Tax Documents

Cross-Border Taxation

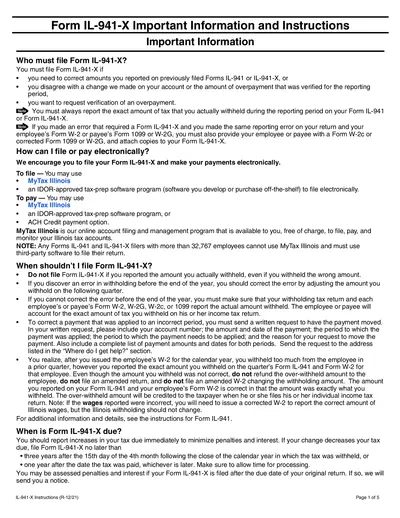

Form IL-941-X Important Information and Instructions

This important document provides instructions for filling out Form IL-941-X. It guides users in correcting previously filed IL-941 or IL-941-X forms. Ensure compliance with state tax regulations by following these instructions carefully.

Cross-Border Taxation

VAT Refund Guide for Non-EU Travelers in Spain

This file provides essential information about the VAT refund process for travelers from non-EU countries. It outlines eligibility requirements, procedures for obtaining refunds, and important documentation needed during departure from Spain. Perfect for international travelers aiming to reclaim value-added tax on purchases made in Spain.

Cross-Border Taxation

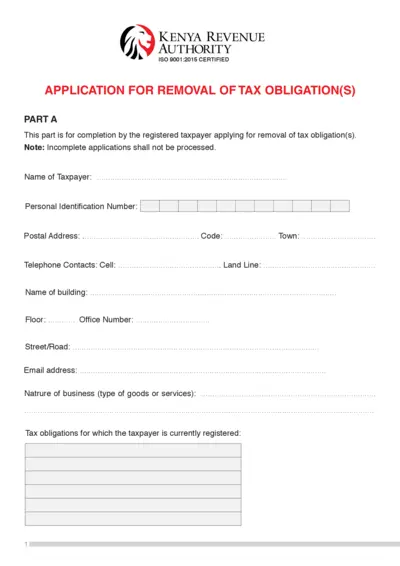

Application for Removal of Tax Obligation Kenya

This file provides the application form for taxpayers in Kenya wishing to remove tax obligations. It includes instructions on completing the form and details necessary for processing. Ensure all required documents are attached for successful submission.

Payroll Tax

Customize Payroll Check Template in R12

This document provides detailed instructions for setting up and using a custom payroll check template in R12. It is essential for businesses that require specific payroll check formatting. Follow the instructions carefully to ensure proper template registration and usage.

Income Verification

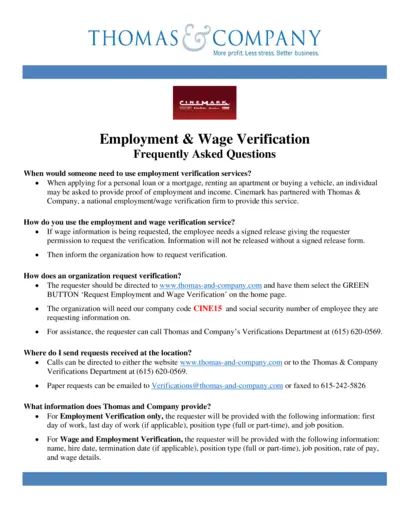

Cinemark Employment & Wage Verification Services

This document provides essential details on employment and wage verification services offered by Cinemark in partnership with Thomas & Company. It includes instructions, frequently asked questions, and contact information necessary for accessing these services. Users seeking verification for loans, rentals, or job applications will find this resource invaluable.

Cross-Border Taxation

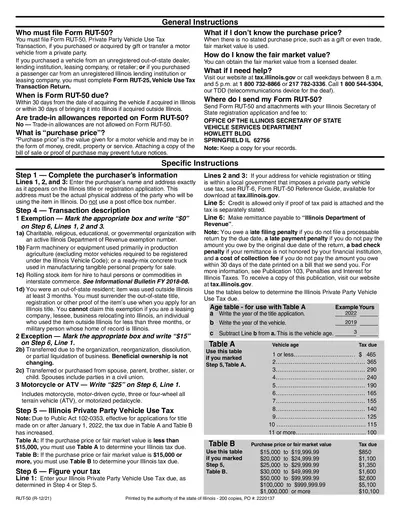

Form RUT-50 Instructions for Vehicle Tax Filing

Form RUT-50 is essential for reporting vehicle purchase taxes in Illinois. This file contains detailed instructions and guidelines for individuals and businesses. It serves as a comprehensive guide for filing and understanding vehicle use tax obligations.

Cross-Border Taxation

Non-Resident Tax Preparation Guide for Students

This document provides essential information on non-resident tax preparation for students and scholars. It covers key tax behaviors and filing instructions for the tax year 2016. Utilize this guide to ensure compliance with your tax responsibilities effectively.

Tax Credits

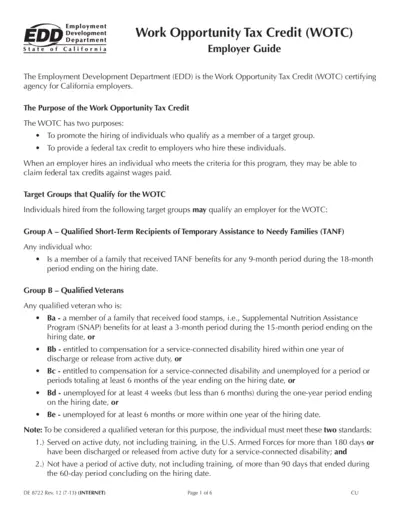

California Employer Guide for Work Opportunity Tax Credit

This guide provides essential information about the Work Opportunity Tax Credit (WOTC) for California employers. It outlines the eligibility criteria, target groups, and tax credit amounts associated with hiring individuals from eligible categories. Employers can effectively navigate the process of obtaining tax benefits while promoting inclusive hiring practices.

Cross-Border Taxation

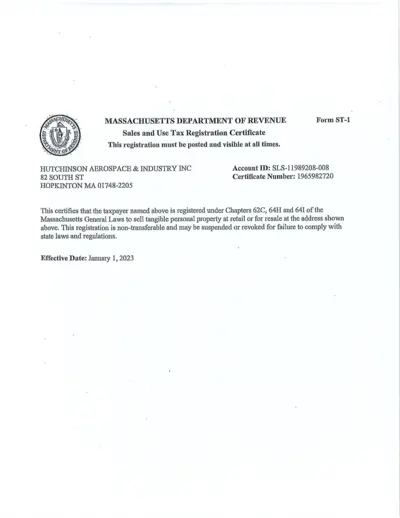

Massachusetts Sales and Use Tax Registration

This document is a Sales and Use Tax Registration Certificate for Massachusetts. It certifies that the taxpayer is registered to sell tangible personal property. This is important for compliance with state sales tax laws.

Sales Tax

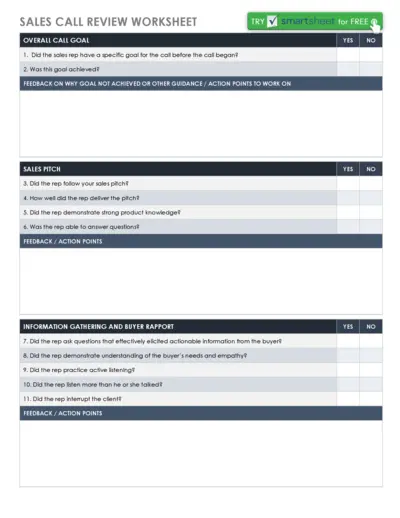

Sales Call Review Worksheet for Effective Feedback

This Sales Call Review Worksheet is designed to help sales teams analyze their performance. It provides a structured format for assessing call goals, pitching, and buyer rapport. Use this worksheet to enhance sales techniques and improve client interactions.

Cross-Border Taxation

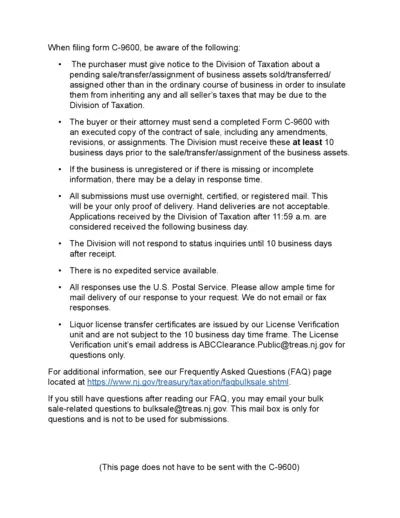

Filing Instructions for Form C-9600 in New Jersey

This file provides essential instructions for completing Form C-9600 required for reporting bulk sales in New Jersey. It details the submission process and necessary information to avoid tax liabilities. Users must follow these guidelines to ensure compliance with New Jersey tax regulations.

Cross-Border Taxation

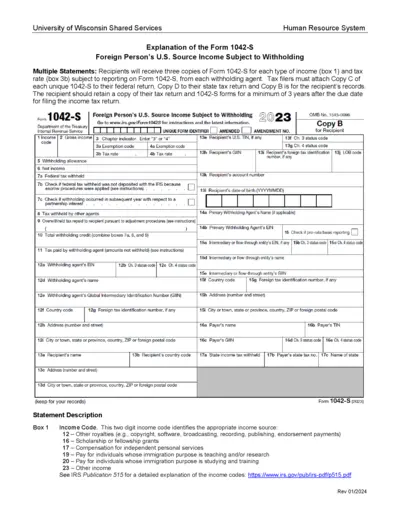

Wisconsin 1042-S Form Instructions for Foreign Income

This document provides crucial information on Form 1042-S for foreign persons receiving U.S. source income. It includes details on how to fill out the form, as well as guidelines for tax submission. Essential for non-resident aliens and other foreign entities to ensure tax compliance in the U.S.