Property Taxes Documents

Property Taxes

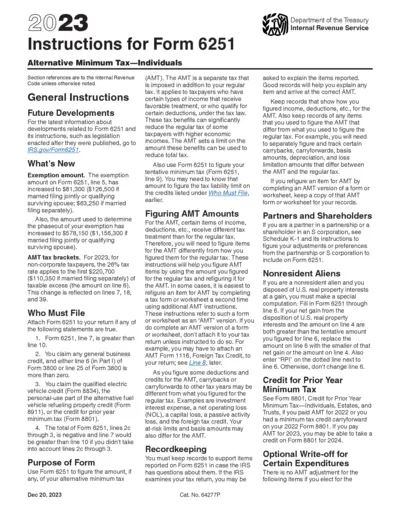

Instructions for Form 6251 Alternative Minimum Tax

This file contains detailed instructions for individuals filling out Form 6251 for the Alternative Minimum Tax (AMT). It provides essential information on who needs to file and how to compute the AMT. Stay updated with the latest tax guidelines and exemption amounts.

Property Taxes

IRS Tax Filing Guide for Small Organizations

This file provides essential tax filing tips and information for small tax-exempt organizations. It includes details on new forms, filing requirements, and important dates. Ideal for employers and tax preparers.

Property Taxes

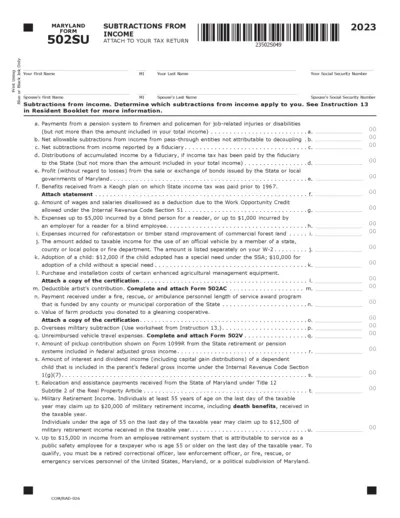

Maryland Form 502SU Subtractions from Income 2023

The Maryland Form 502SU allows taxpayers to report subtractions from their income. This form is essential for claiming eligible deductions on state tax returns. Ensure you understand all the subtractions applicable to your situation before filing.

Property Taxes

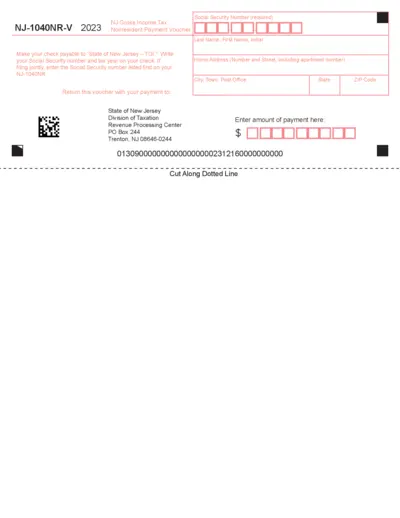

NJ 1040NR-V 2023 Nonresident Payment Voucher

This document is the NJ 1040NR-V 2023 Nonresident Payment Voucher. It provides instructions for nonresidents to pay NJ Gross Income Tax. Use this voucher to submit your payment by check to the State of New Jersey.

Property Taxes

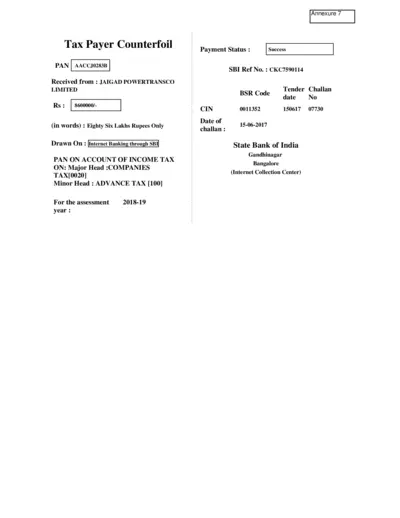

Income Tax Payment Counterfoil Information

This document provides details of income tax payments made by Jaigad Powertransco Limited. It includes table entries for amounts, dates, and payment methods. Use this file for reference in tax-related matters.

Property Taxes

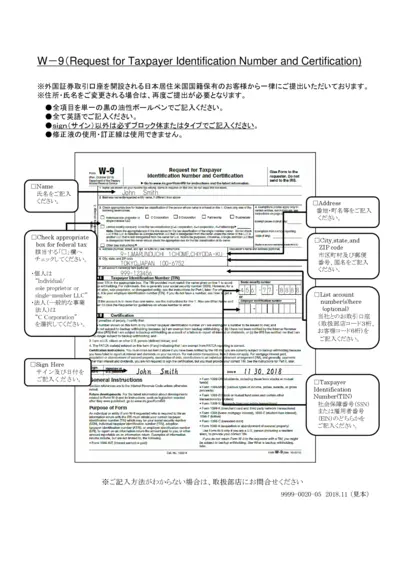

W-9 Taxpayer Identification Number and Certification

The W-9 form is used by U.S. taxpayers to provide their taxpayer identification number to individuals or entities that will report income paid to them. This form is essential for freelancers, contractors, and other self-employed individuals to ensure accurate tax reporting. Completing the W-9 form correctly helps avoid tax withholding and ensures timely processing of your payments.

Property Taxes

IRS Collection Appeal Rights Overview and Guidance

This document outlines the collection appeal rights for taxpayers dealing with the IRS. It provides detailed procedures for initiating appeals, including forms required for hearings. Taxpayers can gain insight into their rights and how to effectively communicate with IRS offices.

Property Taxes

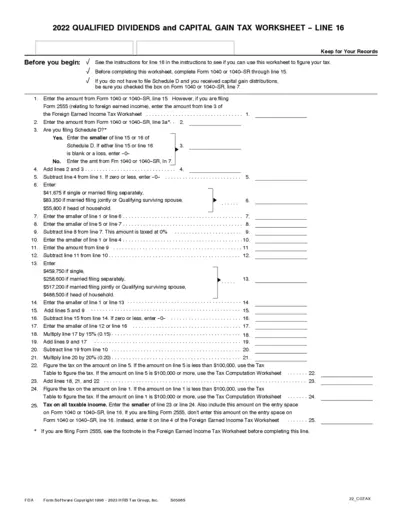

2022 Qualified Dividends and Capital Gain Tax Worksheet

This worksheet helps you determine the tax on your qualified dividends and capital gains. Complete Form 1040 or 1040-SR before using this worksheet. For accurate tax calculation, follow the outlined instructions carefully.

Property Taxes

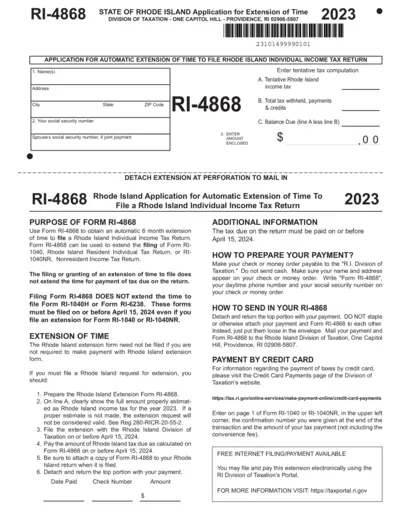

Rhode Island Application for Tax Extension 2023

This file contains the Rhode Island Application for Extension of Time to File the Individual Income Tax Return for 2023. It provides detailed instructions for taxpayers seeking an automatic extension. Utilize this form to ensure compliance with state tax regulations.

Property Taxes

Individual Noncash Contributions Form 8283 Overview

This document provides detailed insights on Form 8283 for noncash charitable contributions for 2004. It includes statistics on donations, categories, and the demographics of taxpayers. Ideal for individuals seeking to understand noncash contributions and filing requirements.

Property Taxes

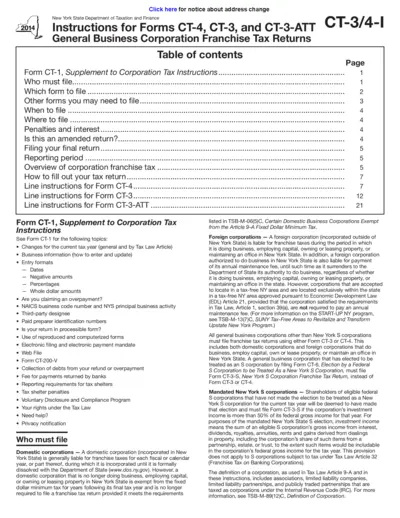

Instructions for New York State Tax Forms CT-4 and CT-3

This file provides necessary instructions and forms for filing New York State franchise tax returns. It covers details on who must file, what forms to use, and line-by-line filing instructions. Business owners and corporations will benefit from following these guidelines to ensure compliance.

Property Taxes

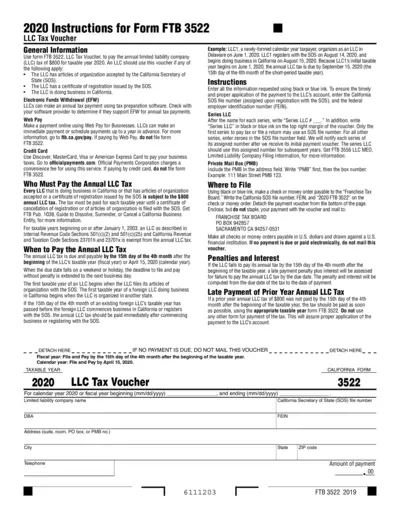

LLC Tax Voucher 2020 Annual Payment Instructions

This document provides comprehensive instructions for submitting the LLC Tax Voucher (FTB 3522) for the year 2020. It outlines payment methods, filing requirements, and pertinent deadlines. Business owners or designated representatives will find crucial information to facilitate compliance with California tax obligations.