Property Taxes Documents

Property Taxes

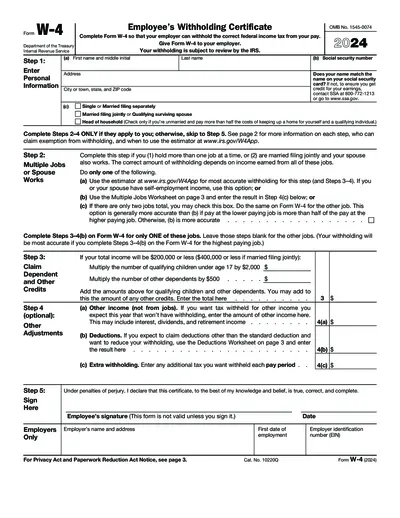

Employee's Withholding Certificate - Form W-4 (2024)

The W-4 form is essential for employees to determine federal income tax withholding from their pay. It helps ensure the right amount is deducted to avoid penalties or large refunds. Complete the form accurately to reflect your tax situation.

Property Taxes

IRS Non-Filing Verification Tax Form

This file is a verification of non-filing for Form 1040. It contains information regarding the taxpayer's status and instructions from the IRS. Essential for taxpayers needing proof of non-filing, especially for specific tax periods.

Property Taxes

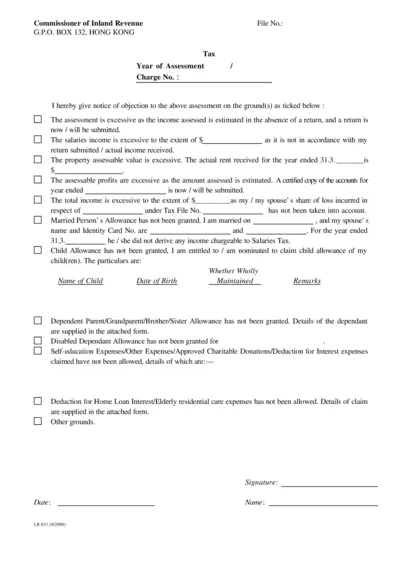

Tax Assessment Objection Form Instructions

This file provides a formal objection notice to a tax assessment issued by the Commissioner of Inland Revenue. It outlines grounds for objection, such as excessive income or missed allowances. Use this form to ensure your concerns are properly addressed.

Property Taxes

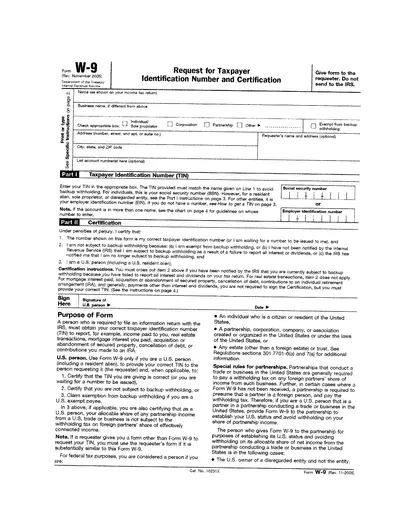

W-9 Taxpayer Identification Number and Certification

The W-9 form is used to provide your Taxpayer Identification Number (TIN) to the requester. It is essential for reporting income and other tax-related information. Completing this form accurately ensures compliance with IRS regulations.

Property Taxes

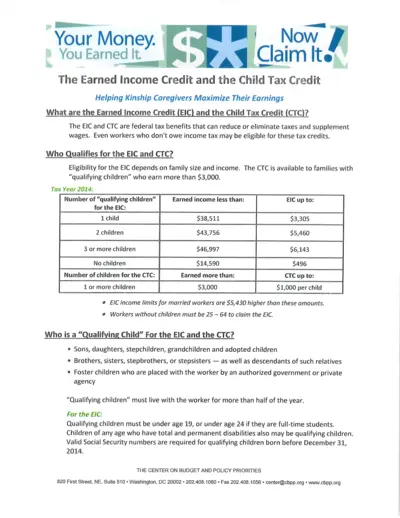

Claim Your Earned Income Credit and Child Tax Credit

This file provides essential information on the Earned Income Credit (EIC) and Child Tax Credit (CTC). Learn how to maximize your tax benefits and ensure you're eligible. Understand the steps to claim these credits effectively.

Property Taxes

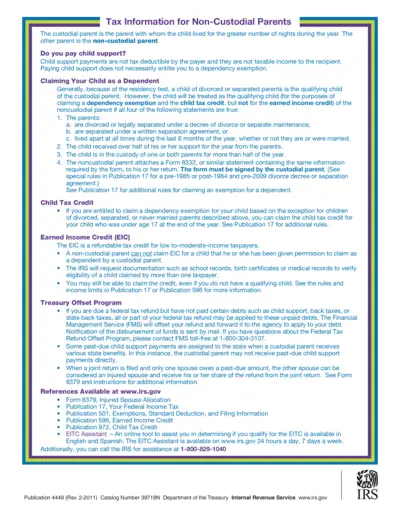

Tax Information for Non-Custodial Parents

This file provides essential tax information for non-custodial parents regarding child support, dependency exemptions, and available tax credits. It outlines the necessary steps to claim a child as a dependent and discusses critical tax-related rules for divorced or separated parents. Understanding these guidelines will ensure accurate filing and eligibility for tax benefits.

Property Taxes

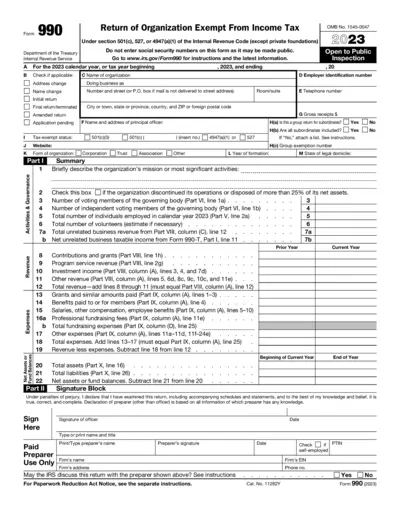

IRS Form 990 Return of Organization Exempt from Tax

This document serves as the tax return for organizations exempt from income tax under IRS regulations. It provides detailed information about the organization's financial activities, governance, and compliance with tax requirements. Organizations must accurately complete and submit this form annually.

Property Taxes

Filing Guidelines for IRS Form 8806 Submission

This document outlines the necessary instructions for submitting IRS Form 8806, Information Return for Acquisition of Control or Substantial Change in Capital Structure. It details the requirements and processes for corporations involved in significant ownership changes. Ensure compliance to avoid penalties by submitting via fax.

Property Taxes

Kentucky Individual Income Tax Forms 2023

This file provides essential instructions and information for filing your individual income tax in Kentucky for the year 2023. It includes various filing options, taxpayer assistance details, and guidelines for various tax credits. Perfect for individuals and families preparing their tax returns.

Property Taxes

Rental Property Tax Guidance for DC Residents

This file serves as a comprehensive guide for District of Columbia residents who own rental properties, outlining key tax obligations and filing requirements. It answers frequently asked questions about rental income reporting, necessary forms, and compliance. This document is essential for ensuring accurate tax reporting and avoiding penalties.

Property Taxes

Prepared 2022 Form 765 Virginia Nonresident Tax Return

This document provides detailed instructions on preparing and submitting the 2022 Form 765 for Virginia Nonresident Individual Income Tax Returns. It covers important updates, guidelines, and resources for taxpayers who need to file a composite return. Essential for any Virginia taxpayer seeking to understand their obligations and options.

Property Taxes

Innovative Motor Vehicle and Truck Credit Application

This file contains instructions for the Innovative Motor Vehicle and Truck Credit for tax year 2023. It outlines the eligibility requirements, how to calculate credits, and submission instructions.