Property Taxes Documents

Property Taxes

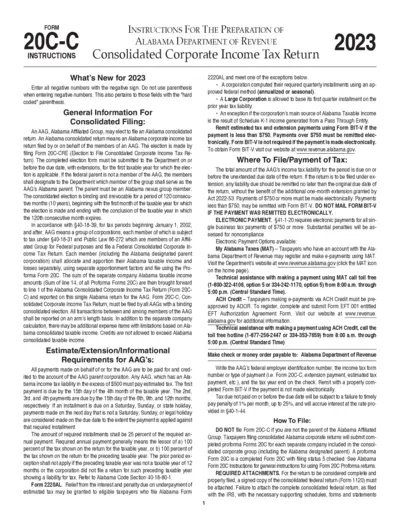

Alabama Corporate Income Tax Return Instructions

This document provides comprehensive instructions for filing the Alabama Consolidated Corporate Income Tax Return. It includes details on eligibility, filing requirements, and important deadlines. Businesses must understand these instructions to ensure compliance with Alabama tax laws.

Property Taxes

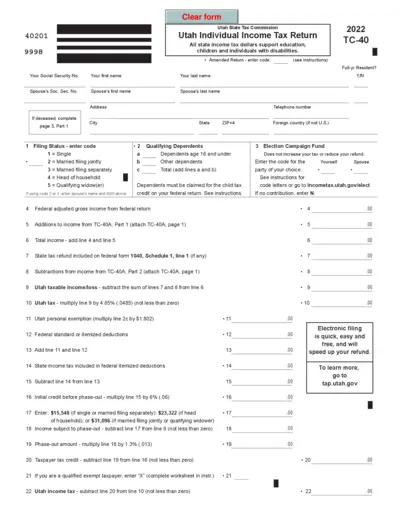

Utah Individual Income Tax Return 2022 Instructions

This file contains the instructions for filling out the Utah Individual Income Tax Return form for the year 2022. It provides essential details on completing the return accurately and efficiently. Whether you're a resident or non-resident, this guide offers the necessary steps to file your tax return correctly.

Property Taxes

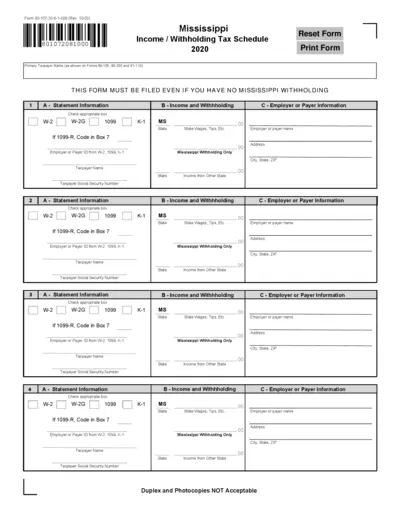

Mississippi Income Withholding Tax Schedule Form

This form is essential for individuals filing Mississippi income tax returns. It outlines the necessary information regarding income and withholding. Ensure all details are accurately filled to comply with state regulations.

Property Taxes

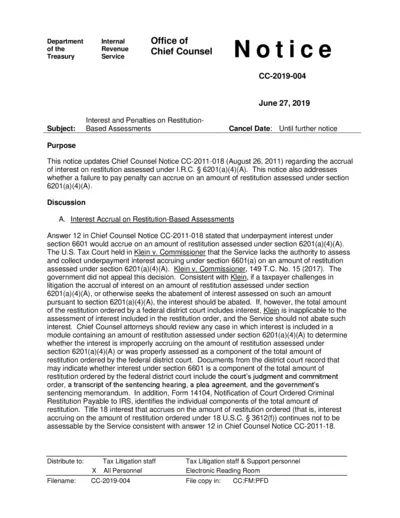

Interest and Penalties on Restitution-Based Assessments

This document provides important updates regarding interest and penalties associated with restitution-based assessments under IRS rules. It outlines the implications of recent court decisions and procedures for taxpayers. Essential for understanding IRS policies on restitution.

Property Taxes

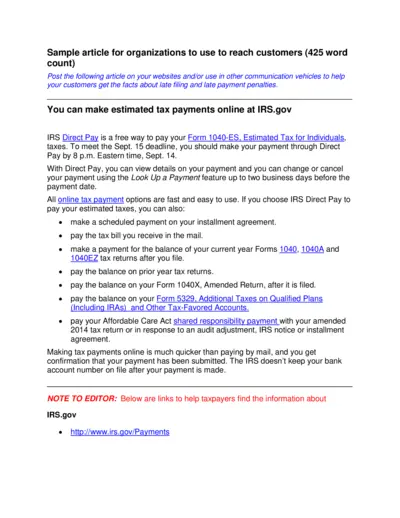

IRS Direct Pay Tax Payment Options for Individuals

This file provides essential information about using IRS Direct Pay for estimated tax payments. Learn how to make secure and easy tax payments online. Stay informed about deadlines and payment options to avoid penalties.

Property Taxes

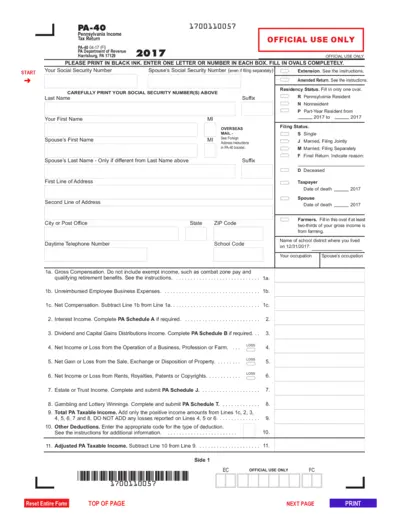

Pennsylvania Income Tax Return PA-40 for 2017

This Pennsylvania Income Tax Return PA-40 form is required for individuals filing their state taxes for the year 2017. The document includes instructions and fields that need to be completed accurately to ensure compliance with state tax laws. Users can edit and download the form using our tools for easy submission.

Property Taxes

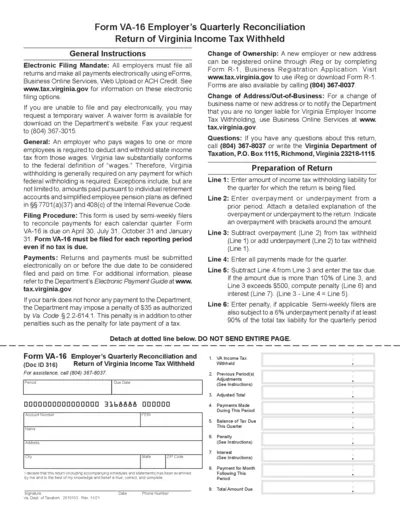

VA-16 Employer's Quarterly Reconciliation Form

The VA-16 form is used by employers for quarterly income tax reconciliation in Virginia. It details the income tax withheld and payments made during the quarter. Employers must file electronically to comply with Virginia law.

Property Taxes

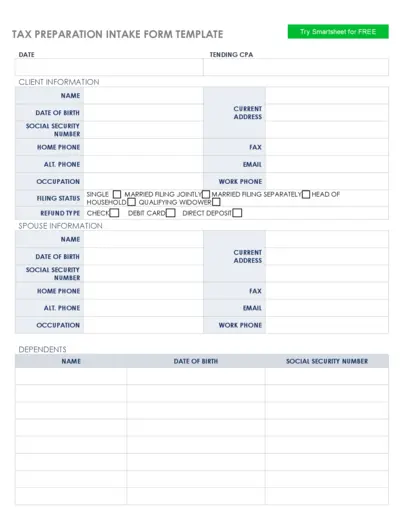

Tax Preparation Intake Form Template

The Tax Preparation Intake Form Template is essential for efficiently gathering client information and income details. This form streamlines the tax preparation process, ensuring all necessary data is collected. Ideal for both individuals and businesses seeking structured tax documentation.

Property Taxes

Sales and Use Tax Exemption for Purchases

This file provides a Sales and Use Tax Exemption Certificate under the Buy Connecticut Provision. It includes instructions for both purchasers and sellers to effectively complete and utilize the form. The document outlines the necessary details for exemptions related to tangible personal property purchases in Connecticut.

Property Taxes

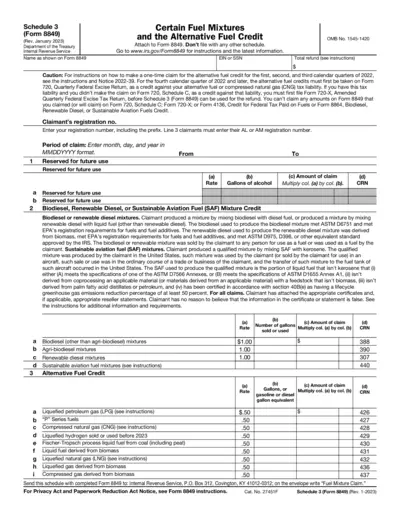

Schedule 3 Form 8849 Fuel Mixture Claim Instructions

This file provides detailed instructions and requirements for claiming alternative fuel credits using Schedule 3 (Form 8849). It is essential for anyone involved in the production or sales of specific fuel mixtures. Use this form to ensure you meet all necessary guidelines and claim your refunds correctly.

Property Taxes

Instructions for Hawaii Form N-848 Power of Attorney

Form N-848 allows individuals to grant authority to a representative for tax matters in Hawaii. This form is essential for taxpayers needing assistance with confidential tax information. Follow the guidelines carefully to ensure proper submission and representation.

Property Taxes

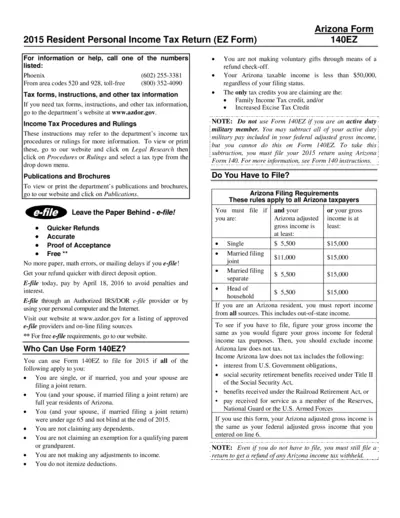

2015 Resident Personal Income Tax Return EZ Form

This document is essential for Arizona residents filing their 2015 income tax. It provides necessary instructions and details on eligibility. Utilize this form to ensure compliance with state tax regulations.