Property Taxes Documents

Property Taxes

2016 Instructions for Form 990-EZ IRS Guide

This file provides detailed instructions for completing Form 990-EZ, which is required for tax-exempt organizations. It includes guidance on filing procedures, necessary information, and compliance requirements. Organizations must understand how to properly fill out this form to ensure accurate reporting to the IRS.

Property Taxes

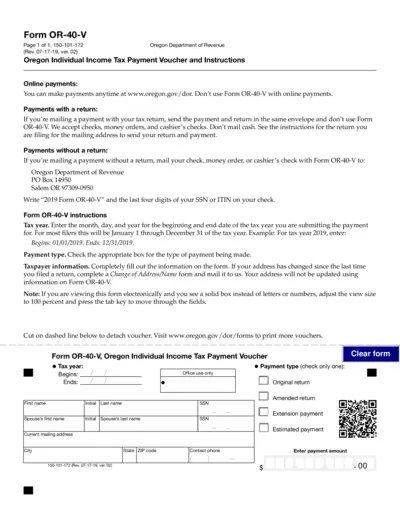

Oregon Individual Income Tax Payment Voucher Instructions

The Oregon Individual Income Tax Payment Voucher is a form required for submitting individual income tax payments in Oregon. It includes detailed instructions for filling out the form, submitting payments, and necessary tax year information. Use this form to ensure your tax payments are processed correctly.

Property Taxes

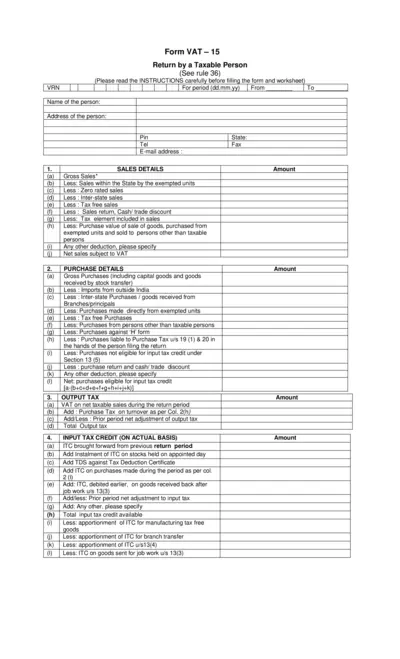

VAT 15 - Taxable Person Return Form

The VAT 15 form is essential for taxable persons to report their sales and purchases. This form includes detailed instructions for accurate completion. Ensure all sections are filled out correctly to avoid penalties.

Property Taxes

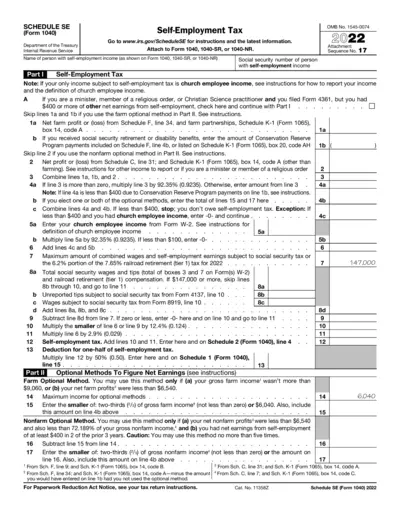

Self-Employment Tax Form 1040 Schedule SE Instructions

This file contains essential instructions for completing the Self-Employment Tax. It guides users through the necessary steps to accurately report self-employment income. A must-have for anyone filing taxes with self-employment income.

Property Taxes

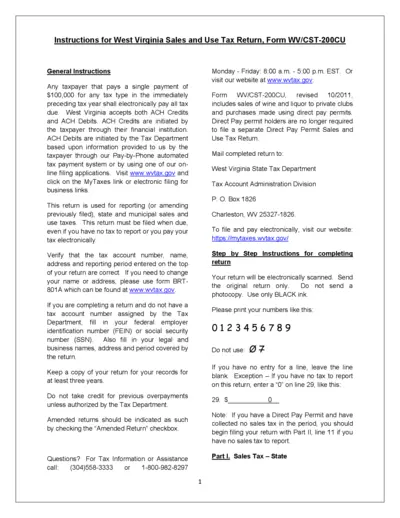

West Virginia Sales and Use Tax Return Instructions

This file contains detailed instructions for the West Virginia Sales and Use Tax Return, Form WV/CST-200CU. It includes guidelines for submission, exemptions, and payment methods applicable to sales and use taxes in West Virginia. Designed for both taxpayers and businesses, this document simplifies the reporting process.

Property Taxes

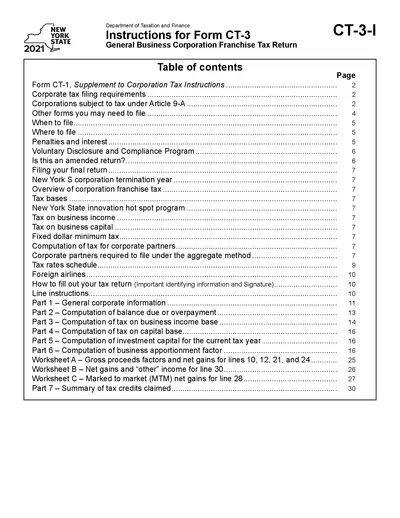

New York State Corporation Franchise Tax Instructions

This file provides detailed instructions on completing the New York State Corporation Franchise Tax Return. It includes essential forms, deadlines, and filing requirements. Perfect for businesses looking to ensure compliance with state tax regulations.

Property Taxes

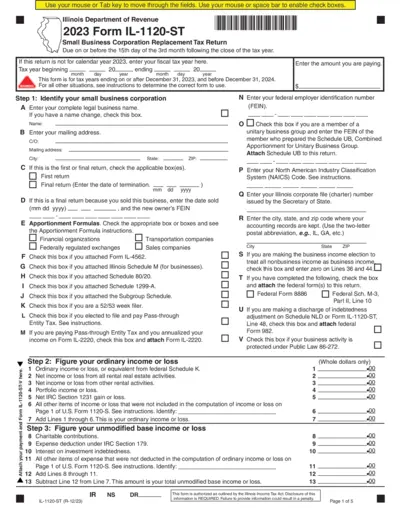

Illinois Form IL-1120-ST Small Business Tax Return

The Illinois Form IL-1120-ST is a tax return for small business corporations. It must be submitted by the 15th day of the third month following the tax year end. This form is essential for businesses operating in Illinois to report their taxes accurately.

Property Taxes

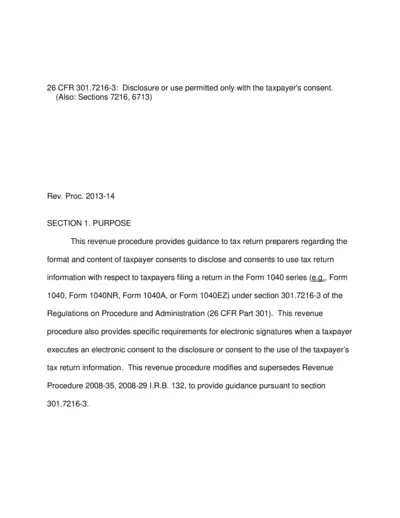

Guidance on Taxpayer Consent for Information Disclosure

This revenue procedure offers essential guidance for tax return preparers on taxpayer consent for disclosing or using tax return information. It outlines specific requirements for consents related to Tax Form 1040 and provides clarity on electronic signatures. Understanding these consents is crucial for compliance with regulations under section 301.7216-3.

Property Taxes

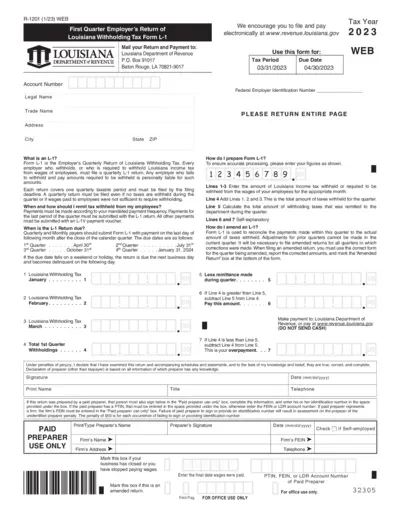

Louisiana Withholding Tax Employer's Return Form L-1

Form L-1 is the Employer's Quarterly Return of Louisiana Withholding Tax. It is mandatory for all employers who withhold Louisiana income tax to file this form quarterly. This document provides important information necessary for proper tax reporting.

Property Taxes

Schedule O Form 1120 Instructions for Controlled Groups

This document provides essential instructions for completing Schedule O for Form 1120, required for corporations within controlled groups. It outlines consent plans, apportionment schedules, and compliance requirements. Ensure accurate submission by following detailed guidance provided in this file.

Property Taxes

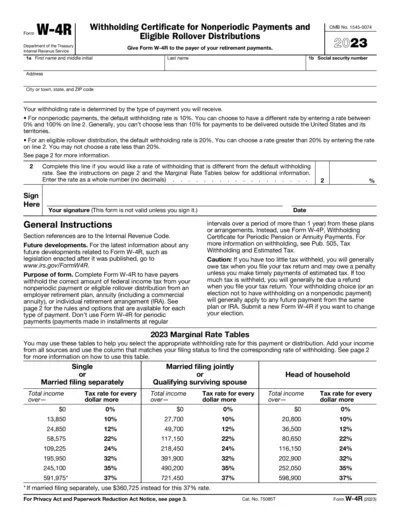

Withholding Certificate for Nonperiodic Payments

This form allows individuals to request federal income tax withholding for nonperiodic payments and eligible rollover distributions. By completing Form W-4R, users can ensure the correct amount of tax is withheld based on their specific financial situation. It is essential for those receiving retirement payments to properly fill out this form to avoid over or under withholding.

Property Taxes

Where to Get IRS Forms and Publications

This file provides detailed information on how to obtain IRS forms and publications for tax preparation. It includes various methods such as online, mail, and local IRS offices. Essential for individuals preparing taxes efficiently.