It outlines how to properly fill out the form and who needs to use it. Refer to this document for detailed guidelines and compliance requirements.

Property Taxes

Senior Citizen Property Tax Exemption Information

This file provides information on the Senior Citizen Property Tax Exemption. It outlines eligibility criteria, how to apply, and useful contacts. It is essential for qualifying senior citizens in Jefferson County.

Property Taxes

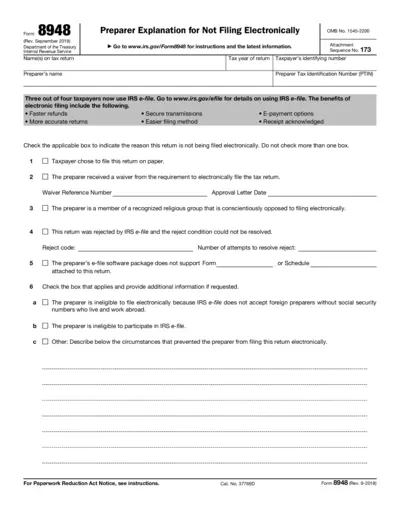

Form 8948 Instructions for Non-Electronic Filing

Form 8948 is essential for tax return preparers filing returns on paper instead of electronically. It includes guidelines, exemptions, and important details for filing. Ensure compliance by filling out this form accurately for required returns.

Property Taxes

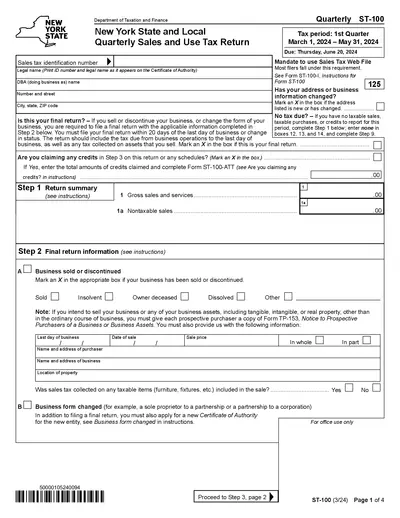

Quarterly Sales and Use Tax Return Instructions

This file provides the necessary guidelines for completing the New York State Quarterly Sales and Use Tax Return. It includes essential details that businesses need to file their tax returns accurately. Users can easily refer to the instructions to ensure compliance with tax regulations.

Property Taxes

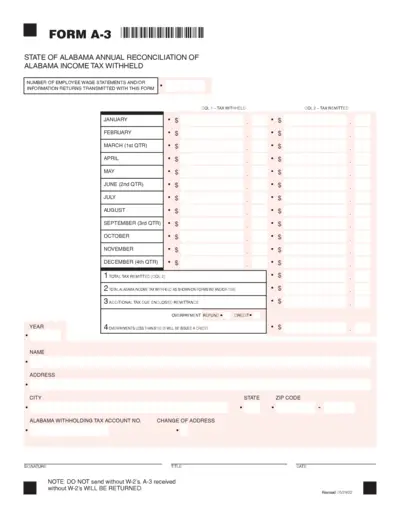

Alabama Form A-3 Annual Income Tax Reconciliation

The Alabama Form A-3 is essential for employers to reconcile annual income tax withholding for their employees. This form requires specific amounts of tax withheld and remitted throughout the year. Accurate completion ensures compliance with Alabama state tax regulations.

Property Taxes

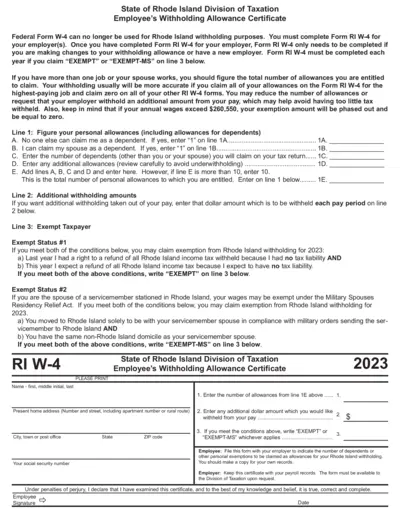

Rhode Island Employee Withholding Certificate RI W-4

The Rhode Island Employee's Withholding Allowance Certificate is essential for employees to determine their withholding tax allowances. This form must be completed accurately to avoid underwithholding or overwithholding. Use this guide to understand how to fill it out effectively.

Property Taxes

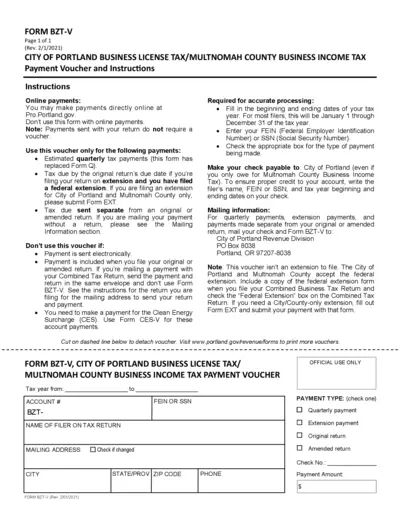

City of Portland Business License Tax Payment Voucher

This file provides a payment voucher for the City of Portland Business License Tax and Multnomah County Business Income Tax. It includes instructions for completing the form, as well as important mailing information. Ideal for business owners needing to make tax payments.