Property Taxes Documents

Property Taxes

California Franchise Tax Board Form 568 Instructions

This document provides comprehensive instructions for completing Form 568, the Limited Liability Company Return of Income in California. It includes vital reporting requirements, important deadlines, and guidance on how to navigate the form. Suitable for LLCs in California and their tax preparers.

Property Taxes

Instructions for Form IT-558 New York State Adjustments

This document provides essential instructions for completing Form IT-558, which is used by taxpayers in New York State to report adjustments due to decoupling from the Internal Revenue Code. It outlines the necessary requirements for partnerships, S corporations, and beneficiaries of estates or trusts. Understanding these instructions is crucial for proper tax filing compliance.

Property Taxes

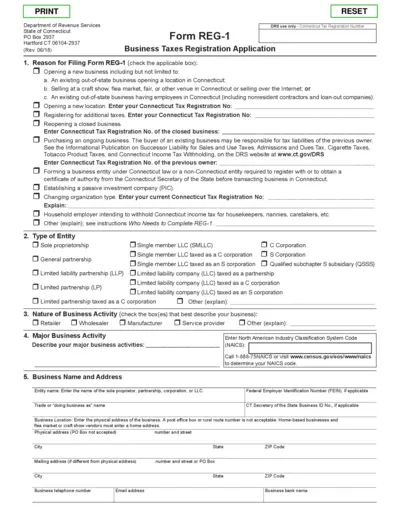

Connecticut Business Taxes Registration Application

This file is the Connecticut Business Taxes Registration Application Form REG-1. It is essential for businesses looking to register for taxes in Connecticut. Fill it out to ensure your compliance with state tax regulations.

Property Taxes

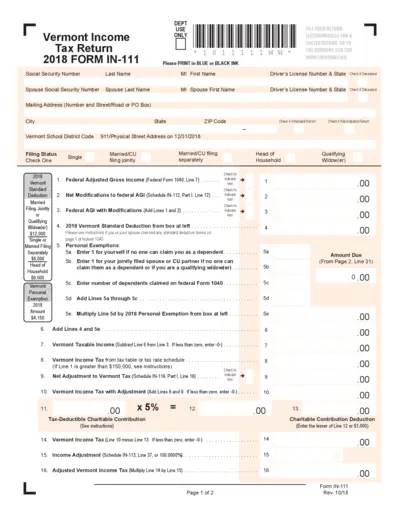

Vermont Income Tax Return Form IN-111 Instructions

This file contains the complete Vermont Income Tax Return Form IN-111 for the year 2018. It includes detailed filing instructions, essential forms, and the information needed to accurately complete your tax return. A must-have for Vermont residents filing their income taxes.

Property Taxes

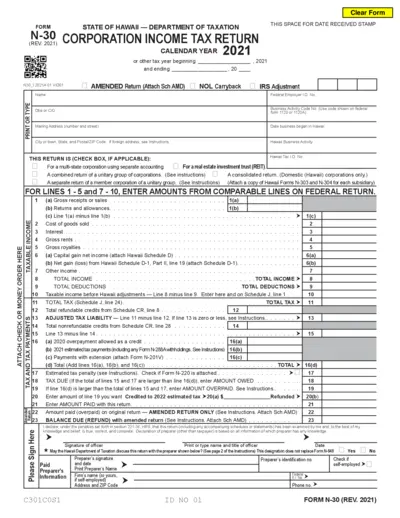

Hawaii Corporation Income Tax Return N-30 Form

The Hawaii Corporation Income Tax Return (Form N-30) must be accurately completed by corporations operating in Hawaii. This file provides the necessary instructions, fields, and guidelines for fulfilling your tax obligations. Utilize this form to report your corporation's income and liability to the state for the tax year 2021.

Property Taxes

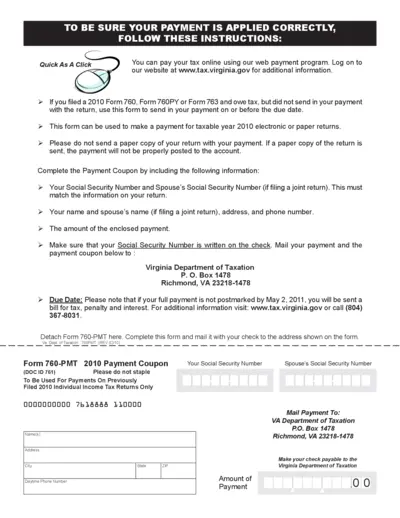

Virginia Tax Payment Instructions for 2010

This file provides essential instructions for taxpayers to correctly submit their payments for the 2010 tax year. It outlines the necessary details required for proper processing and where to send the payment. Stay informed to avoid penalties and ensure your payment is applied correctly.

Property Taxes

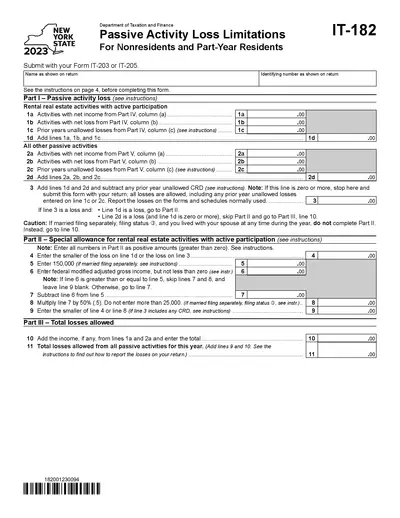

Passive Activity Loss Limitations IT-182 for 2023

This document provides guidelines for passive activity loss limitations applicable to nonresidents and part-year residents in New York State. It is essential for accurately reporting rental real estate and other passive activities. Ensure to follow the provided instructions for correct submission.

Property Taxes

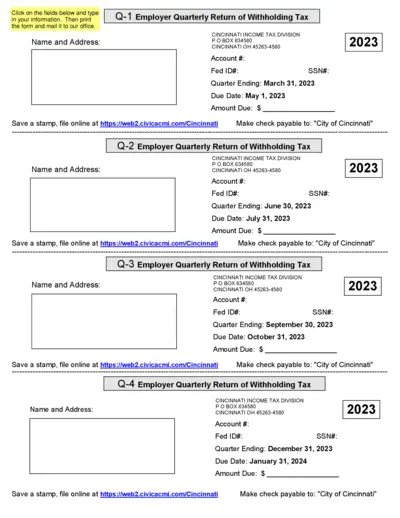

Cincinnati Employer Quarterly Withholding Tax Return

This file is an Employer Quarterly Return of Withholding Tax for Cincinnati. It includes important information for employers regarding tax submissions. Use it to report and pay your withholding taxes to the Cincinnati Income Tax Division.

Property Taxes

North Carolina Individual Income Tax Instructions 2019

This file provides detailed instructions for filling out North Carolina Individual Income Tax Forms. It includes guidelines for various tax forms such as D-400 and related schedules. Ideal for residents needing guidance on state tax submissions.

Property Taxes

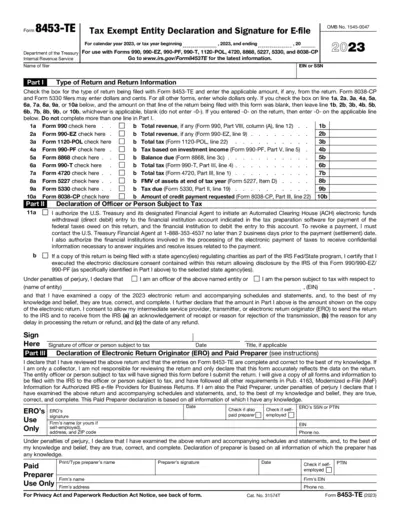

Form 8453-TE Tax Exempt Entity Declaration

Form 8453-TE is essential for tax-exempt entities to authorize electronic filing of specific tax returns and ensure compliance with IRS regulations. This form serves as a declaration and signature for various forms including 990, 990-EZ, and more. Easily fill out and submit to facilitate your organization's tax filing process.

Property Taxes

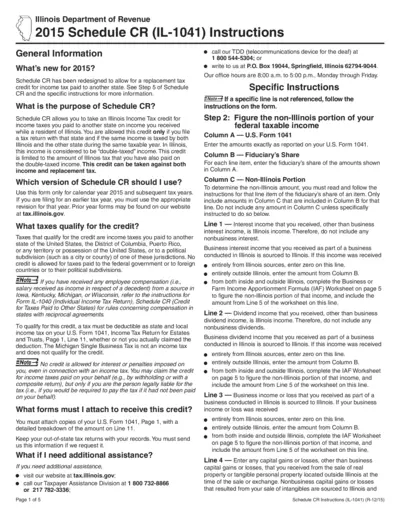

Illinois Schedule CR (IL-1041) Tax Credit Instructions

This file contains detailed instructions for completing Schedule CR used in Illinois tax filings. It outlines the process for claiming income tax credits for taxes paid to other states. Essential for residents who have income taxed by both Illinois and another state.

Property Taxes

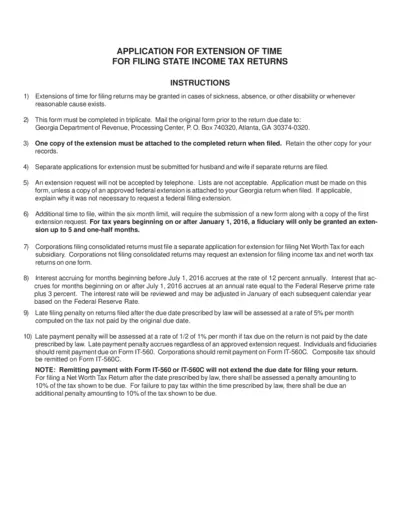

Application for Extension of Time for Filing Tax Returns

This application allows taxpayers in Georgia to request an extension for filing state income tax returns. It is essential for individuals and corporations seeking additional time due to valid circumstances. Completing this form accurately ensures compliance with state regulations and avoids penalties.