Property Taxes Documents

Property Taxes

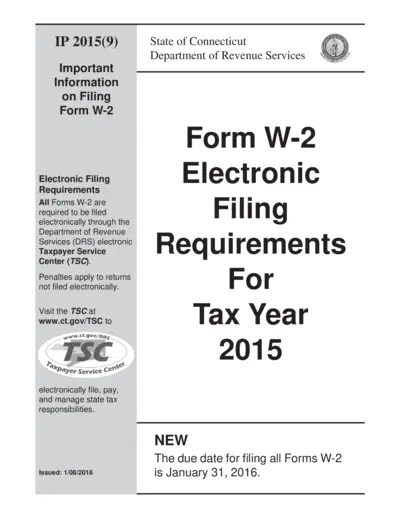

Connecticut Filing Form W-2 Electronic Requirements

This document provides essential information for electronically filing Form W-2 with the Connecticut Department of Revenue Services. It includes deadlines, penalties, and detailed instructions for employers. Understanding these requirements is crucial for compliance and timely submission.

Property Taxes

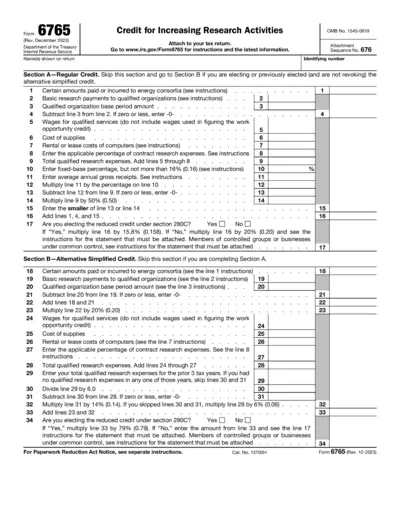

Form 6765 Credit for Increasing Research Activities

Form 6765 is used to claim a tax credit for increasing research activities. It helps businesses to leverage tax incentives associated with their research investments. Users must attach this form to their tax return for proper processing.

Property Taxes

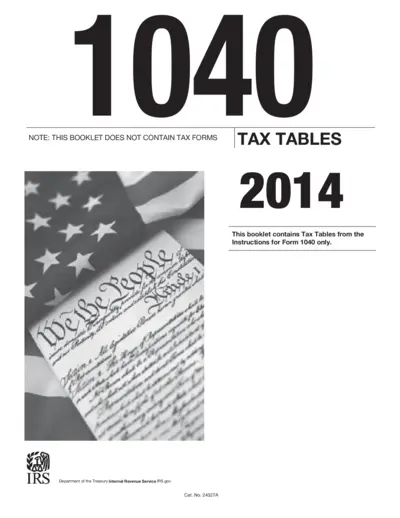

Form 1040 Instructions and Tax Table Overview

This file contains the 2014 instructions for Form 1040 along with relevant tax tables. It provides guidance on tax calculations and filing status requirements. Perfect for taxpayers looking to accurately complete their tax returns.

Property Taxes

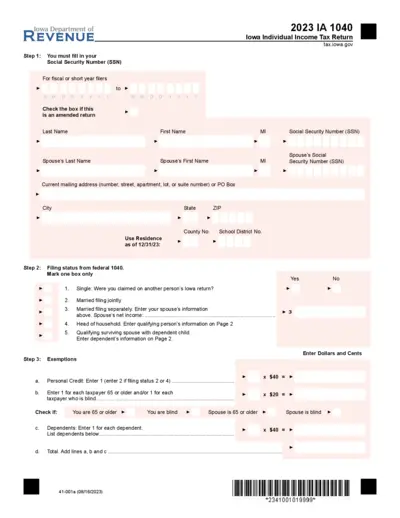

Iowa Individual Income Tax Return Form 2023

The Iowa Individual Income Tax Return, Form 2023, is essential for residents filing their state tax returns. This document helps individuals report their income and calculate tax liabilities accurately. It provides guidance on exemptions, credits, and filing status.

Property Taxes

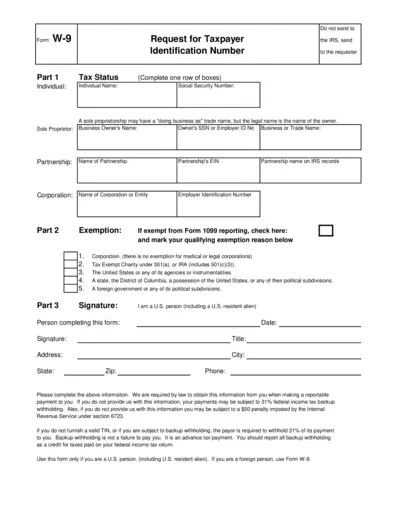

W-9 Form Instructions and Completion Guide

The W-9 form is essential for U.S. taxpayers to provide their Taxpayer Identification Number to the requester. This file contains detailed instructions for individuals and businesses on how to fill out the form accurately. Ensure compliance with IRS regulations by following the guidelines provided.

Property Taxes

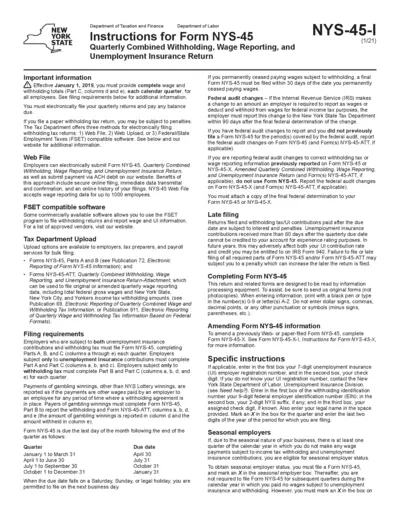

Instructions for Form NYS-45: Tax Reporting

Form NYS-45 provides essential instructions for employers in New York State regarding their quarterly combined withholding and unemployment insurance returns. This file outlines filing requirements, methods for electronic submission, and payment responsibilities. Understanding how to correctly fill and submit this form is vital for compliance and avoiding penalties.

Property Taxes

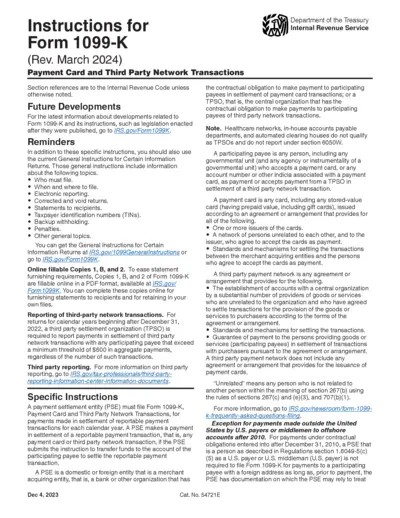

Instructions for Form 1099-K Payment Card Transactions

This document provides essential instructions for filing Form 1099-K. It details the requirements for reporting payment card and third-party network transactions. Understanding this form is crucial for compliance with IRS regulations.

Property Taxes

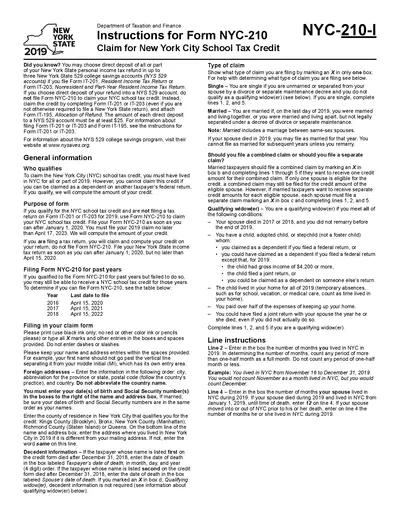

Instructions for NYC-210 NYC School Tax Credit

This file provides detailed instructions for Form NYC-210, which is used to claim the New York City School Tax Credit. It outlines the eligibility criteria, filing processes, and information necessary for users to complete the form accurately. Designed for residents of New York City, it offers essential guidance for maximizing tax benefits.

Property Taxes

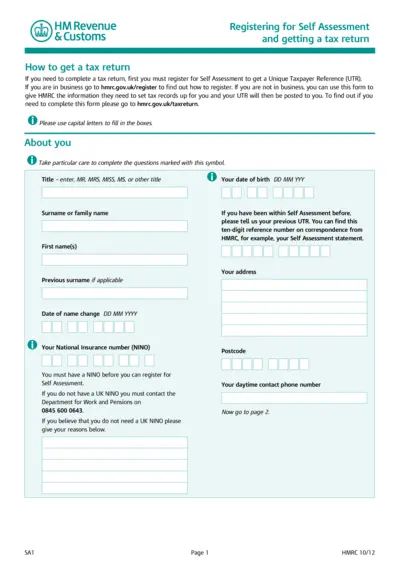

Registering for Self Assessment Tax Return

This file provides instructions on how to register for Self Assessment in the UK. It includes a unique taxpayer reference (UTR) application form. Follow the guidelines to ensure accurate completion of your tax return.

Property Taxes

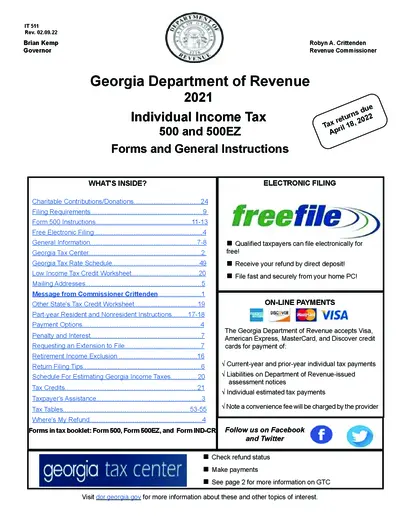

Georgia Individual Income Tax Forms and Instructions

This file provides essential guidelines for Georgia individual income tax filing, including forms and timelines. Users can find detailed instructions for Forms 500 and 500EZ, important dates, and online services. Refer to this document for a step-by-step approach to file your tax returns efficiently.

Property Taxes

Instructions for Form 1139 Corporation Application

This document provides guidelines for corporations applying for a tentative refund of taxes using Form 1139. It details eligibility, necessary attachments, and filing procedures to ensure a smooth application process. Ideal for tax professionals and corporations seeking to understand NOL carrybacks, capital losses, and business credits.

Property Taxes

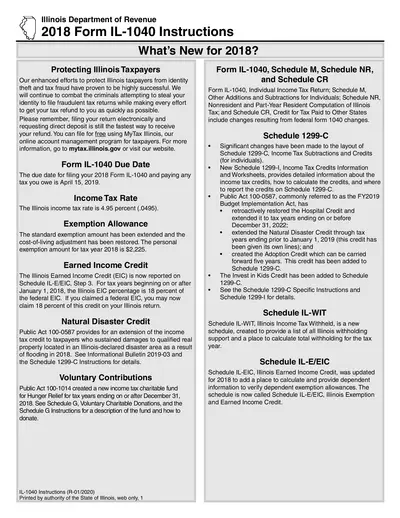

Illinois 2018 Form IL-1040 Instructions Overview

Discover the Illinois Department of Revenue's instructions for the 2018 Form IL-1040. This document provides guidance on filing taxes, understanding rates, and crucial deadlines. Ensure accurate tax submission and optimize your tax refund process.