Property Taxes Documents

Property Taxes

Instrucciones FTB 3519 SP Pago Extensión Individuals

This file contains essential instructions for individuals filing their taxes using the FTB 3519 SP form. It provides detailed guidelines sobre cómo realizar pagos electrónicos y el proceso de presentación de la declaración de impuestos. Follow these instructions to ensure compliance with California tax regulations.

Property Taxes

IRS e-Signature Requirements for Electronic Filing

This file outlines the IRS requirements for electronic signatures when filing tax returns electronically. It provides detailed instructions on how to generate e-signature PINs and the process involved. Essential for taxpayers seeking to comply with e-filing regulations.

Property Taxes

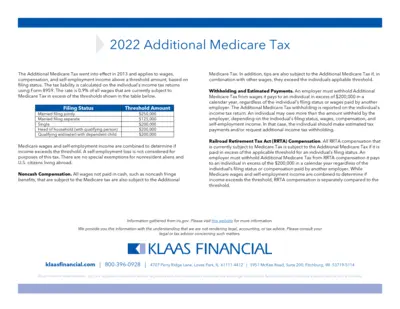

2022 Additional Medicare Tax Guidelines and Details

This file provides comprehensive information on the Additional Medicare Tax.

Property Taxes

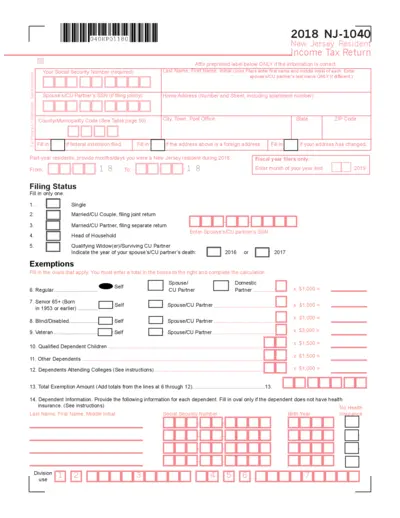

New Jersey 2018 Income Tax Return Form NJ-1040

This is the New Jersey 2018 Income Tax Return Form NJ-1040. It is required for New Jersey residents to file their state income tax. Ensure to provide accurate information to avoid any issues with your tax return.

Property Taxes

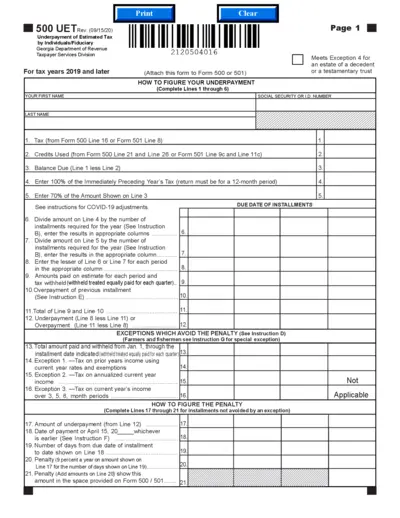

Georgia Underpayment of Estimated Tax Form

This file contains detailed instructions for individuals and fiduciaries on how to calculate underpayment of estimated tax in Georgia. It includes relevant exceptions to avoid penalties and filing procedures to ensure compliance. This form is essential for anyone who needs to assess their tax obligations for the year.

Property Taxes

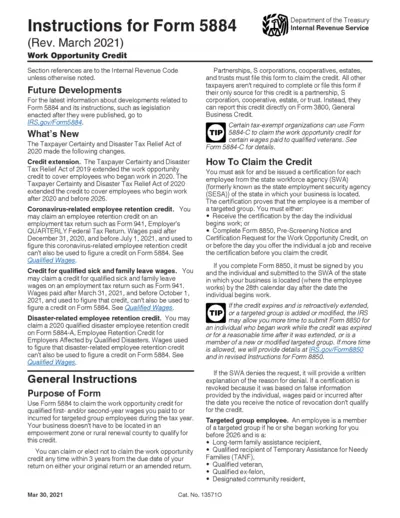

Instructions for Form 5884 Work Opportunity Credit

This document provides important instructions for Form 5884, which allows businesses to claim the Work Opportunity Credit. Understanding these instructions is essential for ensuring compliance with tax regulations and maximizing potential credits. Use this guide to navigate through the form, ensuring that all eligible wages and employees are accounted for.

Property Taxes

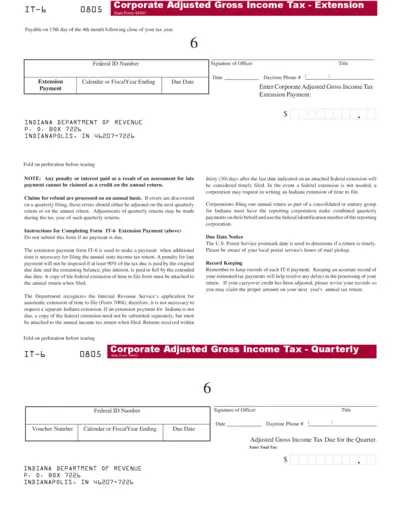

Indiana Corporate Adjusted Gross Income Tax Extension

This file is the Indiana Corporate Adjusted Gross Income Tax Extension form. It provides instructions for corporations that need to file for an extension. It includes payment details and the necessary steps for submission.

Property Taxes

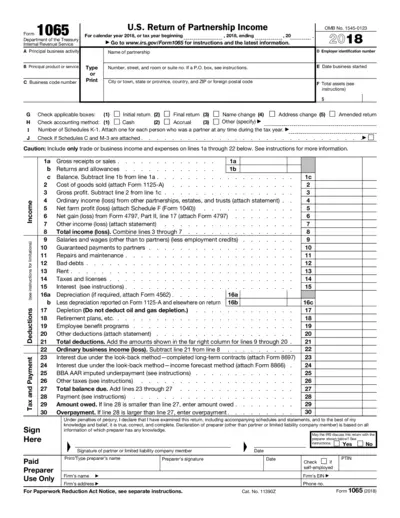

Form 1065 U.S. Return of Partnership Income 2018

Form 1065 is used by partnerships to report income, deductions, and other tax-related information. This form is essential for accurate tax filing for partnerships. It helps the IRS determine the taxable income of partnerships and their partners.

Property Taxes

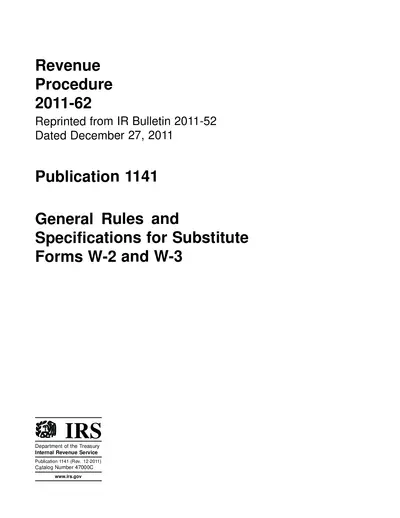

IRS Revenue Procedure 2011-62 General Rules W-2 W-3

This document provides the general rules and specifications for preparing substitute Forms W-2 and W-3 as outlined by the IRS. It targets tax preparers and employers who need guidance on filing wage and tax statements. Proper adherence ensures compliance with IRS requirements.

Property Taxes

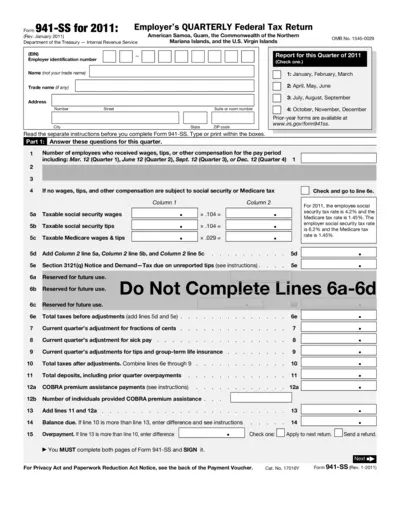

Employer's Quarterly Federal Tax Return (Form 941-SS)

Form 941-SS is essential for employers in territories like American Samoa, Guam, and the U.S. Virgin Islands to report taxes. Utilizing this form ensures compliance with federal tax obligations efficiently. Employers must follow specific guidelines to fill this out correctly for quarterly reporting.

Property Taxes

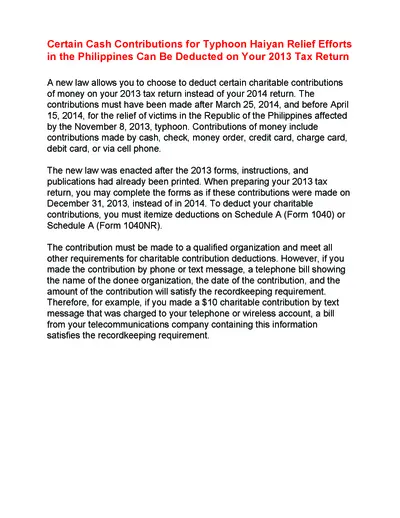

Tax Deductions for Typhoon Haiyan Relief Contributions

This file provides essential guidance for taxpayers on how to claim deductions for certain cash contributions made to relief efforts for Typhoon Haiyan in 2013. It explains the eligibility criteria, recordkeeping, and proper forms required. Understanding this file will help ensure compliance and maximize your tax benefits.

Property Taxes

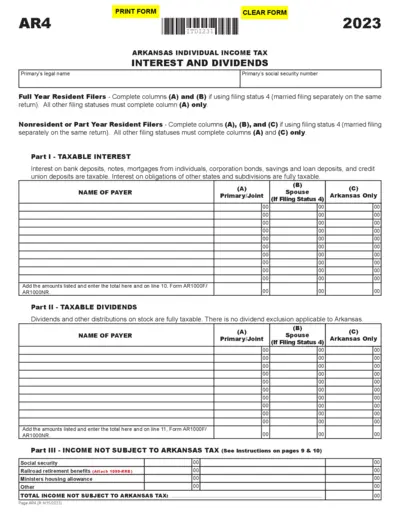

Arkansas Individual Income Tax Filing Instructions

This file provides essential details on how to file Arkansas individual income tax. It outlines the instructions for filling out interest and dividends disclosures. Use this form if you are a resident or a part-year resident of Arkansas.