Tax Documents

Federal Tax Forms

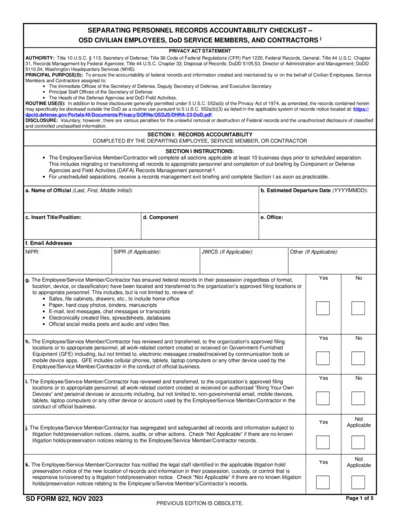

Personnel Records Accountability Checklist

This file serves as a checklist for the accountability of federal records created and maintained by civilian employees, Service members, and contractors. It outlines important policies, procedures, and responsibilities. Utilize this document to ensure compliance with federal record management standards.

Cross-Border Taxation

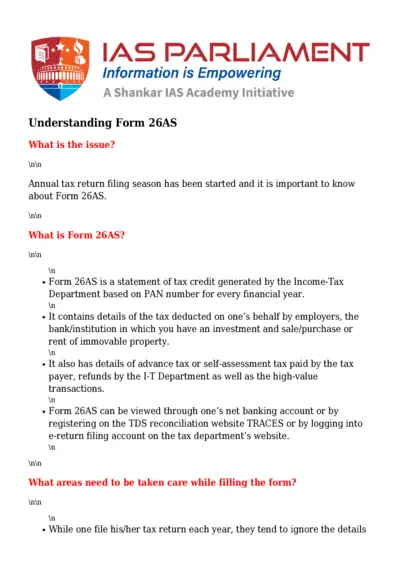

Understanding Form 26AS for Tax Filing

This file provides comprehensive information on Form 26AS, essential for tax filing. Learn about its significance, filling process, and common mistakes. Ideal for taxpayers who want to ensure accurate annual returns.

Cross-Border Taxation

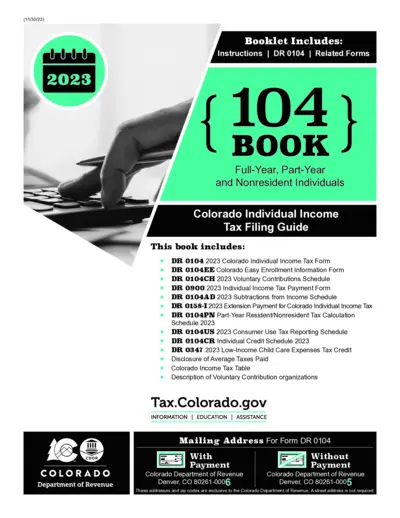

2023 Colorado Individual Income Tax Filing Guide

The Colorado Individual Income Tax Filing Guide provides detailed instructions for residents and nonresidents on completing their income tax returns. It includes various forms, schedules, and important tax information. Ideal for individuals looking to understand their obligations and options for filing taxes in Colorado.

Cross-Border Taxation

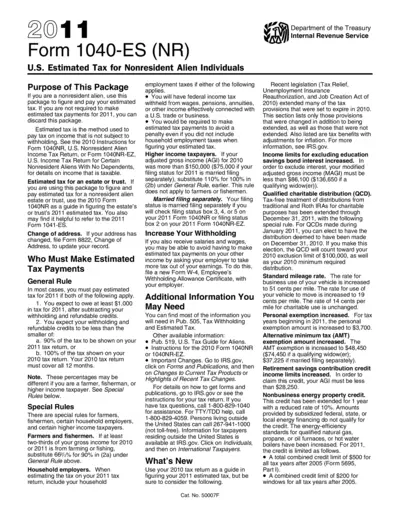

2011 Form 1040-ES NR Estimated Tax Nonresident Aliens

This file provides essential information for nonresident alien individuals filing their estimated taxes for 2011. It includes details about tax payments, instructions, and important updates. Understanding this document is crucial to ensure compliance with U.S. tax obligations.

Cross-Border Taxation

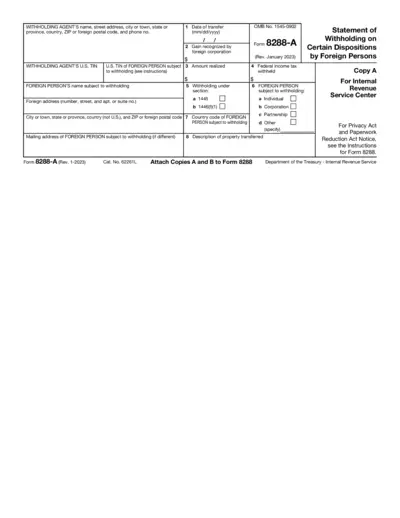

Form 8288-A Instructions for Foreign Withholding

The Form 8288-A is utilized for federal income tax withholding on foreign persons disposing of U.S. real property. This document provides essential instructions and the necessary fields to ensure accurate and compliant tax documentation. Users should follow the guidelines carefully to avoid penalties and ensure proper reporting.

Delinquent Property Taxes

Fresh Deli and Bakery Party Tray Options

Discover a variety of made-fresh party trays and subs for your next event. Our deli offers a money-back guarantee for every item. Enjoy quality and satisfaction with each selection.

Cross-Border Taxation

Florida Reemployment Tax Audit Guide

This document provides essential information regarding Florida reemployment tax audits. It outlines your rights and responsibilities during the audit process. Understanding this guide can help you navigate audits effectively.

Cross-Border Taxation

Instructions Schedule I Form 1120-F Interest Expense

This document provides instructions for completing Schedule I of Form 1120-F for foreign corporations reporting interest expenses. It details necessary allocations of interest expenses and related elections. Understanding this form is essential for accurately reporting effectively connected income for the tax year.

Tax Returns

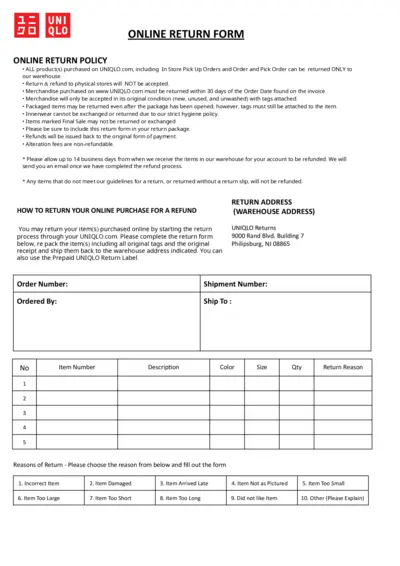

UNIQLO Online Return Form and Policy Guidance

This file contains the essential details and instructions for returning items to UNIQLO. Users will find step-by-step guidance and necessary forms for a smooth return process. It ensures customers know how to initiate a return and the policies regarding refunds.

Payroll Tax

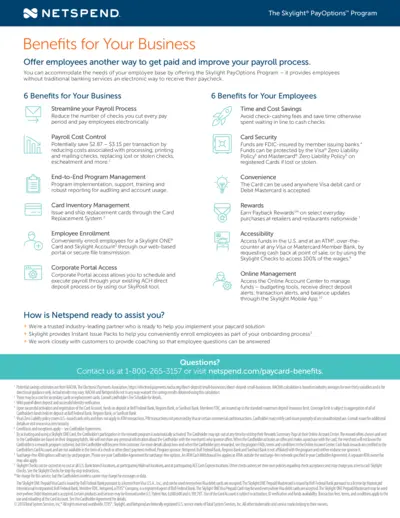

NetSpend Skylight PayOptions Program Overview

The NetSpend Skylight PayOptions Program offers a reliable payroll solution for businesses, enabling seamless payments to employees who lack traditional banking. This guide outlines the program's benefits and provides essential information for enrollment and management. Ideal for HR professionals, this program enhances payroll efficiency while ensuring employee satisfaction.

Cross-Border Taxation

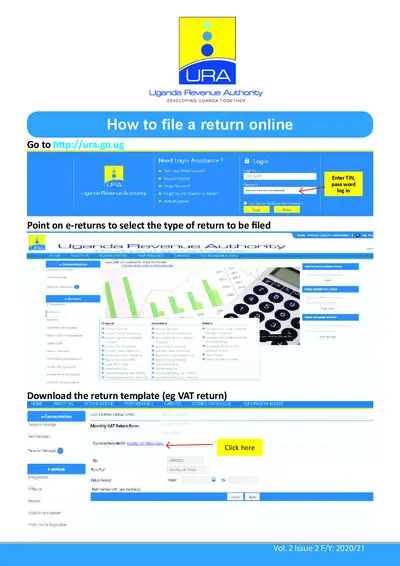

Uganda Revenue Authority Online Return Filing Instructions

This file provides detailed instructions on how to file online returns with the Uganda Revenue Authority. It also includes guidelines for filling out the forms correctly. Users can benefit from clear steps and necessary templates for submission.

Cross-Border Taxation

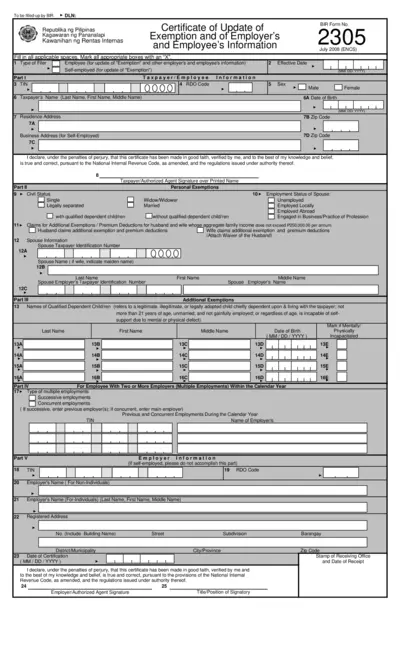

Certificate of Update of Exemption and Employee Info

This file is a certificate used for updating exemption and employee information for the Bureau of Internal Revenue. It is essential for employees and self-employed individuals to accurately report their tax-exempt status. Proper completion of this form ensures compliance with Philippine tax regulations.