Tax Documents

Cross-Border Taxation

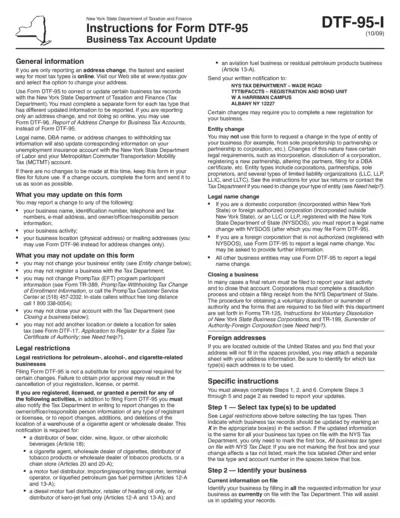

New York State Tax Business Account Update Instructions

This document provides essential instructions for updating your business tax account with the New York State Department of Taxation and Finance. It guides users on how to correctly fill out Form DTF-95 for various updates. Follow the steps outlined to ensure accurate submission and compliance.

Payroll Tax

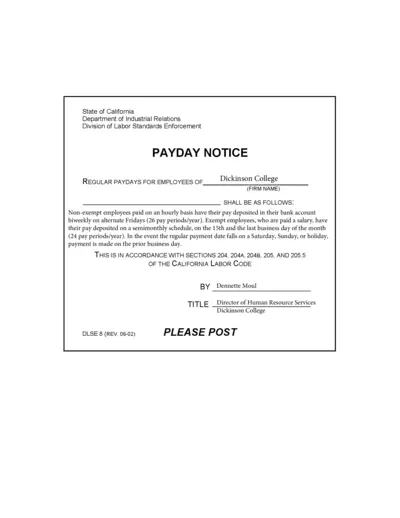

California Payday Notice and Employee Payment Schedule

This document outlines the payday notice and payment schedule for employees of Dickinson College in California. It includes information for both non-exempt and exempt employees regarding their pay frequency and deposit methods. Ensure to follow the guidelines provided for timely and correct salary payments.

Cross-Border Taxation

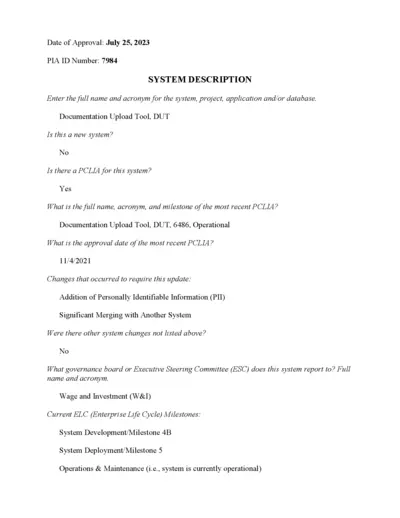

Documentation Upload Tool User Instructions

This document provides details about the Documentation Upload Tool (DUT) system. It explains how to navigate and utilize the file effectively. Users will find important information about the system's function and submission guidelines.

Cross-Border Taxation

IRS Tax Publications Employee vs Independent Contractor

This file provides important distinctions between employees and independent contractors for federal tax purposes. It outlines classification criteria affecting taxes and benefits. Use this brochure to determine your work status.

Cross-Border Taxation

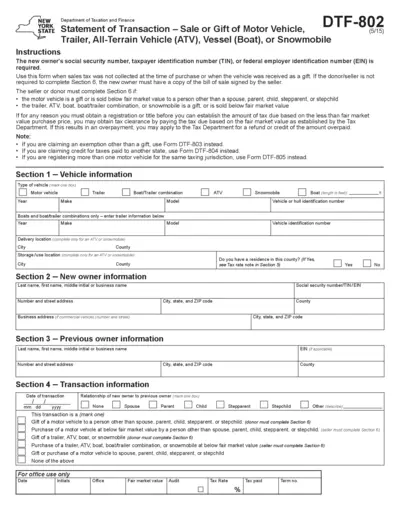

NY State Motor Vehicle Sale or Gift Transaction Form

This form is required for the sale or gift of motor vehicles in New York State. It captures essential information like the new owner's details, the previous owner, and transaction information. Ensure to complete all necessary sections to avoid delays.

Cross-Border Taxation

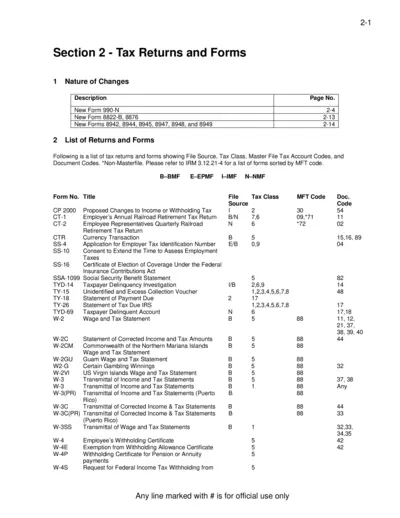

Tax Returns and Forms Overview 2024

This file contains critical information on various tax returns and forms required for compliance in 2024. It provides detailed descriptions of new forms and changes to existing ones. Users can refer to this file for understanding the necessary documentation for tax filing.

Cross-Border Taxation

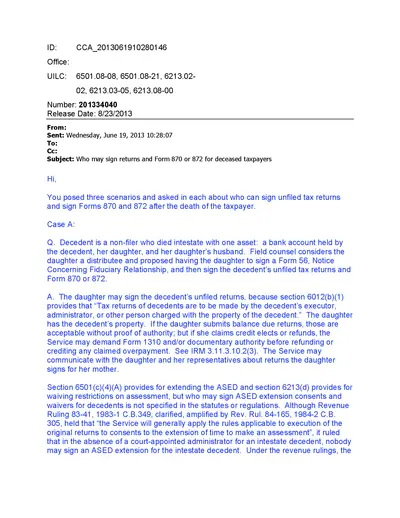

Who Can Sign Returns for Deceased Taxpayers?

This document clarifies who has the authority to sign unfiled tax returns and forms for deceased taxpayers. It includes various scenarios and guidance for executors and personal representatives. Understanding these regulations can help ensure compliance during the tax filing process for estates.

Cross-Border Taxation

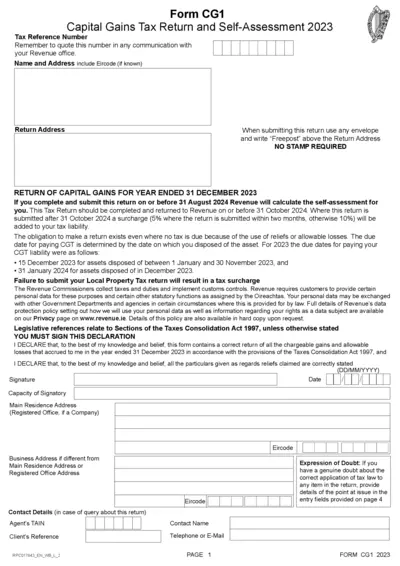

Form CG1 Capital Gains Tax Return Self-Assessment

This form is for the Capital Gains Tax Return for the year ended 31 December 2023. It includes sections for personal details, asset disposals, and claim to reliefs. Submit by 31 October 2024 to avoid penalties.

Cross-Border Taxation

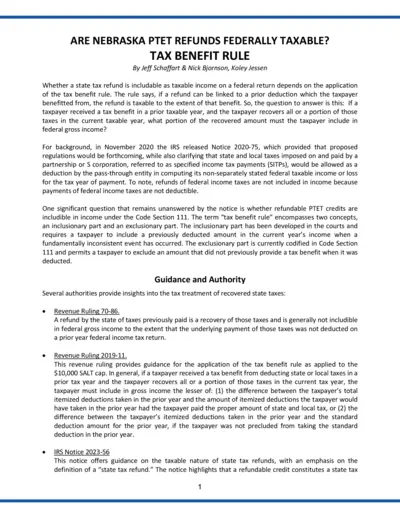

Nebraska PTET Refunds Taxability Explained

This document provides an in-depth analysis of whether Nebraska PTET refunds are federally taxable. It examines the tax benefit rule and relevant IRS guidance, offering clarity for taxpayers. Ideal for accountants and tax professionals needing insights on state tax refunds in Nebraska.

Sales Tax

Miller Heiman Blue Sheet Sales Tool Overview

The Miller Heiman Blue Sheet is a strategic sales tool designed for sales professionals to analyze and manage complex sales opportunities. This file provides a comprehensive framework for adopting the Strategic Selling methodology, ensuring better alignment of sales strategies with customer needs. Utilize this document to enhance your sales effectiveness and drive revenue growth.

Cross-Border Taxation

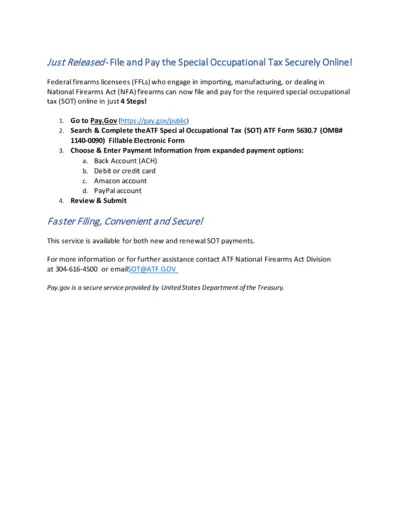

File and Pay Special Occupational Tax Online

This file provides instructions for Federal firearms licensees to securely file and pay the Special Occupational Tax online. It includes a step-by-step guide and essential contact information. Ideal for both new and renewal applications.

Payroll Tax

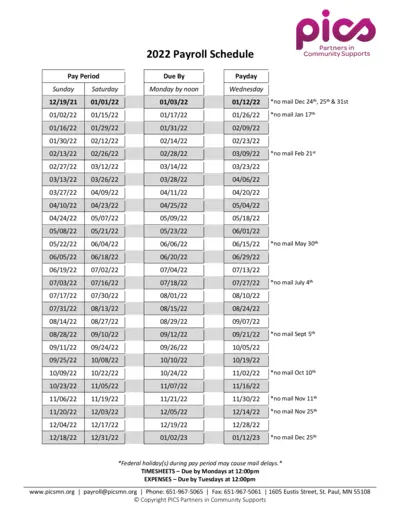

2022 Payroll Schedule and Submission Instructions

This file outlines the payroll schedule, key pay dates, and submission instructions for employees. It serves as a comprehensive guide to ensure timely payroll processing. Utilize this document to stay organized and informed about payment timelines.