Faith-Based Nonprofits Documents

Faith-Based Nonprofits

Understanding IRS Form 990 and GuideStar Access

This file provides comprehensive FAQs regarding IRS Form 990 and its accessibility on GuideStar. Users can find important information about filing requirements, sources of Form 990, and how to access the documents. It serves as an essential resource for nonprofits and individuals seeking information on tax-exempt organizations.

Faith-Based Nonprofits

Spark Good Space Request Tool Guide for Nonprofits

This guide provides instructions for using the Spark Good Space Request Tool. Nonprofits can learn how to request space for fundraising and community awareness campaigns. It covers the requirements and steps to successfully utilize the tool.

Faith-Based Nonprofits

Honda Foundation Application Form for Loan Vehicle

This application form allows organizations to apply for a Honda Hero Loan Vehicle from the Honda Foundation. Ensure all necessary details are accurately filled out before submission. This form is essential for organizations with Deductible Gift Recipient (DGR) status seeking transportation support.

Faith-Based Nonprofits

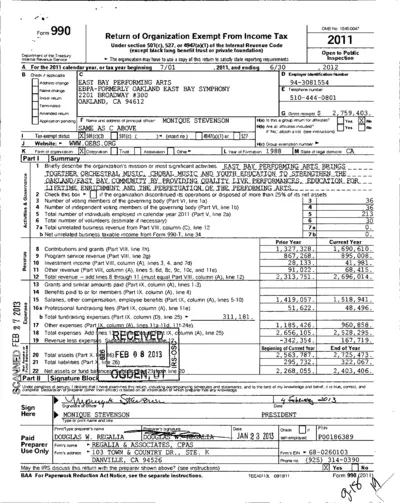

Return of Organization Exempt from Income Tax Form 990

Form 990 provides essential information about an organization's income, expenses, and charitable activities. This document is required for tax-exempt organizations to report their financial activities annually. Use this form to maintain compliance and transparency with the IRS.

Faith-Based Nonprofits

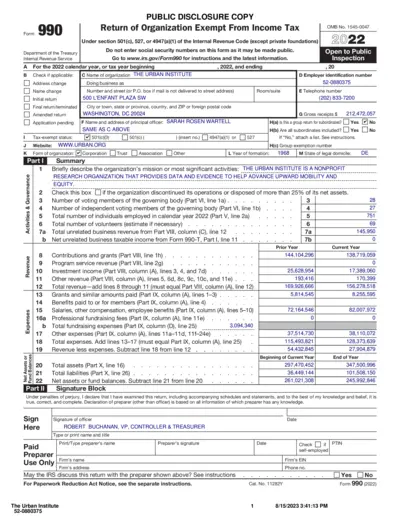

Return of Organization Exempt From Income Tax 990

This file is the IRS Form 990, which is utilized by tax-exempt organizations to report their financial information and activities. It includes details about revenues, expenses, and program services offered by the organization. Filing this form is essential for maintaining tax-exempt status and transparency.

Faith-Based Nonprofits

Volunteer Management Software Resource for Clinics

This resource provides detailed information about volunteer management software tailored for organizations in Toronto. It highlights various platforms to aid in volunteer tasks from recruitment to scheduling. Ideal for volunteer managers seeking the right tools.

Faith-Based Nonprofits

Extreme Makeover Nonprofit Board Edition Guide

This file provides essential instructions and insights for nonprofit organizations looking to enhance their board governance and effectiveness. It offers practical tips and case studies to help organizations navigate the challenges of board reform. Ideal for nonprofit leaders and board members seeking transformative strategies.

Faith-Based Nonprofits

Forming and Maintaining a Nonprofit Organization

This guidebook helps you navigate the essential steps for establishing a nonprofit organization in California. It emphasizes the importance of compliance with federal and state laws. A must-read for aspiring nonprofit founders.

Faith-Based Nonprofits

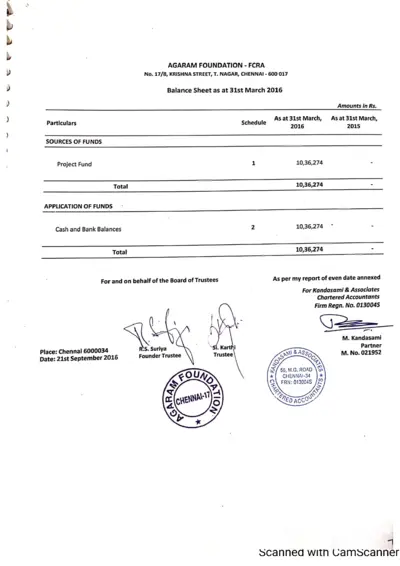

Agaram Foundation Financial Summary 2016

This file contains the financial statements and balance sheet for Agaram Foundation for the year ended March 31, 2016. It includes details on sources and applications of funds, along with the trustee reports. Ideal for stakeholders and regulatory purposes.

Faith-Based Nonprofits

Online Fundraising Compliance Guide for Nonprofits

This file provides crucial information on online fundraising compliance for nonprofits. It outlines necessary regulations and best practices. Essential for nonprofits navigating digital donation channels.

Faith-Based Nonprofits

Institute for Local Government Nonprofit Guide

This file provides a comprehensive overview of nonprofit financial reporting through Form 990. It includes guidance for local agencies on understanding and reviewing Form 990 details. Users will find valuable insights for promoting good governance in local communities.

Faith-Based Nonprofits

California Nonprofit Organizations Tax Guide

This publication provides essential guidance on the sales and use tax law applicable to nonprofit organizations in California. It covers important regulations and tax exemptions that various nonprofit entities, including schools and religious institutions, should be aware of. Users are encouraged to reach out to the Customer Service Center for any inquiries or further assistance.