Faith-Based Nonprofits Documents

Faith-Based Nonprofits

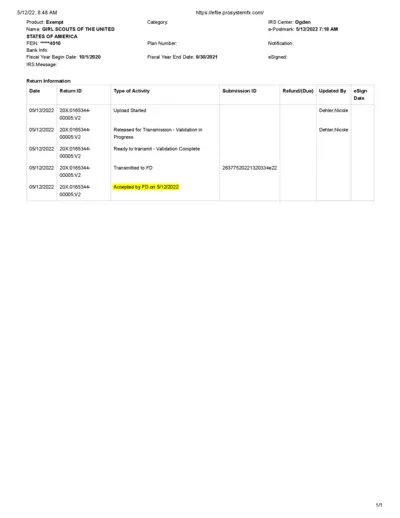

IRS Form 990 Filing for Girl Scouts - 2020

This file contains the IRS Form 990 for the Girl Scouts of the United States of America. It details their activities, revenues, and expenses for the fiscal year. Nonprofit organizations can reference this file for their filing requirements and financial data.

Faith-Based Nonprofits

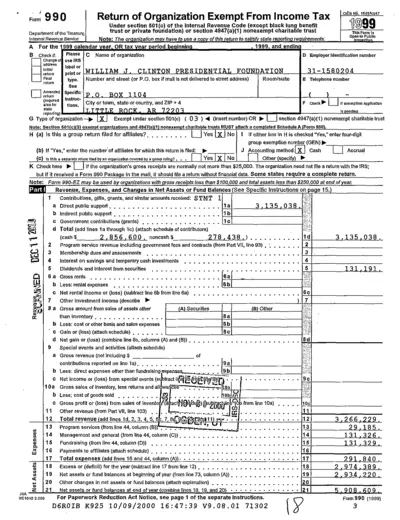

Form 990 Return of Organization Exempt From Income Tax

Form 990 is a return that organizations exempt from income tax must file with the IRS. This form provides important information about an organization's mission, programs, and finances. Nonprofit organizations and charitable trusts utilize this form to comply with federal tax regulations.

Faith-Based Nonprofits

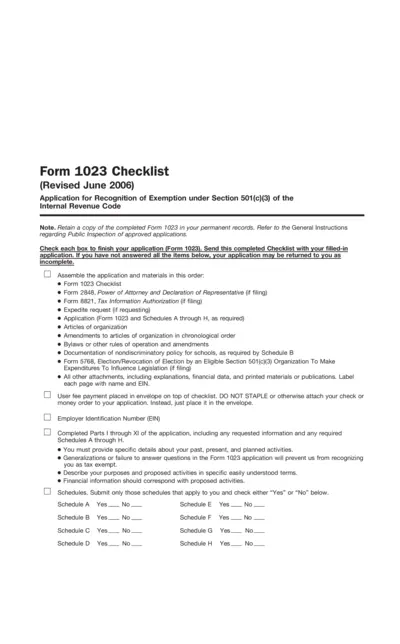

Form 1023 Checklist for 501(c)(3) Exemption

The Form 1023 Checklist provides essential instructions for organizations applying for recognition of exemption under Section 501(c)(3) of the Internal Revenue Code. It includes a detailed list of required documents and proper assembly guidelines to ensure a complete application. This file is crucial for entities seeking tax-exempt status.

Faith-Based Nonprofits

Letter of Inquiry Opportunities for Nonprofits

This document provides guidance on submitting Letters of Inquiry for nonprofit public charities to potential funders. It includes helpful resources and instructions to enhance fundraising efforts. Use this file to explore grant-making opportunities and improve your chances of securing funding.

Faith-Based Nonprofits

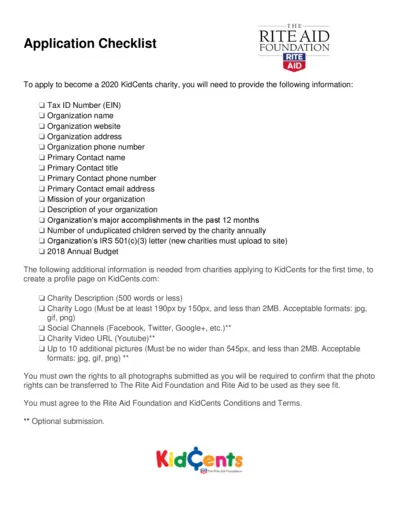

Rite Aid Foundation KidCents Charity Application

This file serves as an application checklist for organizations wishing to apply for the Rite Aid Foundation's KidCents program. It details the required information and documentation needed for submission. Ensure you complete each section thoroughly to increase your chances of approval.

Faith-Based Nonprofits

Electronically File your Form 990 and State Registration Forms

This file provides important instructions for electronic filing of Form 990 and state registration forms for nonprofit organizations. It includes step-by-step details to help users navigate the e-filing system efficiently. Ideal for organizations looking to ensure compliance and simplicity in their filing process.

Faith-Based Nonprofits

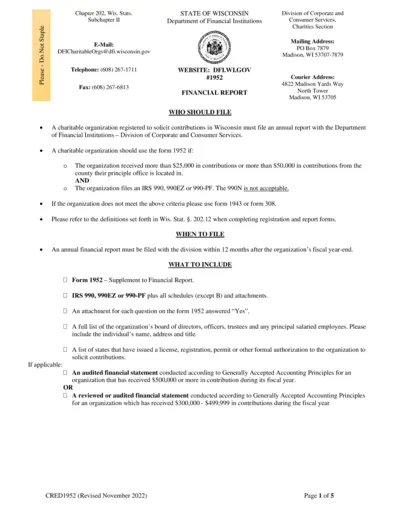

Wisconsin Charitable Organization Financial Report

This file provides essential guidelines for charitable organizations in Wisconsin regarding their annual financial reporting. It includes filing requirements, required documents, and general instructions to ensure compliance with state regulations. Ideal for organizations looking to fulfill their legal obligations.

Faith-Based Nonprofits

Lippman Kanfer Foundation Chief of Staff Job Overview

Discover the responsibilities and opportunities of the Chief of Staff at the Lippman Kanfer Foundation for Living Torah. This file outlines essential qualifications, strategic initiatives, and organizational insights. A valuable resource for those interested in impactful Jewish leadership.

Faith-Based Nonprofits

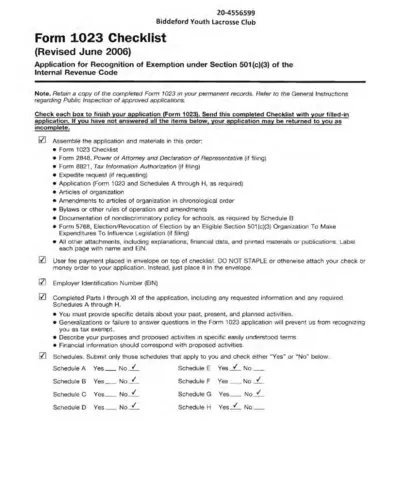

Form 1023 Checklist for 501(c)(3) Exemption

This document provides a comprehensive checklist for completing Form 1023 for the recognition of exemption under Section 501(c)(3). It includes essential components, submission instructions, and important updates to the form. Ideal for organizations seeking tax-exempt status under the IRS regulations.

Faith-Based Nonprofits

Kroger Community Giving Request Instructions

This file provides detailed instructions for requesting donations from Kroger. It outlines eligibility criteria, types of donations, and how non-profit organizations can apply. Learn how Kroger supports community initiatives through its charitable programs.

Faith-Based Nonprofits

Operations Assistant Position Women in Global Health

This document outlines the Operations Assistant role at Women in Global Health. It provides insights into the organization's mission and the responsibilities involved. Ideal for potential candidates and supporters of gender equity in health.

Faith-Based Nonprofits

Form 1023-EZ Eligibility and Filing Guide

Form 1023-EZ is a streamlined application for recognition of exemption under Section 501(c)(3) of the Internal Revenue Code. This document helps qualifying organizations determine their eligibility and provides filing instructions. Ensure to complete the eligibility worksheet before submitting your application online.