Tax Documents

Cross-Border Taxation

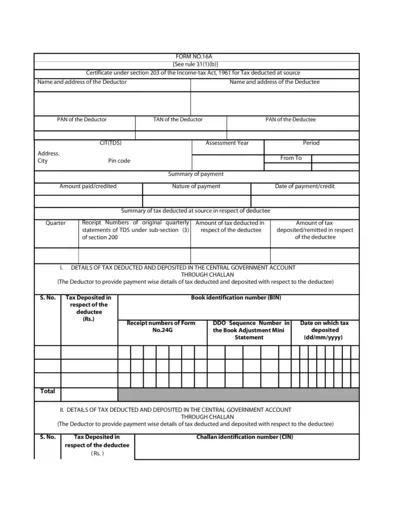

Form 16A: Tax Deducted at Source Certificate

Form 16A is a certificate under the Income-tax Act, 1961 for tax deducted at source (TDS). This document serves as proof of tax deducted by the deductor on behalf of the deductee. It is essential for taxpayers to file their income tax returns correctly.

Sales Tax

Salesforce Lead Capture for Sales Cloud User Guide

This user guide provides comprehensive instructions on how to effectively capture leads using Salesforce for Sales Cloud. It covers step-by-step processes for creating tasks, importing leads, and viewing captured data. Perfect for sales teams looking to optimize lead management.

Tax Returns

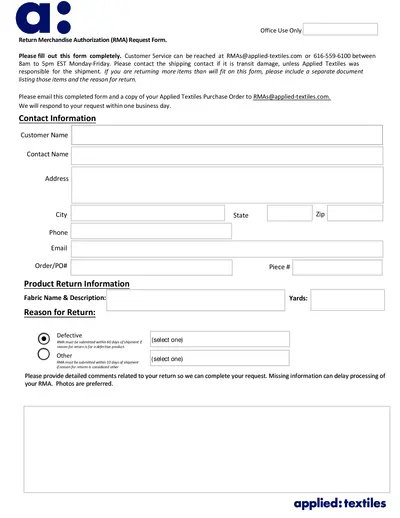

Return Merchandise Authorization Request Form

This RMA Request Form allows customers to initiate the return of products. Complete the form with your contact information and return details. Submit the form via email to expedite processing.

Cross-Border Taxation

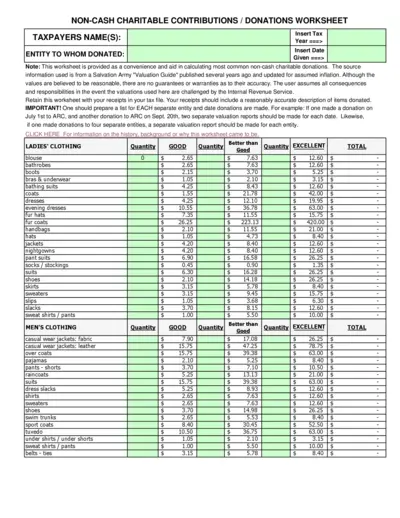

Non-Cash Charitable Contribution Worksheet

This worksheet assists taxpayers in documenting non-cash donations for tax purposes. It provides a convenient format to calculate the value of donated items based on guidelines from a recognized valuation source. Users are reminded to retain this worksheet with their receipts for accurate record-keeping.

Cross-Border Taxation

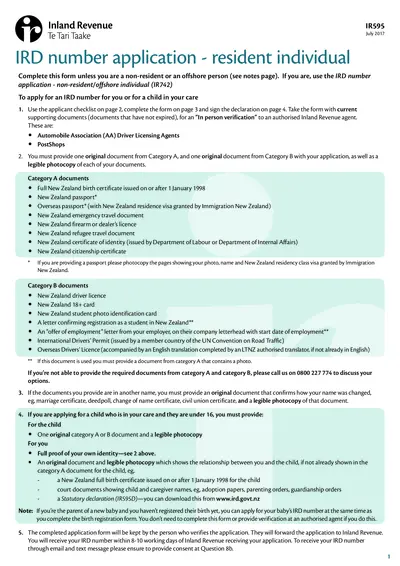

IRD Number Application for Resident Individuals

This document provides the application form for a resident individual to apply for an IRD number in New Zealand. It includes the necessary instructions, required documents, and applicant checklist. Ensure thorough completion for successful application processing.

Tax Returns

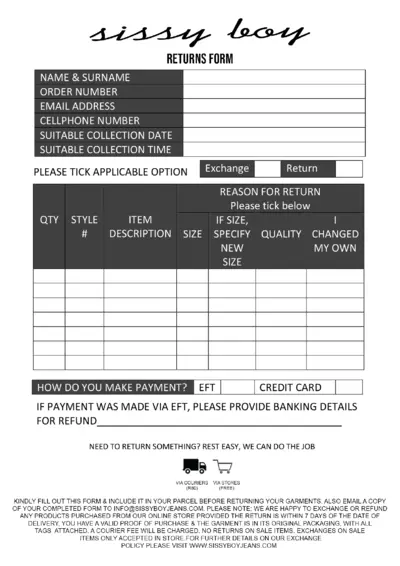

Sissy Returns Form - Easy Exchange and Refund Process

The Sissy Returns Form is designed for customers wishing to exchange or return their purchased garments. It includes necessary fields like name, order number, and reason for return. Ensure all information is filled correctly for a smooth return process.

Cross-Border Taxation

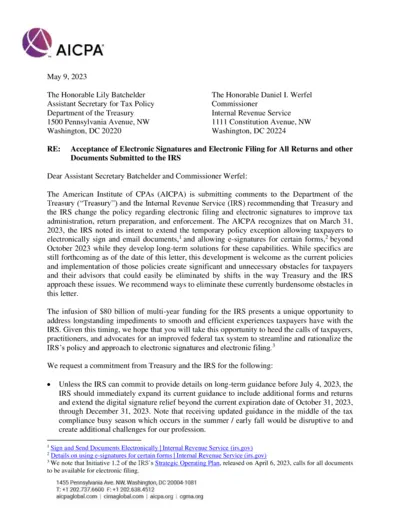

Acceptance of Electronic Signatures for IRS 2023

This file contains recommendations from the AICPA regarding the acceptance of electronic signatures and electronic filing by the IRS. It outlines the current policies, proposed changes, and the impact on taxpayers and tax practitioners. The document emphasizes the need for modernized tax administration to improve efficiency and reduce obstacles.

Cross-Border Taxation

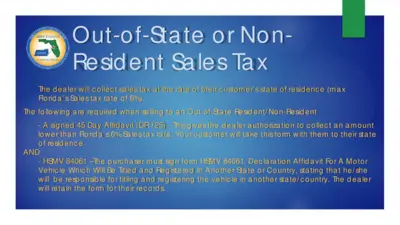

Out-of-State Non-Resident Sales Tax Documentation

This file contains essential information about collecting sales tax for out-of-state vehicles. It outlines the required forms and procedures for dealers selling to out-of-state residents. Understanding this document is crucial for compliance and accurate tax collection.

Cross-Border Taxation

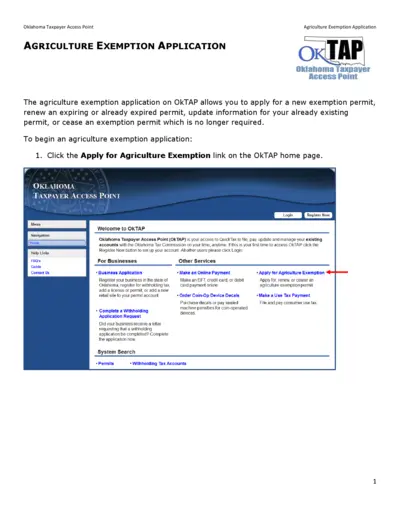

Oklahoma Agriculture Exemption Application Access

This file is an application for the Oklahoma agriculture exemption. It allows individuals and businesses to apply, renew, or update their exemption permits. Ensure you follow the instructions carefully to complete the application process.

Cross-Border Taxation

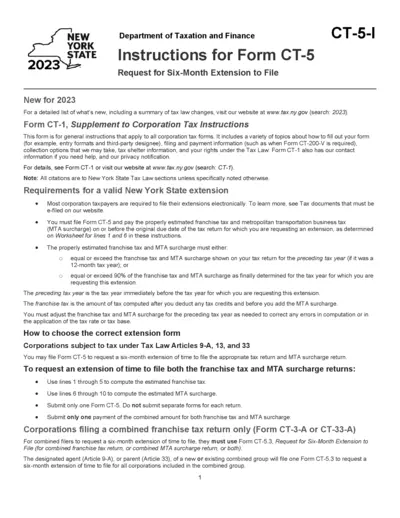

Instructions for Form CT-5 Request for Extension

This file provides detailed instructions for completing Form CT-5 to request a six-month extension for filing taxes in New York. It is essential for corporations seeking to extend their filing deadlines while ensuring compliance with tax laws. The guidelines include eligibility criteria, required forms, and submission instructions.

Cross-Border Taxation

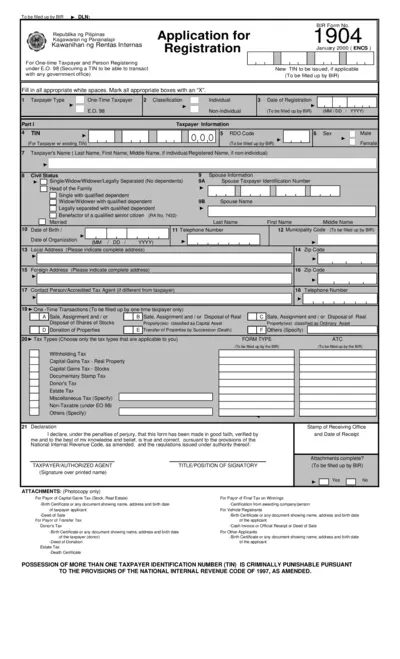

BIR Application for Registration Form No. 1904

This document is the BIR Form No. 1904, intended for one-time taxpayers and individuals seeking to secure a Taxpayer Identification Number (TIN). It outlines essential taxpayer information and includes sections to declare types of transactions and tax types. Proper completion and submission are mandated for compliance with the National Internal Revenue Code.

Cross-Border Taxation

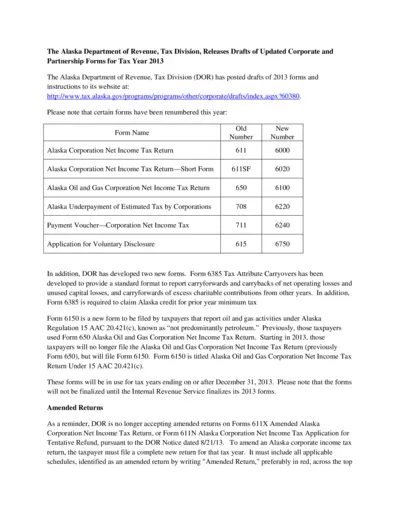

Updated 2013 Alaska Corporate Partnership Tax Forms

This document provides essential information about the updated corporate and partnership forms released by the Alaska Department of Revenue for tax year 2013. It includes important instructions and form renumbering details. Taxpayers should refer to these drafts for accurate tax filing.