Tax Documents

Cross-Border Taxation

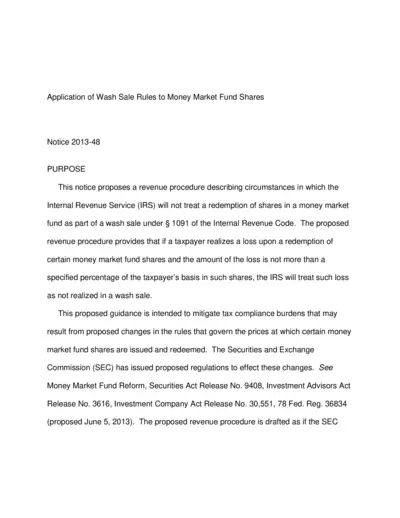

Wash Sale Rules for Money Market Fund Shares

This document outlines the proposed revenue procedure regarding wash sale rules on money market fund shares. It discusses the circumstances under which the IRS will not treat a redemption as a wash sale. It is crucial for taxpayers wanting to understand their tax obligations regarding these investments.

Cross-Border Taxation

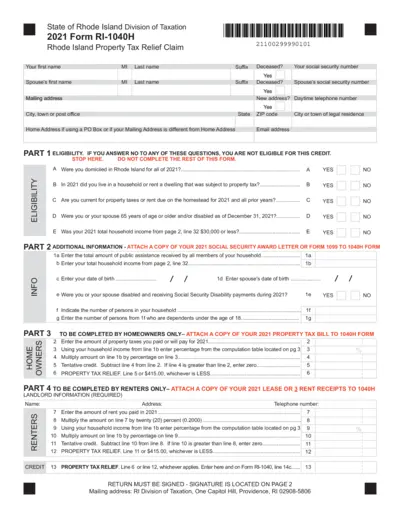

2021 Rhode Island Form RI-1040H Property Tax Relief

The 2021 Form RI-1040H is a tax relief claim for Rhode Island residents. It allows eligible individuals to apply for property tax relief based on their income and age or disability status. Make sure to follow the instructions carefully to ensure proper submission.

Sales Tax

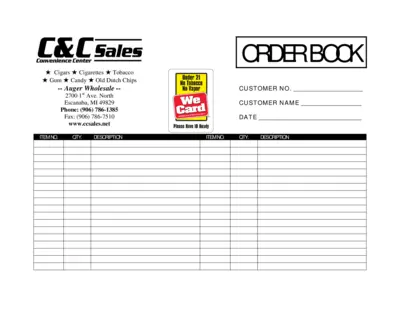

C C Sales Tobacco and Cigarettes Order Form

This file contains details of tobacco products sold at C & C Sales. It includes item numbers, quantities, and descriptions. Ideal for customers and businesses needing to place orders.

Cross-Border Taxation

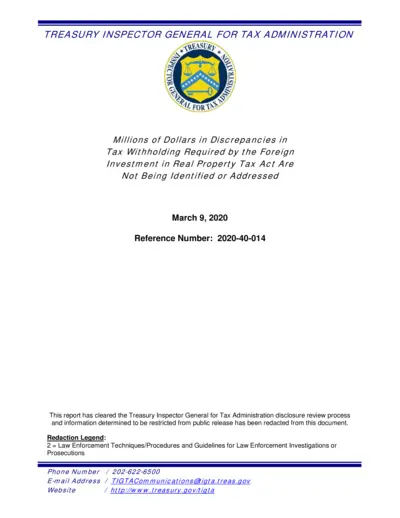

Millions of Dollars in FIRPTA Tax Withholding Discrepancies

This report highlights significant discrepancies in tax withholding required by the Foreign Investment in Real Property Tax Act. It assesses IRS efforts in verifying withholding credits and identifies areas needing improvement. The findings and recommendations aim to enhance compliance and accuracy in tax reporting.

Cross-Border Taxation

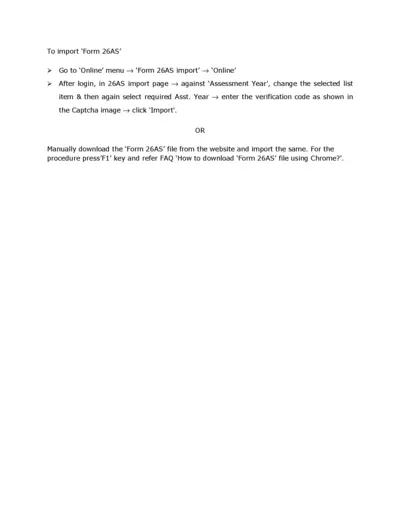

How to Import Form 26AS: Step-By-Step Guide

This file provides a detailed guide on importing Form 26AS. Users can learn about the online import process and manual downloading options. Perfect for tax assessment and compliance.

Cross-Border Taxation

Sprintax Guide for US Nonresidents Tax Filing

This file provides essential information about using Sprintax for tax return preparation. It outlines the step-by-step process for nonresidents to file their state and federal taxes. Get detailed instructions and tips tailored for your needs.

Cross-Border Taxation

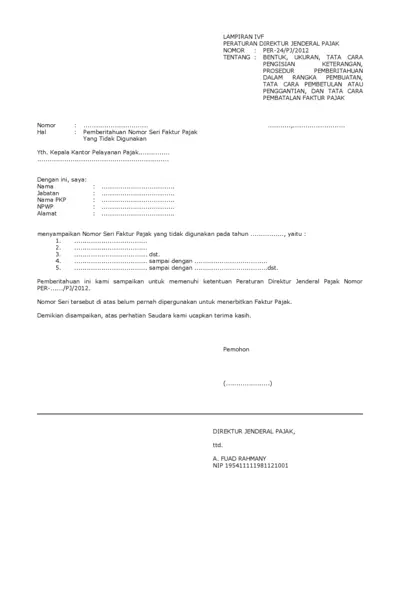

Pemberitahuan Nomor Seri Faktur Pajak Tidak Digunakan

This document provides essential information regarding the notification of unused tax invoice serial numbers. It outlines the procedures for reporting and correcting tax invoice issues. Users can utilize this file to ensure compliance with tax regulations.

Cross-Border Taxation

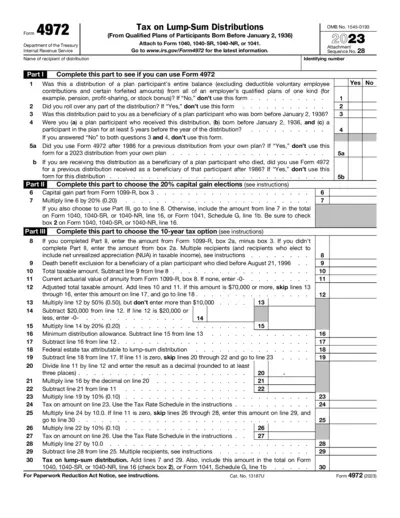

Form 4972 Tax on Lump-Sum Distributions Instructions

Form 4972 is used to calculate tax on qualified lump-sum distributions from retirement plans. This form is essential for beneficiaries born before January 2, 1936. Completing Form 4972 may offer tax advantages by allowing special calculations.

Cross-Border Taxation

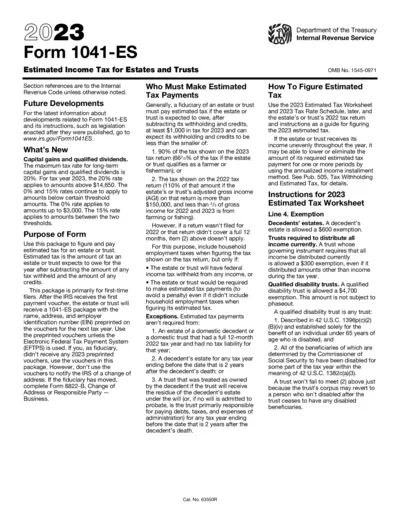

Form 1041-ES Estimated Tax for Estates and Trusts

Form 1041-ES is essential for estate and trust fiduciaries to calculate and prepay estimated taxes. Ensure compliance by submitting this form for tax year 2023. Understanding its structure aids in proper financial planning.

Cross-Border Taxation

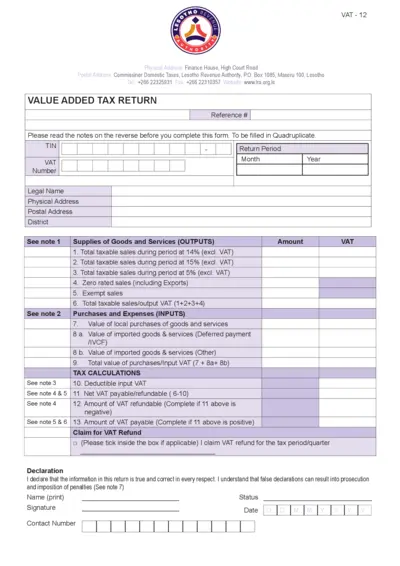

Value Added Tax Return - Lesotho VAT12 Form

The Value Added Tax Return is a crucial document for businesses in Lesotho to report their VAT payments. This return requires detailed information on taxable sales, input purchases, and VAT calculations. Ensuring correct completion is key to complying with Lesotho’s VAT regulations.

Tax Refunds

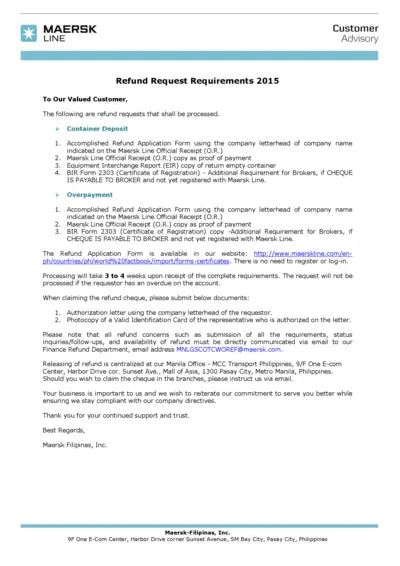

Maersk Line Refund Request Requirements 2015

This file outlines the necessary requirements for processing refund requests with Maersk Line. It details the specific documents needed for different refund types and provides contact information for further inquiries. Ideal for customers seeking to file a refund accurately and efficiently.

Cross-Border Taxation

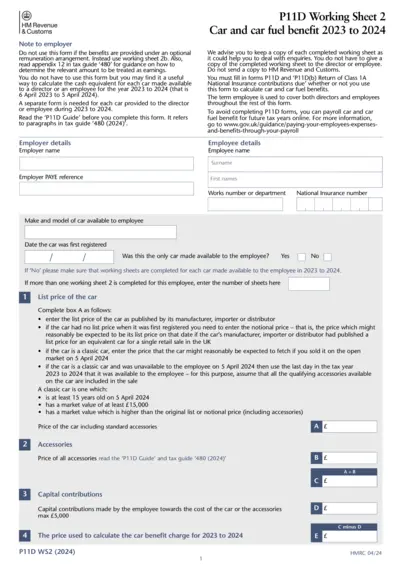

HMRC P11D Car Fuel Benefit Guide 2023-2024

This file provides essential information and instructions for employers regarding the P11D form related to car and fuel benefits. It helps in accurately calculating the cash equivalent for the vehicles made available to employees in the tax year 2023 to 2024. Additionally, it outlines necessary details about employer and employee responsibilities.