Faith-Based Nonprofits Documents

Faith-Based Nonprofits

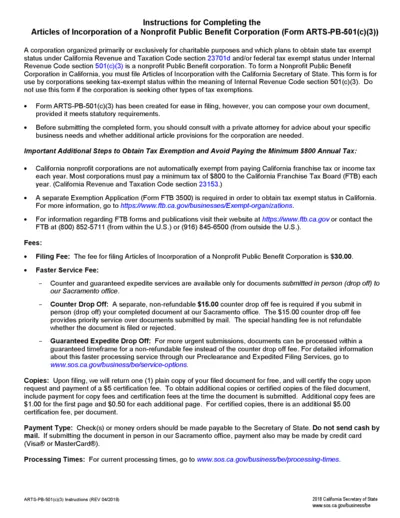

Instructions for Nonprofit Corporation Articles

This PDF provides essential instructions for completing the Articles of Incorporation for a nonprofit public benefit corporation. It details the requirements to obtain California and federal tax-exempt status under the Internal Revenue Code. Follow the guidelines to ensure a successful filing process.

Faith-Based Nonprofits

DonorSnap Glossary of Database Fields for Easy Reference

This file serves as a comprehensive glossary of database fields for DonorSnap, detailing the definitions and usage of various components. Users will find essential information on how to manage donor data efficiently. It is designed for both novice and experienced users looking to enhance their understanding of the DonorSnap platform.

Faith-Based Nonprofits

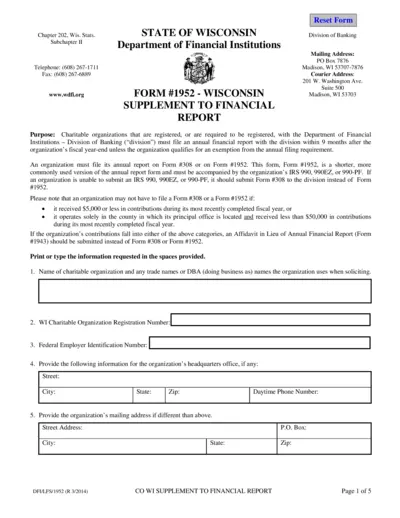

Wisconsin Charitable Annual Financial Report Form

This document provides essential information for charitable organizations in Wisconsin regarding the filing of their annual financial report. It outlines the necessary forms, eligibility criteria, and instructions to ensure compliance. Nonprofits can utilize this simplified report to effectively communicate their contributions and operational transparency.

Faith-Based Nonprofits

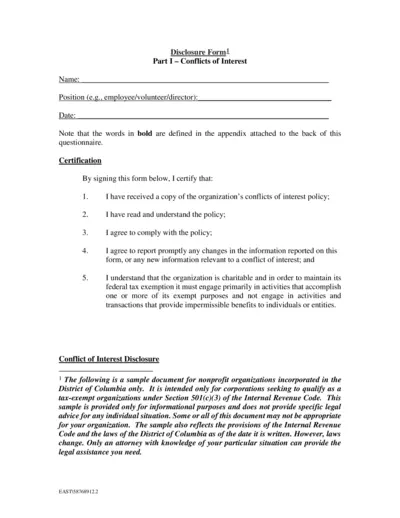

Conflicts of Interest Disclosure Form for Nonprofits

This form assists in disclosing potential conflicts of interest. It is essential for maintaining compliance with IRS requirements. Ensure that all relevant information is accurately reported.

Faith-Based Nonprofits

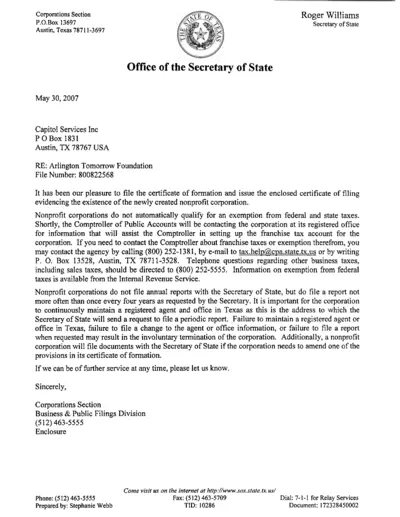

Certificate of Filing for Nonprofit Corporation

This file contains the certificate of filing for the Arlington Tomorrow Foundation. It outlines the formation of the nonprofit corporation and provides instructions for maintaining its status. Essential information for compliance with Texas state regulations is included.

Faith-Based Nonprofits

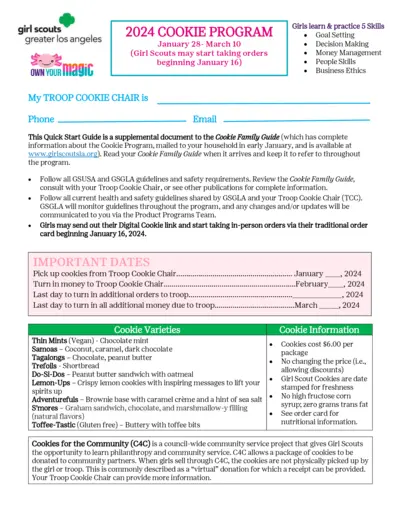

Girl Scouts LA 2024 Cookie Program Guide

This guide outlines the details and instructions for the Girl Scouts Greater Los Angeles 2024 Cookie Program. It includes important dates, skills learned, and roles & responsibilities. Perfect for those participating in or supporting the cookie program.

Faith-Based Nonprofits

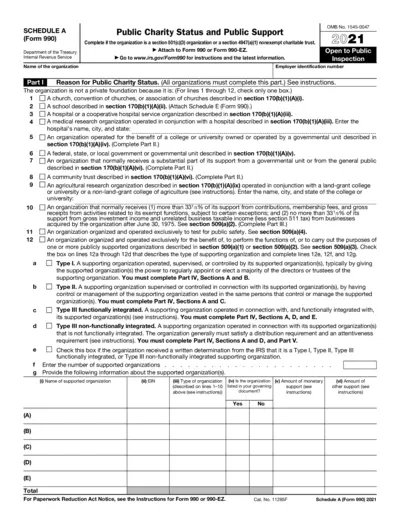

Schedule A Form 990 Public Charity Status Instructions

This file provides essential information regarding the public charity status and public support for organizations. It outlines the requirements for completing Schedule A and related IRS filings. Understanding this form is crucial for tax-exempt organizations to maintain compliance with federal regulations.

Faith-Based Nonprofits

Spark Good FrontDoor Verification Guide for Nonprofits

This file provides comprehensive instructions for nonprofits to become FrontDoor verified. It outlines the registration process, payment preferences, and available resources. Organizations can access Walmart Spark Good programs upon verification.

Faith-Based Nonprofits

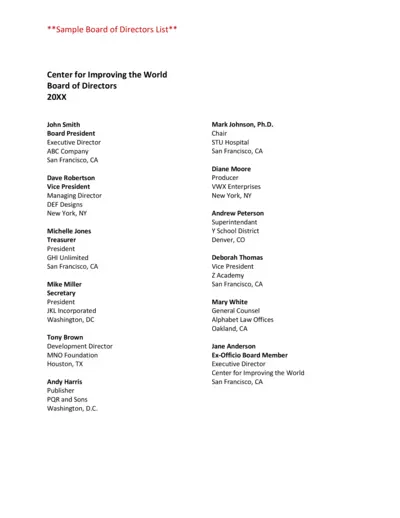

Sample Board of Directors List for 20XX

This document provides a comprehensive list of the Board of Directors for the Center for Improving the World for the year 20XX. Users can reference this document to understand the leadership structure and contact information for board members. It is a valuable resource for stakeholders, partners, and those looking to connect with the organization.

Faith-Based Nonprofits

DARPAN Registration User Guide for NGOs

This user guide provides essential instructions for NGOs to register on the DARPAN portal. Follow the detailed steps to ensure successful registration. Gain access to various resources and support through the DARPAN initiative.

Faith-Based Nonprofits

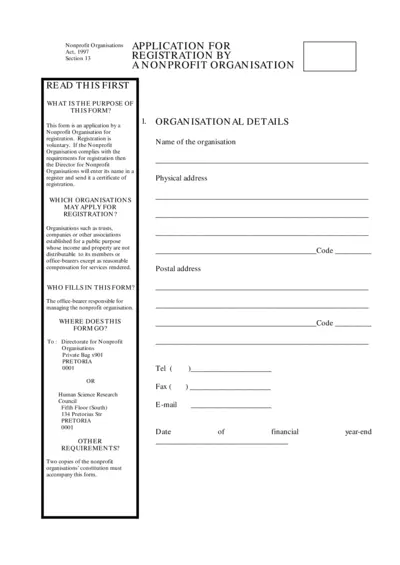

Nonprofit Organisation Registration Application

This document serves as an application form for nonprofits seeking registration. Filling this form allows your organization to gain recognized status. Ensure all requirements are met to avoid delays in processing.

Faith-Based Nonprofits

Forming and Maintaining a Nonprofit Organization

This guidebook provides a comprehensive overview on how to form a nonprofit organization in New Mexico. It details required steps and legal considerations for incorporating and achieving tax-exempt status. Designed for founders and directors, this resource is essential for compliance and successful establishment.