Tax Documents

Cross-Border Taxation

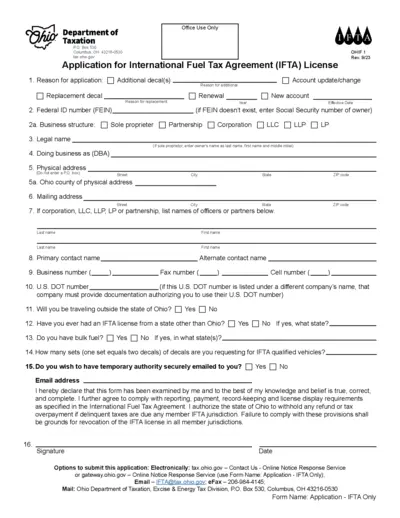

Application for IFTA License - Ohio Department of Taxation

This file contains the application form for obtaining an IFTA license in Ohio. It provides detailed instructions for completing the form accurately. Users must ensure compliance with reporting and payment requirements as outlined.

Cross-Border Taxation

2014 Tax Preparer's Guide for Income Tax Returns

This guide provides crucial information for tax preparers and electronic return originators in New Mexico. It offers instructions and updates to help users efficiently file 2014 income tax returns. Tax practitioners will find the latest requirements and deadlines essential for compliance.

Cross-Border Taxation

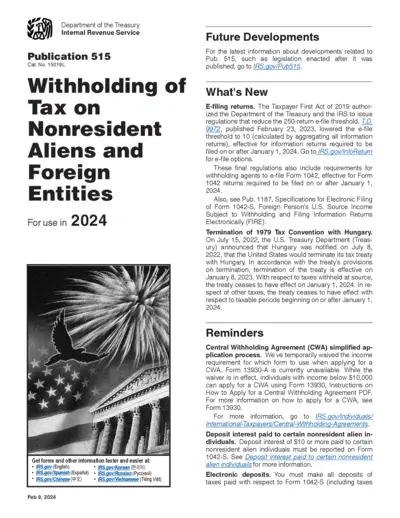

Withholding Tax Instructions for Nonresident Aliens

This publication provides detailed instructions for withholding tax on income payments to nonresident aliens and foreign entities. It outlines the withholding requirements applicable to various types of income and describes the relevant forms for reporting. Essential for withholding agents and international taxpayers alike, this guide is crucial for compliance.

Cross-Border Taxation

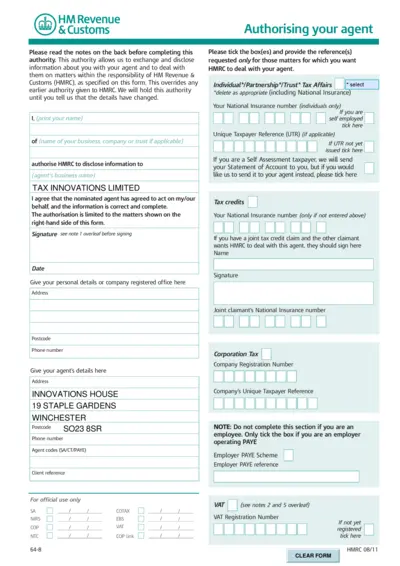

HMRC Agent Authorisation Form Submission

This file is the HM Revenue and Customs (HMRC) Agent Authorisation Form. It allows individuals and businesses to authorize their agents to act on their behalf regarding tax affairs. Proper completion ensures efficient management of your tax-related matters.

Cross-Border Taxation

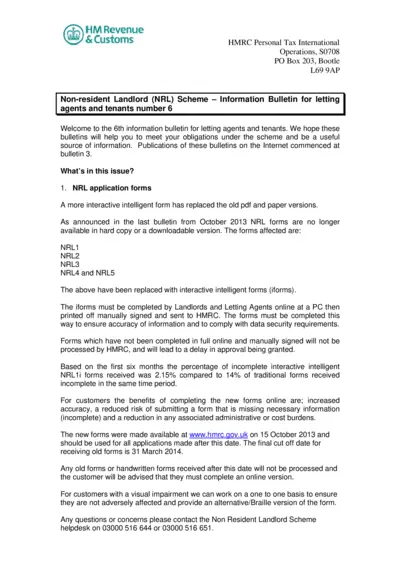

Non-Resident Landlord Scheme Information Bulletin

This bulletin provides essential information for landlords and letting agents regarding the Non-Resident Landlord Scheme. It includes updates about application forms and important deadlines. Ensure you meet your obligations with the latest guidance.

Cross-Border Taxation

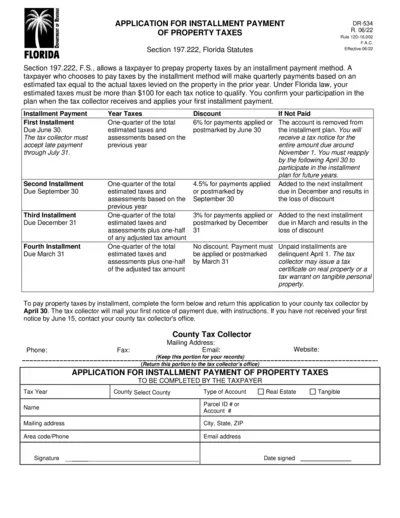

Florida Property Tax Installment Payment Application

This form allows Florida taxpayers to apply for installment payments of property taxes. You can prepay your property taxes in quarterly installments based on your previous year's tax amount. Submit the completed form to your county tax collector by April 30 to enroll in the payment plan.

Cross-Border Taxation

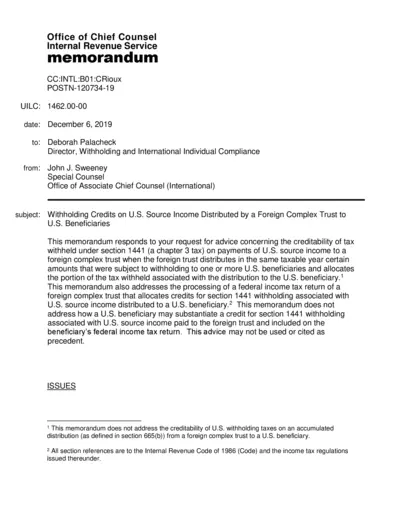

Withholding Credits on U.S. Source Income

This memorandum discusses withholding credits related to U.S. source income. It provides guidance on filing Form 1040-NR for foreign complex trusts. U.S. beneficiaries will find relevant creditability information within.

Cross-Border Taxation

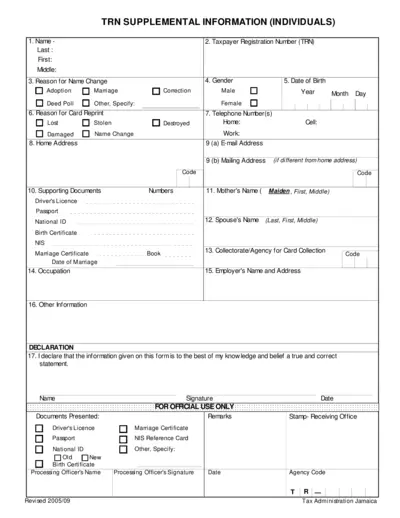

TRN Supplemental Information Form for Individuals

This file contains essential information for individuals applying for Taxpayer Registration Number (TRN). It includes instructions on filling out the form correctly and submitting it. This guide serves as a resource for users needing clarity on the application process.

Payroll Tax

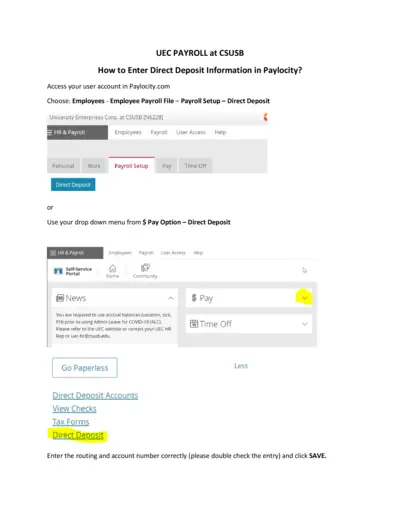

Direct Deposit Information Entry in Paylocity

This file provides detailed instructions for entering direct deposit information in Paylocity. It is useful for employees of CSUSB needing to set up their payment details. This guide ensures accurate submissions for efficient payroll processing.

Cross-Border Taxation

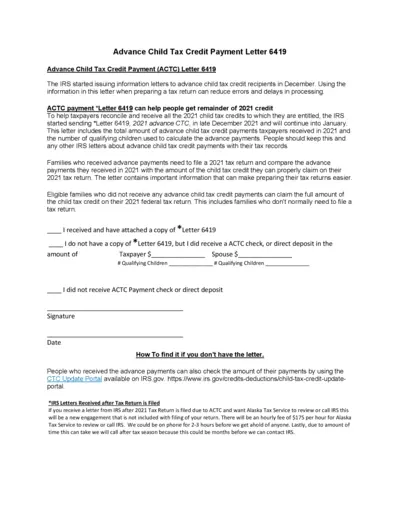

Advance Child Tax Credit Payment Letter 6419

This file contains important information regarding the Advance Child Tax Credit Payment. It assists taxpayers in reconciling their 2021 tax returns. The letter includes details needed to ensure all eligible credits are claimed.

Cross-Border Taxation

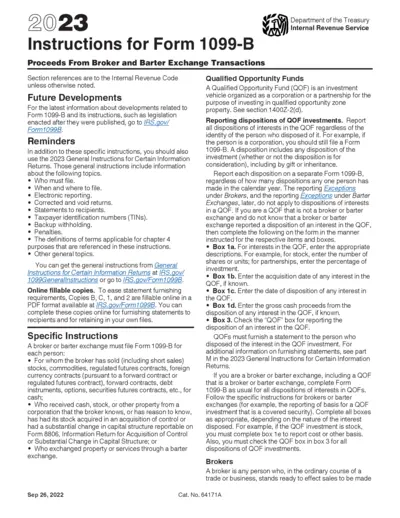

Instructions for IRS Form 1099-B (2023)

This document provides comprehensive instructions for completing Form 1099-B, which is used to report proceeds from broker and barter exchange transactions. It includes necessary details on the filing requirements and guidelines for various situations. Ideal for brokers, financial institutions, and taxpayers engaged in relevant transactions.

Cross-Border Taxation

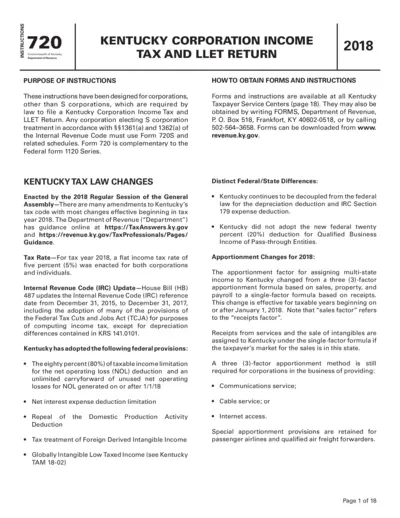

Kentucky Corporation Income Tax Return Instructions

These instructions guide corporations on filing the Kentucky Corporation Income Tax and LLET Return for 2018. They provide essential information on tax rates, form changes, and filing procedures. Corporations should review these instructions carefully to meet their tax obligations.