Property Taxes Documents

Property Taxes

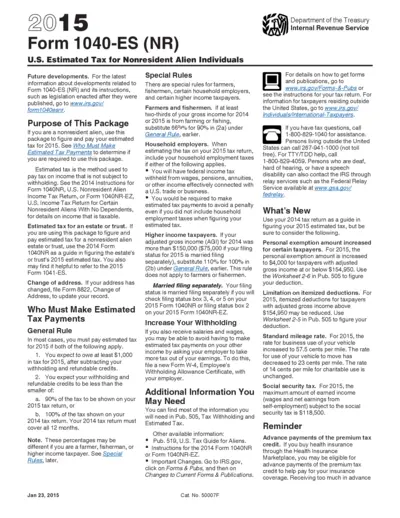

U.S. Estimated Tax Form 1040-ES for Nonresidents

Form 1040-ES (NR) helps nonresident aliens estimate and pay their 2015 tax. Ensure compliance with IRS regulations by using this guide. This document outlines essential information and instructions for taxpayers.

Property Taxes

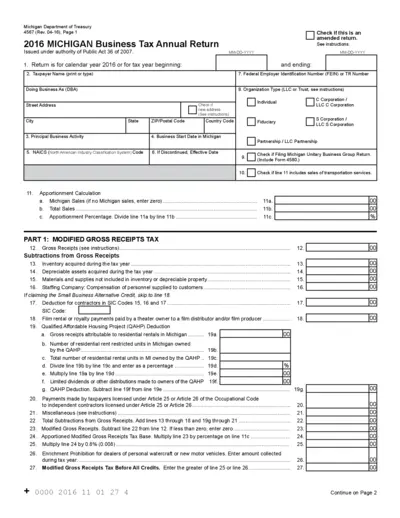

Michigan Business Tax Annual Return 2016

The Michigan Business Tax Annual Return form is essential for businesses to report their income and tax liabilities accurately. This form is required for compliance with Michigan tax laws and helps calculate the business tax due. Businesses should fill out this form to ensure they meet their tax obligations and avoid penalties.

Property Taxes

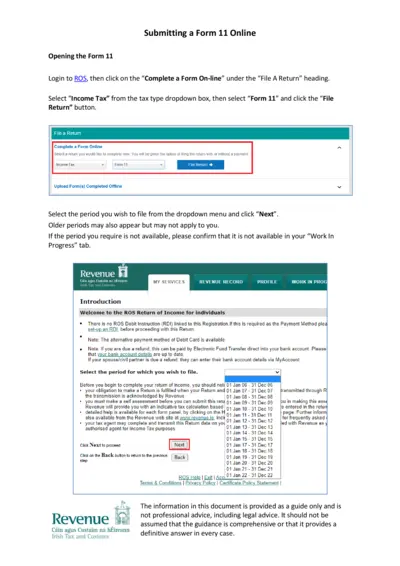

Form 11 Online Submission Guide for Income Tax

This document provides detailed instructions on how to submit Form 11 online. It includes guidance on filling out the form and important deadlines. Ideal for individuals filing income tax in Ireland.

Property Taxes

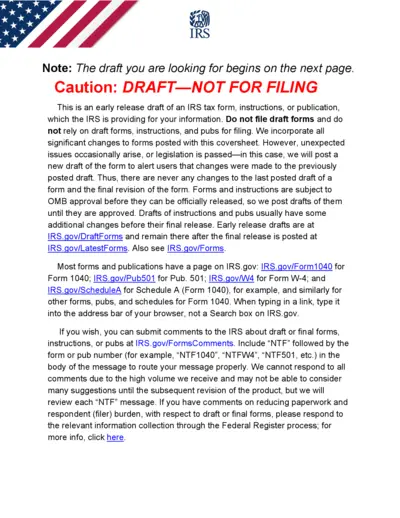

IRS Instructions for Form 1041 for Estates and Trusts

This document provides essential instructions for filing Form 1041, which is used for U.S. Income Tax Return for Estates and Trusts. It outlines the requirements, deadlines, and important filing information necessary for compliance with IRS regulations.

Property Taxes

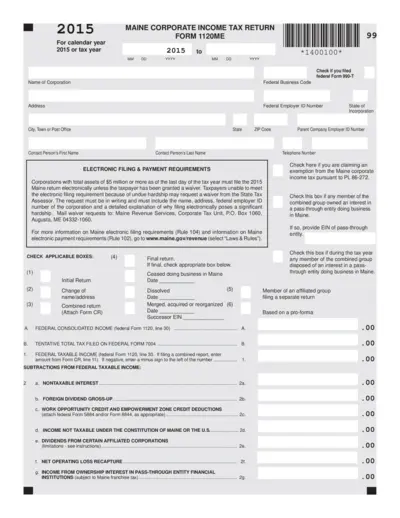

Maine Corporate Income Tax Return 2015 Form 1120ME

This document is the Maine Corporate Income Tax Return for the calendar year 2015. It provides important information and instructions for filing corporate taxes in Maine. Businesses must complete this form accurately to comply with state tax regulations.

Property Taxes

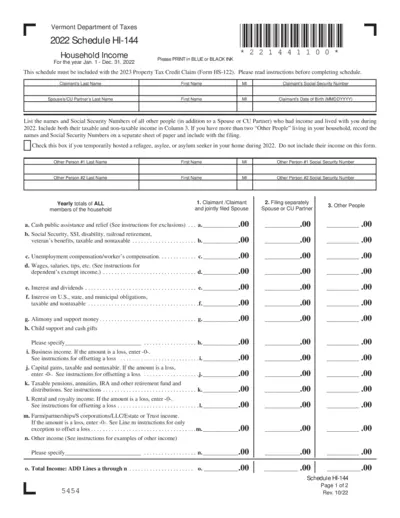

Vermont 2022 Schedule HI-144 Household Income Form

The Vermont Schedule HI-144 is essential for filing your household income for property tax credits. It captures all relevant income details for all household members. Ensure you follow the guidelines carefully to maximize your benefits.

Property Taxes

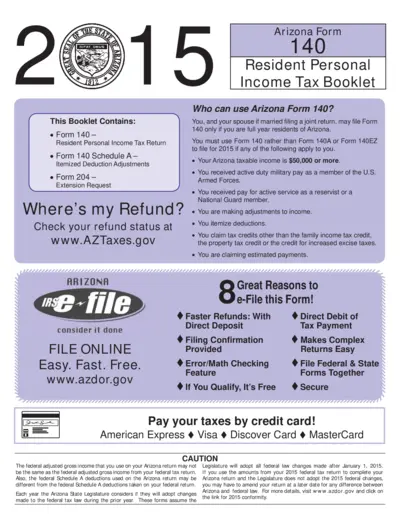

Arizona Form 140 Instructions and Information

This file contains important information and instructions for filling out Arizona Form 140. It covers eligibility, filing process, and updates for 2015 taxes. Ideal for Arizona residents seeking to file their income tax returns accurately.

Property Taxes

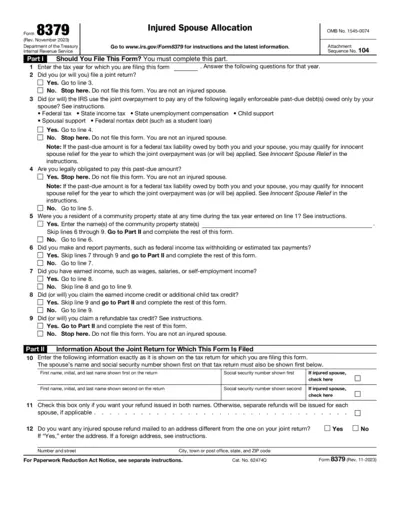

Injured Spouse Allocation Form 8379 Instructions

This document provides critical information regarding the Injured Spouse Allocation Form 8379. It helps individuals understand their eligibility and how to properly file this form to receive their refunds. Make sure to follow the instructions carefully to ensure accurate filing.

Property Taxes

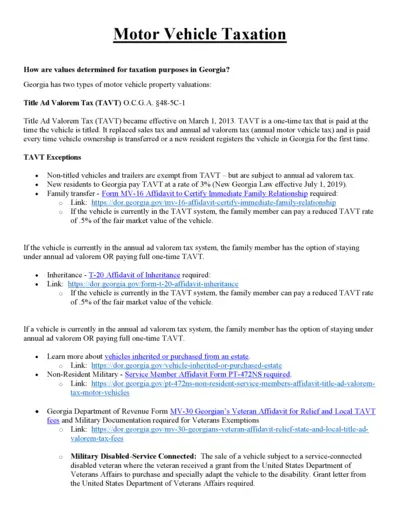

Motor Vehicle Taxation in Georgia - Overview and Instructions

This file provides detailed information on motor vehicle taxation in Georgia, including Title Ad Valorem Tax (TAVT) and annual ad valorem tax. It also outlines exemptions and instructions for filing. Ideal for vehicle owners and residents in Georgia.

Property Taxes

North Carolina Tax Forms and Instructions 2015

This document provides essential guidelines for filling out North Carolina tax forms, specifically the D-400, for individuals. It includes instructions for accurate submission without discrepancies. Ideal for taxpayers looking to complete their 2015 tax filings correctly.

Property Taxes

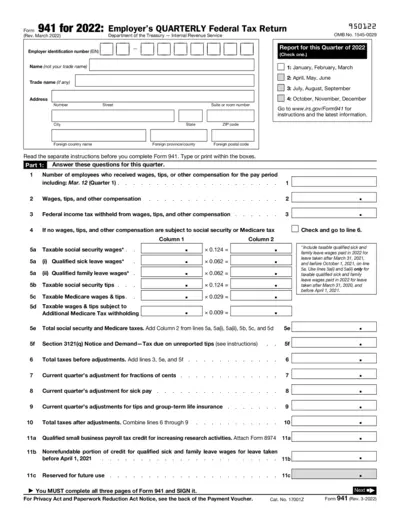

Employer's Quarterly Federal Tax Return Form 941

Form 941 is the Employer's Quarterly Federal Tax Return required by the IRS. This form allows employers to report income taxes, social security tax, and Medicare tax withheld from employee wages. Proper filing is essential for compliance with federal tax laws.

Property Taxes

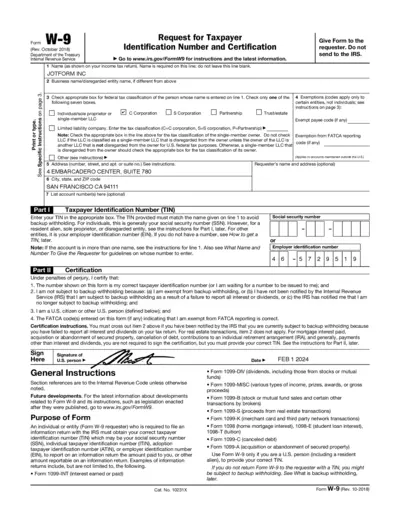

Request for Taxpayer Identification Number W-9

Form W-9 is essential for individuals and entities to provide taxpayer identification information. It ensures accurate reporting to the IRS for payments. Use this form to avoid backup withholding on your income.